Dollars, euros, pounds, or yen …

Regardless of the name, today’s consumer expects to be able to shop seamlessly in their local currency. But selling in multiple currencies can be painful.

In fact, the complexity is significant: sourcing product in one currency and selling it in another exposes your brand to technical challenges, operational hurdles — like researching what markets to enter — and currency exchange risks that can erode margins.

Worse, the time and resources you waste with an incomplete multi-currency solution distract you from what’s really important to scale globally:

-

Customizing your marketing

-

Experimenting with new channels

-

Offering new products to new markets

Below, we’ll walk through why and how (or, you can read the Help Center’s multi-currency documentation). But if you’re already on Shopify Plus and want to start selling in multiple currencies with Shopify Payments.

Benefits of multi-currency ecommerce

In 2022, global cross-border commerce sales reached $396 billion, accounting for more than 11% of total ecommerce sales worldwide. This number has more than doubled since 2014. With the rise of global ecommerce, it’s clear multi-currency acceptance is key to growing market share.

Here are some benefits to consider.

Happy international shoppers

Customers prefer shopping in their own currency. It eliminates the need to mentally convert prices or worry about exchange rate fluctuations. In the end, it makes for a more enjoyable shopping experience online and makes them feel at home on your website.

Imagine you’re a shopper in Japan and you come across a US-based website. As you browse through the products, you see that all the prices are in Japanese Yen — a huge relief, because you don’t have to calculate the cost in Yen yourself.

Improved conversion rates

Showing prices in local currencies can make customers more comfortable and confident, which can lead to higher conversion rates. In fact, 49% of surveyed US and UK consumers said they would abandon purchases if they can’t use their local payment option.

Customizations for different markets

Multi-currency ecommerce lets you price for different markets based on local economic factors, competition, and buying power. Luxury goods companies might price their products higher in affluent markets like Switzerland than in more price-sensitive markets. This lets them maximize profit while remaining competitive in each market.

Besides currency, you can add payment methods popular in different regions, like Alipay for Chinese customers or Paytm for Indian customers.

Lower costs and higher efficiency

A recent study found that decreasing payment acceptance costs was a top priority for 56% of businesses in 2023. With the right ecommerce platform, you can refine the payment process to minimize costs, from integrating local payment options to smart transaction routing and financial reconciliation.

Drawbacks of multi-currency ecommerce

While multi-currency ecommerce opens your organization up to new markets, there are some drawbacks to consider:

Currency fluctuations

The value of a currency can change due to inflation, geopolitical instability, and market demand. When you deal in multiple currencies, you have to adjust prices regularly to reflect these fluctuations.

Say you’re selling in Europe. If the Euro weakens against the Dollar, your products might become more expensive for European customers, which can lead to a drop in sales. If the Euro strengthens, you might earn less in Dollar terms and reduce your profit margin.

Complex accounting practices

All overseas transactions must be converted into a single base currency for accounting purposes. It’s a complex process that involves currency conversion, reconciliation, and tax implications. It’s also prone to error when dealing with a large volume of transactions.

Higher transaction costs and risk

Accepting multiple currencies might involve higher fees from payment gateways and financial institutions. International transactions also carry a higher risk of fraud and chargebacks. For example, say you accept payments in USD, GBP, and JPY. For each transaction in GBP and JPY, the payment gateway charges an extra fee for currency conversion.

💡NOTE: You should review any potential legal or tax implications involved with selling in a currency that is different from the one associated with the country where your store is located.

Multi-currency ecommerce and Shopify

Offering customers a robust multi-currency purchase experience is not a luxury, but a necessity. This reality becomes starkly clear when you consider:

If you want to grow globally you must act locally. The right solution allows you to sell in local currencies and grow while keeping your business lean.

In addition to managing it all in one store, Shopify Payments positions brands to offer customer-friendly international storefronts and checkout experiences that will perform better in three ways.

1. Simplified growth

It’s now easier and faster than ever to expand your reach and develop a global-first mindset with Shopify Payments. Importantly, multi-currency offers the flexibility you need to make decisions — and quickly change them — on a per-currency basis and as the dynamics of specific international markets change.

