Michael Derrer Fuchs

Cautiously optimistic about Swiss pharmaceutical giant Novartis’ (NYSE:NVS) (OTCPK:NVSEF) prospects; late-stage pipeline and new drug launches could offset revenue losses from patent expirations but recent legislative changes in the U.S. and Europe (Novartis’s two biggest markets) could have negative impacts.

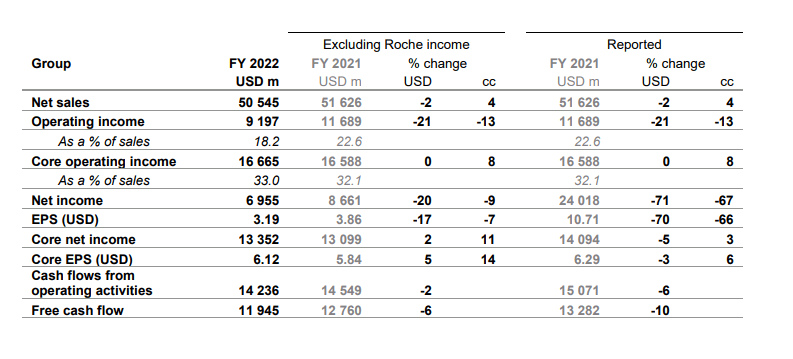

Steady results for FY 2022

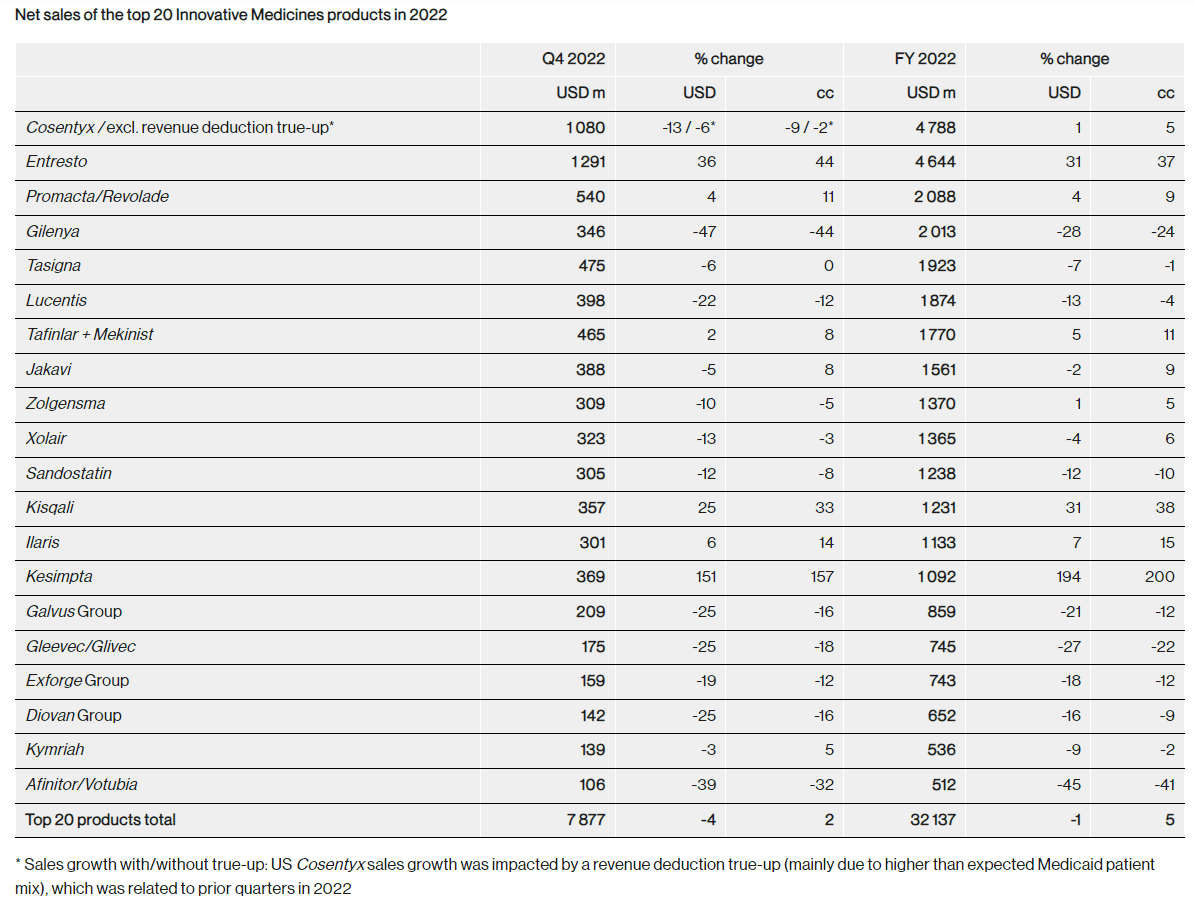

For the year ended December 2022, Novartis’s net sales were down 2% YoY in U.S. dollar terms (owing to an appreciating dollar), but up 4% YoY in constant currency terms, matching the previous year’s performance when net sales grew 4% YoY in constant currency terms. Top line growth was driven by heart failure drug Entresto, multiple sclerosis drug Kesimpta, prostate cancer drug Pluvicto, and breast cancer drug Kisqali.

