(Bloomberg) — A new snapshot of the global economy’s weakening growth and persistent inflation will arrive in the coming week, just as surveys reveal headwinds for manufacturers from the US to Europe and Japan.

Most Read from Bloomberg

The OECD’s forecasts on Tuesday will show how officials at the Paris-based organization perceive a loss of momentum gripping countries around the world amid multiple shocks ranging from the energy crisis triggered by Russia’s invasion of Ukraine, to surging consumer prices and persisting supply squeezes.

The OECD’s previous projections, made in September, already suggested a worsening growth outlook for 2023. With economists now increasingly anticipating a recession to hit the US in 2023 — and with much of Europe possibly already contracting — the view is now likely to be bleaker.

Surveys of purchasing managers due the next day may add another layer of gloom, showing deterioration in industry throughout several advanced economies. All measures in the euro zone and UK are expected to show weakening, while economists predict factory activity in the US will be on the brink of contraction.

The prospect of slowing or slumping economies is sharpening the dilemma for global central bankers as they fight the worst bout of inflation in a generation. Even with signs of price pressures starting to ease in the US, there’s no room for complacency.

“One of the biggest challenges economies around the world are facing is inflation, and to bring inflation down at a time when growth is also slowing,” Gita Gopinath, first deputy managing director at the International Monetary Fund, said at the Bloomberg New Economy Forum in Singapore on Thursday. “We probably are entering an era where for central banks, they really have a trade-off to deal with.”

How such considerations have already begun weighing on policy makers in the US and Europe may be revealed in minutes of the most recent decisions of the Federal Reserve and the European Central Bank, due for release on Wednesday and Thursday, respectively.

What Bloomberg Economics Says:

“Data showing resilient demand, don’t bolster the case for a soft landing. Rather, they suggest the US economy is overheated and the Fed has to go harder at cooling the demand component of inflation. True, adverse supply shocks are receding, bringing inflation down in their wake, but the demand component of price pressures remains intact.”

— Anna Wong, Andrew Husby and Eliza Winger, economists. For full analysis, click here

Elsewhere, multiple central bank decisions will likely feature rate hikes from New Zealand to South Korea, and from Sweden to South Africa. Turkish policy makers may buck the trend with another cut in borrowing costs.

Click here for what happened last week, and below is our wrap of what else is coming up in the global economy.

US Economy

Minutes from the Fed’s policy meeting earlier this month will highlight the shortened Thanksgiving week. Investors will scan for further insight on when policymakers judge it’ll be appropriate to slow the pace of rate hikes.

The final November reading of inflation expectations from the University of Michigan will also be important for Fed watchers. A preliminary survey showed price views climbed from last month.

Several measures of the economy’s manufacturing sector will come out as well, including factory activity in the Richmond Fed’s region, durable goods orders for October, and S&P Global’s composite PMI for November, which also tracks services.

Asia

The central banks of New Zealand and South Korea are widely expected to raise rates again at meetings on Wednesday and Thursday, respectively. That will be the ninth straight hike for the Reserve Bank of New Zealand as inflation continues to surprise on the upside.

Price growth in Korea also remains elevated, though weakness in the won will likely be less of a factor in the decision this time around.

Post-meeting remarks by the RBNZ’s Adrian Orr and the Bank of Korea’s Rhee Chang-yong will be parsed for any signs of change in the policy path, as will comments earlier in the week from Reserve Bank of Australia Governor Philip Lowe.

Friday’s Tokyo CPI numbers for November will probably either show that the national price trend is set to continue accelerating, or that Japan’s inflation has peaked.

Europe, Middle East, Africa

Sweden’s Riksbank will take center stage at the final decision under the helm of Governor Stefan Ingves. A rate hike as big as 75 basis points is likely on Thursday.

