Mutual funds market size to increase by USD 71.62 trillion between 2022 and 2027, Growth led by Aditya Birla Management Corp. Pvt. Ltd., and Amundi Austria GmbH among others

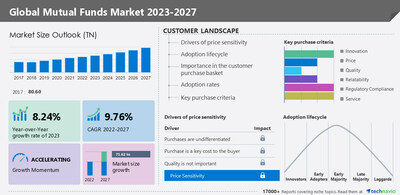

NEW YORK, Feb. 22, 2023 /PRNewswire/ — The global mutual funds market size is estimated to increase by USD 71.62 trillion between 2022 and 2027. The market’s growth momentum will accelerate at a CAGR of 9.76%. The report also includes historic market data from 2017 to 2021. In 2017, the mutual funds market was valued at USD 80.60 trillion. The report provides a comprehensive analysis of growth opportunities at regional levels, new product launches, the latest trends, and the post-pandemic recovery of the global market. For more insights on the historic market data from 2017 to 2021 – Request a sample report

Mutual funds market – Vendor Analysis

Vendor Landscape – The global mutual funds market is fragmented, with the presence of several global as well as regional vendors. A few prominent vendors that offer mutual funds in the market are Aditya Birla Management Corp. Pvt. Ltd., Amundi Austria GmbH, Baroda BNP Paribas Asset Management India Pvt. Ltd., BlackRock Inc., BNY Mellon Securities Corp., Canara Robeco Asset Management Co., DSP Investment Managers Pvt. Ltd., Edelweiss Asset Management Ltd., FMR LLC, Franklin Templeton, HDFC Ltd., ICICI Prudential Asset Management Co. Ltd., IDFC Mutual Fund, JPMorgan Chase and Co., State Street Global Advisors, The Capital Group Companies Inc., The Charles Schwab Corp., The Vanguard Group Inc., Axis Asset Management Co. Ltd., and PIMCO and others.

The major vendors compete based on factors such as product quality, price, economies of scale, and operational cost. Some of the vendors have strong financial, technological, and other resources and can quickly adapt to the changing market conditions. Long-term incumbency can be accomplished through economies of scale with optimized production. The global mutual funds market is highly competitive, with most vendors competing to gain higher market shares. The vendors engage in strategic partnerships and acquisitions to broaden their product portfolios and improve their operational capabilities.

Vendor Offerings –

-

Aditya Birla Management Corp. Pvt. Ltd.:The company offers mutual funds for tax savings, SGX nifty and savings.

-

Amundi Austria GmbH: The company offers mutual funds such as Pioneer AMT, Pioneer balanced ESG sheets, Pioneer core equity fund and growth fund.

-

Baroda BNP Paribas Asset Management India Pvt. Ltd.: The company offers various mutual fund schemes such as axis small cap fund, axis multicap funds and axis growth opportunities.

-

BlackRock Inc.: The company offers mutual funds such as multi cap fund, multi asset funds and equity funds.

-

BNY Mellon Securities Corp.: The company offers mutual funds such as iShares ETFs, high yield bond fund and closed ends funds.

-

For Details on vendor and its offerings – Buy the report!

Mutual funds market – Segmentation Assessment

Segment Overview

Technavio has segmented the market based on type (Stock funds, Bond funds, Money market funds, and Hybrid funds), and distribution channel (Advice channel, Retirement plan channel, Institutional channel, Direct channel, and Supermarket channel).

-

The stock funds segment will grow at a significant rate during the forecast period. These funds are significantly less volatile than mid-cap and small-cap funds and are capable of offering prospective respectable returns. Stock funds are excellent choices for capital growth investments since they can generate wealth over the long term. They are a good option for investors who seek exposure to the stock market and long-term investments. Thus, the growing demand for stock funds will drive the global mutual funds market during the forecast period.

Geography Overview

By geography, the global mutual funds market is segmented into North America, Europe, APAC, South America, and Middle East and Africa. The report provides actionable insights and estimates the contribution of all regions to the growth of the global mutual funds market.

-

North America is estimated to account for 52% of the growth of the global market during the forecast period. This rise is attributed to continuous trading activities in the region and the large presence of the equity market in the US. Tax efficiency, transparency, and the ability to gain access to a centralized stock exchange platform make it a lucrative security option for investors. As most investors on the stock exchange are cost sensitive, they look for low-cost brokerage options. All such factors are expected to drive regional mutual funds market growth during the forecast period.

Get a glance of the market contribution of various segments including country and region wise , Download a Sample Report

Mutual funds market – Market Dynamics

Leading Drivers – The market liquidity is notably driving the market growth. Liquidity can be defined as the ease with which an asset can be bought or sold quickly and efficiently in the market without significantly affecting its price. Mutual funds are one of the easy-to-implement financial markets. This is due to the composition of investment funds and the volume of business. In general, mutual funds are invested in the market of small, medium, and large companies, where large companies have the most liquidity. The liquidity of mutual funds has several advantages, such as easy switching from one fund to another and flexibility during market volatility. Therefore, high liquidity is expected to drive the growth of the market during the forecast period.

