Today’s podcast

- PMIs generally softer than expected, especially in Europe

- EZ Composite PMI at 50.3 vs 52.5 expected as Manufacturing remains weak and French Services slump

- Euro -0.6% and Europe leads global yields lower

- UK retail sales beat helps further lift in BoE pricing

- Today: German IFO, Dallas Fed Manufacturing, BoJ Summary of Opinions, ECB’s Villeroy, BoE’s Dhingra, SNB’s Jordan

- This Week: AU Monthly CPI & Retail Sales, ECB’s Sintra Talkfest, US PCE Inflation, EZ, CA & Tokyo CPI, China PMIs

Events Round-up

UK: GfK consumer confidence, Jun: -24 vs -26 exp.

JN: CPI (y/y%), May: 3.2 vs. 3.2 exp.

JN: CPI ex fr. food, energy (y/y%), May: 4.3 vs. 4.2 exp.

UK: Retail sales x auto fuel (m/m%), May: 0.1 vs. -0.3 exp.

GE: Manufacturing PMI, Jun: 41.0 vs. 43.5 exp.

GE: Services PMI, Jun: 54.1 vs. 56.3 exp.

EA: Manufacturing PMI, Jun: 43.6 vs. 44.8 exp.

EA: Services PMI, Jun: 52.4 vs. 54.5 exp.

UK: Manufacturing PMI, Jun: 46.2 vs 46.8 exp.

UK: Services PMI, Jun: 53.7 vs. 54.8 exp.

US: Manufacturing PMI, Jun: 46.3 vs. 48.5 exp.

US: Services PMI, Jun: 54.1 vs. 54.0 exp.

It was a negative end to the week for risk assets on Friday with the equities lower and the US dollar managing a 0.4% gain on the DXY as the euro slid 0.6% after PMIs showed Eurozone output growth close to stalling as manufacturing remained very weak and services growth showed greater-than-expected moderation. Europe led yields lower on Friday following the data.

News over the weekend was developments in Russia, where a deal brokered by Belarus leader Lukashenko means that Wagner Chief Prigozhin has turned his convoy of troops, weapons and tanks away from Moscow after 24 hours of crisis. Prigozhin will go to Belarus as part of deal to end the mutiny in Russia. With fighting in Moscow avoided and clear de-escalation we might not see a large market reaction as trading gets underway on Monday, but uncertainty about what happens next remains high. Neither Putin nor Prigozhin has reappeared more than 24 hours after the standoff ended

S&P Global PMIs on Friday showed a larger moderation than expected across most economies with manufacturing output still falling and the outperformance of services easing back. These indices tend to be more closely watched in Europe, and the Eurozone Composite PMI slipped to 50.3 from 52.8 and 52.5 expected. Under the hood, manufacturing slipped deeper into contraction territory at 43.6, but there was also a sizeable moderation in services to 52.4 from 54.5. That weakness was led by France, where the Services PMI surprised sharply lower at 48 vs 52.1 expected , while in Germany manufacturing (41) and services (54.1) both fell more than expected and the divergence remains stark. New orders fell and future output expectations deteriorated. But the prices side offered some hope. Manufacturing input prices fell for their fourth consecutive month and by the most since 2009, and even the more stubborn price dynamics on the services side moderated to their lowest since May 2021 but remain well above the long run average amid elevated wage pressure. Downstream, prices charged also continued their easing trend. In the US, the manufacturing PMI fell further while the US services PMI was in line with expectations at 54.1.

Should that slowing be confirmed in the harder data, the question for markets is twofold. First, whether that easing is enough to see inflation back to target while labour markets remain tight and wages growth is elevated. Secondly, if it is enough, can central banks be confident of that soon enough to avoid an unnecessarily deep slowdown. During the week, the BoE and Norges Banks increased rates by 50bp amid inflation backdrops that continued to provide too little evidence of cooling. In the US, Powell reiterated the June dots for two more hikes in front of lawmakers, but that FOMC baseline continues to be discounted by markets, which price just one hike for a peak in November. On Friday, Atlanta’s Bostic, firmly at the dovish end of the FOMC spectrum, said that “I’d be comfortable with the information I have today, staying right where we are and just staying here through the rest of this year and long into next year.” San Francisco’s Daly said that two more quarter point hikes are a “very reasonable projection” but further emphasised that that outlook is conditional on the data flow, “we are going to have to find the terminal rate by looking at the data.”

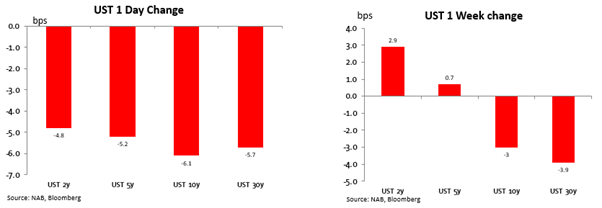

US treasury yields were 5-6pb lower across the curve on Friday, while the soft PMI drove large falls in European yields. Ahead of the PMI data, the US 2yr yields briefly moved above 4.80, its highest since, March. Over the week, curves were flatter. US 2yr yields were 3bp higher, while 10yrs fell 4bp, the 2s10s spread back below -100bp. German 10 years were 14bp lower on Friday to 2.35%, down 14bp over the week, while the 2yr yields fell 11bp on Friday to 3.10% to be little changed over the week as the backdrop of rising growth concerns and central banks holding the line against high inflation also saw European curves flatter. The German 2s10s spread fell to -75bp, from around -30 as recently as mid-May.

