Norwegian krone has taken a hit against all major currencies this year. is it time to buy?

| Get all the essential market news and expert opinions in one place with our daily newsletter. Receive a comprehensive recap of the day’s top stories directly to your inbox. Sign up here! |

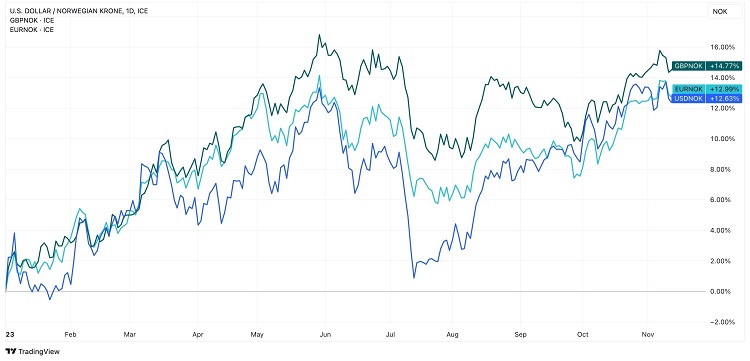

The national currency of Norway has fallen in 2023 against the British pound, the euro, and the US dollar. This decline has been significant – over 12% in each case. Let’s try to find answers to why the NOK has weakened as rapidly as a Norwegian ski jumper swiftly descending after leaving a trampoline behind and if there are potential trade opportunities.

While the krone might not be the most obvious choice for Forex deals, it is surprisingly volatile. Plus, it serves as a reminder that Norway isn’t part of the European Union and maintains its own currency rather than adopting the euro.

The EUR has massively outperformed the NOK, as well as the USD and the GBP. You can observe various changes in the chart below – and many of them were predictable. In order to forecast such movements, you can use specific trading tools like economic data calendar. This tool keeps track of economic events worldwide that affect exchange rates.

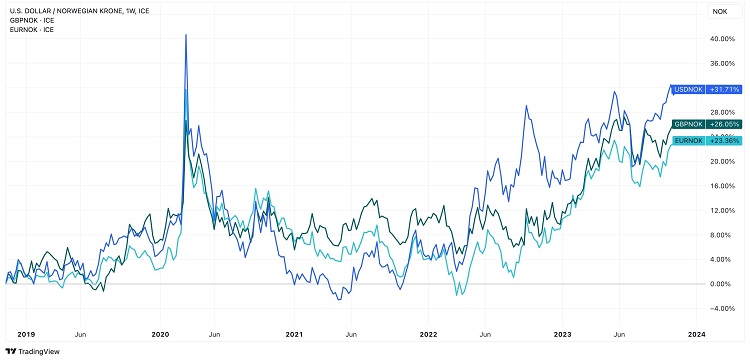

Looking at the chart with a broader timespan, it becomes evident that the Norwegian krone has gone downhill since the peak of the Covid pandemic.

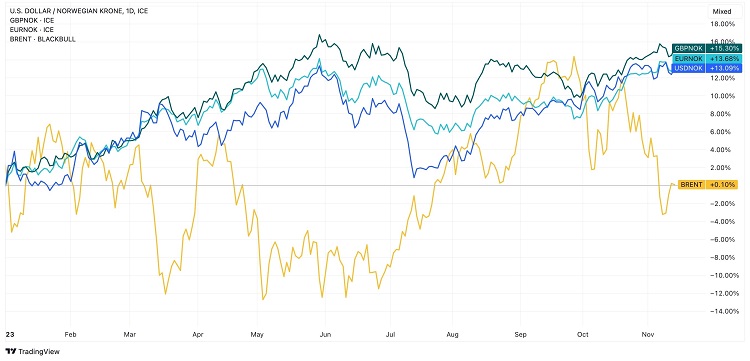

What sets the NOK apart from its counterparts? First, the Norwegian krone traditionally belongs to commodity currencies. Norway, being a significant oil-producing nation, sees its currency strongly linked to Brent oil prices.

Take a look at the chart below. When Brent oil prices drop, the krone weakens. Commodity prices have been far from their peaks this year, depriving the NOK of additional support. It’s worth noting that despite ongoing international conflicts, such as the Israeli-Palestinian and Russian-Ukrainian situations, oil prices are not on the rise.

Another thing to consider is the Chinese economy. China is one of the significant exporters, and if this massive economic zone is in trouble, it also puts pressure on the Norwegian currency.

However, there’s potential for a change in the wind next year. The continued recovery of the Chinese economy could bolster energy prices. Concurrently, major central banks likely have concluded their interest rate hike cycles and might initiate rate cuts in 2024, whereas Norges Bank has yet to complete its cycle of increases.

These factors might contribute to the krone’s rise in the coming year. If you’re considering trade opportunities with this currency, staying well-informed about relevant news is crucial. Numerous economic and geopolitical developments can impact the NOK in various ways.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.