Novartis

Operating incomes declined 13% YoY in constant currency terms and operating margins fell to 18.2% from 226% the previous year, mainly due to the impact of higher restructuring (USD 1 billion) and impairment costs (USD 0.6 billion due to lower divestment gains) as a result of the company previously announced streamlined organizational model.

Novartis Q4 financial results media release

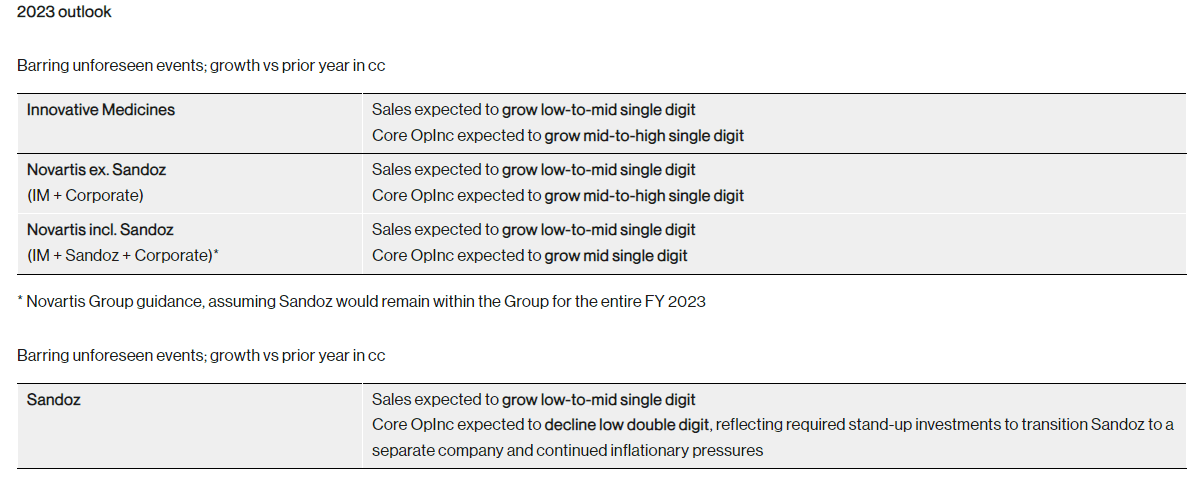

Near term, Novartis expects performance to be roughly in line with FY 2022 with net sales expected to grow in the low to mid-single digits for FY 2023. Including Sandoz, operating income is expected to grow in the low-to-mid single digits.

