(Bloomberg) — The pound is set to resume its run as one of this year’s best-performing currencies despite the UK economy’s slide into recession, according to market-watchers from Bank of America to Credit Agricole SA.

Most Read from Bloomberg

They point to economic green shoots and an inflation rate double the Bank of England’s target, bolstering the case for interest rates to be held high for longer. Against this backdrop, they argue sterling will reverse its recent weakness.

That’s backed up by data indicating how investors are betting on the currency. Wagers for further strength have jumped, but are still below what they were in July — when the pound was trading above $1.30 compared with around $1.25 currently — suggesting there’s room for traders to increase their exposure.

Against the euro, sterling snapped a seven-week run of gains, dragged down by data Thursday that showed the UK economy slipped into a recession last year. But Bank of America went as far as calling it “the dollar of Europe,” a reference to the greenback’s remarkable run in recent years that’s seen it trounce all other major currencies.

The bullishness contrasts sharply with the pervasive pessimism toward the UK, where growth has looked anaemic and where the economy — beset by strikes and and labor shortages — is struggling to adjust to life outside of the European Union.

“The UK has become a low benchmark of sorts for everyone else in G10 with all the problems the economy had to deal with in 2023,” said Valentin Marinov, head of G10 currency research and strategy at Credit Agricole, who sees the pound strengthening to 0.83 versus the euro. The pair fell below 0.85 for the first time in six months on Wednesday.

“Despite that, the data hasn’t been all terrible,” he added. “The pound could become more attractive, especially as monetary tightening catches up with the US economy and weighs on the growth outlook in the Eurozone even further.”

UK business surveys imply activity is picking up, albeit from low levels. S&P Global’s Composite Purchasing Managers’ Index unexpectedly rose in January to the highest level in seven months. Retail sales data on Friday posted the biggest monthly increase in almost three years.

The labor market, meanwhile, has proved remarkably resilient, despite monetary tightening that’s taken the key rate to 5.25%, a 16-year high. The unemployment rate stands at 3.8%, close to its historical low, and wage growth is slowing.

It all hints at a possible soft landing that won’t force the BOE to cut rates too quickly, said Mark Nash, head of fixed income alternatives at Jupiter Asset Management. Money markets predict the BOE will only cut from August, compared with June for the ECB.

Read More: UK Retail Sales Rise Most Since 2021 as Economy Stabilizes

“If the activity data is improving and inflation is coming down, which is the case in the UK, then something is going right,” said Nash.

That’s a view that chimes with the latest messaging from officials. Governor Andrew Bailey last week said he is putting more weight on recent indicators that show the economy is picking up.

To be sure, tighter policy could weigh on the pound over the long term if it takes a greater a toll on growth. BOE officials are particularly worried about hot services inflation.

MUFG Bank, which recommended selling the euro to buy the pound late last month, considered closing the trade last week after sterling failed to appreciate beyond the 0.85 support level. The pair was trading at 0.8555 as of 12:30 p.m. in London on Friday.

For now, the bank is sticking with its call for a move to 0.8275, given the possibility an ECB April cut “can’t be dismissed,” according to Derek Halpenny, head of European global markets research.

Read More: UK’s Stronger-Than-Expected Wage Growth Bolsters BOE Caution

Options markets suggest traders aren’t convinced by the euro’s recovery last week. Three-month risk reversals in the euro-pound pair edged down to their lowest level since March 2022, a sign of traders’ willingness to pay a bigger premium for options with lower strikes versus higher strikes.

“Pound flows look quite resilient against the euro for now,” said Michael Metcalfe, head of macro strategy at State Street Global Markets, a global custodian. “Long-term investor flows” suggest investors still see room for the euro to weaken further, he said.

Bank of America’s bullish view makes a striking contrast with its position less than two years ago, when analysts warned of a potential “existential” sterling crisis.

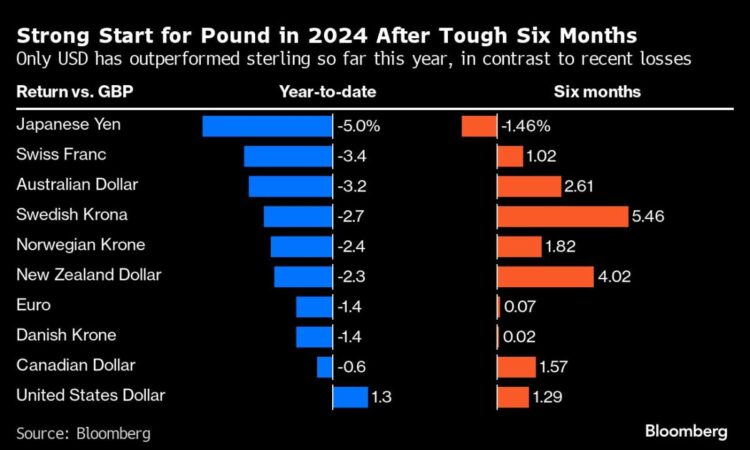

Now they predict it will be among the best-performing major currencies in 2024, with strategist Kamal Sharma forecasting the pair at 0.84 this year, compared with 0.88 previously. It’s posted gains against all of its G10 peers, except the dollar, year-to-date.

“Though US growth has been stronger for longer versus the UK, the nuance here is that expectations around UK macro have been very low,” he said. “With the domestic economy continuing to improve, the pessimistic read on UK growth is harder to reconcile.”

–With assistance from Vassilis Karamanis and Tom Rees.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.