- FTX wants to sell some of its last functioning business units, according to a court filing.

- One of which is US derivatives platform LedgerX, which is considered one of FTX’s most valuable assets.

- FTX’s new CEO John Ray described the crumbled exchange as having “a complete failure of corporate controls.“

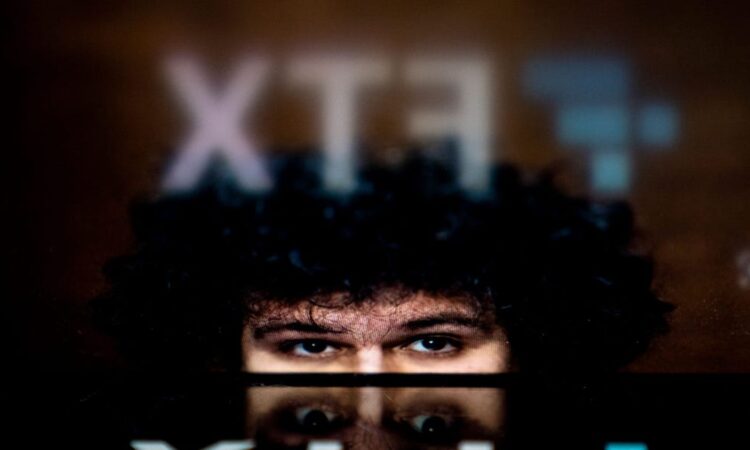

FTX wants to put some of the last solvent pieces of Sam Bankman-Fried’s once-$32 billion crypto empire up for sale.

The embattled company has petitioned a federal court for permission to sell several of its subsidiaries, including US derivatives platform LedgerX, as the troubled firm’s restructuring process picks up.

Company attorneys say it’s a “priority” for FTX to “explore sales” and “strategic transactions” of some of its remaining businesses, according to a court filing on Thursday. Other functional units include Embed Business, FTX Japan, and FTX Europe.

“Based on their preliminary review, the Debtors own or control a number of subsidiaries and assets that are regulated, licensed and/or largely not integrated into the Debtors’ operations, within and outside of the United States,” according to a document filed to the Bankruptcy Court of Delaware.

The filing continued: “The Debtors believe a number of these entities have solvent balance sheets, independent management and valuable franchises.”

LedgerX, which is registered with the US Commodity Futures Trading Commission, is now considered one of Bankman-Fried’s most valuable assets after FTX and nearly 130 other associated entities filed for bankruptcy protection last month.

The US derivatives platform is attracting buyer interest from industry heavyweights like the Winklevoss twins’ exchange Gemini and crypto services platform Blockchain.com, Bloomberg reported on December 2, citing people familiar with the matter. Gemini and Blockchain.com did not immediately respond to Insider’s request for comment on the matter.

FTX wants to sell these businesses fast, according to the court document, which indicated that some of the entities have had their operating licenses suspended following FTX’s collapse.

“The Debtors and/or the Businesses have been in active conversations with a number of regulators for the Businesses,” the filing said, adding that the licenses held by FTX Europe have been suspended and that FTX Japan are subject to the same as well.

“The longer operations are suspended, the greater the risk to the value of the assets and the risk of a permanent revocation of licenses,” the filing said.

FTX has received dozens of “unsolicited inbound inquiries” for the businesses, per the filing. No final decisions have been made to sell any of FTX’s associated entities until the approval of both the court and independent directors of the debtors.

“A sound business purpose for the sale of a debtor’s assets outside the ordinary course of business exists where such sale is necessary to maximize and preserve the value of the estate for the benefit of creditors and interest holders,” the filing reads.

FTX’s new CEO John Ray said it could take months to secure the collapsed exchange’s assets in a congressional testimony earlier this week.

“I’ve just never seen an utter lack of record keeping. Absolutely no internal controls whatsoever,” said Ray, who took over as Enron’s chairman when the defunct energy giant restructured in the early 2000s.

Elsewhere, Bankman-Fried was arrested in the Bahamas on Monday night. US prosecutors are accusing the disgraced founder of a years-long scheme to defraud investors, according to a Securities and Exchange Commission complaint on Tuesday.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors that it was one of the safest buildings in crypto,” SEC Chair Gary Gensler said in a statement.