Novartis

Looking ahead…

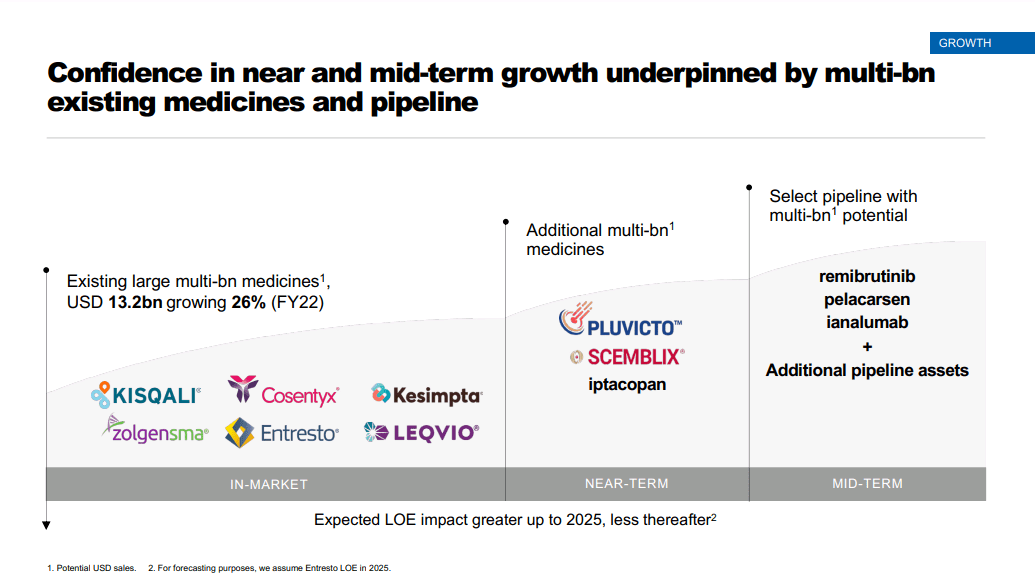

Strong late-stage pipeline and new drug launches could offset revenue losses from patent expirations

Several of Novartis’s blockbuster drugs are nearing patent expiration which could impact revenues as generics or biosimilars enter the market. Notable drugs nearing the patent cliff include Promacta/Revolade (USD 2.08 billion sales in FY 2022), Tasigna (USD 1.9 billion sales in FY 2022), Ilaris (USD 1.1 billion sales in FY 2022), and Entresto (USD 4.5 billion sales in FY 2022) among others. Estimates on Novartis’s possible revenue losses from lapsing patents range from USD 9 billion to USD 14 billion.

Recent drug launches and a strong late-stage pipeline however could potentially offset revenue declines from patent expirations; cholesterol injection Leqvio, leukemia drug Scemblix, and prostate cancer medication Pluvicto have been launched U.S. and are being rolled out in other regions as well. Meanwhile Novartis’s blockbuster hopeful Iptacopan which is seeing some delays for other indications (i.e., kidney diseases C3 glomerulopathy, IgA nephropathy and atypical hemolytic uremic syndrome) beat rival AstraZeneca’s (AZN) (OTCPK:AZNCF) Soliris and Ultomiris in a Phase III trial for Iptacopan’s lead indication – PNH (paroxysmal nocturnal hemoglobinuria) and will be submitted to regulators this year. Leqvio is expected to generate peak sales of USD 2.5 billion, Scemblix USD 2 billion, Pluvicto more than USD 2 billion, and Iptacopan USD 3.6 billion.

Novartis Q4 2022 earnings presentation

Strong performance from drugs already commercialized should further contribute to top line growth. Plaque psoriasis medication Cosentyx generated USD 4.8 billion in sales in FY 2022, and the company is aiming to grow this to USD 7 billion. Heart failure drug Entresto generated USD 4.6 billion in FY 2022 and is expected to reach peak sales of USD 6.3 billion by 2025 when the drug’s patent expires. The patent for asthma injection Xolair (which Novartis licenses from Genentech) has already expired (in 2020) but the drug’s sales continue to rise (sales up 6% in constant currency in 2022 in Emerging Markets, Europe and Japan – Novartis does not record U.S. sales for Xolair) and could continue enjoying strong performance as the medicine as yet does not have a generic available. About 15% of the 300,000 severe asthma patients eligible for biologics are currently taking Xolair and with many patients unaware about biologics but open to trying, this figure could increase.

