Stock Market LIVE: Sensex tops 61k, Nifty up 50 pts; Tata Steel, Hindalco gain

Global stock markets wrapped up their worst performances in years on Friday before heading into 2023 under recession fears following Russia’s invasion of Ukraine, high inflation and rising interest rates. Wall Street saw its worst annual drop since 2008, with the S&P 500 index down around 20% and the tech-heavy Nasdaq losing about 30% for the year.

Jefferies is cautious on Indian IT sector. This stock is its only ‘Buy’ pick

During Q3 FY23, global brokerage Jefferies expects aggregate revenues for its Indian IT coverage to moderate sharply to 1.4% sequentially (QoQcc), with HCL Technologies and LTIMindtree leading growth. Margins for other IT firms are likely to be steady QoQ as slower growth will offset benefits of improving pyramid and easing attrition, it said.

Given this Jefferies believes risk/reward is unfavorable as IT stocks still trade near +1 standard deviation above their 10-year average and 15% premium to Nifty, and has maintain its cautious stance with Infosys its only BUY (target price of ₹1,710). (Read More)

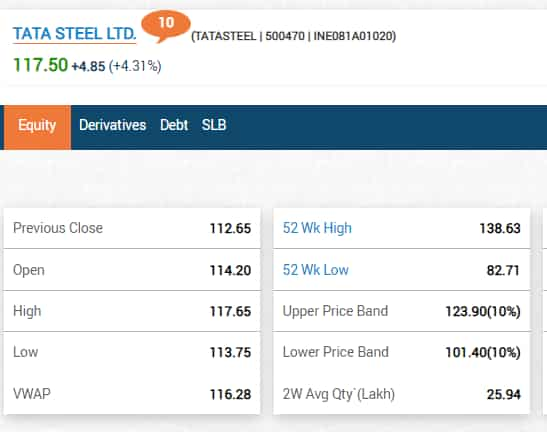

Tata Steel jumps 4% in early trading; leads the Metal Index rally

View Full Image

Toyota’s Indian unit warns of a possible customer data breach

A data breach at Toyota Motor’s Indian business might have exposed some customers’ personal information, it said on Sunday.

Toyota India said it has notified the relevant Indian authorities of the data breach at Toyota Kirloskar Motor, a joint venture with Indian conglomerate Kirloskar Group.

“Toyota Kirloskar Motor (TKM) has been notified by one of its service providers of an incident that might have exposed personal information of some of TKM’s customers on the internet”, TKM said in an emailed statement without disclosing the size of the data breach or number of customers affected.

An unrelated issue at Toyota Motor’s T-Connect service potentially leaked about 296,000 pieces of customer information, it said last October. (PTI)

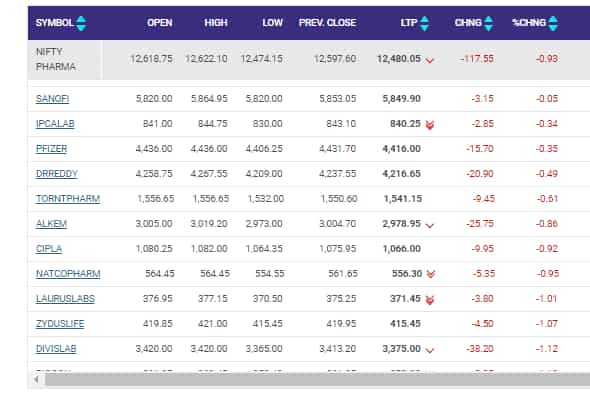

Pharma index struggles in early trading as most stocks trading in red

View Full Image

Morgan Stanley sells stake in Elein Electronics after weak listing

After a weak flat listing and a further slide in Elin Electronics shares on Friday, big investment firms like Morgan Stanley Asia (Singapore), Societe General and Copthall Mauritius Investment have offloaded their respective shareholding in the company. As per the bulk deals, detail available on the official website of NSE, Morgan Stanley Asia (Singapore) has sold out 5 lakh Elin Electronics shares whereas Societe Generale sold out 3,37,897 Elin Electronics shares. Mauritius-based foreign institutional investor (FII) Copthall Mauritius Investment also sold out 5,42,828 Elin Electronics shares in a bulk deal executed on Friday, 30th December 2022. These foreign funding agencies sold out their shares after weak listing of Elin Electronics shares on BSE and NSE. (Read More)

