Written by Convera’s Market Insights team

Equity slump and huge yen rally stabilise

George Vessey – Lead FX Strategist

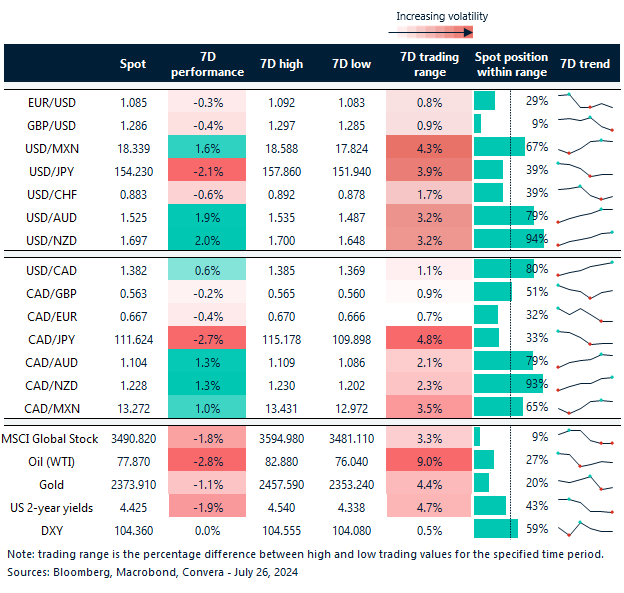

Global risk aversion has gripped markets this week as investors continued to sell some of this year’s top tech stocks for a second day, following the worst sessions for the S&P500 and Nasdaq 100 since 2022. “Position liquidation” is perhaps at play, as recent price action in tech stocks and the yen suggest that consensus positions have come under the cosh. Despite safe haven demand, the US dollar index has struggled for three days straight and is primed for a marginal weekly loss amidst a surging Japanese yen.