Approved in March 2017, Novartis’s breast cancer drug Kisqali which generated USD 1.2 billion in FY 2022 (up 31% YoY) continues to lag rivals Pfizer’s (PFE) Ibrance (approved in 2015, and which generated USD 3.37 billion in the U.S. FY 2022, down 1% YoY) and Eli Lilly’s (LLY) Verzenio (approved in 2017, and which generated USD 2.5 billion for FY 2022, up 84% YoY and could see further growth ahead with the drug recently gaining FDA approval for an expanded indication). Nevertheless, with breast cancer incidence rising worldwide, Kisqali is expected to generate peak sales exceeding USD 3 billion.

Multiple sclerosis drug Kesimpta generated USD 1 billion in FY 2022 and lags far behind rival Ocrevus by Roche (OTCQX:RHHBY)(OTCQX:RHHBF)(OTCPK:RHHVF) (CHF 6 billion sales in FY 2022) who has an early mover advantage and appears to be favored among doctors according to a survey of neurologists. While Ocrevus is expected to remain a leader, Kesimpta has some delivery advantages over its bigger rival (Kesimpta can be administered at home while Ocrevus is infused at a doctor’s office) and is expected to generate sales of USD 1.5 billion by 2025.

Novartis’s gene therapy medication Zolgensma (which generated sales of USD 1.37 billion in FY 2022) lags Biogen’s (BIIB) Spinraza (which generated sales of USD 1.79 billion) but the former is gaining share at the expense of the latter (Zolgensma sales were up 5% in constant currency terms in FY 2022 versus a decline of 2% in constant currency for Spinraza). Zolgensma could potentially generate peak sales of USD 1.5 billion.

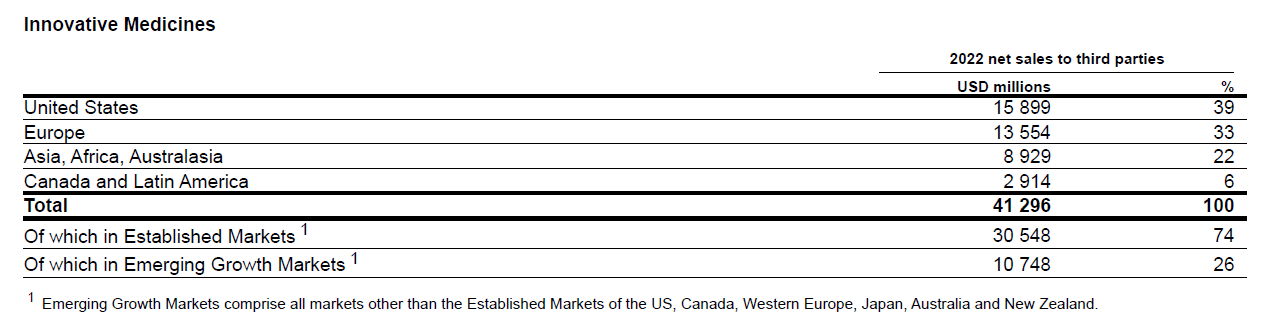

U.S. and China strategic focus to support growth

Novartis’s strategic efforts focus on four key geographies i.e., the U.S., China, Germany, and Japan. The company is aiming to organically build its business to be a top five player in the U.S. by 2027 (from 10th last year), and top three player in China.(from fifth last year), while maintaining market leading positions in Germany, and Japan.

The U.S. is Novartis’s biggest market by geography and the U.S. is a priority for Novartis with the company saying it would adopt “a U.S.-first” mindset, increase the share of U.S. patients in clinical trials, build capability there and give U.S. staff and executives more say and better career opportunities within the organization.