Geojit Financial Services views on today’s market: Since valuations continue to be high, there can be selling pressure, particularly from FIIs

Dr V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services: There are mixed signals from the economy and markets as trading begins for the New Year. Robust GST collections at ₹1.49 trillion indicate the resilience of the economy and surveys among CEOs reveal that many companies are upbeat about hiring and capex in 2023. This augurs well for India’s economic outperformance again in 2023 and this can lead to market outperformance, too. However, since valuations continue to be high, there can be selling pressure, particularly from FIIs, in the early days of 2023. The rising bond yield in the US (the 10-year yield is at 3.88 %) is negative. Investors should focus on beating the market in 2023. Market-beating returns can come from banking, capital goods and construction-related sectors.

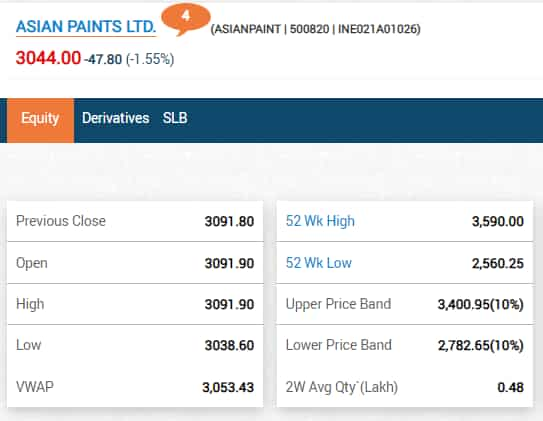

Asian Paints sinks at open; drops more than a per cent

View Full Image

Rupee to open flat; volatility tipped to rise later in Jan

The Indian rupee is tipped to open little changed against the U.S. dollar on Monday, with traders assessing the outlook for the local currency after a difficult year.

The rupee is expected at around 82.70-82.75 per dollar at the open, compared to 82.72 in the previous session. It tumbled 11.2% last year.

The currency traded in a narrow range in the last three weeks of 2022 and traders reckon that volatility is likely to pick up later this month.

These kinds of rangebound moves do not last too long and when the breakout happens, it can be quite sizeable, a trader at a Mumbai-based bank said.

We anticipate an increase in volatility later this month on new positions and flows and before India’s budget, the trader said. India’s union budget will be presented on Feb. 1. (Reuters)

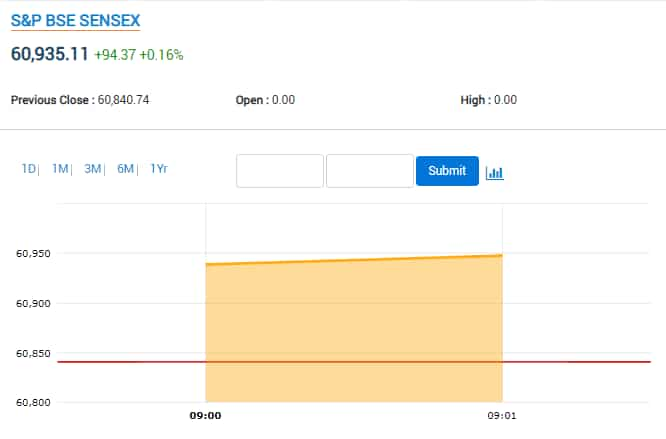

Indices open the 2023 on a flat note with Metal and Auto shining

View Full Image

Tata Steel, Hindalco stocks upgraded to ‘Buy’ as Jefferies turns positive on Indian metals

After almost a year of cautious view, global brokerage Jefferies said it has turned positive on India metals. China has started to ease Covid policy and support its ailing property sector. The brokerage believes the worst-margin quarter for Indian steel, and the big chunk of earnings cuts for Tata Steel/Hindalco are behind.

