The rupee rebounded after two straight days of fall to settle 17 paise higher at 83.17 (provisional) against the U.S. dollar on Thursday, amid a weak American currency overseas and a rally in domestic equity markets.

The inflow of foreign funds and a downward trend in crude oil prices also supported the Indian currency, forex traders said.

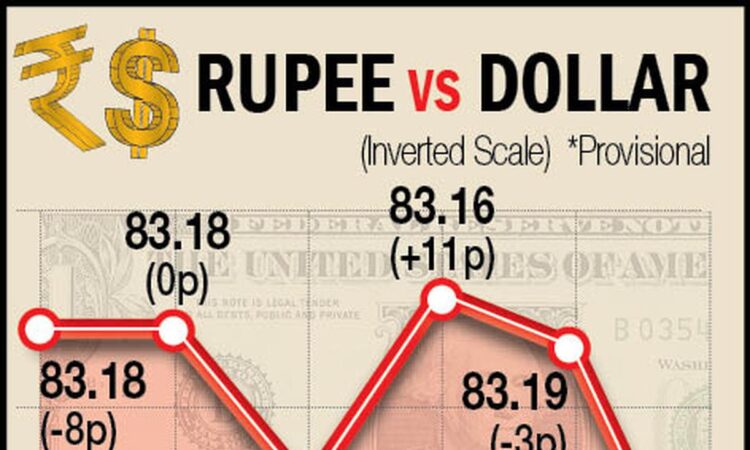

At the interbank foreign exchange, the domestic currency opened at 83.33 and traded in a range of 83.16-83.34 against the greenback. The local unit finally settled at 83.17 (provisional), registering a gain of 17 paise over its previous close.

The rupee had lost 18 paise in the previous two sessions.

On Wednesday, the domestic currency settled 15 paise lower at 83.34 against the dollar, a day after closing at a loss of 3 paise.

Anuj Choudhary, Research Analyst at Sharekhan by BNP Paribas, said the rupee appreciated on the weak U.S. dollar and a surge in domestic markets.

Mr. Choudhary said the rupee is likely to trade with a slight positive bias on fresh foreign inflows and an extended decline in the U.S. dollar. Also, “traders may take cues from weekly unemployment claims data from the U.S. USD-INR spot price is expected to trade in a range of ₹82.90 to ₹83.50”.

The U.S. dollar declined on rising expectations of rate cuts by the U.S. Federal Reserve.

The dollar index, which gauges the greenback’s strength against a basket of six currencies, was trading lower by 0.28% at 100.37 on Thursday.

Meanwhile, global oil price benchmark Brent crude declined 0.64% to $79.14 per barrel.

In the domestic equity market, the 30-share BSE Sensex jumped 371.95 points or 0.52% to settle at an all-time high of 72,410.38 points. The broader NSE Nifty soared 123.95 points or 0.57% to 21,778.70 points.

FIIs bought equities worth ₹2,926.05 crore on Wednesday, according to exchange data.

month

Please support quality journalism.

Please support quality journalism.