Khaosai Wongnatthakan/iStock via Getty Images

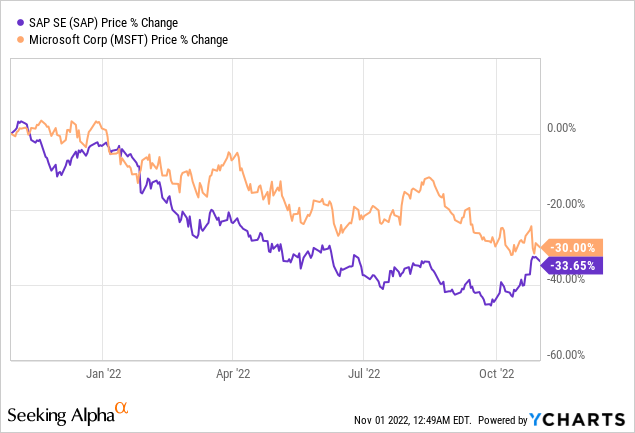

The strong dollar is a pain for U.S. companies exporting to the rest of the world including software giant Microsoft (NASDAQ:MSFT) whose stock is down by 30% as shown in the orange chart below. In my quest to look for companies who are profiting from greenback strength, I came across Germany’s SAP SE (NYSE:SAP) available at a share price of $96.61 which is 33% down from its November 2021’s high (blue chart) despite the company producing upbeat third-quarter (Q3) results. This is probably due to investors giving more importance to Europe’s economic woes together with the company’s losses in Russia.

This thesis will demonstrate that investors are wrong and that analysts’ average target of $120.3 remains achievable, but, first, I lay emphasis on SAP’s revenue diversification strength which makes it well suited to weather deteriorating economic conditions in the Eurozone where inflation just reached a record 10.7%.

Europe Plight Vs. SAP’s Shine

This inflation print increases the likelihood of a recession in the old continent when viewed in the context of the regression in private sector activity in Q3. Now, with the European Central Bank having to hike interest rates to tame inflation, risks of severe economic slowdowns just increase with Germany’s industrial base already suffering from a low and costly supply of natural gas.

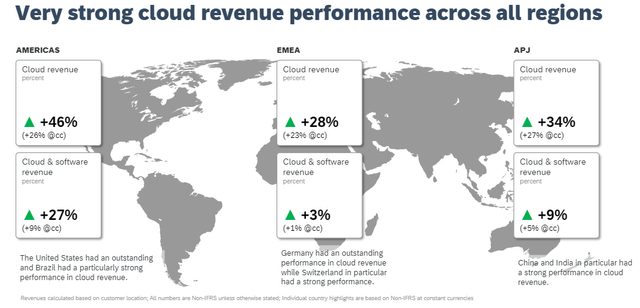

However, SAP is an Information Technology company and remains well diversified globally, with 44.7% of its third-quarter revenues being derived from the Americas which includes the U.S., the country where the growth rate for its cloud segment has been the highest at 46% as pictured below. The EMEA (Europe Middle East and Africa) region which includes Europe constituted 40% of total sales and grew at 28% with 14.8% revenues from the Asia Pacific which grew at 34%.

Q3 Financial Results with SAP Hana (www.sap.com)

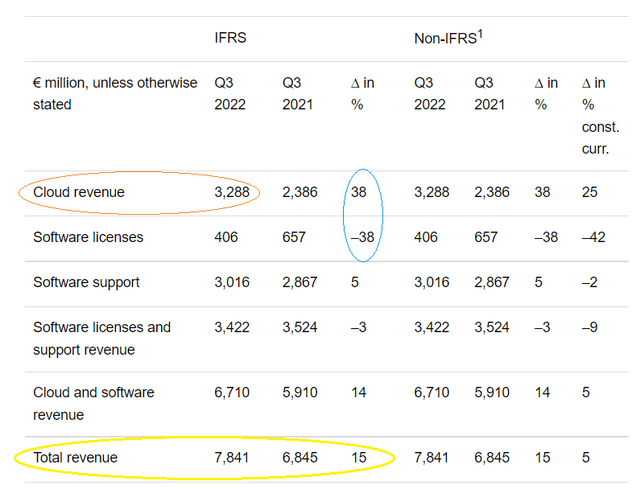

Moreover, with total revenues growing by 15%, SAP displays a rosy picture, far from the gloom which is grappling much of Europe, but, the best part is yet to come, namely with currency tailwinds.

