Image © Adobe Images

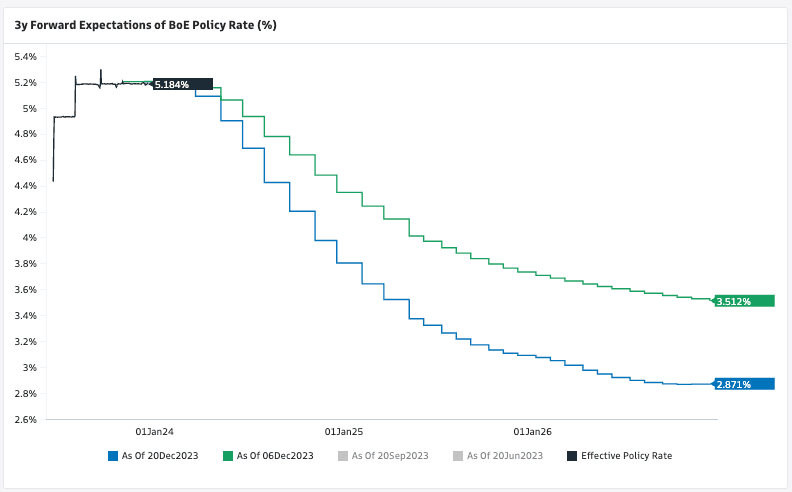

The British Pound was the best-performing major currency of 2023 until August when it became clear that inflation would slow and negate the need for the Bank of England to raise interest rates as high as 6.5%, which money markets were implying at the time.

The slowdown in UK inflation has come to pass, culminating in the December inflation release that showed a significant slowdown in November.

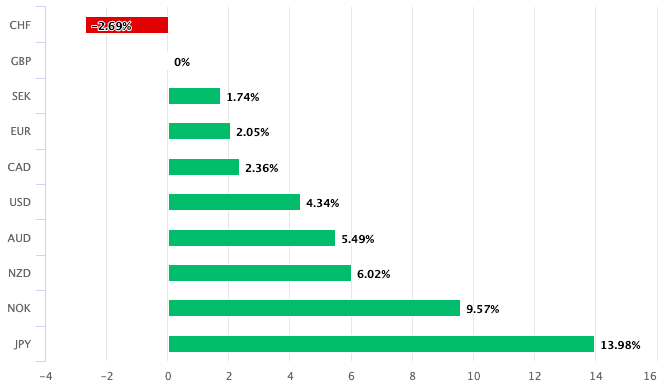

Markets have ramped up rate-cut bets, and the Pound is the second-worst performer in the G10 when screened over the past month. Yet, the UK currency remains the second-best performer in the G10 for 2023, with just a handful of trading days remaining.

For currencies, 2024 will be all about the timing and scale of central bank rate cuts; should the Bank of England cut before its major peers, the Pound will struggle. If it cuts later, UK yields can outperform, and the Pound can appreciate in value again.

NatWest expects the British Pound to steadily advance against the Euro and Dollar until about the third quarter of 2024 before paring gains into year-end as the Bank of England takes a knife to interest rates.

According to a year-ahead analysis from NatWest, attractive UK bond yields will be the lynchpin of GBP strength, particularly in the first half of the year.

NatWest’s economists expect the UK to have one of the highest nominal policy rates in the G10 for much of next year.

“Yield differentials are set to move in favour of Sterling,” says Paul Robson, Head of FX Strategy for EMEA at NatWest Markets.

Above: GBP is the second-best performer of 2023.

The Pound to Dollar exchange rate is pencilled in for 1.24 by the end of March, 1.27 by the end of June, 1.31 by the end of September and 1.30 by the end of the year.

The Euro to Pound rate is seen at 0.87, 0.85, 0.87 and 0.88 at these time points, giving a Pound to Euro profile of 1.15, 1.18, 1.15 and 1.14.

Foreign exchange analysts at ANZ say the Pound is “not to be underestimated” in 2024, “though the growth outlook remains challenging, recent data suggest the economy may be turning a corner.”

“Signs of resilience and the easing of inflationary pressures point to a robust GBP in 2024,” says ANZ.

Track GBP with your custom rate alerts. Set Up Here.

ANZ forecasts the Euro-Pound exchange rate at 0.85 by the end of March and 0.86 through to the end of 2024. This translates into a Pound-Euro profile of 1.18 and 1.16.