The brokerage turned cautious on Indian steel in January 2022, as it believed the earnings cycle was inflexion-down while market was too optimistic on a China stimulus. It finds the landscape flipped now with China policies turning supportive and the big earnings cut for TATA/HNDL behind. Jefferies believes a sequential improvement in quarterly EBITDA trend for Tata Steel/Hindalco in 2023 will help drive stock performance. (Read More)

Reliance Securities Stock in Focus for Today: Sail

STOCK IN FOCUS

SAIL (CMP 83): We expect demand improvement and better pricing in 2HFY23 with likely pick up in infrastructure activities and government’s turn key projects going ahead. Therefore, we reiterate our BUY rating on the company with a Target Price of Rs95.

Intraday Picks

SUNPHARMA (PREVIOUS CLOSE: 1,001) BUY

For today’s trade, long position can be initiated in the range of Rs996-

991 for the target of Rs1,016 with a strict stop loss of Rs984.

ONGC (PREVIOUS CLOSE: 147) BUY

For today’s trade, long position can be initiated in the range of Rs145.50-

144 for the target of Rs151 with a strict stop loss of Rs142.

MUTHOOTFIN (PREVIOUS CLOSE: 1,063) SELL

For today’s trade, short position can be initiated in the range of

Rs1,068-1,074 for the target of Rs1,026 with a strict stop loss of Rs1,092.

Sensex remains flat at the preopen session; TCS, Maruti Suzuki, Adani Power in focus

View Full Image

Confident to surpass 700MT production target in FY’23 but price revision crucial: Coal India chief

Coal India chairman Pramod Agrawal remained confident in surpassing the ambitious 700 million tonne production target by March 2023 and said a “price revision is essential” for the dry fuel to get the company compensated adequately.

It will be another feather in coal India’s cap, once the company meets the annual production target with over 12 per cent growth for the first time set by the government, while keeping the coal price capped for nearly five years to support the nation containing the inflation to some extent.

In 2021-22, the production was 622.6 million tonne.

The Kolkata-headquartered company is extracting more coal to meet India’s growing energy demand, but at the same time, it was “taking several measures to reduce emissions to support the country’s net zero target by 2070”. (PTI)

Sah Polymers IPO: GMP, subscription status on day 2 of the issue

The initial public offer (IPO) of Sah Polymers was subscribed 86 per cent on the first day of subscription on Friday, December 30, 2022. The initial share-sale received bids for 48,04,470 shares against 56,10,000 shares on offer. The price band of the issue, which will conclude on Wednesday, January 4, 2023, has been fixed at ₹61 to ₹65 per share.

As per market observers, Sah Polymers shares are commanding a premium of ₹5 in the grey market today. The company’s shares are expected to list on leading stock exchanges BSE and NSE on Thursday, January 12, 2023. (Read More)

GST revenues grow 15% to nearly ₹1.50 lakh crore in December

The collections from Goods and Services Tax (GST) grew by 15 per cent to over ₹1.49 lakh crore in December 2022, indicating improved manufacturing output and consumption demand, besides better compliance.

This is the 10th month in a row that the revenues have remained above the ₹1.4 lakh crore mark. The collection in November was about ₹1.46 lakh crore.

“The gross GST revenue collected during December 2022 is ₹1,49,507 crore, of which CGST is ₹26,711 crore, SGST is ₹33,357 crore, IGST is ₹78,434 crore (including ₹40,263 crore collected on import of goods) and Cess is ₹11,005 crore (including ₹850 crore collected on import of goods),” the ministry said in a statement.

The revenues for December 2022 are 15 per cent higher than the GST collection in the same month last year, which itself was close to ₹1.30 lakh crore. (PTI)

Stocks to Focus: Maruti, TCS, Adani Power, Torrent Power, Tata Motors, IEX, Shriram Finance, Kalpataru Power Transmission, Coal India, IOB

Maruti Suzuki: Maruti Suzuki India Ltd on Sunday reported a 9 per cent decline in total wholesales at 1,39,347 units in December 2022 compared to the year-ago month. The company had clocked a total sales of 1,53,149 units in the same month in 2021, Maruti Suzuki India (MSIL) said in a statement. Total domestic wholesales were at 1,13,535 units last month as against 1,26,031 units in December 2021, down 9.91 per cent, it added. (Read More)

2023 will be ‘tougher’ for global economy, says IMF’s Georgieva

The International Monetary Funds’ (IMF) Managing Director Kristalina Georgieva has said that 2023 is going to be a ‘tougher’ year for the global economy, tougher than the one left behind in 2022. Georgieva said this during an interview on Sunday morning on the first day of the new year.

