Exchange Rates

·August 5, 2019

The Fletcher School, Tufts University and University of California, Berkeley

The Issue:

U.S. political leaders from President Trump to Democratic presidential candidate Elizabeth Warren see the dollar’s current strength as a drag on the American economy. A strong dollar makes U.S. goods more expensive in foreign markets while at the same time making it more difficult for U.S. producers to compete with cheap imports. The result, according to critics: closed factories and manufacturing workers losing their jobs. The President has repeatedly blamed loose monetary policies in Europe, Japan, China, and elsewhere, which he characterizes as “currency manipulation.” He has called on the Federal Reserve to “match” easy foreign monetary policies and has raised the idea of direct currency intervention. At the same time, the Commerce Department is considering regulations to treat currency undervaluation as an unfair trade subsidy, subject to countervailing duties. But is it accurate to view a strong dollar as a barrier to growth? Is the dollar’s current strength entirely due to the actions of foreign governments?

What are the options open for U.S. policies to manage the dollar’s value and what are their costs?

The Facts:

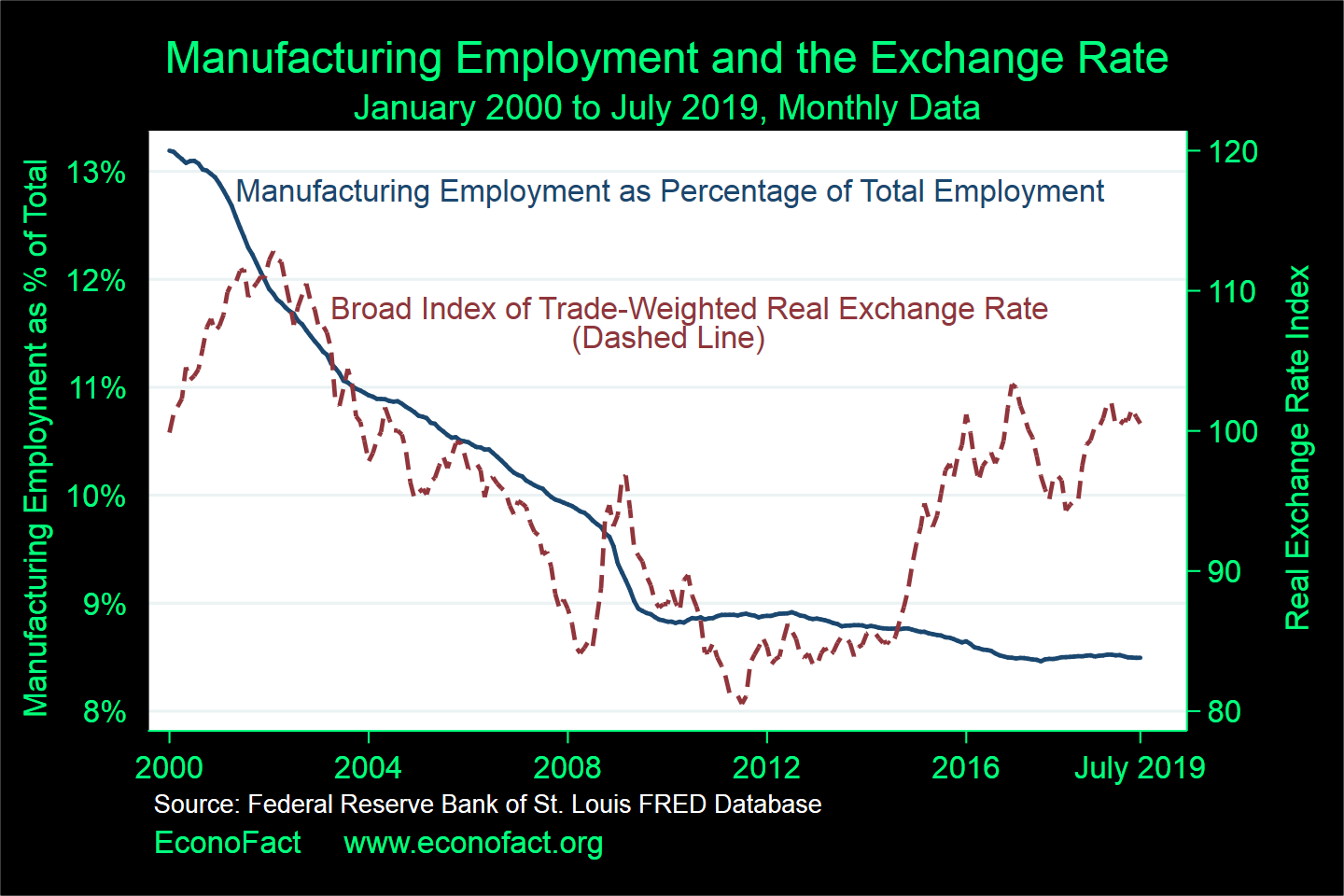

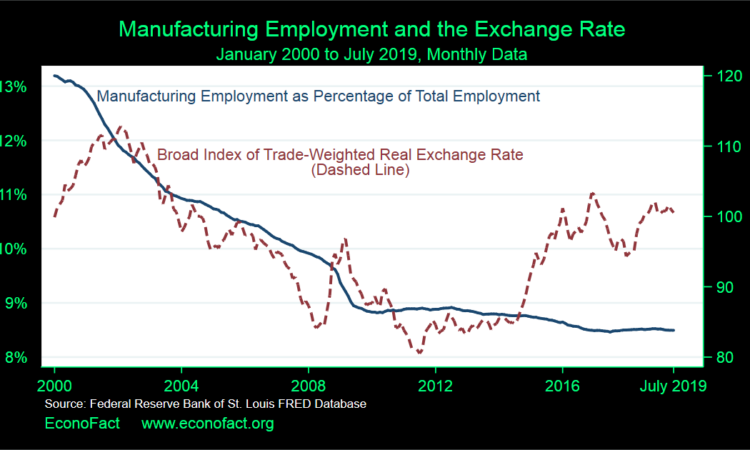

- The U.S. dollar appreciated by 25 percent between July of 2011 and July 2019 (see chart). The value of the dollar has been rising over the past eight years, as measured by an index of the dollar’s real (or inflation-adjusted) exchange rate that measures the cost of U.S. goods relative to those of almost fifty major trading partners (twenty-five countries plus the euro area), weighting their exchange rates by the amount of trade with the United States. It is worth noting though that the value of the dollar index in July 2011 hit its lowest point since currencies began to float in 1973 and, while it has risen since, it remains below the levels in the early 2000s. According to the International Monetary Fund, in 2018 the dollar was overvalued in the range of 6 percent to 12 percent, with about 5 percentage points of that due to a fiscal policy that the IMF judges to be excessively expansionary relative to trading partners.

- An important determinant of the value of the dollar is the expected return on U.S. assets. This return, in turn, depends on the current and future expected strength of the economy (which helps determine the returns on U.S. investments, including the policy interest rate set by the Federal Reserve). The figure illustrates this. It shows that the sharpest sustained appreciation of the dollar over the past two decades began in mid-2014 as the economy of the United States expanded more quickly than many of its major trading partners.