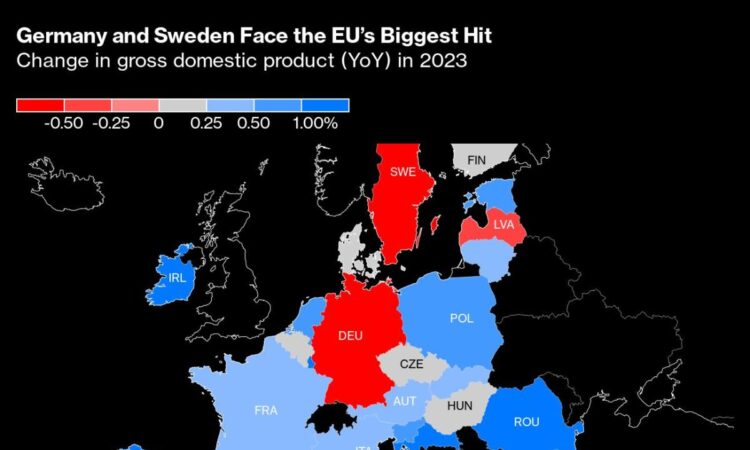

While smaller than the 100 basis-point move last time, it still showcases aggression against inflation in the face of a noticeably deteriorating economy and housing market. The European Commission predicts Sweden’s gross domestic product will shrink next year by 0.6%, matching Germany for the worst performance in the European Union.

In the euro region, where inflation is currently running at the highest in the history of the single currency, minutes of the ECB’s Oct. 27 meeting will throw light on the factors that drove officials to raise by 75 basis points, even with the economy possibly already in recession.

Several speeches are scheduled by ECB policy makers, including Vice President Luis de Guindos. Data highlights include euro-area consumer confidence on Tuesday, purchasing manager surveys due the next day, and German Ifo business sentiment.

Looking south, analysts are divided over the size of the Bank of Israel’s next rate hike on Monday after inflation jumped more than expected in October. Some predict officials will slow monetary tightening.

Nigeria is expected to increase borrowing costs for a fourth straight meeting on Tuesday to contain inflation, now at a 17-year high. The next day in Kenya, the monetary policy committee is forecast to hike for a second consecutive meeting.

On Thursday, South African rate setters are likely to raise the benchmark by 75 basis points yet again. Governor Lesetja Kganyago said in an interview last month that the bank will only consider rate cuts when there’s a sustained retreat in inflation. Price growth is expected to have slowed to 7.4% in October, data on Wednesday is forecast to show.

In Turkey, the central bank is expected to deliver another rate cut on Thursday and lower its benchmark into single digits, as demanded by President Recep Tayyip Erdogan — even as inflation spirals out of control and the local currency remains under pressure.

Slowing inflation may see monetary policy officials in Angola cut borrowing costs on Friday for a second meeting, making it another outlier at a time of global monetary tightening.

Latin America

In Mexico, tight financial conditions, inflation and high borrowing cost have consumers on the back foot, likely damping September’s retail sales results. The final print of third-quarter GDP should reaffirm the surprising strength seen in last month’s flash reading, while highlighting some of the headwinds slowing the economy toward year-end.

Mexico watchers are keen to pore over the minutes of Banxico’s Nov. 10 meeting, where policy makers hiked the key rate to a record 10%, kept a hawkish bias, and signaled more increases to come. Based on early estimates for mid-month inflation, Banxico’s stern posture looks about right: analysts expect that consumer prices have again drifted higher while the core reading, a focal point for the central bank, pushed to a fresh 22-year high.

Interest rates and inflation that are high by Peru’s standards, coupled with unending political turmoil, likely slowed third-quarter growth dramatically from the 3.3% year-on-year pace posted in April-June.

In Brazil, the mid-month consumer price report may underscore a hard truth: getting inflation down almost 600 basis points since April to roughly 6.2% was the easy part. Economists surveyed by the central bank don’t see inflation back to target until 2025, and only under the duress of unforgiving monetary policy.

–With assistance from Robert Jameson, Reade Pickert, Paul Richardson, Malcolm Scott and Molly Smith.

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.