Thus, with the cloud momentum continuing to accelerate, revenues were up by 38%, but only up by 25% at constant currency or taking into account forex exchange rates which have predominantly been skewed towards the U.S. dollar this year. This 13% (38-25) difference represents windfall gains due to the strong greenback and contrasts sharply with Microsoft’s loss of 7% (31-24). This is explained by the fact that the software giant’s actual revenue growth was only 24%, but had it not been for the strong greenback, it would have been up 31%.

Assessing the Sustainability of Cloud Growth

Now, with the U.S. Fed’s mandate being to tame the high inflation, there is less likelihood of a moderation in the pace of hikes anytime soon, which signifies that SAP could even see even higher currency-related windfall gains in its fourth quarter. In this respect, the company has reaffirmed its full-year guidance of €11.55 to 11.85 billion for cloud revenue, or an increase of 23%-26% over 2021’s €9.42 billion, all measured at constant currency. Now, think of what the actual growth will look like with the rising dollar.

However, it is important to assess whether SAP can deliver such growth in view of questions now being raised about cloud adoption after Microsoft reported financial results.

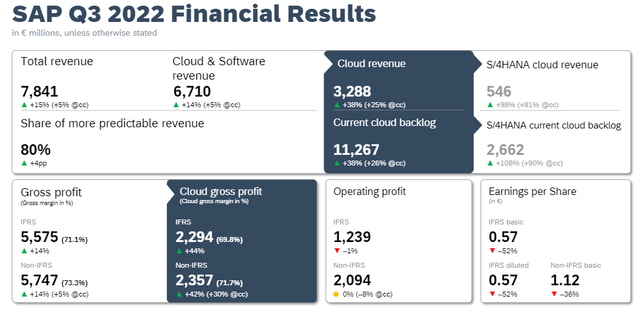

Here, the German company’s cloud-related backlog increased by 38%, out of which its ERP (enterprise resource planning) business called SAP S/4HANA surged by 108%. This is explained by the fact that SAP was late to migrate its ERP to the cloud in comparison to Oracle (ORCL), one of its main competitors in this industry. Hence, after being late, it is logical that the German company is making up for the lost time by benefiting from more business from existing customers migrating their legacy applications sitting in their corporate data centers to SAP’s global infrastructure.

Q3 Financial Results with SAP Hana (www.sap.com)

The move to the cloud also constitutes a valid argument for inflation-hit corporations in Europe as their individual data centers consume a lot of energy, whereas when hosted on SAP’s cloud, they are charged on a pay-per-use model and therefore pay relatively less. This Opex-based charging model enabled by the cloud also makes a lot of sense at times when costs have risen sharply across the board as companies strive to reduce Capex in order to raise free cash flow.

Pursuing further and looking at sustainability, the fact SAP has seen cloud gross profit margins soar by 44% (using IFRS accounting standards) shows that it is not necessarily reducing its pricing structure to gain more customers. Moreover, I assess whether competitive positioning can sustain growth and profitability.

