| U.S. President Joe Biden on March 9, 2022, placed the “highest urgency” on research and development efforts into a potential U.S. central bank digital currency Source: Sarah Silbiger via Getty Images |

Sanctions against Russia are highlighting how Western governments have fallen behind in developing digital money and how this delay could weaken future blacklists.

|

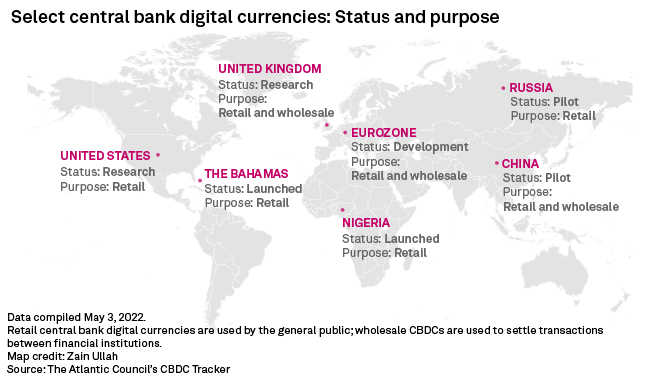

The U.S., U.K. and eurozone are only studying or investigating central bank digital currencies, or CBDCs, while nations including China and Russia have started pilot programs. This lag could leave Western nations on the outside as a new global payment system emerges, making it harder for them to shape standards and regulations including sanctions enforcement.

“Being early in this game is important,” said Maria Shagina, a visiting fellow at the Finnish Institute of International Affairs, where she researches currency statecraft and de-dollarization. “Right now, the U.S. and the EU are not even in the game.”

CBDC-based payment systems could undermine sanctions as they would lessen the use of the dollar in the global financial system and reduce reliance on two key tools for imposing blacklists — the worldwide Swift payment network and the use of banks as intermediaries. These concerns have raised interest in government-built digital currencies, even in Western nations that previously saw little need for looking beyond their existing and well-functioning networks.

“The current conflict and sanctions have changed these calculations significantly,” said Sabyasachi Kar, Reserve Bank of India chair professor at the Institute of Economic Growth, University of Delhi, where he researches CBDCs. “The West now realizes that without a CBDC, it will be very difficult for them to ensure that their interests are preserved.”

The U.S. government is now looking at how foreign CBDCs could aid sanctions evasion and other crimes, as well as possibly pose a threat to the nation’s central role in the global financial system. President Joe Biden’s executive order in March, which prompted the work, also placed “urgency” on developing a potential U.S. CBDC. Still, the nation is yet to decide whether to issue one.

The European Central Bank is further ahead as it is working out design and distribution models for a digital euro — work that will last at least until 2023 and could be followed by a pilot project. The Bank of England is still assessing the merits of a CBDC and it plans to launch a consultation this year.

CBDCs are based on similar technology to cryptocurrencies such as bitcoin, but are issued directly by a central bank, so their value is fixed.

The U.S. Federal Reserve, the Bank of England and the ECB declined to comment on the impact of the conflict on their central bank digital currency strategies and whether a CBDC could help enforce sanctions.

Momentum for CBDCs

|

Russia earlier this year kicked off a pilot of its digital ruble, which the central bank has said will make the nation more resistant to foreign sanctions. A CBDC may be more successful in this regard than previous “go-around” attempts — such as Russia’s System for Transfer of Financial Messages or China’s Cross-Border Interbank Payment System — because it has the potential to work outside the banking sector, Kar said.

The sanctions on Russia will also spur faster work in China on its e-CNY program, according to Shirley Ze Yu, a political economist and a fellow at Harvard Kennedy School’s Ash Center. The nation, which has been working on a CBDC since 2014, added another 11 cities to its pilot initiative in early April.

“Geopolitical risks have become a concern and an incentive” for CBDC development, Yu said. China’s e-CNY facilitated more than $300,000-worth of daily transactions during the Beijing Winter Olympics in February, according to a Chinese central bank official cited by Reuters.

China is already working with nations including Thailand and the UAE on a cross-border CBDC payment network, known as mBridge, which could eventually undermine the effectiveness of international sanctions, according to Shagina. China could expand the use of its CBDC through its global Belt and Road infrastructure development program, particularly among countries seeking to pare reliance on U.S. systems, Shagina said.

The People’s Bank of China did not respond to a request for comment.

Enhancing sanctioning powers

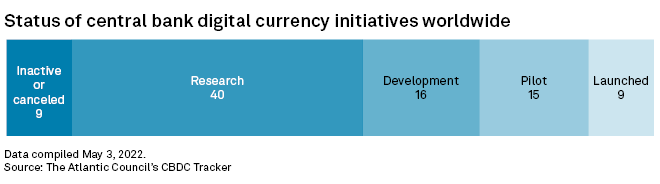

Globally, 80 countries or currency unions have active CBDC projects, according to the Atlantic Council’s CBDC tracker. Nine countries comprising Nigeria and predominately Caribbean nations have rolled out full systems, while another 15, including China and Russia, have live pilots, according to the think tank.

The financial clampdown against Russia will be a “major catalyst” for the development of digital currencies, particularly in countries that want to make themselves less exposed to Western sanctions, said Michael Sung, a professor in fintech at Fudan University in China.

|

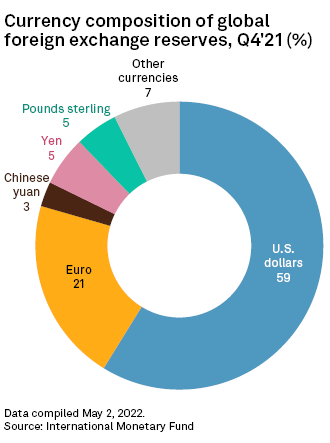

Still, the U.S. retains key advantages that may compensate for the slow development of a CBDC. The nation has a strongly entrenched position in international markets, helped by the dollar’s status as the dominant reserve currency. The rapid rise of private sector dollar stablecoins is also reinforcing this position, even as the government moves more slowly, Sung said.

The Fed can “afford to take its time” in developing a digital dollar, Sung said. China is still years away from finalizing and then internationalizing the e-CNY, even after eight years of work, he said.

Well-designed CBDCs could even help Western governments enforce sanctions because such coins are programmable, allowing the issuer to control access to the network of users, according to Alisa DiCaprio, chief economist at blockchain enterprise R3. That would make it quicker and easier for regulators to both find and freeze assets held by rogue actors.

“Having programmability and a wholesale CBDC would give any issuer more control over what’s happening,” DiCaprio said. Wholesale CBDCs are used to settle transactions between financial institutions.

The strength of such assets may motivate Western CBDC development and spur more research into how digital assets can support sanctions, according to Ananya Kumar, assistant director of digital currencies at the Atlantic Council.

“Blockchain-based systems provide advantages of traceability that can make finding and punishing sanctions evasions easier,” Kumar said.