US CPI was in line with expectations, adding to confidence the FOMC will skip at tomorrow’s meeting even as yields pushed higher. Strong UK labour market saw UK yields surge.

Today’s podcast

- US CPI data in line with expectations

- Pricing firms on a skip tomorrow, but treasury yields higher across the curve

- UK labour market and wages data drive BoE pricing higher

- USD broadly weaker, while PBoC easing weighs on yuan; AUD +0.3%

- Coming up: FOMC (likely skip), NZ BoP and food prices, UK Monthly GDP, US PPI

UK: Unemployment rate (%), Apr: 3.8 vs. 4.0 exp. from 3.9

UK: Wkly earnings ex bonus (y/y%), Apr: 7.2 vs. 6.9 exp. from 6.8

US: NFIB small bus. optimism, May: 89.4 vs. 88.5 exp. from 89.0

US: CPI (m/m%), May: 0.1 vs.0.1 exp. from 0.4

US: CPI ex food, energy (m/m%), May: 0.4 vs. 0.4 exp. from 0.4

US: CPI (y/y%), May: 4.0 vs. 4.1 exp. from 4.9

US: CPI ex food, energy (y/y%), May: 5.3 vs. 5.2 exp. from 5.5

US 30-year auction: bid/cover ratio 2.52 from 2.43; indirect bidding 72.9% from 72.4%

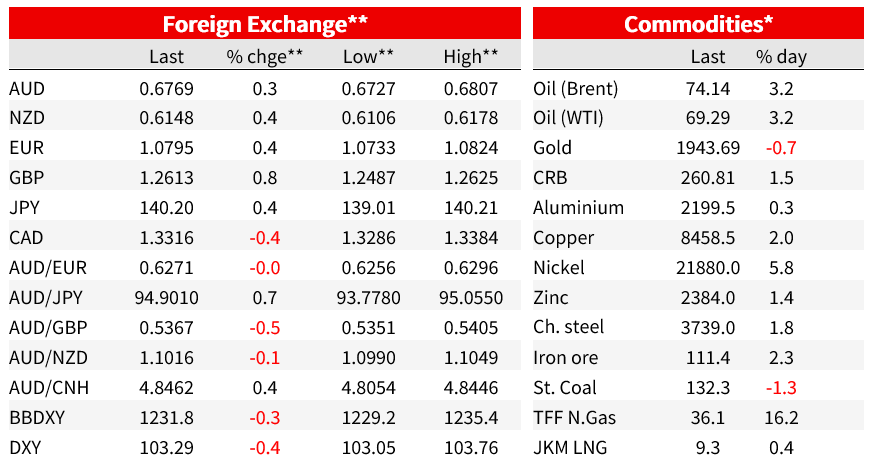

There has been a lot of news flow competing for focus over the past 24 hours. China cut its reverse-repo rate ahead of soft credit growth data, stronger-than-expected labour market data saw a surge in UK yields, and what should have been the headliner, US CPI, came in broadly as expected. Yields are higher globally, the USD lost 0.3% on the DXY, and equities were stronger.

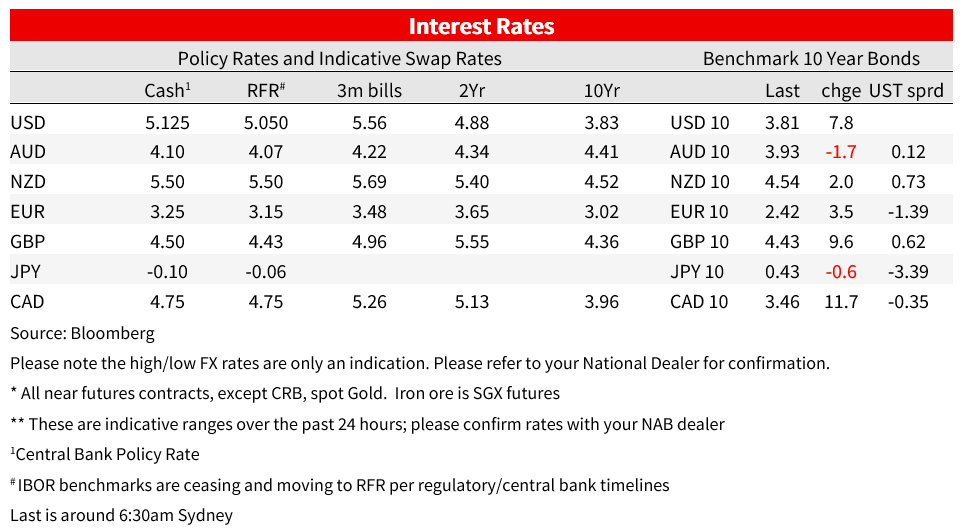

First to the US CPI, which was in line with expectations rising 0.1% m/m and 4.1%y/y from 4.9% (0.1/4.1 expected). The headline easing was helped by a 5.6% drop in gasoline prices, declines in electricity and natural gas prices and a base effect from a large increase a year ago. Watch for base effects to help the y/y rate down further next month. Core inflation was also in line with expectations at 0.4% m/m and 5.3% y/y (0.4/5.2 expected). Used cars rose for the second month, up 4.4% in May and adding 0.15ppt to the core CPI, but auction prices suggest that will reverse. Rents were 0.5% m/m for the third consecutive month, a marked downshift from their earlier pace with further declines still to come through the remainder of the year.

While core inflation has been stubborn, tracking sideways at around 5.0% in 3m annualised terms through 2023, other core measures provided more room for optimism. A narrower core excluding shelter and used cars rose just 0.1% m/m and 2.3% 3m annualised, its lowest since March 2021. The Cleveland Fed’s trimmed mean is 3.2% 3m-annualised, and while median CPI is higher at 4.8%, it has still slowed sharply in recent months. The Atlanta Fed’s sticky CPI slowed to 4.5% in 3m-annualised terms, its slowest since October 2021.

