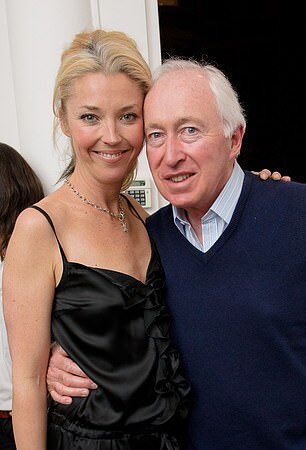

Backer: Tycoon Sir John Beckwith with his niece, socialite Tamara

The foreign exchange market is the largest financial market in the world, with more than £5.5trillion of currencies traded every day, far exceeding stock and bond markets.

Many trades are purely speculative, as banks and brokers bet on the direction of certain currencies. But currency markets also provide an essential service for anyone who works regularly with customers or suppliers from abroad. Argentex operates in a specific area of this vast industry – looking after businesses, financial firms and the very wealthy, who want more than is on offer from their high street banks.

The firm floated on AIM in June 2019 at £1.06 and its share price had risen to more than £1.60 by January 2020. Then the pandemic hit. The shares lost their way, the firm had a couple of wobbles and the stock fell to below £1 earlier this year. But chief executive Harry Adams used the Covid downturn to strengthen his business and the results are starting to come through. Sales are growing fast and the shares are now above the flotation price once more, at £1.19. They should continue to gain ground.

Adams founded Argentex in 2012. Then a 30-year-old foreign exchange trader in the City, he spotted a gap in the market. Huge multinational firms could use top investment businesses to sort out their currency needs, while holidaymakers and small businesses could use high street banks, post offices and bureaux de change. Mid-sized firms were in a bind. They wanted more than traditional banks could give them but were too small to be of interest to major foreign exchange specialists.

Fortunately for Adams, his currency clients included the billionaire Sir John Beckwith. He backed Argentex from the start and his family office, Pacific Investments, remains a 14 per cent shareholder. The investment has proved sound.

From nothing a decade ago, Argentex has nearly 1,400 customers, including supermarkets, carmakers, oil producers – even flower importers and motorbike manufacturers.

Many of these firms have complex foreign exchange needs. They may be exporting to or importing from several different countries. They may be buying goods from one part of the world and selling to another. They may want to lock in rates months or years in advance. Above all, they want to know that they are in capable hands.

That is where Argentex comes into its own. The group adopts a private banking approach to its customers, taking time to understand their business so they can offer tailor-made advice and service, however complicated or unusual the demands.

Adams does not indulge in speculative trading or trading on its own account. Instead, Argentex focuses purely on customers’ present and future currency needs, minimising foreign exchange risks so companies can plan ahead with greater confidence.

Business has been brisk. Last month, Adams revealed a 75 per cent increase in revenues to £27.4million for the six months to September 30. The company has now changed its year end to December and brokers expect annual revenues of £47 million for 2022, alongside profits of £9million.

Robust growth is forecast for 2023 and beyond, with profits of £10.7million expected next year and nearly £16 million for 2024.

Argentex pays a decent dividend too, with 2.5p pencilled in for this year, rising to 3p in 2023 and 3.5p the year after.

City optimism partly reflects growing economic and financial uncertainty. When markets are tough or volatile, companies are keen to remove as much foreign exchange risk as possible. But the uptick in Argentex’s fortunes also reflects some key changes that the group has initiated in the past 18 months.

When Adams founded the firm, he was joined by fellow currency trader Carl Jani and they developed the business together until Jani left in 2021. Adams then conducted a comprehensive review of the business, since when the company has upped its game on the technology side and accelerated international expansion plans.

Both decisions are paying off. Investment in IT has brought in new customers and encouraged existing ones to do more with Argentex. In the six months to November alone, there was an 82 per cent increase in the number of customers using the group’s online service, boding well for future growth.

Argentex has opened up in the Netherlands as well. Early signs are encouraging and there are now plans to expand – at a measured pace – across Europe.

Midas verdict: Foreign exchange is an essential part of business life and Argentex helps to make the process smooth, efficient and cost-effective. But around 85 per cent of companies still turn to banks for their foreign exchange needs, with trades amounting to billions of pounds in the UK alone.

Adams is determined to change banks’ dominance of the market, aiming to offer better service and more competitive pricing than traditional players. As a 12 per cent shareholder, he is highly incentivised to succeed, while the board provides further reassurance, chaired by corporate veteran Digby Jones, a former director general of the CBI and stalwart defender of UK business interests.

The shares, at £1.19, should go far. And the dividend adds an attractive little extra.

Traded on: AIM Ticker: AGFX Contact: argentex.com or 0203772 0300

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.