A sense of caution lingered across financial markets on Thursday as investors weighed the impact of rising oil prices on economic growth. Anticipation ahead of the US jobs report on Friday added to the tense atmosphere with market players adopting a guarded approach toward riskier assets. In the equity space, stocks in Europe edged higher as global markets searched for normality after the recent volatility. There was an uneasy calm in the currency markets with the dollar on standby while oil prices hovered near three-week highs after OPEC+ agreed to cut output by 2 million barrels a day.

Over the past few days, our attention has been on the mighty dollar but this morning the spotlight shines on commodity currencies and minors. The minors refer to non-USD forex currency pairs while commodity currencies are those which are correlated with the value of a particular commodity. With oil bulls back in the building thanks to OPEC+ latest decision this could influence commodity currencies. Economic, domestic, and political forces impacting non-USD currencies may translate to increased volatility across minor pairs. Where there is volatility, this presents opportunity and our tool will be technical analysis.

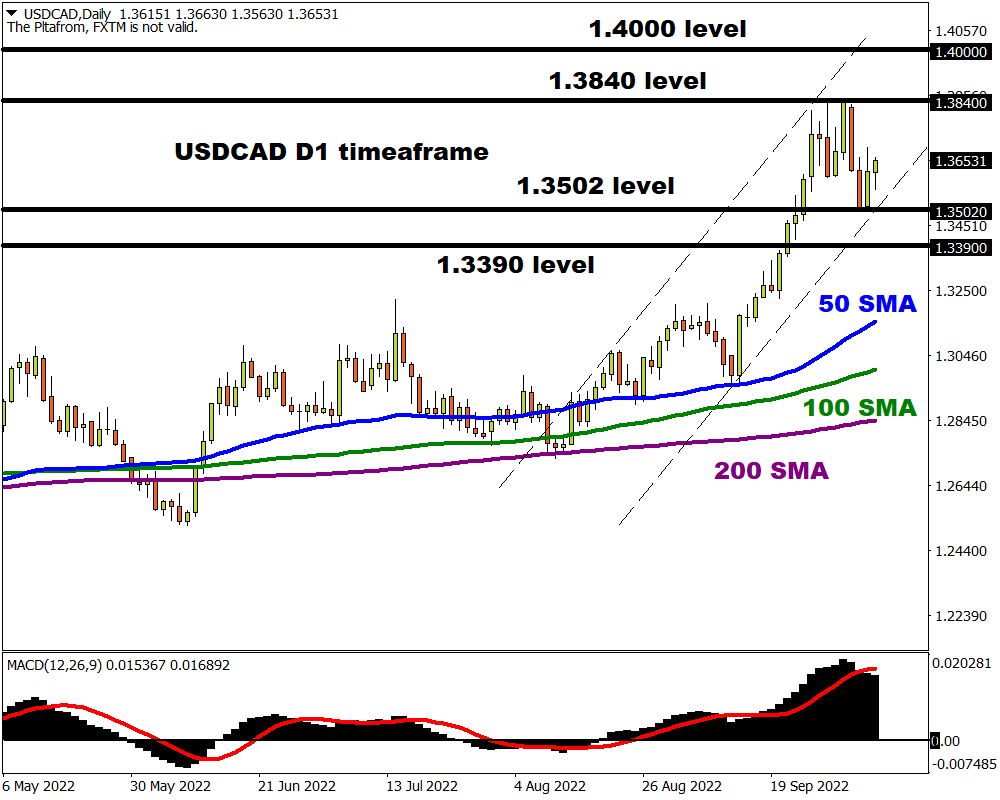

USDCAD eyes 1.3840

Canadian Dollar bulls failed to draw inspiration from the rebound in oil prices yesterday. The USDCAD could be experiencing a technical rebound from 1.3502 which may encourage an incline back towards 1.3840. Overall, the currency pair remains bullish on the daily charts as there have been consistently higher highs and higher lows. A solid breakout above 1.3840 could trigger a move towards 1.4000. Below 1.3502, bears will be eyeing 1.3390.