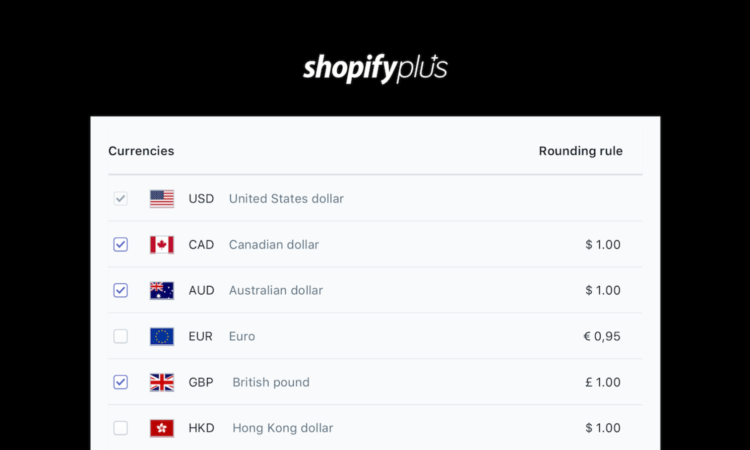

With Shopify Payments, you can enter new international markets in minutes and select only the currencies in which you wish to sell. Change your mind or see a new opportunity? No problem. Shopify Payments’ multi-currency solution allows you to easily add or remove currencies based on market changes.

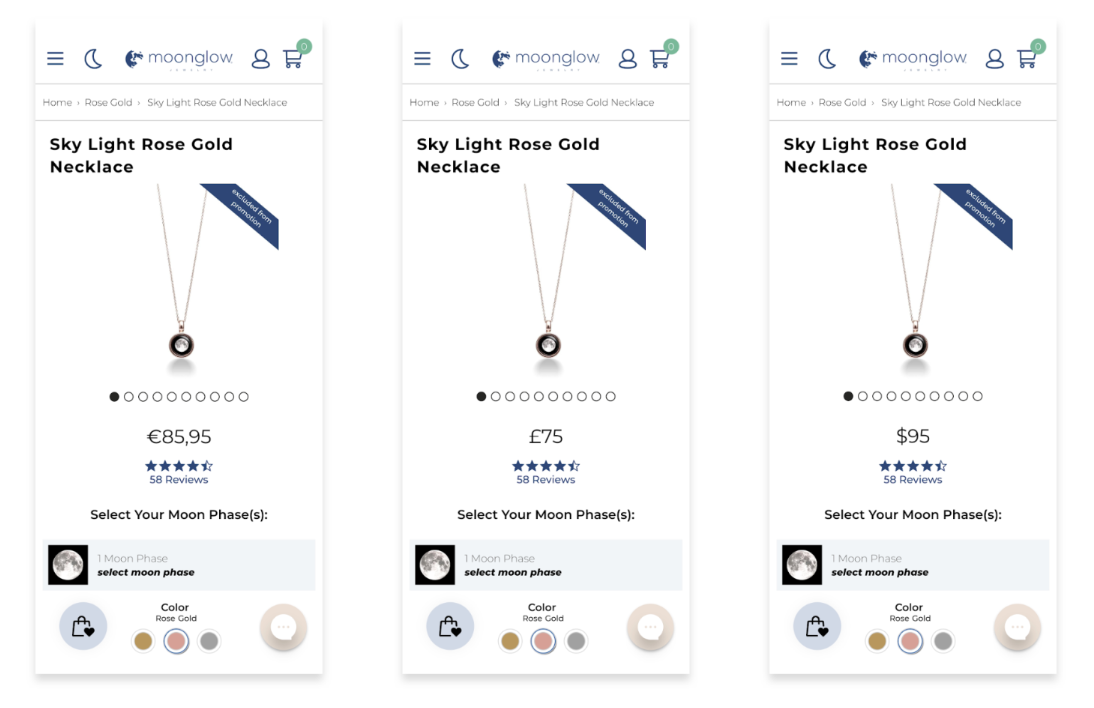

“In the first 45 days of our first year with Shopify,” says Julien Plouffe — CEO at Moonglow Jewelry, “we shipped to 84 countries. During the same time the year before, we had only shipped to 20 countries. International visitors just weren’t converting once they reached the cart page. Allowing buyers to see our products in their local currency gave them the confidence to finish their checkout instead of dropping out.”