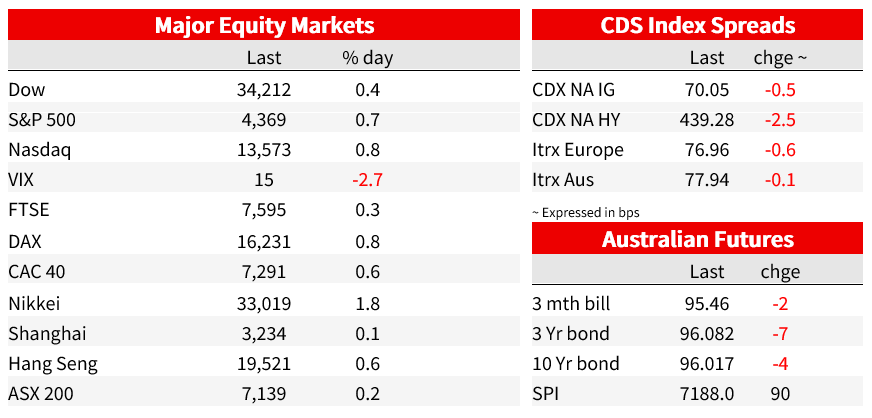

The CPI data won’t necessitate any frantic rethinks ahead of tomorrow’s FOMC decision, where a skip is widely expected. Following CPI, market pricing is now for just 3bps tomorrow (down from 6bps) and a cumulative 17bps by July (down from 22bps). US yields initially fell on the data, but more than retraced to be higher over the day. The 10-year Treasury yield rose 8bp to 3.81%, from an intraday low of 3.68%. The 2-year rate is up 11bps to 4.70%.

Not helping the mood across rates was stronger UK Labour market data. The unemployment rate dropped to 3.8% in the three months through April, below forecasts for an increase to 4% while a large fall in payrolled employees last month that had initially signalled some easing in the labour market was revised away (from -136k to +7k) and preliminary May numbers showed a further increase. Key though was average earnings excluding bonuses, which rose to 7.2% y/y, up from 6.7% and against 6.9% expected. Governor Bailey told lawmakers “ We still think inflation is going to come down but it’s taking a lot longer than expected.” And while dove Dhingra still counselled patience, market pricing surged to imply a Bank Rate of 5.75% by December, up 25bp from a day earlier, and 5.8% in February. A 13% chance of a larger 50bp hike is priced for next week’s meeting. UK 2yr gilts surged 25bp to 4.88%, higher than the 4.68% peak following the Truss mini budget and their highest since 2008. 10yr gilt yields were 10bp higher to 4.43%

China Broad credit growth slowed in May. New yuan loans were RMB1360bn, against RMB1550 expected, while aggregate financing was RMB1560bn (RMB1900bn expected). Growth in outstanding broad credit slowed from 10.0% y/y to 9.5%, almost entirely reversing its reopening rebound. Another read on China’s momentum comes in May activity data on Thursday, while expectations a cut to the MLF rate could come as soon as Thursday have grown following yesterday’s cut to the short-term reverse repo rate. Soggy credit expansion and a move towards lower policy rates weighed on the yuan. The CNH was 0.3% lower against a broadly weaker USD, with USD/CNH moving above 7.17. Some offset was provided by Bloomberg reports that China is considering a broad package of stimulus including at least a dozen measures designed to support areas such as real estate and domestic demand. The State Council may discuss the policies as soon as this Friday but it’s unclear when they will be announced or implemented. Oil was up over 3% from a 3-month low, with Brent edging over $74/bbl.

In broader currency moves, the US dollar is weaker, down 0.3% on the DXY. Higher yields weighed on the yen, which lost 0.4% against the dollar and saw USDJPPY move above 140. Higher UK yields saw the GBP the top of the G10 currencies, up 0.8% to 1.2609. The AUD was 0.3% higher to 0.6768. The aussie briefly hit 0.6807 as US yields fell and the USD dipped on the initial CPI reaction before falling back.

Equities were higher. The S&P500 gained 0.7%, led by Materials and Industrials, while the Nasdaq was 0.8% higher. Equities in other markets were also generally higher. The Euro Stoxx 50 rose 0.7%, while the Nikkei gained 1.8%.

Locally yesterday, the NAB Business Survey showed Business conditions fell 7pts to +8 in May. Trading fell 8pts to +14, employment declined 7pts to +4 and profitability fell 5pts to +7. The broad-based deterioration in conditions still leaves the index a little above its long run average. Confidence fell 4 points to -4 and forward orders dipped 6pts to -5, suggesting conditions should deteriorate further. In terms of inflation risks though, while retail industry prices fell a little further, broader price measures for labour, inputs and final prices all rose a little in the month and capacity utilisation remained very high, edging only marginally lower to 84.7 from 85.0.

Coming Up

- The FOMC decision is 4am Sydney time tomorrow morning. Just 8 of 108 analysts in the Bloomberg Survey look for a hike, with a skip in June before re-evaluating in July the firm consensus. Markets currently price just a 13% chance of a June increase, but a 60% chance of a hike by July. Focus will be on Powell’s press conference, and whether the dot plot reinforces likely hawkish messaging by pencilling in another one or two more hikes. The US also gets PPI data.

- All quiet on the domestic calendar today ahead of employment tomorrow. Across the ditch, NZ sees the Balance of Payments ahead of tomorrow’s GDP data, and monthly food prices.

- The UK sees Monthly GDP, seen up 0.2% m/m even as manufacturing and industrial production are expected to show narrow declines in the month.

Market Prices