The rupee pared initial gains to settle 2 paise lower at 83.03 (provisional) against the U.S. dollar on Thursday, weighed down by a surge in crude oil prices and strong American currency overseas.

However, a positive trend in domestic markets cushioned the downside for the local unit, forex traders said.

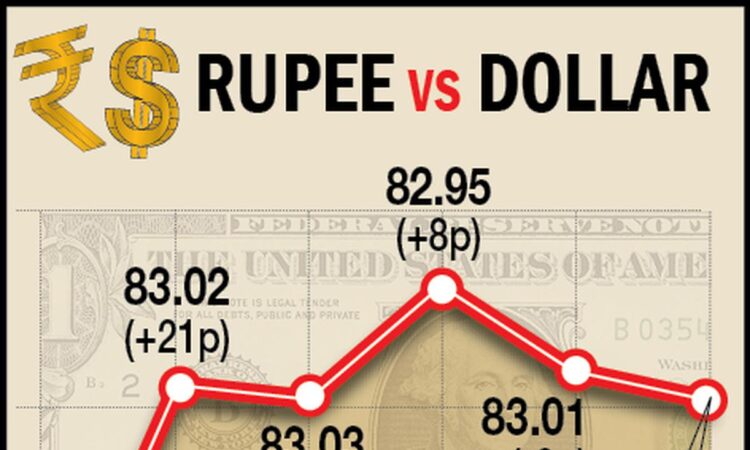

At the interbank foreign exchange market, the local unit opened at 82.98 against the U.S. dollar and moved in a range of 82.93 and 83.04.

The rupee finally settled at 83.03 (provisional) against the U.S. dollar, down 2 paise from its previous close.

On Wednesday, the rupee closed at 83.01 against the U.S. currency.

“The Indian rupee fell on Thursday on a positive U.S. Dollar and rising crude oil prices. This may impact the external payments.

“However, the positive tone of domestic equities prevented a sharp fall in the domestic currency. The U.S. Dollar gained on hotter than expected CPI raised rate hike concerns,” said Anuj Choudhary – Research Analyst at Sharekhan by BNP Paribas.

Meanwhile, the dollar index, which gauges the greenback’s strength against a basket of six currencies, rose marginally by 0.01% to 104.77.

Brent crude futures, the global oil benchmark, advanced 0.70% to $92.52 per barrel.

“We expect the rupee to trade with a slight negative bias on expectations that the U.S. Dollar may rise further. Elevated crude oil prices and selling pressure from foreign investors may put further pressure on the rupee,” Mr. Choudhary said.

However, any intervention by the Reserve Bank of India and positive domestic markets may support the rupee at lower levels, Mr. Choudhary said, adding that traders may remain cautious ahead of retail sales and PPI data from the U.S., expected to be softer than the previous month.

On the domestic equity market front, the 30-share BSE Sensex closed 52.01 points or 0.08% higher at 67,519.00. The broader NSE Nifty advanced 33.10 points or 0.16% to 20,103.10.

Foreign Institutional Investors (FIIs) were net sellers in the capital market on Wednesday as they offloaded shares worth ₹1,631.63 crore, according to exchange data.

month

Please support quality journalism.

Please support quality journalism.