- Goldman Sachs sees GBP better supported

- But Bank of England could remain a handicap

- Deutsche Bank says holds positive stance on GBP

Image © Pound Sterling Live

The British Pound is 2023’s best-performing developed market (DM) currency and further gains are likely say analysts at a major investment bank, despite global banking sector stress.

Sterling had entered March as a mid-performer for 2023 but has seen its value increase over recent days as investors take fright of stresses in the global banking sector.

“Far larger banking sectors in the US and Europe may be helping the pound in this environment with investors more confident of the UK banking sector avoiding any nasty surprises than in the US or the euro-zone,” says Derek Halpenny, Head of Research for Global Markets EMEA at MUFG Bank.

The outperformance comes as a surprise given the Pound is not traditionally associated with a ‘safe haven’ status; indeed during the 2008 financial crisis, it plumbed a record low against the Euro and other major peers.

“Sterling is the best-performing DM currency so far this year, and we remain constructive,” says Shreyas Gopal, Strategist at Deutsche Bank.

Signs of banking sector stress in the U.S. and Europe contrast with the UK’s major banks which have steered clear of the headlines, suggesting the sector to be well positioned.

“The UK banking system is well capitalised and funded, and remains safe and sound,” said the Bank of England in a statement following news UBS was to acquire its Swiss rival, Credit Suisse.

“Britain’s banks so far have not been under investors’ microscope, and the zero usage of the Bank of England’s U.S. dollar liquidity swap line on Monday suggests that stress levels within the banking system currently are low,” says Samuel Tombs, Chief UK Economist at Pantheon Macroeconomics.

Global equity markets have fallen alongside bond yields as investors take fright at a number of bank failures in the U.S. and the dramatic failure of Credit Suisse.

This is typically an environment that sees the Pound lag the likes of the Yen, Franc, Dollar and Euro as ‘hot money’ tends to flow out of the UK’s financial services sector when investor sentiment deteriorates.

Tombs says it makes sense that UK banks have not been a source of concern, “given that none of the main U.K. banks have been mismanaged like Credit Suisse or have acquired a large destabilising pool of fixed-income securities like SVB.”

The Pound potentially reflects this state of affairs.

“It’s striking that the usually very risk-sensitive pound has been insulated from the fall in equities,” says Gopal.

The Pound to Euro exchange rate has risen above 1.14, having been as low as 1.12 earlier in March. The Pound to Dollar exchange rate (cable) is at 1.2272, its highest level since February 02. (If you are looking to protect or boost your international payment budget you could consider securing today’s rate for use in the future, or set an order for your ideal rate when it is achieved, more information can be found here.)

“Cable’s short-term correlation to US equities briefly dipped negative last week and reached its lowest point since the start of the Covid pandemic, with GBP having proved the least risk-sensitive of all G10 currencies over the past few weeks,” says Gopal.

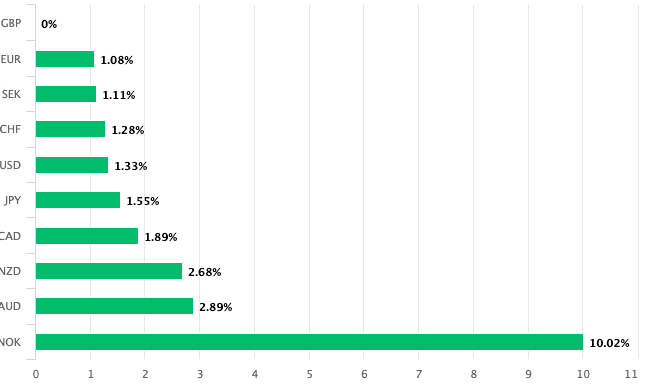

Above: GBP has advanced against all G10 peers in 2023. Consider setting a free FX rate alert here to better time your payment requirements.

Currency analysts at Goldman Sachs say Pound Sterling is looking better positioned against Euro and Dollar as they upgrade their forecasts for the UK economy and account for a more stable political environment.

“The tide on idiosyncratic GBP weakness has turned in our view,” says Kamakshya Trivedi, an economist at Goldman Sachs.

“Falling gas prices have mitigated several unique pressures as our economists no longer expect a technical recession and attenuated fiscal pressures create space for more spending but lower debt,” he adds.

