Recession risks were highlighted on Friday with the US S&P Global Services PMI again in contractionary territory.

Todays podcast

Overview: Recession fears grow

- Recession fears heighten after last week’s central bank meetings

- Equities fall (S&P500 -1.1%), soft S&P Global PMI for the US a factor

- Hawkish Fed talk downplayed by rates, seeing growth risks instead

- US short-end rates lower and yield curve steepens; USD lifts a little

- This week very quiet: RBA Minutes, BoJ, German IFO, US PCE figures

Recession fears built further on Friday after last week’s hawkish central bank messaging. Global risk appetite has taken a hit with the S&P500 -1.1%, USD/JPY -1.6% to 135.90, and short-term yields have also fallen (US 2yr ‑6.2bps to 4.18%). A weak US S&P Global Services PMI appeared to be a catalyst, but in your scribe’s opinion merely reinforced fears stemming from softening activity indicators against hawkish central bank rhetoric (e.g., US retail sales last Thursday). Across the pond in contrast, better than expected PMIs (but still mostly in contractionary) saw EZ yields on the rise as markets continued to digest the hawkishness from the ECB and the implications from the ECB starting QT from March which will require the private sector to soak up newer bond issuance – the German 2 yield rose around 7bps to hit a fresh post-GFC high of 2.43%, while Italian 10yr yields rose 14bps. As for this week, it is a quiet week apart from the BoJ on Tuesday, as the market winds down ahead of the Christmas break. A Santa rally looks doubtful given elevated growth risks and hawkish central banks rhetoric.

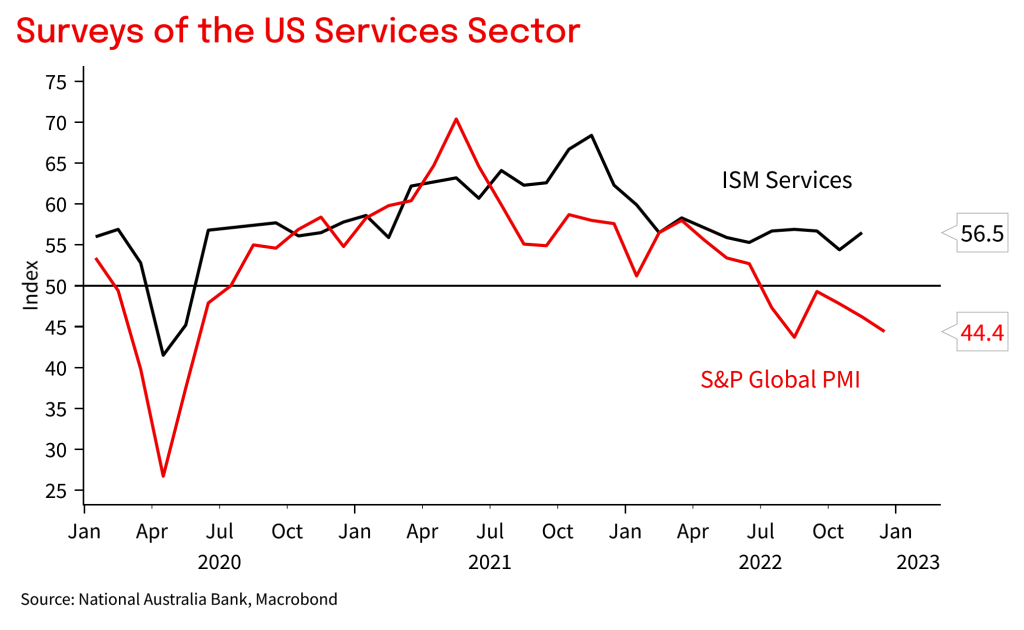

Recession risks were highlighted on Friday with the US S&P Global Services PMI again in contractionary territory. And indeed, have been since July 2022, in sharp contrast to the ISM Services which remains in expansion (see macro chart of the day below). The Services PMI fell to 44.4 against 46.5 expected and 46.2 previously (in contrast the rival ISM Services Index was 56.5 for November). Within the report, the most interesting bit for your scribe was on the prices side, with extensive disinflationary anecdotes: “Inflationary pressures in the service sector cooled notably in December, as input costs rose at the softest pace since October 2020. Despite some material and labor costs rising, reports of lower wholesale and fuel prices eased pressure on cost burdens. Partly in response to softer input price hikes, but also in an effort to drive sales, service sector firms reported the slowest increase in selling prices for over two years”. (see S&PGlobal PMIs press release for details).