- While a strong dollar normally tends to be associated with relative strength in the overall economy, dollar strength makes U.S. exports more expensive for foreigners, and imports cheaper for U.S. residents, diverting some of the benefits from growth away from manufacturing and other sectors engaged in international trade. A stronger dollar exerts competitive pressure on U.S. exporting and import-competing firms, even though some of them may simultaneously benefit to some degree from the higher domestic demand driving relative U.S. growth and a stronger dollar. Firms that do most of their business abroad, or that face intense competition from imports, may actually suffer on balance. This possibility lies behind concerns that a strong dollar could compromise growth by harming manufacturing. At the same time, cheaper imports help manufacturers that import inputs used in their own production. What do the data say? On balance, it is hard to see any consistent relationship between dollar strength and manufacturing employment (see left axis in the chart above, which depicts manufacturing employment relative to total non-farm employment). For example, over the period 2001-09, which saw the steepest historical fall in manufacturing employment, the dollar weakened on average.

- If the exchange rate becomes the target of policy, how would the government go about weakening a strong dollar? The U.S. fiscal stimulus owing to the December 2017 tax cuts and subsequent increased government spending contributed to the strength of the economy and the strong dollar. Tapering this stimulus, as the IMF has recommended, would weaken the dollar, but this seems unlikely any time soon. (President Trump and Congress have shown no inclination to reverse the tax cuts passed in 2017 or reduce the levels of spending. Indeed, on August 2, 2019 President Trump signed new legislation to extend the Federal debt limit and relax spending caps for an additional two years.) Alternatively, dollar assets would become less attractive if the Federal Reserve lowered interest rates. This is one reason behind President Trump’s calls for the central bank to do so. But the Federal Reserve sets monetary policy to achieve its dual mandate of low inflation and high employment, and the exchange rate’s value is a result of that monetary policy setting, not its main determining factor. A policy of lowering interest rates to weaken the dollar, rather than focusing on the dual mandate, is letting the tail wag the dog. Moreover, cutting interest rates systematically when the economy is strong in an effort to weaken the dollar would risk higher inflation, which, just like a strong dollar, would raise the foreign prices of U.S. goods and work to undermine the U.S. competitive position in global markets.