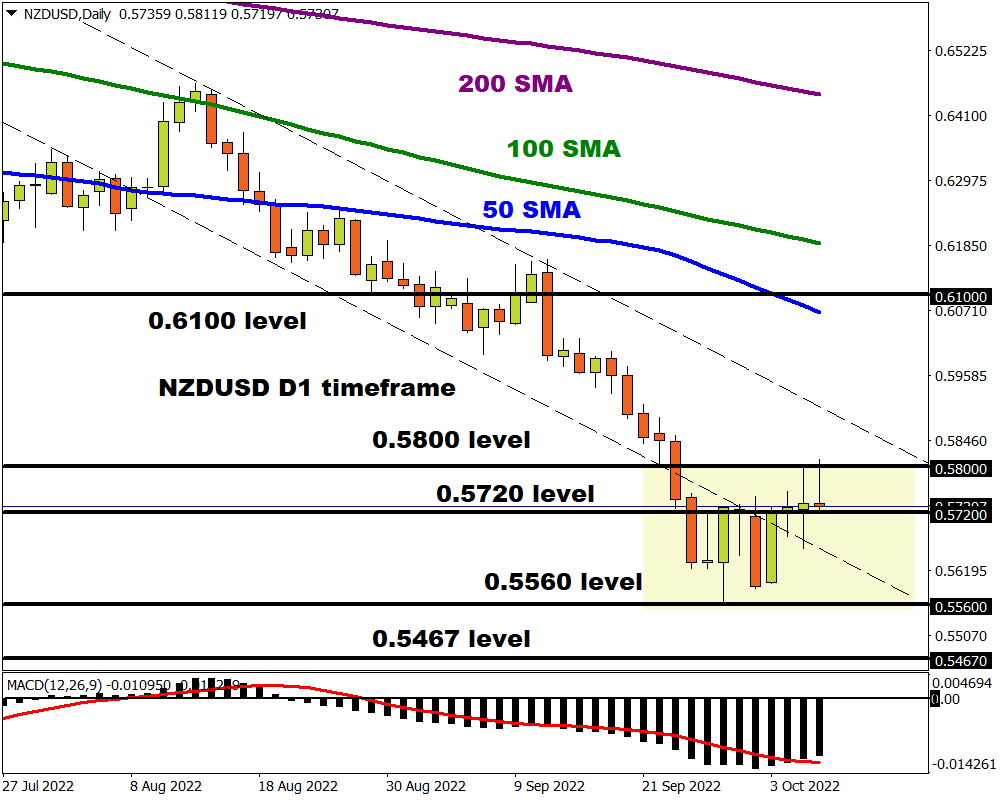

NZDUSD to resume downtrend?

After failing to conquer the 0.5800 resistance level, the NZDUSD could be preparing to resume its journey south.

All eyes will be on how prices behave around the 0.5720 level which has acted as a resistance in the past. A strong breakdown below this point could encourage a selloff towards 0.5560 and 0.5467. If bulls can push prices back above 0.5800, this could open the doors towards 0.5880 and higher.

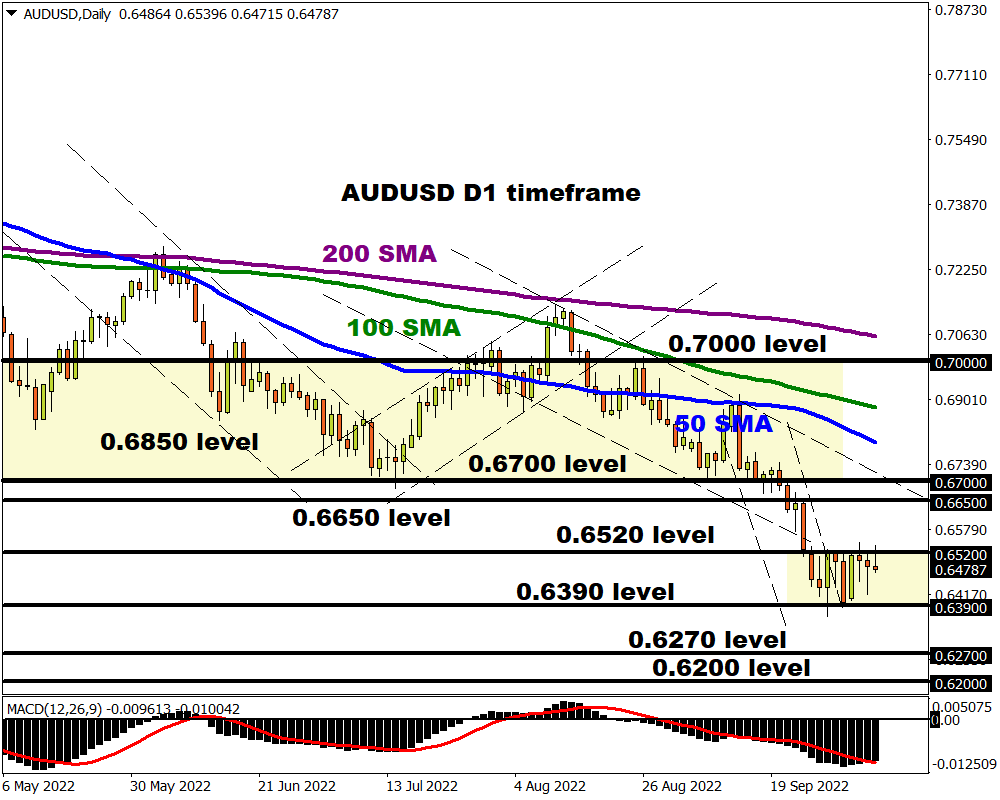

AUDUSD trapped within range

There is nothing much going on for AUDUSD but the pressure is building. Support can be found at 0.6390 and resistance at 0.6520. Although there have been consistently lower lows and lower highs, the currency pair could need a directional catalyst to breakout/down. A solid move above 0.6520 could trigger an incline towards 0.6650 and higher. Alternatively, a move below 0.6300 may result in a selloff towards 0.6270 and 0.6200, respectively.

GBPJPY wobbles above 100 SMA

If you are craving action, then look no further. The GBPJPY has been incredibly volatile over the past few days thanks to fundamental forces in the United Kingdom. Prices are trading below 164.00 as of writing and could edge lower if the 100-day SMA gives way. Bears may target 162.00 and 160.00 if the pound continues to weaken. Alternatively, a move back above 164.00 could open the doors towards 165.50 and 167.00.

EUR/JPY back within range

The EURJPY is trading back within a range with support at 141.50 and resistance at 144.00. A breakout could be on the horizon. Bulls could take control of the driving seat if prices push beyond 144.00. Such a development is likely to open the doors toward 145.60. Should 144.00 prove to be reliable resistance, the currency pair may decline back towards 141.50 and 139.00.