The S&P Global PMIs for the US are not typically market moving, but on this occasion short-term yields did fall sharply post the numbers, highlighting recession fears after last week’s hawkish central bank meetings and some signs of softening in other macro data such as US retail sales last Thursday. The US 2yr yield fell from around 4.30% immediately before the data was released to 4.18%, ending 6bps lower on the day. The US 10-year also fell from its intraday highs but ended 3.6bps higher on the session to 3.48%. Interestingly break evens are edging lower with the 10yr implied breakeven -3.9bps to 2.13%. While real yields rise with the 10yr TIP yield +7.6bps t0 1.35%. The 2/10s curve steepened but remains deeply inverted at -70bps.

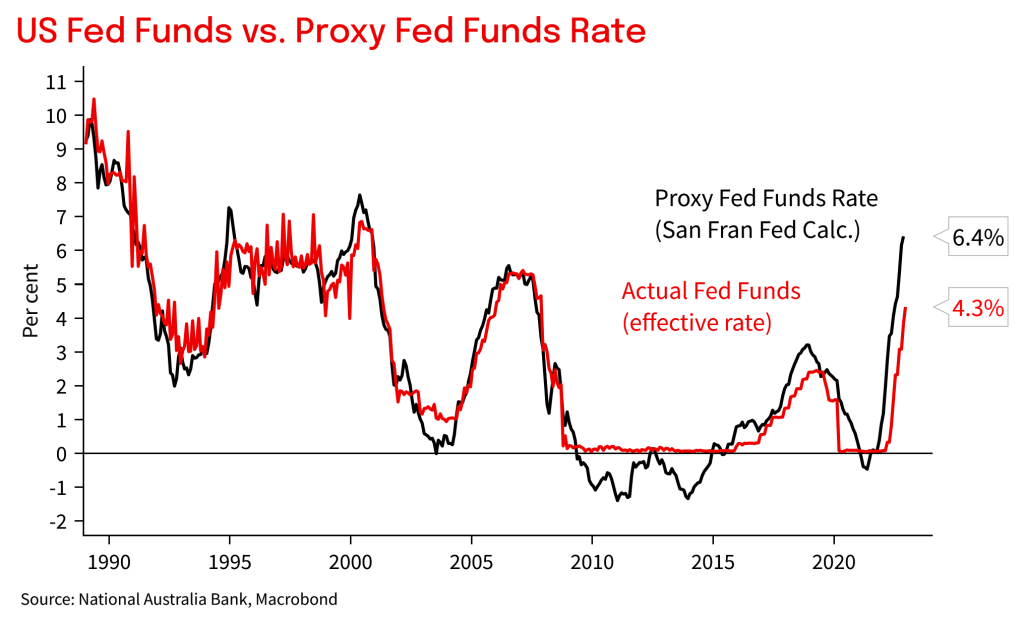

Hawkish Fed talk was downplayed by rates markets, who are instead focused on growth risks. Markets price a terminal fed funds rate of 4.84% by mid-2023 and 49bps worth of cuts in H2 2023, against the Fed dot plot of a peak of 5.1%. All Fed speakers on Friday backed up the hawkish message given by the Fed last week The Fed’s Williams noted the issue is not about getting inflation down a little, but “the real issue is how do we get it all the way [to 2%]” and illustrates the commitment the Fed has in getting inflation back to 2%. Williams also alluded to the possibility that the Fed could take the fed funds rate higher than the 5.1% median dot, but also doesn’t see a 6% rate. Interestingly the Fed’s Daly (who has historically been one of the most dovish on the FOMC) said markets were “pricing for perfection” in expecting a rapid normalisation in inflation next year (the market prices US annual CPI inflation of 2.4% at the end of 2023). The Fed’s Mester also gave similar comments.

In contrast to the US, the European PMIs unexpectedly rebounded in December, with the manufacturing index increasing from 47.1 to 47.8 and the services index increasing from 47.8 to 48.8. This continues the recent trend of European economic data proving not as dire as feared. That said, both services and manufacturing remain in contractionary territory, consistent with the very challenging economic backdrop in the region. European yields were sharply higher on Friday for the second session running, as the market continued to digest the very hawkish messaging from the ECB meeting. Also adding to upward pressure on European yields were ECB member comments – Centeno noting that “if the numbers we have on the table are confirmed, it is very likely, almost as likely that there will be a rate hike in February identical to the one we just decided”. ECB member Holzmann noted that the ECB is prepared to go deep into restrictive territory if needed to curb inflation.