Key Trends – The growth of mutual fund assets in developing nations is an emerging trend in the market. One of the major reasons behind the increase in the asset size of the mutual fund (MF) sector is due to the robust performance of the equity markets and net inflows to equity schemes in developing nations. Individual investors’ assets held by mutual funds increased in value in 2022 as compared to 2021. Similarly, the worth of the institutional asset also increased in 2022 as compared to 2021. Thus, the potential opportunity will drive the growth of the mutual market during the forecast period.

Major challenges – Transaction risks are major challenges impeding the market growth. Transaction risks arise when a company makes financial transactions or holds accounts in a currency other than its own currency. The risk is that the exchange rate will change before the transaction is completed. The duration between transaction and settlement is essentially a source of transaction risks. Moreover, when someone sells mutual funds, if the foreign currency has appreciated against the dollar, the person may earn a profit. On the other hand, if the fund currency or underlying index has gone down relative to the dollar, it will lead to a loss. Such transaction risks may hinder the growth of the market during the forecast period.

What are the key data covered in this mutual funds market report?

-

CAGR of the market during the forecast period

-

Detailed information on factors that will drive the growth of the mutual funds market between 2023 and 2027

-

Precise estimation of the mutual funds market size and its contribution to the market in focus on the parent market

-

Accurate predictions about upcoming trends and changes in consumer behavior

-

Growth of the mutual funds market industry across North America, Europe, APAC, South America, and Middle East and Africa

-

A thorough analysis of the market’s competitive landscape and detailed information about vendors

-

Comprehensive analysis of factors that will challenge the growth of mutual funds market vendors

Gain instant access to 17,000+ market research reports.

Technavio’s SUBSCRIPTION platform

Related Reports:

The Canada asset management market is estimated to grow at a CAGR of 14.57% between 2022 and 2027. The size of the market is forecast to increase by USD 20,974.2 million. This report extensively covers market segmentation by class type (equity, fixed income, alternative investment, hybrid, and cash management), component (solution and service), and sourcing (pension funds and insurance companies, individual investors, corporate investors, and other sources).

The homeowners insurance market is estimated to grow at a CAGR of 4.18% between 2022 and 2027. The size of the market is forecast to increase by USD 57.01 billion. This report extensively covers market segmentation by type (fire and theft, house damage, floods and earthquake, and others), source (captive, independent agent, and direct response), and geography (APAC, North America, Europe, Middle East, and Africa, and South America).

|

Mutual Funds Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

156 |

|

Base year |

2022 |

|

Historic period |

2017-2021 |

|

Forecast period |

2023-2027 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.76% |

|

Market growth 2023-2027 |

USD 71.62 trillion |

|

Market structure |

Fragmented |

|

YoY growth 2022-2023 (%) |

8.24 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 52% |

|

Key countries |

US, China, Australia, Germany, and France |

|

Competitive landscape |

Leading Vendors, Market Positioning of Vendors, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Aditya Birla Management Corp. Pvt. Ltd., Amundi Austria GmbH, Baroda BNP Paribas Asset Management India Pvt. Ltd., BlackRock Inc., BNY Mellon Securities Corp., Canara Robeco Asset Management Co., DSP Investment Managers Pvt. Ltd., Edelweiss Asset Management Ltd., FMR LLC, Franklin Templeton, HDFC Ltd., ICICI Prudential Asset Management Co. Ltd., IDFC Mutual Fund, JPMorgan Chase and Co., State Street Global Advisors, The Capital Group Companies Inc., The Charles Schwab Corp., The Vanguard Group Inc., Axis Asset Management Co. Ltd., and PIMCO |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the forecast period. |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

Browse for Technavio’s consumer discretionary market reports

Table of contents

1 Executive Summary

2 Market Landscape

3 Market Sizing

4 Historic Market Size

5 Five Forces Analysis

6 Market Segmentation by Type

7 Market Segmentation by Distribution Channel

8 Customer Landscape

9 Geographic Landscape

10 Drivers, Challenges, and Trends

11 Vendor Landscape

12 Vendor Analysis

13 Appendix

About Us

Technavio is a leading global technology research and advisory company. Their research and analysis focuses on emerging market trends and provides actionable insights to help businesses identify market opportunities and develop effective strategies to optimize their market positions. With over 500 specialized analysts, Technavio’s report library consists of more than 17,000 reports and counting, covering 800 technologies, spanning across 50 countries. Their client base consists of enterprises of all sizes, including more than 100 Fortune 500 companies. This growing client base relies on Technavio’s comprehensive coverage, extensive research, and actionable market insights to identify opportunities in existing and potential markets and assess their competitive positions within changing market scenarios.

Contact

Technavio Research

Jesse Maida

Media & Marketing Executive

US: +1 844 364 1100

UK: +44 203 893 3200

Email: [email protected]

Website: www.technavio.com/

View original content to download multimedia:https://www.prnewswire.com/news-releases/mutual-funds-market-size-to-increase-by-usd-71-62-trillion-between-2022-and-2027–growth-led-by-aditya-birla-management-corp-pvt-ltd-and-amundi-austria-gmbh-among-others—technavio-301751727.html

SOURCE Technavio