Novartis Annual Report FY 2022

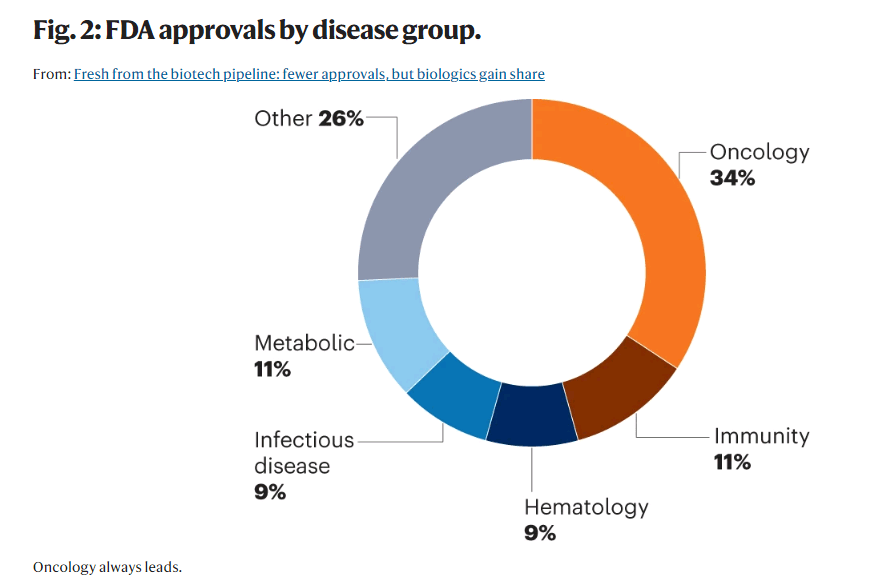

The U.S., the world’s largest pharmaceutical market offers plenty of opportunities for pharmaceutical companies particularly in the areas of oncology and cardiology (cancer and heart disease are top two leading causes of death in the U.S.) and these two disease groups are also the top two in term of FDA approvals. Novartis is strategically well positioned; cardiology and solid tumors are among Novartis’s five core therapeutic areas of focus and 40% of the company’s R&D budget is focused on developing oncology medicines.

Nature.com

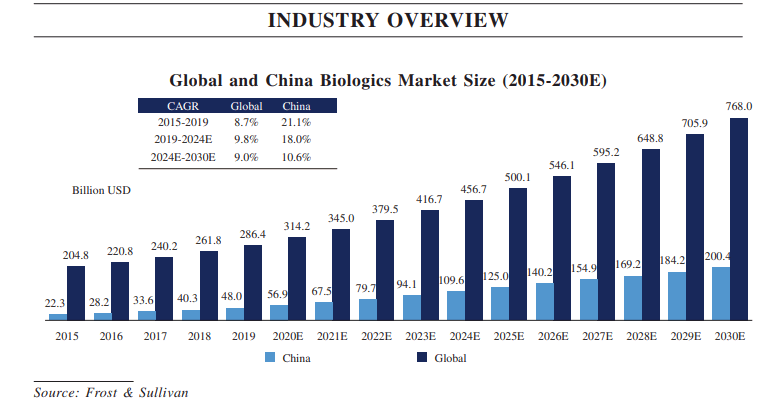

China is the world’s second-largest pharmaceutical market in the world and the country has several structural drivers to support drug demand including having one of the fastest aging populations in the world, rising incidence of lifestyle diseases, as well as a government push to broaden access to quality drugs presenting opportunities for pharma companies like Novartis.

Noteworthy developments for Novartis in the country include blockbuster drugs Cosentyx, and Kesimpta, being added to the National Reimbursement Drug list which would allow the therapy to be included in hospital formularies and support Novartis’s peak sales targets for those respective drugs. Both drugs are biologics and could be well placed to serve growing demand for biologic medicines in the country. China’s biologics market is currently relatively small, owing to affordability and regulatory challenges. That, however, is changing. China’s biologics market has been growing at a faster rate than the global biologics market in recent years and is expected to grow significantly over the coming years due to favorable regulations and rising incomes in the country which allow residents’ ability to pay for more expensive medical therapies (biologics are much more expensive to produce and therefore more costly for patients).