In FX, the USD was generally stronger amidst the cautious tone. The DXY was up 0.1% and EUR was -0.1% despite widening EU-US rate differentials, and GBP was unchanged. The big mover was USD/JPY, down -1.6% to 135.90 and highlights the more cautious risk tone. The NZD was one of the few currencies to rise against the USD with the NZD up 0.9% to 0.6383, rebounding after its sharp fall the previous night. My BNZ colleagues note NZGBs inclusion in the WGBI saw foreign investors increasing their holdings of nominal NZGBs by just over $4b in the month of November, the biggest monthly increase on record; my BNZ colleagues had previously estimated there might be around $2b of offshore inflows into NZGBs on the first month of WGBI entry, based on the recent experience of Israel. As for other FX pairs the AUD was +0.4% to 0.6705.

Finally in China, state media reported that the government would prioritise domestic demand next year, with the authorities calling for “more forceful” fiscal position and “forceful” monetary policy. The government is expected to set a GDP growth target of 5% for next year, as it shifts focus away from Covid containment back towards economic growth. Also in the news was the US government stating it would purchase 3 million barrels of crude oil to replenish its Strategist Petroleum Reserves (SPR). The US has sold around 180m barrels from the SPR since the Ukraine war started, part of an effort to dampen oil prices and broader inflationary pressures. The news didn’t provide much support to oil prices on Friday, with markets preoccupied by recession risk, Brent crude selling off 2%, to just below $80 per barrel.

Coming up this week

- Australia: The RBA Minutes on Tuesday is the main event as the year winds down with no top tier data until the week of 9 January. The Minutes will be important given the post Meeting Statement stopped short of explicitly acknowledge the possibly of pausing despite recent rhetoric, merely adding the caveat that policy was “not on a pre-set course” to the existing “expects to increase interest rates further over the period ahead “. The Minutes should confirm whether a 25bp hike was the only option discussed. If 50bp was also considered it would further steer against the prospect of a near-term pause, while mention of 0bp would add to that probability. Also under focus will be discussion around trying to keep the economy on an “even keel” after the Statement also acknowledged a “range of potential scenarios” for the first time. NAB continues to the see the RBA hiking by 25bps in February and March, taking the cash rate to 3.60%.

- Offshore: The calendar is winding down with a quiet week ahead. The BoJ meets on Tuesday, with no change expected yet, but rising prospects of a review after Kuroda’s term ends in March and the outcome of Spring wage talks are known. On the calendar before the year is out are the US PCE on Friday, the German IFO and Japanese CPI. The first week of the new year is dominated by US data with December Payrolls on 6 January, along with the ISMs and JOLTS. Payrolls will be important ahead of the FOMC meeting on 1 February and whether a step down to a 25bp hike is justified as we expect (markets price 33bps). (for further details please see NAB’s What to Watch – Weeks of 19 December to 6 January – RBA Minutes, BoJ, US PCE, JOLTS & Payrolls)

Coming up today

- NZ: Consumer Confidence & PSI: unlikely to be market moving and likely to remain in recessionary territory; prior month was 87.6. The main services index is also out.

- EZ: German IFO & ECB speak: Another read on business activity with consensus at 87.5 from 86.3 previously. There are also two ECB speakers with Guindos and Simkus.

- US: NAHB Housing Index: unlikely to be market moving and likely to continue to point to dire conditions in housing; prior month was 33.

Macro chart of the day – which survey is giving a better read of the US economy? S&P Global PMI suggests a services recession has been underway since July 2022, while the ISM suggests conditions remain strong

Markets chart of the day – Fed funds rate may be more restrictive than previously though based on a proxy rate calculated by the San Francisco Fed

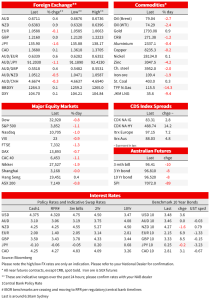

Market Prices

NAB Markets Research Disclaimer