Pound-Dollar is meanwhile seen rising to 1.34 by the end of next year.

Meanwhile, analysts at Goldman Sachs have raised forecasts for the Pound-Dollar exchange rate, albeit largely due to expectations for a weaker dollar.

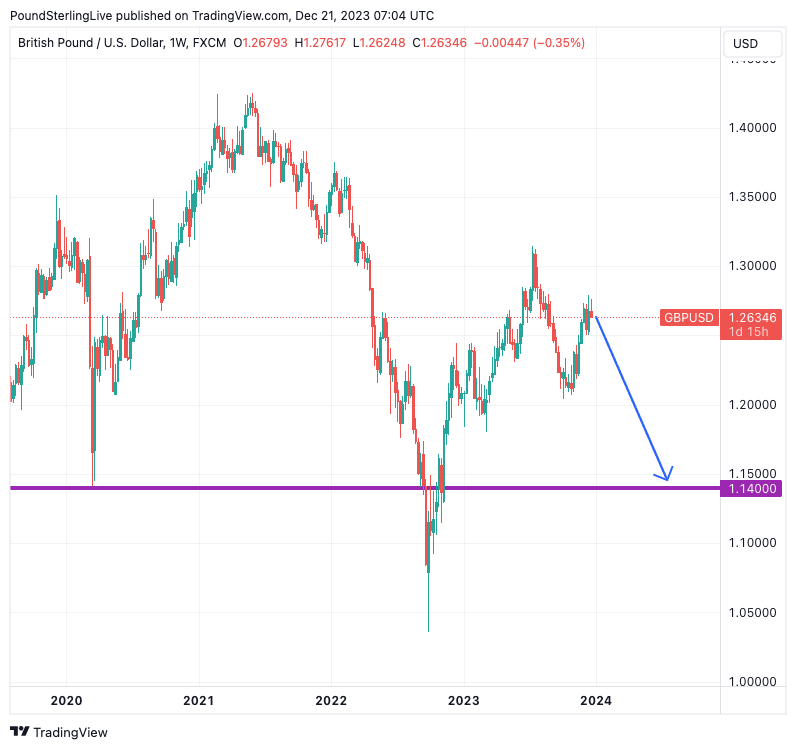

Above: GBPUSD at weekly intervals showing the direction of travel and low point anticipated by Morgan Stanley in 2024.

Following recent downside surprises in U.S. inflation readings and last week’s Federal Reserve Open Market Committee meeting, economists at Goldman Sachs have made a “significant” change to their Fed call.

They expect five interest rate cuts from the Federal Reserve next year, compared to just one made in the initial 2024 Outlook publication.

Goldman Sachs now forecasts the Pound to Dollar exchange rate at 1.28 in three months, an upgrade from the previous forecast of 1.25. In six months, the pair is seen at 1.30, unchanged from the previous forecast and in 12 months, the target is raised to 1.35 from 1.30.

However, several investment banks are outright pessimistic about Sterling’s prospects in 2024.

Above: Market expectations for rate cuts have increased dramatically in December, coinciding with a softer GBP. How much lower the curve goes will determine how much further weakness is to come. Image courtesy of Goldman Sachs.

Foreign exchange strategists at investment bank Morgan Stanley say they are “most negative” on Pound Sterling in the G10 space for 2024.

This negativity crystalises in a sobering year-ahead forecast profile that sees the Pound set to fall to crisis-era levels against the Dollar.

“We are cautious on EUR and EMFX, and most negative on GBP,” says Matthew Hornbach, a strategist at Morgan Stanley.

According to Hornbach, Pound Sterling chiefly benefited from its “high carry” in 2023 thanks to elevated UK bond yields as investors anticipated significantly higher Bank of England interest rates.

But he expects the Bank to cut far faster and more aggressively than what’s priced by financial markets.

Morgan Stanley forecasts the Pound-Dollar exchange rate will fall to 1.14 by mid-2024, ahead of 1.15 by year-end.

Track GBP with your custom rate alerts. Set Up Here.