Moonglow Jewelry’s conversion rates in four specific countries skyrocketed:

-

Germany: 428% increase

-

Saudi Arabia: 397% increase

-

United Kingdom: 581% increase

-

United Arab Emirates: 124% increase

“Shopify Payments’ multi-currency helped us crack the code for international expansion,” Plouffe adds. Onsite and during checkout, offering the customer’s preferred currency is a small touch that produces big results

Moonglow offers prices in Euros, British Pounds, and Dollars.

2. Localized experiences

When in Rome, act like a Roman, right? Now, you can offer customers worldwide a more personalized experience regardless of where your brand is headquartered. With powerful built-in geolocation functionality, you can show customers local currency prices based on current exchange rates that are rounded for stability.

Here’s how it works:

-

Shopify Payments’ multi-currency feature automatically shows prices based on current exchange rates.

-

Prices displayed to customers are generated by using your store’s price and multiplying it by the exchange rate and fee, then applying the rounding rules for that currency.

-

This means you’ll receive a similar payout from a multi-currency order as a store currency order, and will keep your prices stable for longer.

Currency conversion ensures that after rates and fees, you will still earn about the same for your multi-currency orders as your store currency orders.

Besides positioning your brand to boost conversion rates by giving customers the control they want, Shopify Payments offers you low conversion fees and no transaction fees to help you remain competitive on price.

Ediz Ozturk, founder of international fitness and apparel brand Doyoueven, admits that one of the challenges the company has identified with scaling globally was instilling customer trust. Before using Shopify Payments’ multi-currency functionality, Doyoueven only surfaced multiple currencies on storefront, but did not allow customers to checkout in their local currency.

Ozturk notes that, without multi-currency on checkout, the experience had an “inverse effect on the relationship we had worked so hard to build between us and our audience.” His customer support team was inundated with customer calls asking for clarification, which greatly strained Doyoueven’s internal resources.

Soon after using multi-currency, the customer calls stopped, and the business saw unprecedented growth. “In just the first month of implementing multi-currency, we experienced year-on-year growth of 89%, with a total sales increase of 122%,” Ozturk says. “Carrying on with a record-breaking month was a further 28% increase in orders, translating to a 39% increase in sales in the next month, which was March — a historically quieter period for the brand.”

The future is looking even brighter for Doyoueven. With confidence in the platform, the company can now focus less on technology and more on creating a seamless delivery system by expanding into fulfillment centers in the U.S. and Europe to better match its global demand.

3. Integrated solution

It’s easier to scale internationally now that you have an integrated solution that does the heavy lifting across your storefront, checkout, orders, products, reports, apps, and more.

From product creation to payout reconciliation, Shopify’s multi-currency feature provides a consistent experience so you can keep selling internationally with confidence.

Currency conversion is applied to:

-

Product prices

-

Taxes

-

Gift cards

-

Discounts

-

Shipping

-

Refunds

Businesses can also automate custom, international experiences with Shopify Scripts for automated discounting and Shopify Flow for back-end workflows. Shopify Scripts lets you hide or show specific payment options; below, Shopify Flow can automatically tag international orders for easy identification or customer segmentation for marketing.

“With Shopify Payments’ multi-currency solution, it has never been easier or faster to scale globally,” according to David Cameron, a Shopify Plus product manager. “Not only can brands now sell confidently all over the world, they can do so knowing they’re providing the type of customer experience today’s consumer demands.”

