Receive free United States Steel Corp updates

We’ll send you a myFT Daily Digest email rounding up the latest United States Steel Corp news every morning.

America is fond of big things, the Financial Times of 1901 remarked as it marvelled at the creation of the new United States Steel Corporation. Like Niagara Falls, it said, the world’s first company to be capitalised at more than $1bn was of a scale that was hard for the ordinary man to grasp.

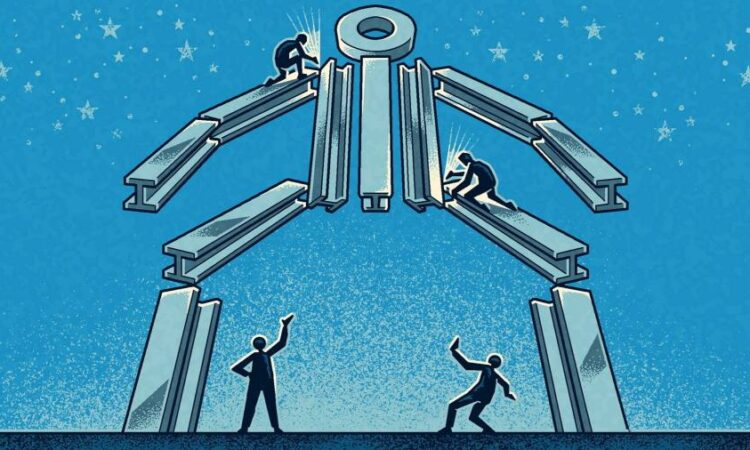

This “monster steel trust”, put together by power brokers including John Pierpont Morgan, Andrew Carnegie and Charles Schwab, would make two-thirds of the nation’s steel, giving it enormous pricing power. “It may easily give rise to trust legislation of a drastic character,” the FT wrote, prefiguring the long battle to break up United States Steel that ultimately failed in 1920.

The news last week of a brewing takeover battle for US Steel was greeted with less awe. The Pittsburgh-based company rejected a $7.3bn approach from rival Cleveland-Cliffs, and seemed to shrug when the privately held Esmark followed with a $10bn proposal. Both sums are drops in Niagara Falls against the trillion-dollar valuations the country’s leading tech companies command.

Steel may no longer seize or symbolise the American imagination, but its most storied name can still tell us something about how today’s capitalists pursue bigness, and what the US wants from its critical industries now they cannot compete globally on scale alone.

US Steel is still reviewing “strategic alternatives”, including several unsolicited approaches for all or parts of the company. It may yet stay independent, though last week’s stock price jump suggests investors are betting on a sale that could create a new industry leader domestically and put a US steelmaker back in the global big leagues.

Steel has long been a symbol of manufacturing’s drift to lower-cost countries. No US steelmaker ranked in the World Steel Association’s top 15 last year. China had nine companies on that list.

Even so, the industry’s enduring political salience has given America’s steelmakers cause for optimism of late. US Steel’s chief executive David Burritt welcomed Donald Trump’s 25 per cent tariffs on imported steel back in 2018 as a reprieve from 30 years of having “sand kicked in our faces” by other countries.

More recently, he has excitedly suggested that Joe Biden’s Inflation Reduction Act, with its incentives for investment in steel-hungry things such as electric vehicles, should be rebranded as the Manufacturing Renaissance Act. The $369bn stimulus showed that “the place we’ve called home for 120-plus years” was finally recognising that a strong manufacturing base was vital to its security in a deglobalising age, Burritt told analysts last month.

Similar flag-waving was on display from the very first line of Cleveland-Cliffs’ bid announcement, which promised to create an American steel company to rank among the world’s top 10. Its desired deal would secure investment in critical niche materials for the supply chain, it said, bolstering America’s economic security.

Lourenco Goncalves, the Cleveland-Cliffs chief who once predicted that investors betting against his company would have to kill themselves, is not known for his silver tongue. But his pitch to buy US Steel is a masterclass in stakeholder capitalist smooth-talking, painting the enlarged group as an emissions-cutting ESG leader focused on creating union jobs, innovating for customers and benefiting its communities.

Cannily, Goncalves has co-opted one critical stakeholder by securing the support of the United Steel Workers union, which lauded Cleveland-Cliffs as “an outstanding employer”. The contrast with US Steel’s early years, with its strikes over 84-hour working weeks, could not be starker, but 21st-century industrialists must win over many more constituencies than their predecessors did to build their combines.

Washington could prove the toughest of those stakeholders to persuade. The USW’s enthusiasm for Cleveland-Cliffs’ bid should carry some weight with Biden, a self-styled union booster who will need labour support for his re-election bid. The prospect of creating a globally significant US steelmaker also chimes with his administration’s embrace of industrial policy.

Yet, a deal with Cleveland-Cliffs or another suitor will test an administration whose antitrust agenda has been more aggressive than any Washington has seen for decades.

If Goncalves wins his target over, he will need to convince Biden’s Federal Trade Commission that combining two of the country’s four large steelmakers will not harm competition. Together, they would control the country’s entire ore supply and about half of its output of sheet steel, on which other key industries such as automakers depend.

FTC chair Lina Khan has drawn inspiration from Justice Louis Brandeis, who sat out the Supreme Court’s 1920 US Steel case having already given congressional testimony against the company but spent that era railing at the “curse of bigness” in industry. Capitalists’ tactics have changed radically since the days of Morgan, Carnegie and Schwab, but the tensions over big business have not.

We will soon discover which impulse is stronger in the White House: the desire for national champions in critical industries, or the suspicion of companies that get too powerful.

The market reaction suggests that investors believe America is still fond of big things. So too, it seems, does another heir to the whiskered robber barons who founded US Steel: Cleveland-Cliffs is advised by JPMorgan.