By Stuart Talman, XE currency strategist

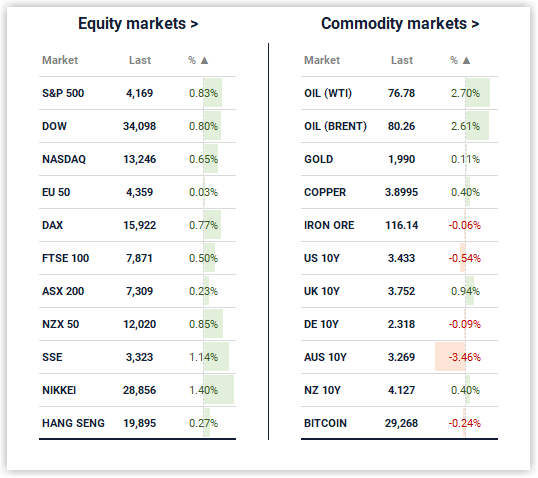

Improving risk sentiment carried through Friday’s overnight sessions, the major US equity indices extending their rally for a second day, buoyed by a week of stronger-than-expected earnings results from megacap tech.

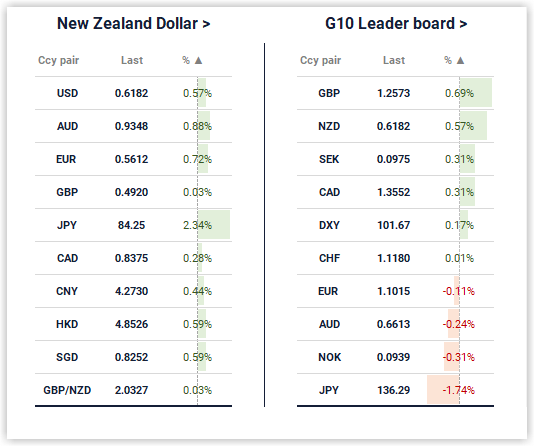

Likewise, the New Zealand dollar logged a second day of gains, rebounding from 7-week lows marked near 61 US cents earlier in the week, avoiding a test of the year-to-date low at 0.6084.

Finding resistance near 0.6160 to be offered throughout Friday’s local session, the Kiwi based around 0.6125 heading into the European afternoon. From here it was one-way traffic into the week’s close, NZDUSD easily piercing through 0.6160 to log Friday’s high a few pips shy of 0.6190 before ending the week around 0.6180.

Having traded with a downside bias through the first half of the week amidst a re-emergence of US banking sector concerns, the Kiwi’s rally through the back end of the week pushed the pair back into positive territory, logging weekly gain of 0.80%.

The British pound was the strongest weekly performer, climbing over 1%, continuing its run as one of the strongest performing currencies this year. Resilient macroeconomic data and a lack of meaningful progress in reining in muti-decade high inflation has required the Bank of England to maintain a tightening bias, sustaining a GBP tailwind.

At the other end of the G10 leaderboard – the Australian dollar declined over 1% for the week whilst the Japanese yen was the notable underperformer, down around 1.60% plunging during an action-packed Asian session.

The major news story from Friday was the Bank of Japan’s monetary policy meeting, the first under new governor Kazuo Ueda.

Currently operating a policy rate at -0.10% and a yield curve control (YCC) policy to cap the yield on the 10-year Japanese government bond, the BoJ is the outlier amongst the cohort of developed nations’ central banks, maintaining ultra-easy monetary policy settings.

Not only is Ueda a noted dove, his deputy Governor Uchida Shinichi is the architect of YCC and negative interest rate policies……policy settings not expected to change in the immediate term which had been flagged earlier in the week when Ueda addressed parliament.

Trading around 133.80 prior to the BoJ policy update, the yen nose-dived against the dollar and its other major peers, USDPJY ripping through 134.80. Dollar-yen continued to climb throughout offshore trade, ending the week above 136.00, its highest weekly close since early December.

Announcing no-change to current policy settings and removing forward guidance, Ueda further announced that a comprehensive review of the BoJ’s policies would be conducted over the next 12 months.

Despite the no-change, it is widely believed the BoJ will alter YCC in June or more likely July followed by a total abonnement before the year is done. Rate hikes are expected to commence in 2024.

Despite this speculation, JPY weakness was Friday’s storyline.

Climbing close to 2.50%, NZDJPY soared through 84.00 to mark Friday’s high just north of 84.32, the pair’s highest level since early March. The Kiwi has been unable to maintain a foothold above 85.00 following the BoJ’s December YCC policy tweak…..Kiwi importers with suppliers in Japan – you are being presented with favourable levels.

It’s a mammoth week ahead.

Multiple volatility inducing events should deliver a volatility step-up following a subdued period stretching back to mid-February.

The Fed’s interest rate decision is the headline event, widely expected to deliver a further 25bps of tightening…..popular opinion calls for this to be the Fed’s last hike.

Perhaps not.

Friday’s employment cost index and PCE data in addition to the prices paid component of the 1Q GDP release, earlier in the week, indicate that price pressures remain persistent. Inflation in the US and other major economies, whilst receding is still a great distance away from targeted levels.

The Fed acknowledges this and could deliver a hawkish raise on Thursday morning, signalling that it is too premature to rule out more hikes.

Should this occur, the megacap tech lead rally in US stocks is extinguished, US bond yields and the dollar takes flight, the New Zealand dollar tests year-to-date lows below 61 US cents.

Conversely, if Powell uses language that suggests the Fed is done, expect a strong upsurge for risk-sensitive assets.

A huge week for central bank decisions also delivers an RBA meeting on Tuesday and the ECB on Thursday evening.

Whilst the consensus calls for the RBA to remain on hold at 3.60%, the door is still open for the RBA to deliver a late cycle hike given it is yet to totally abandon its tightening bias.

The Kiwi rallied around 2% against the Aussie last week as weaker than expected inflation data adds to the case for the RBA to remain on-hold. However, worryingly for the RBA, services inflation continues to trend higher. Services inflation is far more sticky relative to goods inflation given it is primarily driven by domestic factors such as wages and house prices.

Regarding the ECB, it’s a tight call between 25bps vs 50bps.

The macroeconomic calendar is chock full of tier 1 releases, including eurozone inflation, local jobs numbers, retail sales for Australia and the EU and the US employment report, Friday evening.

This evening delivers the ISM Manufacturing PMI, expected to remain firmly in contractionary territory.

We favour a hawkish hike from the Fed with Jay Powell reminding the market the Fed is not likely to be cutting rates later in the year.

Last week we called for the Kiwi to test the 0.6084 2023 low……it came within 30-odd pips.

We’ll maintain this call.

Select chart tabs

Stuart Talman is Director of Sales at XE. You can contact him here.