Hong Kong Stock Exchange

Organizational restructuring could yield positive results

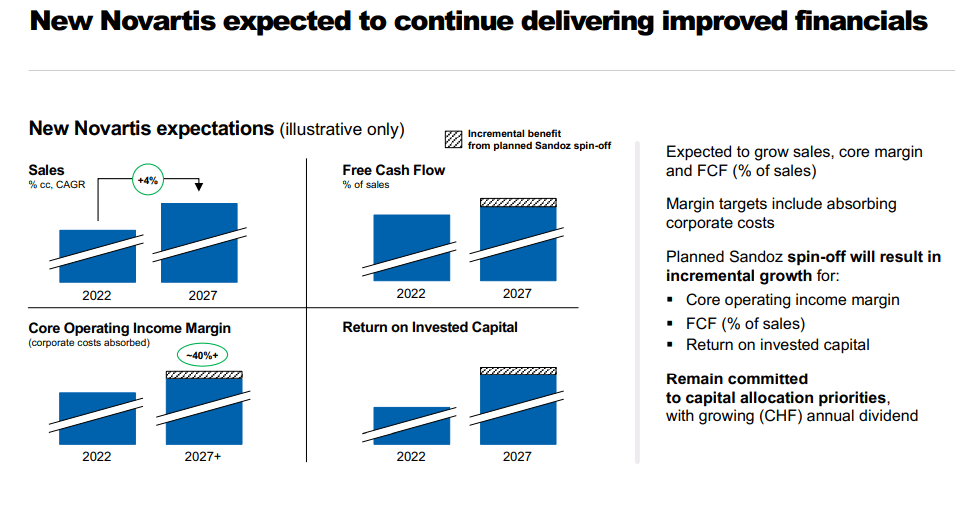

Novartis is targeting savings of at least USD 1 billion by 2024 through a simplified structure that integrates its pharmaceutical and oncology units which could support management’s ambitions to increase operating margins to 40% by 2027.

Novartis Q4 2022 earnings presentation

Meanwhile strategic divestments could not only allow the company to focus on producing higher-margin novel drugs (and thereby push towards its 40% operating income target), but also add to Novartis’s cash reserves enabling them to bulk up their R&D pipeline through acquisitions. Novartis as well as rivals Merck (MRK) and Pfizer are on the hunt for deals as top-selling drugs lose patent protection. Novartis is expected to get USD 21 billion from the sale of its Roche stake and more from the spinoff of its generic drugs division Sandoz (spinoff expected by 2H 2023), giving the company ample resources to make strategic acquisitions.

Risks

Europe is planning sweeping changes to its pharma legislation, the largest change in two decades. Some of the proposed changes, however, are disincentivizing to pharmaceutical businesses and may impact financial performance as well. Danish pharma giant Novo Nordisk (NVO) (OTCPK:NONOF) has indicated that if the draft EU rules go through, the company would be forced to research, test, and launch products in the U.S. and elsewhere instead of Europe. Meanwhile, Novartis has already made a strategic decision to ramp up their operations in the U.S.

Over in the U.S., the country’s recent price cap on medicines could impact financial performance for pharmaceutical businesses as well. The Inflation Reduction Act signed into law in 2022 will allow prices to be negotiated for the most costly Medicare drugs starting in 2026 for small molecules, and two years later for biologics. The law allows for negotiations for small molecule drugs nine years after approval and for biologics 13 years after approval which may not only discourage investment in small molecule drugs, but also potentially impact revenues as small molecule drugs like Novartis’s Leqvio come up for price negotiations sooner than anticipated.

Conclusion

Novartis is currently trading at a forward P/E of 12.8 and offers a dividend yield of 3.5%. This could be attractive for some while others may view NVS stock as a hold.

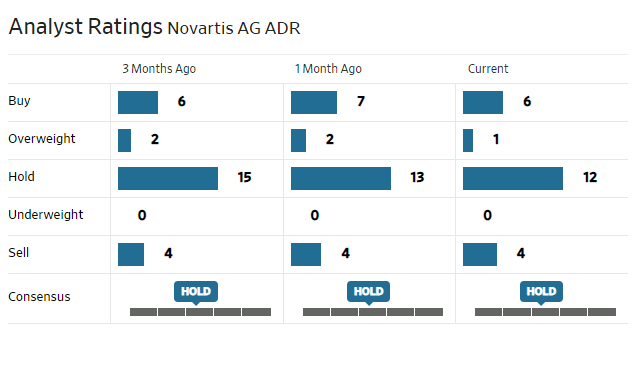

Analysts are generally neutral on the stock.

WSJ