How to display multi-currency pricing

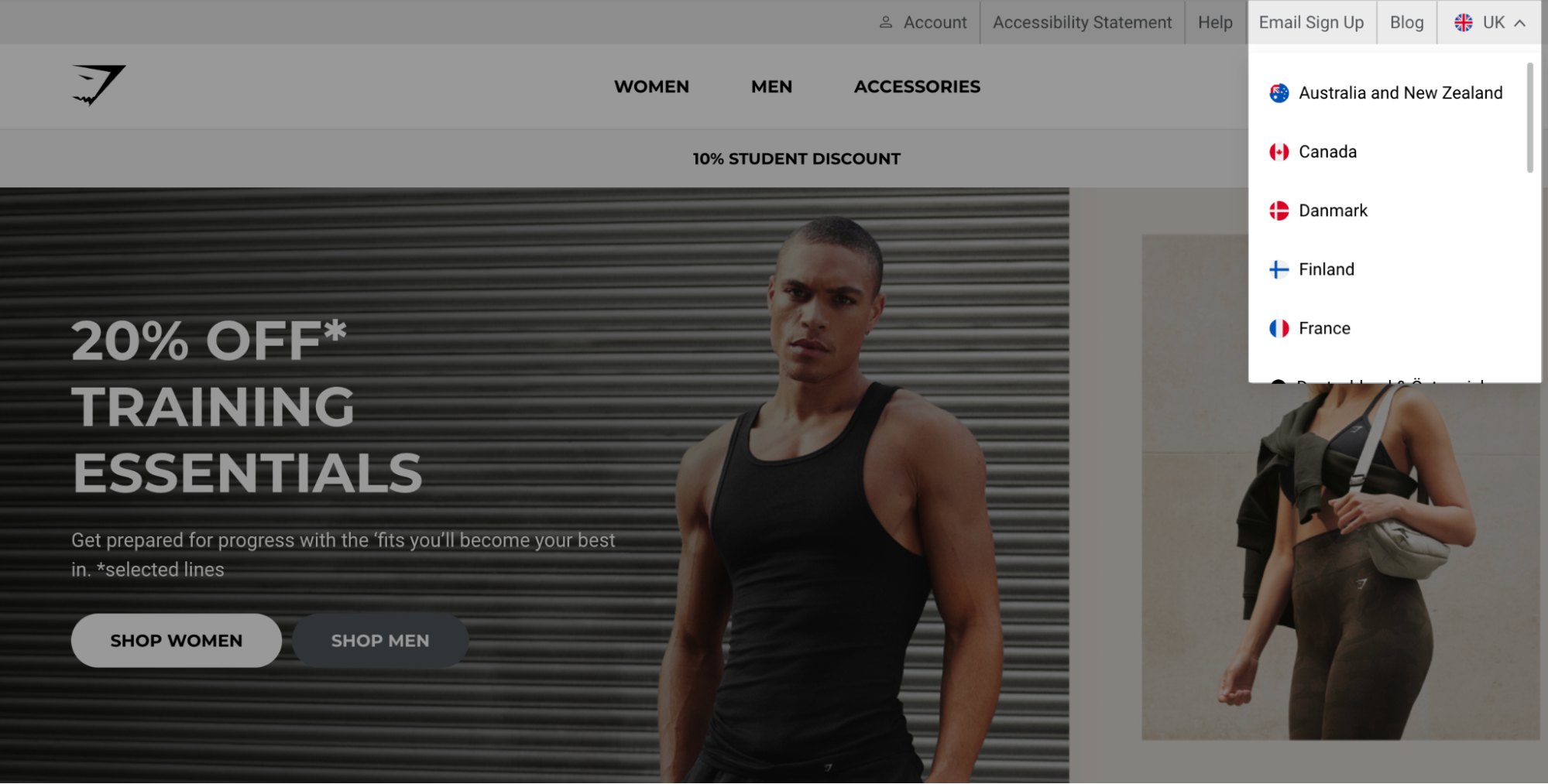

To display multi-currency pricing, you’ll need to use Shopify Payments and activate Shopify Markets. With Shopify Markets, you can offer a localized shopping experience for international customers by displaying prices in their local currency.

You can also install Shopify’s Geolocation app to include a country selector in your online store.

Gymsharks lets shoppers choose their country to see prices in their currency.

Sell easier around the world with Shopify Plus

Global expansion has its complexities. But for online businesses with the right tools, tapping what analysts estimate will be an $8.1 trillion global B2C ecommerce market by 2026 is far less difficult than it once was.

And we promise to do even more to help you grow globally tomorrow.

Multi-currency Ecommerce FAQ

Does Shopify accept multiple currencies?

What is multi-currency?

Multi currency in ecommerce is when a merchant is able to facilitate buying and selling internationally, between currencies. Typically software within an ecommerce platform will support multicurrency transactions.

How do I change the currency on my ecommerce platform?

In Shopify, go to your admin, go to Settings > Store details. In the Store currency section, select your new store currency from the list.

Should I use multi-currency pricing?

A multicurrency pricing strategy offers international customers a more personalized shopping experience. Customers can view prices and make payments in their local currency, which can increase conversion rates and cross border ecommerce sales.