Privacy currencies lost over $6 billion this year, anonymity takes a back seat to Defi and NFT

The last 12 months have been tough for digital currency investors, as the crypto winter has wiped out much of the value of this once thriving economy. The private currency economy, for example, has lost more than 55 percent against the U.S. dollar, falling from $11.7 billion in January 2022 to $5.22 billion currently.

Private currency economy loses 55% to greenback, EU seeks to ban anonymous cryptocurrencies.

Privacy currencies aren’t the talk of the town like they used to be. These days, the hype and discussion around decentralized finance (defi) and non-fungible tokens (NFTs) has overshadowed conversations about privacy coins.

In addition, over the past 12 months, the private coin economy has fallen from 1.5 percent to 11.7 billion to today’s $5.22 billion. Last January, the two main privacy tokens were monero (XMR) and zcash (ZEC).

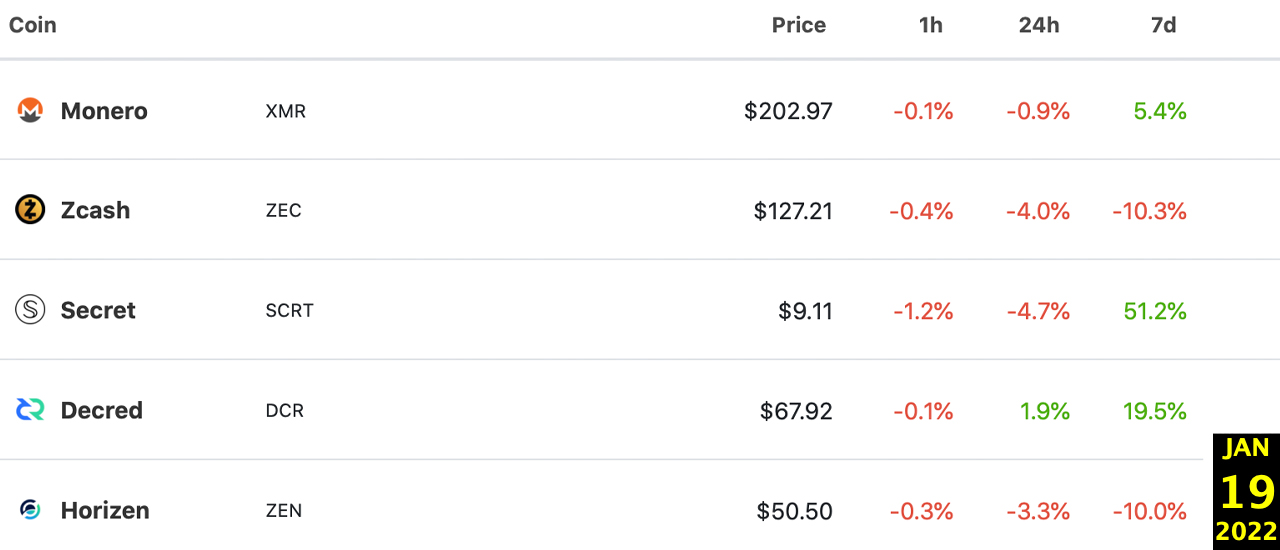

At the time, Monero was the largest private coin in terms of market capitalization and still is today. As of January 2022, the share price was approximately $202.97 per unit and its market valuation was approximately $3.66 billion on January 19, 2022.

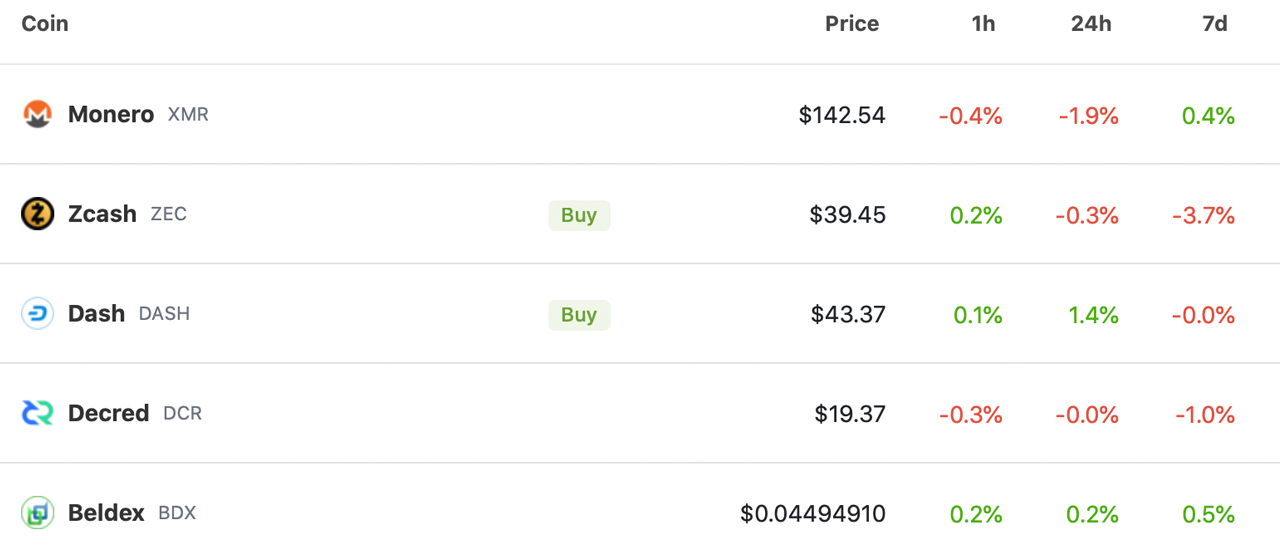

Today, XMR trades at about $142.35 per unit and has an overall market capitalization of about $2.58 billion. Zcash holds the second highest valuation in the private coin market this year and as of January was approximately $1.53 billion.

By the end of December 2022, ZEC’s market capitalization has fallen to $517 million. The top five private coins in January 2022 by market capitalization include monero (XMR), zcash (ZEC), secret (SCRT), decred (DCR) and horizen (ZEN).

December 2022 statistics show that the top five private coins are monero (XMR), zcash (ZEC), dash (DASH), decred (DCR) and beldex (BDX). The market capitalizations of XMR and ZEC are equivalent to about $3.1 billion, or 59.4 percent of the total private coin economy.

As of January 2022, XMR and ZEC were valued at $5.19 billion and accounted for only 44.36% of the total private coin economy. Today, the top two private coins by market capitalization are much more dominant.

Last month, it was reported that leaked EU plans could ban private coins such as XMR, ZEC, and DASH. “The European Union could ban banks and crypto-currency providers from processing privacy-enhancing coins such as zcash, monero, and dash under a draft anti-money laundering bill obtained by Coindesk“, the publication noted on November 15, 2022.

Government policy decisions and proposed guidelines have led a number of crypto-currency exchanges around the world to stop listing privacy-related coins, such as XMR and ZEC. The lack of listing gives private currencies much less liquidity, making them more susceptible to price fluctuations.