The Gulf Arab states adopted a de facto peg of their currencies to the U.S. dollar decades ago. However, the arrangement became official starting January 2003. The only exception so far is Kuwait, which moved to an undisclosed basket of currencies in order to mitigate the detrimental effects of the peg on imported inflation. Nonetheless, the U.S. dollar remains a major part of the undisclosed basket, and the new arrangement remains an appropriate policy anchor, delivering low and stable inflation while providing significant monetary policy autonomy, according to the International Monetary Fund. For the other Gulf Arab states, with the fluctuations of the price of the main export commodities (oil and natural gas) and other shocks, in the current circumstances, there may be more advantageous options for the region than the peg to the U.S. dollar.

The Pros and Cons of the Currency Peg in GCC States

Gulf Arab states’ consensus to keep the peg is mostly a political decision. At the economic level, nonetheless, it is easy to find compelling arguments in favor as well as against the arrangement.

The Rationale in Favor of Maintaining the Peg

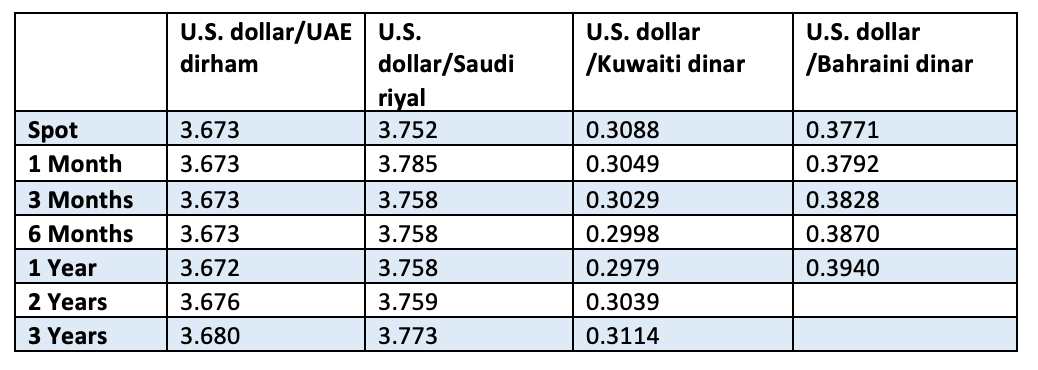

First, a large share of the financial assets held abroad by Gulf monetary authorities, sovereign wealth funds, and even the private sector is denominated in U.S. dollars. Therefore, a peg to the dollar provides a degree of certainty with regard to the evaluation of these assets, compared to a fluctuating exchange rate, which limits the exchange rate risk for all concerned agents. This is clear in the Forward Market for the GCC currencies, where the rate fixed today for a transaction that will take place in a year or more is not much different from the spot rate.

Forward Rates of GCC Currencies

Second, the currency mismatch, i.e., a high ratio of short-term debt to official international reserves, was a major issue in the Asian economies during the 1997-98 crisis, for example, because these economies kept an overvalued currency and encouraged the inflow of speculative short-term capital that was reversed as soon as exchange rates plunged, followed by a collapse in stock markets and other assets values. In the case of the Gulf Arab states, however, sufficient official foreign reserves and appropriate communications about the commitment to the peg should prevent speculation against the local currency.

Third, inflation is under control unless the main driver is local, such as the huge shortage of housing in Dubai during the 2006-08 real estate boom. A recent IMF paper warned that: “moving away from the peg would remove a credible monetary anchor—delivering low and stable inflation—with limited competitiveness gains in the near-term.”

Finally, a move to a more flexible arrangement would require monetary authorities to have the technical capabilities to manage the new system. Acquiring such expertise would require resources and time, challenges that could be difficult to address, at least in the short term. Gulf monetary authorities are therefore generally in favor of keeping the peg, as its abandonment is perceived as a leap into the unknown. And even though the Kuwaiti de-peg proved that there is nothing taboo about shifting to an alternative arrangement, there is no urgency to do so either, as long as the current regime seems to be working.