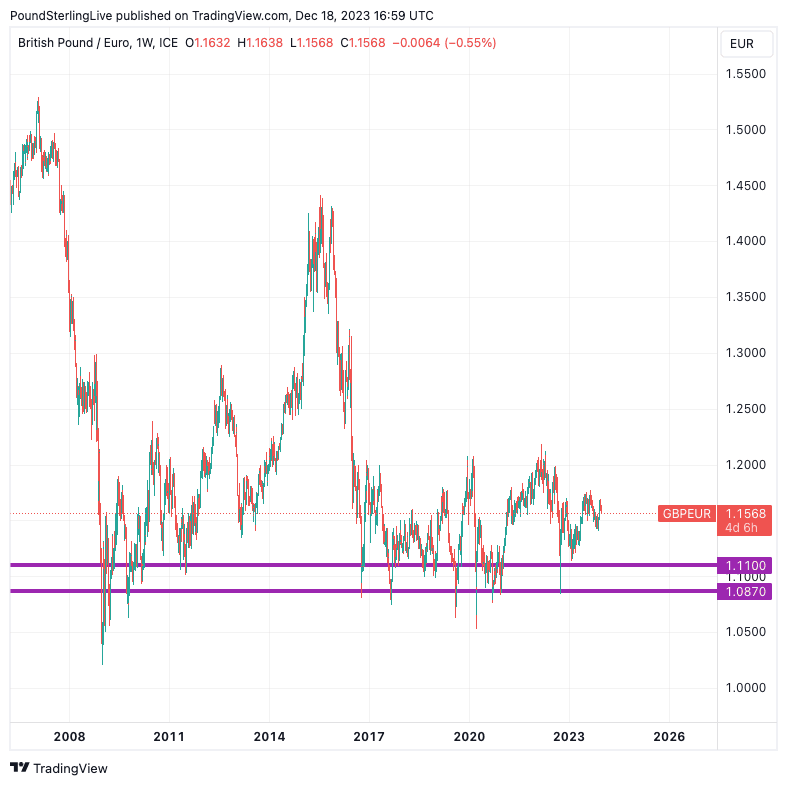

According to Deutsche Bank, the British Pound will fall to levels last seen against the Euro during the crisis sparked by former Prime Minister Liz Truss when she introduced her controversial budget in September 2022.

Deutsche Bank analyst George Saravelos explains, “the timing and speed of the adjustment from hiking to cutting for individual central banks will be a dominant influence for each currency in 2024.”

On this count, the Pound will be penalised by the Bank of England, which Deutsche Bank expects to cut Bank Rate in May, ahead of the U.S. Federal Reserve and European Central Bank, both of which are seen cutting in mid-year.

“For EURGBP meanwhile, we think a move north of 0.90 (which we assess to be fair value across DBeer and PPP models) is likely, and fair value in the cross will continue to drift higher as long as UK inflation remains stickier,” says Saravelos.

The Euro to Pound exchange rate is forecast to rise to 0.90 by mid-year 2024, ahead of 0.92 by year-end. This gives a Pound to Euro exchange rate of 1.11 and 1.0870.

Above: It is back to levels associated with recent crises for Pound-Euro says Deutsche Bank. (Purple lines show forecast levels at mid-year and year-end).

Europe’s biggest asset manager, Amundi, says the Pound-Dollar will tumble more than 4% to 1.21 as inflation slows and the economy shows the pain of policy tightening.

“We expect the pound to fall apart,” Federico Cesarini, head of developed FX at Amundi Investment Institute.

The expectation is built on Amundi’s expectation that the Bank of England will cut rates by 125 basis points next year. Yet, markets are already pricing in around 150bp and it therefore looks to us that this prediction leans heavily on USD power.

TD Securities expects the first cut from the Bank of England in May, the Federal Reserve and European Central Bank are meanwhile forecast to cut in June.

Pound Sterling would likely come under pressure should the Bank of England lead the rate cutting cycle as this implies UK bond yields will fall faster relative to those of the Eurozone and U.S.

“Growth expectations for the UK are starting to correct lower and a lot of the good news that had been priced into GBP has started to recede,” says TD Securities.

As such, analysts forecast the Pound to Dollar exchange rate to trade at 1.22 by the end of the first quarter of 2021, down from the 1.26 level seen at the time of publication. 1.24 is forecast by the end of the second quarter, 1.26 by the end of the third quarter and 1.28 by the end of 2024.

For the Euro to Pound exchange rate, a target of 0.89 is pencilled in for the end of Q1 through to the end of Q2, and 0.88 is forecasted for the end of Q3 and Q4.

This gives a Pound to Euro exchange rate forecast profile of 1.12 and 1.14, both below the current levels in spot at 1.1760.