Competition, Valuations, and Risks

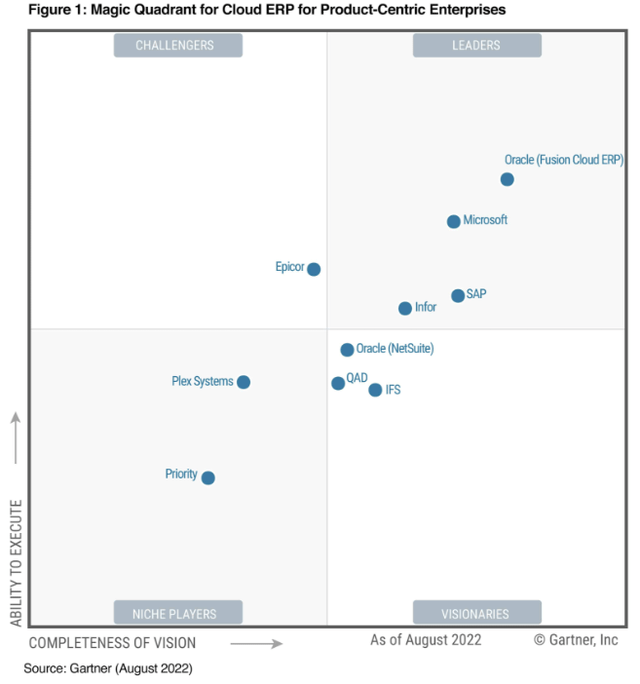

As shown in Gartner’s Magic Quadrant which lists the prominent players in cloud ERP, SAP is one of the leaders together with Microsoft and Oracle. Now, after having fully adapted its ERP suite to the cloud and being favored by a better currency differential over its two American competitors, it is no surprise that it is growing sales at 46% in the U.S.

SAP as a Leader in Gartner’s Magic Quadrant (news.sap.com)

This is likely to continue and, when considering the windfall gains effect of dollar revenues making their way into its euro-denominated income statement, the German company deserves to be valued better.

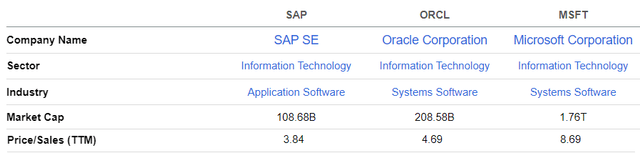

Thus, with a trailing price-to-sales ratio of only 3.84x, the company is undervalued. Adjusting, based on Oracle’s higher multiples of 4.69x, I obtain a target of around $118 ((96.91 x 4.69)/3.84)), or near analysts’ expectations.

Comparison of key metrics (seekingalpha.com)

Now, since businesses are facing high inflation times even on the western coast of the Atlantic ocean, investors have cost and profitability at the top of their minds. In these circumstances, shifting the focus to earnings, the company suffered from a 1% decline in operating profit margins in Q3 due to additional investment in sales and R&D to support growth.

However, advantaged by the lower valued euro and equipped with a high-quality product as evidenced by Gartner’s quadrant, profitability should improve and, based on “the strength in the cloud profit” being generated, the management is confident that Q4 will see positive operating profit growth.

This positive mood contrasts starkly with the highly pessimistic one prevalent just a few months back, or at the end of July during second quarter results when the company announced losses due to its heavy exposure to Russia. Its exit from that country is proving painful as it is having to wind down Russian operations in line with sanctions imposed by the U.S. and its allies. Thus, the company which had announced earlier this year that it would take its Russian cloud services offline could miss the end-of-2022 exit deadline after finding it tough to find a buyer.

However, on the financial front, things are in much better shape now as cloud strength has helped to negate the revenue impact from Russia.

Conclusion

Looking ahead, there are global recession fears, but the company’s cloud backlog grew by 26% in Q3 exceeding the 11 billion euros mark, which is equivalent to more than three times the sales from that segment. Add to this its cloud ERP’s (SAP S/4HANA) backlog of €2.7 billion and you have €13.7 billion equivalent of waiting-to-be-filled sales orders, which provides a high level of cushion against deteriorating financial conditions.

At the same time, SAP S/4HANA growing by 81% shows that the company is recouping back lost market share in ERP where it was earlier the leader.

On the other hand, in the same way as companies transitioning from traditional annual license-based revenue models to software-as-a-service, the German company is losing software licensing revenues, which regressed by 38% YoY in Q2 as encircled in blue in the table below, but that segment constitutes only about one-eight of its cloud business. Still, managing the transition is critical in order not to see more losses from licensing than gains from the cloud in a particular quarter.

Segmental Revenues (seekingalpha.com)

Finally, in case you are a tech investor and feel like flying away from some of the volatility likely to impact U.S. markets as a result of the mid-term elections, you may want to quietly position yourself on Germany’s SAP while everyone else is focused on Russian-led economic worries. Still, be reminded that its share price rhymes with the mighty Nasdaq thousands of miles away across the Atlantic and, therefore, a super-hawkish Fed may prove to be highly volatile for the stock.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top Ex-US Stock Pick competition, which runs through November 7. This competition is open to all users and contributors; click here to find out more and submit your article today!