Nigerian economy shows its strength but the national currency is struggling again this year – ICEF Monitor

Short on time? Here are the highlights:

- Nigeria is the largest economy in Africa and growth is continuing

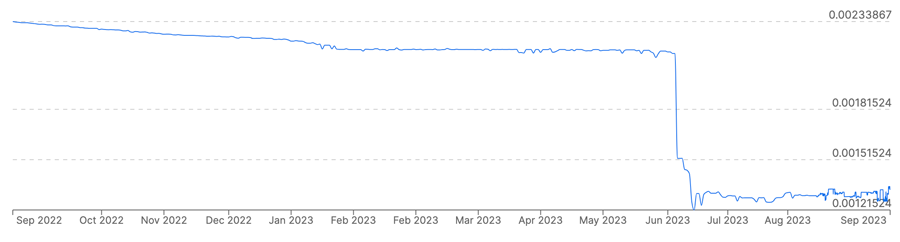

- The Nigerian currency remains under pressure this year, however, with a sharp devaluation cycle that began in June

- This has left many students struggling to cover foreign tuition and living expenses

Nigeria is firmly on the radar of international student recruitment professionals as a major driver of overall growth in outbound mobility from Africa. And this is only underscored by the latest trends from leading study destinations. In the US, for example, visa issuances to Nigerian students were up 20% in 2022 compared to the year before. Nigerian enrolments in Canada spiked by nearly 60% last year, and, most recently, student visa grants for Nigerian students in the UK jumped by 73% year-over-year through June 2023.

Those surging growth indicators are backed by the underlying strength of the Nigerian economy. The latest data from the World Bank again pegs Nigeria as the largest African economy in 2022, a position that the country has now held for five consecutive year after surpassing South Africa in 2018.

After booking year-over-year growth of 8.3%, the World Bank reckons that Nigeria’s nominal GDP was just over US$477 billion in 2022, which is a bit more than 17% of the GDP for the entire continent. In fact, the top three economies in Africa – Nigeria, Egypt, and South Africa – accounted for nearly half of the GDP for all of Africa last year. (We should add that Egypt is increasingly challenging for the title of largest economy with more than 12% growth last year and a GDP estimated at US$476 billion.)

Those large and growing economies are expected to boost Africa its the position of the second fastest-growing economic region in the world this year, after only Asia.

Currency woes persist

In spite of those promising macro trends, Nigeria has a continuing challenge with maintaining the value of its national currency, the naira. The country’s foreign exchange reserves are low, and access to foreign exchange is centrally controlled via the Central Bank of Nigeria. At the same time, there is tremendous demand for forex throughout the economy to pay for imported products and services, including for study abroad.

Part of that demand is being met by the so-called parallel market – that is, a black market for foreign exchange trading outside of official central bank channels. But the cost of foreign currency has been rising this year in both official and unofficial markets, due to surging demand from Nigerian families and businesses alongside a significant devaluation of the Nigerian naira that began in June this year.

“In the official market, August started with a bang as the naira reached a high of N789.08/$1 on August 1st,” explains a report from the news site Nairametrics. The currency rallied somewhat through part of August but more recently has fallen off and is again flirting with that 1 August low point. Nairametrics adds that this in turn placed pressure on the inflated exchange rate in the parallel market where: “The naira faced a sharp decline, weakening to N930 to US$1 dollar in the unofficial foreign exchange market.”

We should understand that some proportion of Nigerian families that are funding their children’s studies abroad will be doing so from bank account held outside the country. But for many others, who must convert their native currency to foreign funds to pay international tuition and living expenses, the inescapable effect of the naira’s devaluation is that studying abroad has become quite a bit more expensive this year.

Some students are going deeper into debt, taking on additional work, and otherwise cutting expenses in order to try to make ends meet. “I still had my last school fee payment to make and the payment immediately doubled in naira. So, I plunged deeper into debt,” said one Nigerian student in the UK, speaking to University World News last month. ““Two months ago, I was buying pounds for N850-870 per pound – at some point, N900. But it has since moved up to over N1000. It’s been very challenging,” added another.

The Central Bank is moving to try to stabilise the currency this quarter but the persistent cycle of devaluation for the naira means that more efficient and flexible payment options will be as important as ever for many Nigerian students this year.

For additional background, please see: