Written by Convera’s Market Insights team

Dollar drifts lower ahead of inflation data

Boris Kovacevic – Global Macro Strategist

The upbeat risk tone across financial markets has seen the US dollar erase all of last week’s gains as investors await a raft of key inflation data from major economies for guidance on the global interest rate outlook. An upside surprise in the core personal consumption expenditures (PCE) price index report – the Federal Reserve’s preferred measure of inflation – this Friday, could trigger a big reaction in terms of a move up in US yields and a resurgence in dollar strength.

Continental Europe and Asia were the two sole drivers of price action in global markets at the beginning of the week with US and British investors staying away from their desks due to respective holidays. Volatility therefore remained muted, but sentiment continued to follow the trends established on Friday with equities, commodities and pro-cyclical currencies pushing slightly higher. The US dollar gained in every single trading session last week going into Friday but suffered major losses before the market close. Profit taking, pulled forward month-end rebalancing and lower-than-expected consumer inflation expectations published by the Michigan University can be blamed for the selling pressure, which continued Monday. Speculative positioning of the US dollar turned negative for the first time in six weeks as asset managers increased their wagers on a falling Greenback.

Investors will now pay close attention to the upcoming US PCE inflation report, which is expected to show stagnant price growth. Core inflation is likely to have stayed at 2.8% for a third consecutive month, highlighting the recent cooling of disinflationary pressures. Looking at global factors, the commodity cycle is expected to add to inflationary pressures going into the second half of the year. Price growth of around 77% of commodities is now positive on an annual basis, highlighting the uptick in the pro-cyclical part of the global economy. The rise in commodity prices alone has historically not been able to lift inflation rates meaningfully as shown in the period from 2017 to 2018. However, put in the context of a recovering Europe, rising demand from China and financial conditions continuing to ease globally, policy makers will tread carefully when discussing premature easing.

Sterling at multi-month highs

George Vessey – Lead FX Strategist

The British pound rose to its highest level since mid-March versus the US dollar yesterday amid the rise in global risk sentiment and thin trading conditions due to the US and UK holidays. GBP/USD is hovering under the $1.28 handle, almost 4% higher than its 2024 low of around $1.23 and just one cent away from its 2024 high. Against the euro, sterling is lingering near 9-month peaks, just 30 pips shy of a €1.18 and almost 2% higher than 2024 low of €1.1560 recorded at the end of April.

The main driver of sterling strength of late was the hotter-than-expected inflation report published last week resulting in the probability of a June rate cut by the Bank of England (BoE) plunging from 50% to 10%. Less than two BoE rate cuts are now being priced in by money markets for 2024, with 30 basis points of total easing expected by year-end, which seems far too hawkish in our opinion. However, as a result, yields on UK Gilts jumped to 1-month highs and the UK-US yield spread to a 2-month high, driving GBP/USD to its 11-week peak. Meanwhile, the election news hasn’t had a negative impact on sterling so far, but noise could pick up if polls show the incumbent Conservatives narrowing the gap, thus increasing uncertainty. Ultimately though, neither party is promising radical fiscal policy shifts, and neither party is going to want to spook financial markets like former PM Truss did back in October 2022. Therefore, it’s possible that this election campaign will be much less volatile and the direction of UK assets, like the pound, will likely be dictated more by fundamental economic drivers and by the timing and pace of BoE rate cuts.

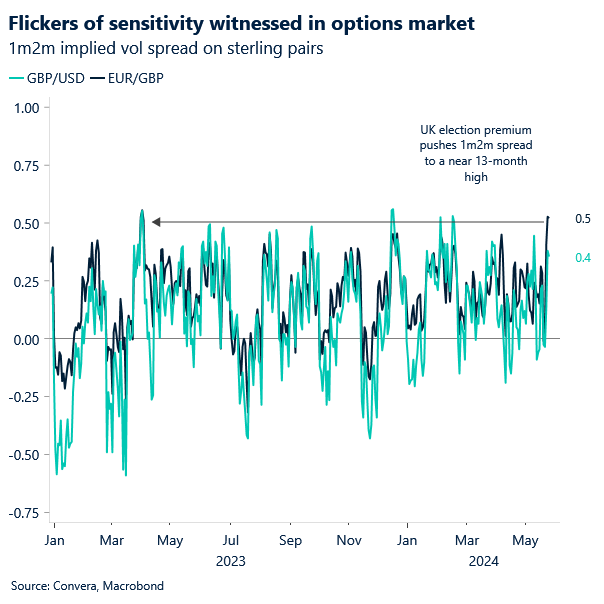

Although the spot market has been rather muted on the election news, the reaction in options market reflects the anticipation of volatility picking up though, with 2- and 3-month implied vols, which capture the election date, spiking higher. The biggest risk to sterling over the next couple of months, which could drag GBP/USD back under $1.25, is a surprise June rate cut by the BoE or a hung parliament in the election, but both scenarios are tail risks at this stage.

Euro rebounds after first weekly loss in six

Ruta Prieskienyte – FX Strategist

Despite maintaining resilience across most G10 peers, the euro suffered its first weekly drop since mid-April last week, as the US dollar strengthened due to the scaling back of Fed easing expectations. However, the start of this week began with echoes of hawkishness from ECB chief economist Philip Lane highlighting the need for policy to stay restrictive through 2024. Eurozone inflation rates have flatlined between 2.4% and 2.9% for seven months now as the global disinflationary impulse has slowed with expectations for the May print on Friday to confirm this trend. This has pushed expectations of further policy easing beyond June down significantly in recent weeks.