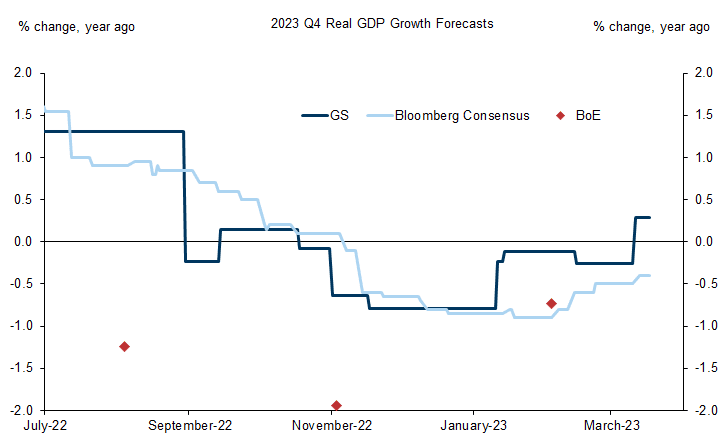

Above: “We have continued to upgrade our UK growth forecasts” – Goldman Sachs. Source: Bloomberg, Bank of England, Goldman Sachs Global Investment Research.

UK wholesale gas for next-month delivery on Monday fell below £100/Thm for the first time since August 2021 in an ongoing dramatic drop that means bills facing households and businesses will start to fall from mid-year.

Deutsche Bank’s Gopal says “the sharp drop in energy prices and improvement in real yields” have aided the UK’s external position, which has benefited Sterling.

Goldman Sachs says they “continue to upgrade” their UK growth forecasts amidst signs of economic resilience and falling energy-lead inflation.

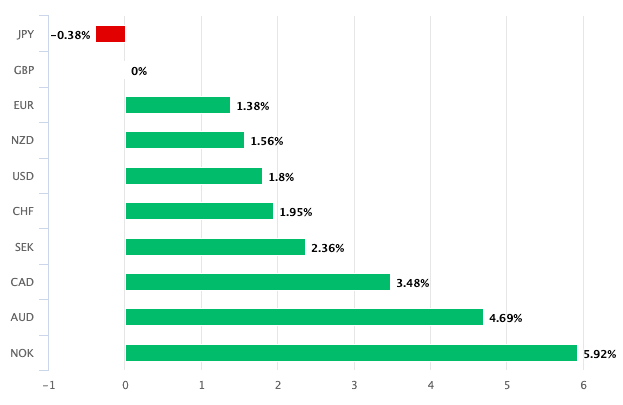

Above: In the past month only the Yen has outperformed GBP.

In addition, the UK’s political climate also appears to be assisting.

“At the same time, political instability appears increasingly distant as the current government appears to have found a path to compromise across divisions, both at home and abroad,” says Trivedi.

The UK government has managed to avoid any major scandal under Sunak while diplomacy with the EU has yielded an agreement on the contentious issue of Northern Irealnd, which analysts say should allow for improved relations with the UK’s largest trading partner going forward.

Deutsche Bank analysis meanwhile finds a good deal of the Pound’s recent outperformance is an unwind of investor bets looking for further weakness in the Pound.

“The bigger factor behind sterling’s resilience is likely a positioning squeeze, possibly driven by an unwind from trades where GBP had been used as a funder for even higher-beta currencies,” says Gopal.

Commitment of Traders data show the market has retained a net short position in the Pound for several months, as of early March.

Bank of England Near-term Hurdle

Image © Pound Sterling Live

Analysts at Goldman Sachs unite with a host of their peers in warning the Bank of England will likely remain a potential block on further gains in the Pound.

Trivedi, in a weekly currency research update to clients, says the Bank remains the final “lynchpin” for Sterling underperformance.

The Bank of England has proven a ‘reluctant hiker’ when raising interest rates by either delivering a smaller-than-expected hike or hiking and warning that it would not need to deliver too much more.

Downbeat GDP growth forecasts have tended to combine with optimistic inflation forecasts, curating a message to investors that the Bank was not going to meet their lofty expectations for the scale of incoming rate hikes.

Expectations for Sterling weakness following the Thursday 23 rate hike is therefore widely anticipated.

“The Bank of England has consistently delivered a dovish message to markets over the last year, and this hardly seems like the environment to break that streak. For that reason, we think it is too early to be long GBP even if it is no longer the best short,” says Trivedi.

But Goldman Sachs says the Bank cannot remain a handbrake for Pound upside indefinitely, but it would take an acknowledgement of an improving economy to snap its dovish hold on the currency.

When this happens, the prospect of holding ‘long’ GBP bets becomes more attractive.

Deutsche Bank says the market has lowered its expectations to such an extent that a 25 basis point hike on Thursday would prove a surprise that could ultimately help the Pound.

Economists at Deutsche Bank expect the Bank of England to deliver one final (25bp) hike.

“With UK financial conditions not having tightened as much as in the Euro Area and the US following the recent banking stresses, tightening policy above what’s priced ought to still play positive for the currency. We continue to favour sterling higher against the Swedish krona and US dollar,” says Gopal.