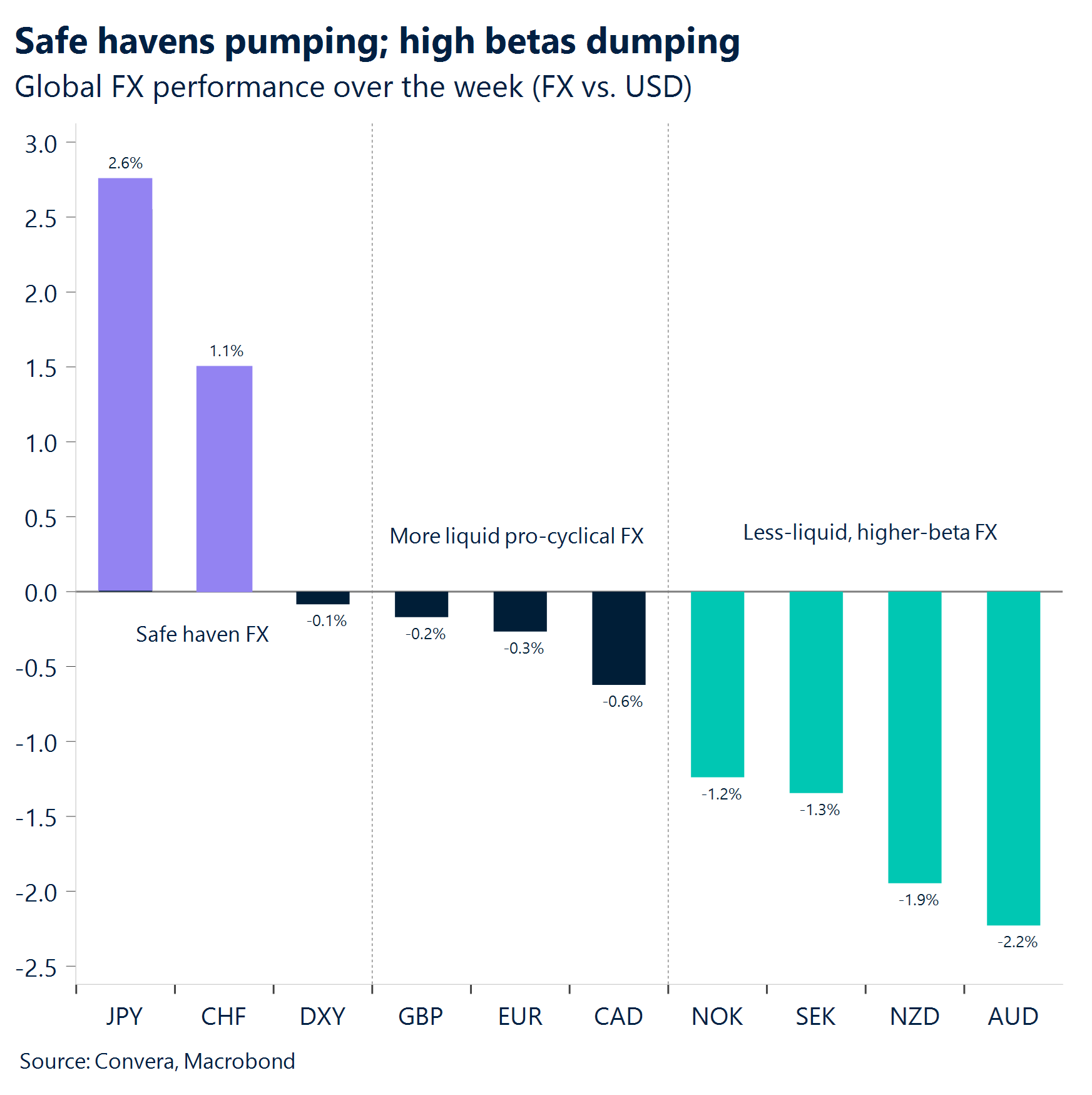

As well as the pick-up in equity volatility, we’ve seen a rapid unwinding of carry trades which has benefited the funding currencies of the Japanese yen and Swiss franc. These two low yielding currencies, used to fund high yielding currencies in a carry trade, are the star performers of late. However, although the US dollar is down around 3% versus the yen this week, it is faring better versus other majors like the pound and euro and much better versus less liquid and high beta peers like SEK, NOK, AUD and NZD. Meanwhile, on the economic data front, the better-than-expected 2.8% expansion in Q2 US GDP, up from 1.4% in Q1, reinforces the view that the Federal Reserve (Fed) can curb inflation without hurting the economy.

In addition, the PCE inflation indicator, that accompanied the GDP data, surprised to the upside, so it’s possible the monthly PCE inflation figures due later today — especially the core indicator that the Fed watches — could do so as well, potentially supporting the dollar into the weekend ahead of next week’s key Fed meeting.

Pound at the mercy of global sentiment

George Vessey – Lead FX Strategist

The risk off mood in global financial markets this week has caused reverberations in Bank of England (BoE) policy pricing too. The probability of a BoE rate cut in August has jumped back above 50% and has dragged the 2-year gilt yield below 4%, to a new 1-year low. Hence, the pound is on track for its second weekly loss in a row against the US dollar, currently flirting with its key 200-week moving average near $1.2850.

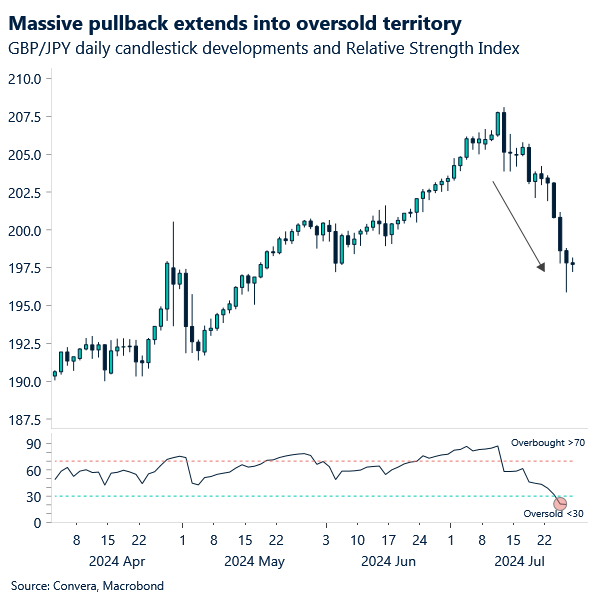

Like the dollar though, the pound’s biggest weekly losses have been against the safe havens Swiss franc and Japanese yen – the latter down almost 3% this week – its worst week since the UK mini budget crisis back in late 2022. GBP/EUR is also on track to record a second weekly decline, pulling further back from almost 2-year highs above €1.19. Against these liquid major currencies – sterling could be vulnerable to further losses as we think markets might be underestimating the prospects of UK rate cuts this year. Whether the first move comes in August or September is a very close call and with 1-week GBP/USD implied vols at a 1-month high, markets are getting ready for the upcoming knife edge BoE meeting next week.