- Are there policies to manage the value of the dollar without diverting monetary policy from its primary targets? Direct intervention by the U.S. Treasury in the foreign exchange market offers one possibility, and several economists have advocated just such a move to counteract potential currency manipulation by foreign countries. In such operations, the Treasury would use dollars to buy foreign currency bonds, bidding up the relative prices of foreign currencies and weakening the dollar. The Treasury can intervene through its Exchange Stabilization Fund (which would give it just under $23 billion to sell, although the Fed could join the Treasury, as it has in the past, to sell U.S. bonds on its balance sheet for foreign bonds, without altering its interest-rate policy). Foreign exchange interventions might have to be big to move markets in a sustained way. For example, in the fiscal year 2019 through June, the Federal government issued $747 billion in dollar bonds to finance its deficit, or about $83 billion per month (and 23 percent higher than the same period a year earlier). All else being equal, these big increases in the supply of dollar-denominated bonds should weaken the dollar as investors diversify their increased U.S. bond holdings into foreign currencies, but although that was not the reason these bonds were issued, the dollar has not fallen. Given the size of international bond markets, would another few billions (the maximum size of past interventions) make a difference?

- The one major instance in which foreign exchange market intervention seemed to affect the value of the dollar dramatically and persistently was the September 1985 Plaza Accord – but that experience is not a good model for what might happen today. At that time, the finance ministers of the five largest industrial economies acted together to weaken the dollar. But this was a unique event and has limited implications for the success of intervention policy in general. One important feature of the Plaza Accord was that it was a coordinated effort: all the participants agreed on a weaker dollar, and they coordinated their intervention sales of dollars. Another important aspect was that the dollar had been on a long upswing during which its value rose by more than 50 percent after 1978; most economists viewed some of this appreciation as excessive, given growth and policy fundamentals, and the dollar’s decline had already started about six months before the Plaza action. In this case, markets saw that the dollar still had a long way to fall, and the multilateral meeting at the Plaza Hotel that produced the Accord offered markets a trigger that hastened a sustained decline in the dollar.

- Others have proposed imposing taxes on the foreign purchase of U.S. assets as a way of weakening the dollar and reducing the trade deficit. Farther reaching is new bipartisan legislation proposed by Senators Tammy Baldwin (D-WI) and Josh Hawley (R-MO), which would require the Federal Reserve to levy a “market access charge” on foreign purchases of U.S. assets, with the aim of managing the dollar’s exchange rate so that the U.S. trade balance is always near zero. Using investment inflow taxes to achieve balanced trade would lead to collapsed investment and a sharply higher government debt burden, given the U.S. economy’s high dependence on foreign financing.

The general reason the dollar has been strong recently is that the United States economy is growing rapidly relative to many major economies abroad, also leading the Federal Reserve to maintain a higher level of interest rates as a brake on inflation. As always, however, the benefits of economic growth are not evenly distributed, and trade-oriented sectors of the economy, notably manufacturing, might benefit if the dollar were weaker. With the overall stance of U.S. monetary policy currently consistent with strong growth and stable prices, shifting monetary policy to target a weaker exchange rate would let the tail wag the dog, inflicting collateral damage on the economy over the longer term in the form of higher inflation and reduced central-bank credibility. If the U.S. government sees a need to support certain sectors of the economy, it would be more efficient to do so explicitly through budgetary actions, making the tradeoffs apparent to voters, rather than distorting the monetary policies appropriate for the economy as a whole. More limited actions to affect the exchange rate, such as intervention led by the U.S. Treasury, are unlikely to be sustainably effective unless carried out on a very large scale, or in coordination with trade partners. But the United States has long pledged, along with other major countries, to avoid intervening in foreign exchange to attain a competitive advantage. Thus, far from supporting the United States in its efforts, U.S. trade partners might deliver a further offset to its attempted weakening of the dollar in the form of retaliation in kind – a “currency war” likely to roil world financial markets.