The global economy’s new year (2023) is going to be “tougher than the year we leave behind,” IMF’s Georgieva said on Sunday. She cited the simultaneous slow down of the United States, China and the European Union’s economies for the same. (Read More)

INDIA BONDS-Bond yields likely to rise on elevated Q4 state debt supply

Indian government bond yields are expected to rise on Monday, the first trading session of 2023, as states announced a bigger-than-expected borrowing schedule for the January-March quarter.

The benchmark 10-year yield is likely to move in a 7.32%-7.37% band, a trader with a private bank said. The yield ended at 7.3277% on Friday.

The yield eased for the second consecutive quarter in October-December, but jumped 87 basis points in 2022, its biggest such move since 2009.

Indian states plan to raise 3.41 trillion rupees ($41.22 billion) by selling bonds in 13 weekly auctions between January and March, sharply higher than market expectations of 2.70 trillion rupees to 3.00 trillion rupees. (Reuters)

Multibagger stock to enter into new business segments, scrip hits upper circuit

With a market valuation of ₹108.32 Cr, Gautam Gems Ltd. is a small-cap company that operates in the consumer discretionary industry. The company manufactures, exports, and imports rough and polished diamonds. The company’s registered office and corporate headquarters are in Surat, India’s diamond capital. The business has declared its intention to venture into a new product.

On Friday, the company said in a stock exchange filing that “As we know India has a massive demand for energy to fuel its rapidly growing economy. Today, we are a power surplus nation with a total installed electricity capacity of over Four lakh MW. (Read More)

Cryptocurrency prices today: Bitcoin, ether gain marginally; dogecoin, Shiba Inu fall

In cryptocurrencies, Bitcoin price today rose with the world’s largest and most popular digital token trading almost flat with a positive bias at $16,566. The global cryptocurrency market cap today remained below the $1 trillion mark, as it was flat in the last 24 hours to $828 billion, as per the data by CoinGecko.

On the other hand, Ether, the coin linked to the ethereum blockchain and the second-largest cryptocurrency, was also trading marginally higher at $1,195. Meanwhile, dogecoin price today was trading about a per cent lower at $0.06 whereas Shiba Inu gained was down at $0.000008. (Read More)

Budget 2023: PHDCCI pitches for increasing health budget by 30-40%

Industry body PHDCCI on December 29 said the health budget should be increased by 30-40 percent as there is a growing need for health facilities and infrastructure across the country. Making the suggestion for the forthcoming Union Budget, Saket Dalmia, President of PHDCCI, said the budget for health has seen a rise of about 16 per cent in absolute terms between budget estimates of 2021-22 and 2022-23.

The major focus could be on a widespread campaign for healthy living, which is the need of the hour to build up a healthy human resource for the country. (Read More)

Buy or sell: Vaishali Parekh recommends 2 stocks to buy today

Vaishali Parekh of Prabhudas Lilladher has recommended two stocks to buy today. Here we list out full details in regard to those two shares:

1] Canara Bank: Buy at ₹333, target ₹345, stop loss ₹328; and

2] Gujarat Alkalies & Chemicals: Buy at ₹767, target ₹788, stop loss ₹757. (Read More)

Domestic passenger vehicles sales rise 23 pc to record of 37.93 lakh units in 2022

Domestic passenger vehicles sales rose by 23 per cent to a record of 37.93 lakh units in 2022 led by the likes of Maruti Suzuki, Hyundai and Tata Motors as the companies rode on easing of pandemic-related challenges and semiconductor shortages to cash in on pent up demand, specially for SUVs. Other manufacturers like Toyota Kirloskar Motor and Skoda India also reported record sales in 2022.

