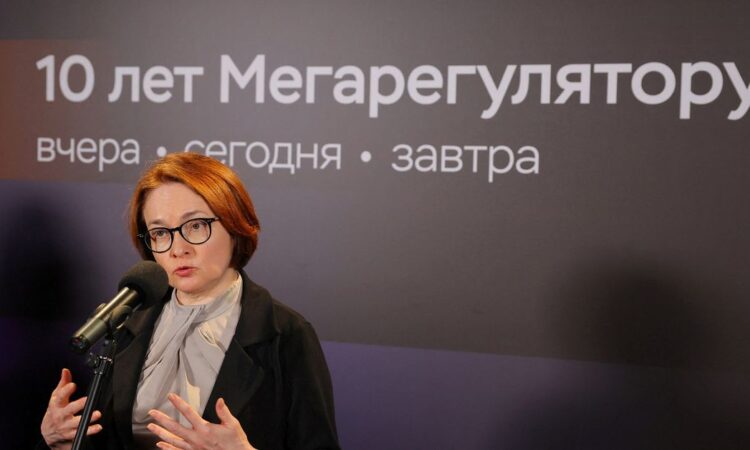

MOSCOW, Sept 15 (Reuters) – Russian central bank governor Elvira Nabiullina and her deputy Alexei Zabotkin gave a news conference on Friday after the central bank raised its key rate to 13% from 12%.

NABIULLINA ON RATE DECISION

“We raised the rate due to the appearance of inflation risks and will keep it at high levels for quite a long time, until we are convinced of the sustainable nature of the inflation slowdown.”

NABIULLINA ON INFLUENCE OF ROUBLE WEAKENING ON INFLATION:

“According to our estimates, a 10% weakening of the exchange rate adds 0.5-0.6 percentage points to inflation. The speed and scale of this effect depend on many factors. For us, the factor accelerating the effect now is the excessively rapid growth of domestic demand, this also creates the preconditions for the accelerated transfer of the weakening exchange rate into prices.”

NABIULLINA ON ROUBLE WEAKENING:

“Of course, we take into account that the weakening of the exchange rate is a pro-inflationary factor. And when we raised the key rate, we reacted to the strengthening of inflationary factors, among which the exchange rate played a significant role, but not only the exchange rate, but also faster lending, and so on.”

NABIULLINA ON RATE DECISION OPTIONS:

“Today we discussed three options – to maintain the rate and look at all the lags… increasing the rate by different amounts – 13% and higher … there have been major changes in terms of exchange rate dynamics and lending growth rates, which are much higher than what we predicted, and this shows that we need a higher key rate trajectory in order to achieve 4% inflation by the end of next year”.

NABIULLINA ON INFLUENCE OF CAPITAL OUTFLOW ON THE RATE:

“Indeed, this is one of the factors, but in our opinion, not the most significant. Moreover, capital outflow this year was much less than last year … For 8 months of this year it was $28.6 billion, and last year it was $195.1 billion. And similarly, the acquisition of net foreign assets is also less this year. This affects the exchange rate, but of course the influence is much less than other factors.”

NABIULLINA ON POSSIBLE CURRENCY CONTROLS

“The discussion on currency restrictions is currently under way. In many respects, it is the government’s decision. I will talk about the position of the Central Bank. If there is a need to influence capital flows that affect the exchange rate, then it is better to do this through economic rather than administrative measures. In my opinion, administrative measures should really be limited to mirroring reactive measures. What does “economic measures” mean? It means increasing the attractiveness of rouble savings, creating incentives for companies to sell proceeds to pay for current expenses … and not taking out excess loans instead…

It is necessary to understand that administrative restrictions, if they are effective…, then they are usually effective only for a limited time. The longer they last, the less effective they are, the more costly they are…

If we try to close more and more loopholes, for example, limiting transfers abroad, then these ineffective restrictions will snowball. We close one thing, then business will find a new way round. In the end, it will mean administrative costs and inefficiency for business.”

NABIULLINA ON POTENTIAL LIMITS ON ROUBLE WITHDRAWALS

“In my view, this measure will not work, and will not be effective”.

“(Restrictions on) transferring roubles abroad are similar to previous measures. Transferring funds to a foreign bank does not in itself create demand for currency. Demand arises at the moment when this currency is purchased. Demand can only be influenced by increasing the attractiveness of the rouble as a store of value. And by the way, it doesn’t matter for the exchange rate whether roubles are converted from a Russian account or a foreign one.”

NABIULLINA ON MANDATORY CONVERSION OF FOREX REVENUES:

“What is being discussed first of all is to return, for example, to the mandatory sale of foreign currency earnings. A significant portion of our revenue is already in roubles. According to the latest data, 42% of all export revenue is already in roubles … If you look at residents who hold foreign currency earnings in accounts abroad, these volumes essentially did not change, whether there were currency restrictions or not, they amount to less than 1% of the total volume of export foreign exchange earnings. And about 90% of the converted foreign exchange earnings of the company continue to be sold. Having sold their foreign exchange earnings, exporters have the opportunity to buy it back in the volumes in which they deem necessary. As a result, only turnover on the foreign exchange market will increase … but the supply and demand balance for currency will not change. And at the same time, this will create inconvenience for companies for which revenue is needed to purchase imported equipment, costs for additional conversion, but will not have a significant effect on the exchange rate”.

NABIULLINA ON REPATRIATION OF FOREIGN CURRENCY PROCEEDS:

“The second topic is the repatriation of foreign currency earnings, the transfer of foreign currency funds from foreign banks to Russian ones. This does not mean that the supply of foreign currency on the Russian market will increase by the given amount. Because regardless of where you keep your foreign currency savings – in a foreign bank or a Russian one – it will not appear on the market, it will simply be stored in foreign currency accounts in a Russian bank and this will not affect the exchange rate”.

ZABOTKIN ON EASING MONETARY POLICY:

“Easing monetary policy will only be possible once the current price growth steadily declines and inflation expectations fall commensurately with it.”

NABIULLINA ON DIVERSIFICATION OF RESERVES AND RENMINBI

“If you invest reserves in non-reserve currencies, they will cease to be reserves… We have no plans for diversification… Our basket of gold and foreign currency reserves was more diverse, there were constant fluctuations in the prices of certain currencies… It is very important for us that the availability of yuan in reserves allows us to ensure the task of maintaining financial stability if necessary. Our economy, trade settlements have largely already switched to yuan. And if any currency interventions are needed … Previously, when a significant part of the economy was dollar and euro-denominated, there was no demand for yuan. Now there is a demand for yuan, and with the help of yuan we will be able to solve all the problems facing gold and foreign exchange reserves. Therefore, there are no plans for diversification.”

NABIULLINA ON UNPLANNED RATE INCREASE ON AUGUST 15:

“This was not a reaction to (the rouble exchange rate) reaching any specific level. This level does not exist … A really quite rapid shift in the exchange rate occurred, which we took into account in our forecasts. We considered it important not to wait until the key meeting, because this would be an additional boost to inflation expectations. And we might need to immediately raise the rate much more in order to achieve 4% inflation”.

BOTH ON RISE IN FUEL PRICES:

Nabiullina: “Fuel prices are an important factor in inflation…Fuel prices are now adjusting to both higher export prices and the new damper mechanism. The government is already working on this problem and we expect effective decisions to be made here.”

Zabotkin: “Taking into account the fact that this is a marker commodity that everyone watches, it is natural that there is an upward trend that has been observed in recent months, it, of course, contributes to an increase in inflation expectations. And the impact of gasoline on inflation expectations is something that we will also, of course, take into account.”

Our Standards: The Thomson Reuters Trust Principles.