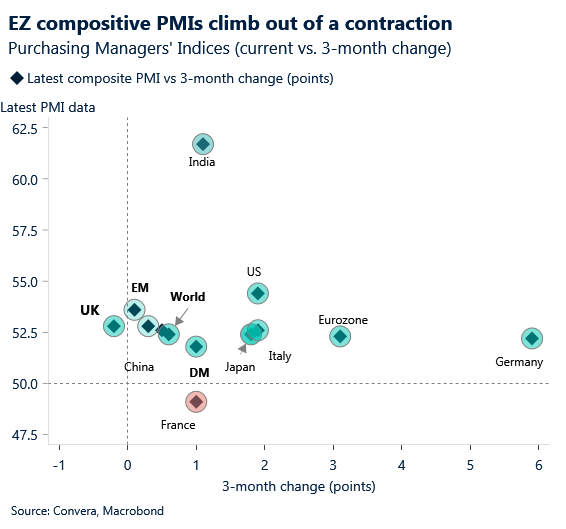

Recovery across the common bloc is gaining momentum as evidenced by the flash HCOB Eurozone Composite PMI published last week, which rose to 52.3 in May, the highest reading in a year, exceeding the market consensus of 52. Growth continued to be cantered on the services sector, but the manufacturing sector edged closer to stabilisation too. Having said that, the most anticipated data point over the past few months sent a note of caution to expectations that price increases are definitively retreating. Contrary to expectation, negotiated pay increased 4.7% y/y in Q1 2024, up from 4.5% observed the same time last year, matching a record set in Q3 2023. While wage growth is expected to remain elevated in 2024, pressures look set to decelerate in 2024. Nonetheless, money markets’ assurance of a June rate cut wavered, with probability of a 25bps cut easing below 90% for the first time in over three weeks. Year-end expectations scaled back to 57 basis points, down from 67 basis points at the start of last week.

The euro has jumped in on the dollar weakness at the weekly open and ignored both the weaker than expected German Ifo index and headlines on the rising trade tensions between China and Europe. German business confidence remained unchanged in May at 89.3 as the current conditions index declined slightly from 88.9 to 88.3. The forward-looking expectations component continued to improve on rising hopes of a rebound in China and reached the highest level in a year. However, the setback of the headline index suggests that Germany is recovering one step at a time.

Pound holding gains, unfazed by election risk so far

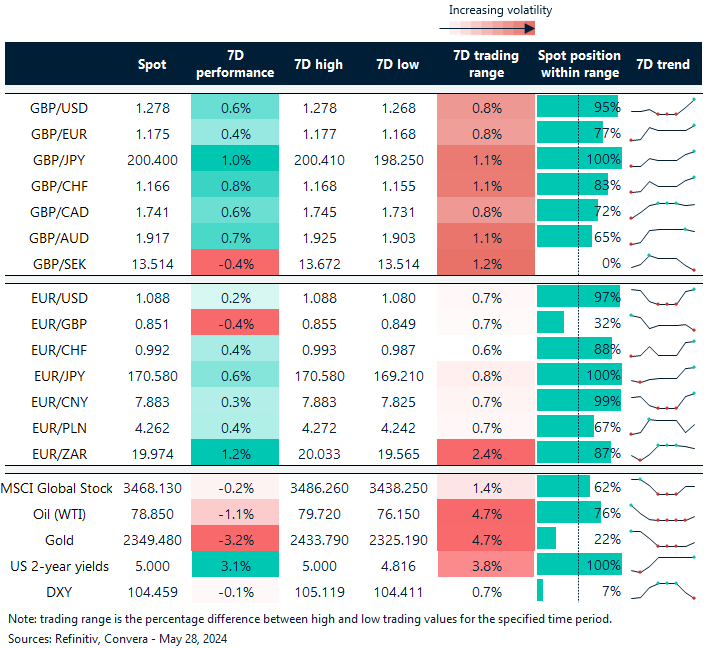

Table: 7-day currency trends and trading ranges

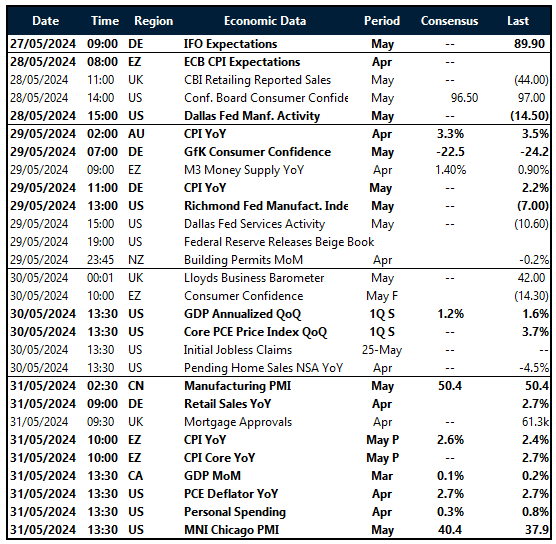

Key global risk events

Calendar: May 27-31

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.