“The industry wholesales in January to December 2022 were just short of 38 lakh units. It was 37.93 lakh units against 30.82 lakh in 2021, which is a growth of 23 per cent,” Maruti Suzuki India Senior Executive Officer, Marketing & Sales Shashank Srivastava told reporters in a virtual conference. He further said the 2022 wholesales are “the highest ever in the industry for a calendar year” and the last highest was in 2018 which was 33.3 lakh units. “So, this is about 14 per cent higher than the highest ever,” he added.

On the reasons for the growth, Srivastava said, “I believe this resurgence to the highest ever level is partly because of the better availability of semiconductors because last year was badly affected by the semiconductor issue.” (PTI)

JSW Group mulls foray into EVs, to manufacture 4-wheelers

Sajjan Jindal-led conglomerate JSW Group is considering a foray into the manufacturing of electric vehicles, according to a top official of the group. “The group had examined EV manufacturing plans earlier also but now it is becoming attractive,” JSW Group Chief Financing Officer Seshagiri Rao told news agency PTI.

The manufacturing of EVs is being discussed actively at the group level, he said while divulging JSW Group’s plan to expand its presence into more sectors.

The group is looking to manufacture four-wheelers, Rao said. He said that the manufacturing location is yet to be decided. (Read More)

Rupee falls over 11 pc in 2022 — worst since 2013

The Indian rupee depreciated over 11 per cent in 2022 against the dollar — its poorest performance since 2013 and the worst drubbing among Asian currencies — as the US Federal Reserve’s aggressive monetary policy propelled the greenback.

The rupee closed 2022 at 82.61 to the US dollar, down from 74.29 at end of 2021 as the US currency headed for its biggest yearly gain since 2015.

The Indian unit, however, fared better than some other global currencies like the Turkish Lira and British Pound.

The volatility in the forex market, prompted by a rally in global oil prices following Russia’s war in Ukraine, meant the Reserve Bank had to frequently dip into its reserves as imported inflation became a challenge for policymakers.

Since mid-October, the rupee recovered from the bouts of volatility experienced in the earlier part of the year and has been trading close to its long term trend, as per the RBI’s Financial Stability Report. (PTI)

Govt may raise interest rate subsidy for MSME exporters

The government is considering raising interest equalization or subsidy benefits extended to small and medium exporters in the annual budget for 2023-24 to relieve some of the interest rate burden on them due to a tightening monetary policy.

The proposal to extend the low-interest rate benefit is being examined at a time Indian exporters are facing headwinds on account of slowing demand in key markets amid record inflation and the threat of a global recession. (Read More)

Torrent Power in talks with ReNew to buy 1.1GW clean energy capacity

Torrent Power Ltd is in talks to buy clean power projects totalling 1.1 gigawatts (GW) from ReNew Energy Global Plc at an enterprise value of around $1.2 billion, two people aware of the development said.

Ahmedabad-based Torrent Power has submitted a non-binding offer (NBO) for ReNew’s solar and wind power assets of 350 megawatts (MW) and 750MW, respectively, at an equity value of around $450 million, the people cited above said on the condition of anonymity, adding discussions on valuation are continuing. (Read More)

US stocks sink on Friday in worst yearly performance since 2008

Wall Street stocks marked a gloomy end to 2022 on Friday, slumping to close lower in their worst annual showing in years.

Surging inflation and steep interest rate hikes to cool demand have battered markets and investor sentiment this year, on top of global shocks like Russia’s invasion of Ukraine.

“The last trading day of the year just confirmed what we had all year, a horrible stock market,” said Peter Cardillo of Spartan Capital Securities.

Key US indices saw their poorest performances since 2008, with the S&P 500 and Nasdaq both seeing double-digit drops over the past year.

The Dow Jones Industrial Average shed 0.2% to 33,147.25, while the broad-based S&P 500 lost 0.3% to 3,839.50.

The tech-rich Nasdaq Composite Index dropped 0.1% to 10,466.48 after bigger losses earlier in the day.

A year-end rally “looks to have eluded us this year” given the shocks of 2022 and vast uncertainty ahead, said Craig Erlam of the OANDA trading platform.

While analysts expect the worst of Federal Reserve rate hikes to be over, some caution that the coming months will remain tough. (AFP)

Download

the App to get 14 days of unlimited access to Mint Premium absolutely free!