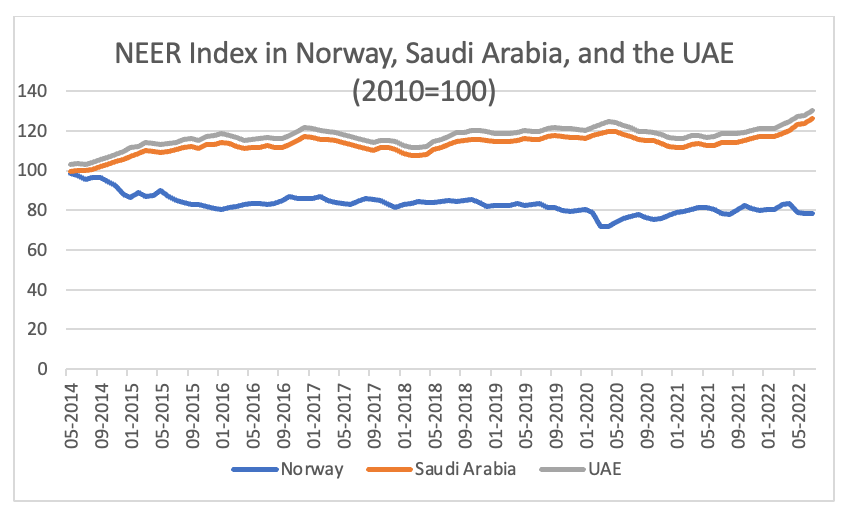

In assessing the relative merits of maintaining the peg, authorities must also consider the costs associated with a permanent overvaluation of the domestic currency that may result from the peg. According to the theory of the Real Equilibrium Exchange Rate, i.e., the exchange rate that achieves both an internal balance (a level of economic activity that keeps inflation stable) and an external balance (a sustainable current account of the balance of payments), the domestic currency should depreciate when the economy is subjected to a negative shock, such as the deterioration of the terms of trade defined as the ratio of export prices index to import prices index. For the Gulf Arab states this could happen as a result of a fall in oil prices, as was the case in mid-2014. Compared to Norway, as an example, where the currency depreciated by about 15%, the de-pegging decision could harm the competitiveness of export-oriented industries and therefore be detrimental to economic diversification.

Arguments Against the Peg

Norway employs a policy of inflation targeting with a basically free-floating exchange rate. An IMF report noted: “The Norges Bank does not normally intervene to influence the exchange rate of the krone; however, it may intervene in the foreign exchange market on short notice if the krone deviates substantially from the level the NB considers reasonable in relation to fundamentals and if exchange rate developments weaken the prospect of achieving the inflation target.”

This monetary and exchange rate policy autonomy in Norway allowed an adjustment in the Nominal Effective Exchange Rate of the krone, a trade-weighted exchange rate of the local currency, which fell by 15% from May 2014 to September 2016 and by 19% from May 2014 to December 2019. In contrast, with the peg arrangement in place, the Saudi riyal appreciated by 11.9% and 16.7%, respectively, while the United Arab Emirates dirham appreciated by 12.4% and 17.1%, respectively. Such an appreciation of the Gulf currencies was harmful to the competitiveness of nonhydrocarbon exports, the prices of which increased in foreign currency, thereby hindering economic diversification out of oil, which is the overriding objective of new economic strategies in the Gulf states. What is required in this case is internal devaluation, mainly reducing the labor costs to be able to reduce export prices. The Gulf Arab states have been able to do this in the past by lowering wages for expatriates. But there is a limit to this as expatriates can find better offers in other countries. Governments are also responding to pressures to improve conditions of low-paid nationals. Examples include the Saudi Ministry of Human Resources and Social Development’s on-the-job training programs to improve Saudi workers’ skills and the UAE “Nafis” (compete) program launched in September 2021 to support UAE nationals who choose to pursue a career in the private sector.

Given these realities, what might be an advantageous alternative exchange rate arrangement for the Gulf countries? The first option might be a free-floating exchange rate with intervention in the foreign exchange market if needed, as is the policy with Norges Bank. The problem for Gulf monetary officials would be that developing the technical skills to manage the new system would likely take time, and the uncertainty that would be introduced with the announcement to de-peg could be sufficient enough to dissuade decision makers.

Another alternative is the adoption of a currency board. The UAE knows this system very well, since it was the precursor of the central bank until its demise with the issuance of “Union Law No. (10) of 1980 Concerning The Central Bank, The Monetary System, And Organization of Banking.” With a currency board, the issuance of domestic currency is backed by the inflow of foreign currency. With large swings in oil prices, though the fluctuations in money supply may be large, monetary policy intervention (especially with limited use of macroprudential tools that aim to mitigate risks of shocks to the global financial system) is, by its very nature, restricted. Therefore, a currency board that may be appropriate for a small, open economy, such as in Hong Kong, may not be advisable for oil-exporting Gulf Arab states.

Economist Jeffrey Frankel has suggested a third alternative of a “currency-plus-commodity basket.” He argues that the effects of increased swings on Gulf states have been exacerbated by their exchange rate arrangement. The currency peg forced monetary policy to be pro-cyclical, thereby exacerbating economic fluctuations. He suggests that, both during oil booms and oil busts, the problems would have been moderated if the currency had been allowed to adjust, i.e., appreciate during the boom and depreciate during the bust. With a currency-plus-commodity basket, GCC countries would peg their currencies to a basket that includes the export commodity (oil) alongside major currencies. In the simplest case, the basket could assign equal weights of importance to three components: one-third to the U.S. dollar, one-third to the euro, and one-third to oil. Frankel argues that this system would have much of the advantage of a fixed exchange rate (a firm transparent anchor for the value of the currency) and that of a floating exchange rate (an automatic appreciation when world trade conditions favor the country’s export commodity, and vice-versa).

Putting the Pieces Together

As global economies become prone to unexpected supply shocks, it is important to rethink the economic policy toolkit. For the GCC countries this means rethinking the current peg system, among other things. An option like the adoption of a currency-plus-commodity basket comprised of the U.S. dollar, euro, and oil price could have many benefits. And the success of the new regime would be enhanced by the development of technical capabilities in monetary management and the decision-making framework. Institutions like the IMF and Norges Bank could provide valuable assistance in this regard.