We caution though, that if the BoE delivers a hawkish cut, or even keeps rates unchanged, underscoring upside risks to inflation persistence, we could see GBP/USD and GBP/EUR move back towards $1.30 and €1.20 respectively, but this also depends on the broader global market dynamics as evidenced this week.

Euro recovers towards $1.085 despite US growth upside

Ruta Prieskienyte – Lead FX Strategist

Contrary to the upside surprises in consumer sentiment witnessed earlier this week, it appears that German businesses are much less optimistic about the Eurozone economic outlook. The Ifo Business Climate indicator for Germany declined for the third consecutive month, touching its lowest point since February 2024. Sentiment has declined considerably among companies in Germany, with both current conditions (87.1 vs 88.3) and expectations (86.9 vs 88.8) worsening. The business climate deteriorated across manufacturing, services, trade, and construction, as Germany remains stuck in crisis mode.

Souring investor sentiment, along with disappointing Eurozone PMIs from earlier this week, points to weakening economic momentum, which could see equities retract further and the euro lose its supportive cushion from the first half of 2024. Speaking of equities, the Stoxx 50 extended its losses for a second consecutive day. The cumulative week-to-date and month-to-date losses currently stand at 0.9% and over 1.6%, respectively. Meanwhile, European bonds continue to perform well, with the yield on the 2-year German bond falling to 2.68%, its lowest since early February.

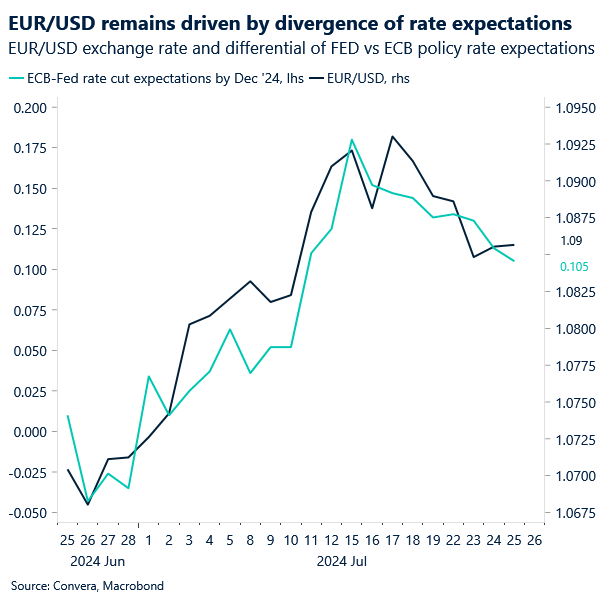

The Euro Index is on track to decline for the first time in a month, shedding approximately 0.45% week-on-week, with losses driven solely by a flight to safe-haven currencies: USD, CHF, and JPY. On aggregate, EUR/USD is still up 1.4% month-to-date, but that may cap near-term gains. Previously supportive seasonality trends weaken in August and are set to turn negative in September, leading to an overall negative Q3 performance.

For now, we maintain that the EUR/USD trajectory will continue to be almost exclusively determined by US-driven events, expecting the pair to be supported in the $1.08 region, with the July high of $1.095 as the ceiling.

Safe havens surge; precious metals rebound

Table: 7-day currency trends and trading ranges

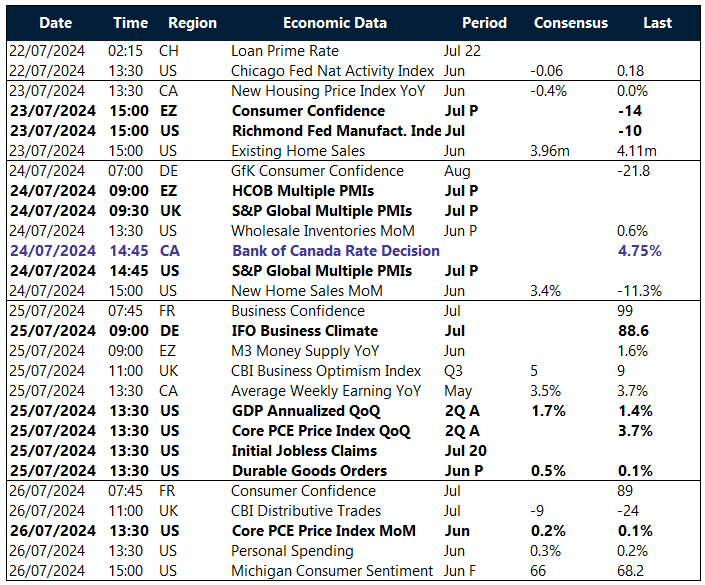

Key global risk events

Calendar: July 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.