UK retail sales volumes rose 0.3% after a 0.5% gain in April and against expectations for a 0.2% decline, which contributed to a further upward revision to the pricing for terminal rates . Expectations had already moved sharply higher following the inflation data and 50bps hike by the Bank of England (BOE). UK PMIs also showed moderation, if less so than Europe at 53.7 vs 54.8 expected. The market is pricing a peak policy rate close to 6.15%, which is 35bps higher than the start of last week. The ~120bps of tightening expected by December is the largest amongst developed market central banks. 10yr Gilt yields were 5bp lower on Friday to 4.32% and 9bp lower over the week, while 2yr yields were another 9bp higher on Friday to 5.16% and 23bp higher over the week.

Equities Performance

Equities were lower on Friday. The S&P500 lost 0.8% to be 1.4% lower over the week while the Nasdaq lost 1.0% to be 1.4% lower. That broke a 5-week streak of gains for the S&P500 and 8 weeks of gains for the Nasdaq. Friday’s losses were broad-based, with all 11 sectors in the S&P500 in the red. Asian bourses led declines on Friday, with the Nikkei down 1.5% and the Hang Seng off 1.7% after Thursday’s holiday to be down some 5.7% over the week. Mainland China was closed on Thursday and Friday, but the CSI 300 was 2.7% lower by Wednesday.

Concerns about China’s growth outlook have not yet been met with any large fiscal stimulus announcements, disappointing investors after reporting the prior weekend that more support could be forthcoming. Another update on Chinese growth momentum comes with official PMIs on Friday, while attention will remain on when and how much support will be forthcoming. Domestic tourism over the dragon boat festival fell short of prepandemic levels, with revenue 94.9% of the amount recorded in 2019 before the pandemic, according to a statement from the Ministry of Culture and Tourism, though the number of trips was 12.8% higher.

FX Performance

In FX, growth concerns out of Friday’s PMIs weighed on the euro, which lost 0.6% on Friday to be 0.4% lower over the week to 1.0910. Global growth concerns did the AUD no favours. The Australian dollar was 1.1% lower on Friday to be back below 67 cents at 0.6682. The AUD was the worst performer of the G10 currencies over the week, down 2.8%.

The yen was 1.3% lower over the week, taking USDJPY to 143.70. It reached an intraday high above 143.80 on Friday, it’s highest against the dollar since November. Previous weakening toward 146 against the US Dollar triggered the first intervention to support the currency since 1998 and current USD/JPY levels are likely to prompt increasing verbal intervention by Japanese authorities.

Japan’s May CPI Friday morning was a little above expectations . The headline rate slowed to 3.2% as expected, while the core rate, excluding fresh food, was 3.2% from 3.4% and 3.1% expected. At most tension with the BoJ’s patient rhetoric is the core-core rate, excluding fresh food and energy, which rose further to 4.3% from 4.1% and 4.2% expected. The data point to upward revisions to the BoJ’s inflation forecasts at its July meeting and add another question mark to the longevity of the YCC policy in its current form. The previous BoJ forecasts saw inflation slowing back below target, to 1.8% in the year to March and 1.6% for fiscal 2025. June numbers for Tokyo are in focus this coming Friday.

Commodities Performance

Commodities were generally weaker on Friday and over the week. Further weakness in manufacturing PMIs, especially in Europe, weighed on base metals on Friday.

Coming Up

Today

- A quiet data calendar in the day ahead with only the German IFO and Dallas Fed Manufacturing Survey of some note. From central banks is the BoJ Summary of Opinions, ECB’s Villeroy, BoE’s Dhingra, SNB’s Jordan

This Week

- AU: Important updates on inflation, retail spending, and the labour market fill out the week and will set the backdrop for the RBA’s July meeting. For the Monthly CPI indicator on Wednesday we pencil in 5.9% y/y from 6.8% as base effects from fuel price drive the headline lower. Forecasts in the Bloomberg Survey are clustered at 5.9-6.2 and a 6.1 median. The magnitude of the drop is likely to paint an overly rosy picture of the pace of disinflation given it is base effect driven and we expect the full Q2 CPI on 26 July to print above the May Indicator. The excl. fuel, fruit/veg, and travel number is likely to show much less moderation from April’s 6.5%. Thursday’s Retail Sales are seen up 0.3% m/m (consensus 0.1%) and Job Vacancies are also on Thursday. Vacancies have so far retreated only modestly, and will need to show a more substantive moderation to give the RBA confidence in their forecasts

- NZ: Thursday’s ANZ business survey could show further progress out of its peak-stagflation funk but Friday’s ANZ-RM consumer confidence index seems unlikely to improve materially. Wednesday sees the release of May employment indicators.

- Central bank talk will be the dominant theme with the ECB’s flagship Sintra Conference from Monday to Wednesday. Representatives from most major central banks will be participating, with the conference concluding with a policy panel that includes the ECB’s Lagarde, Fed’s Powell, BoE’s Bailey and BoJ’s Ueda (see Sintra Conference Programme for details).

- US PCE Inflation figures are on Friday where consensus for the Core PCE Deflator is 0.4% m/m, a similar pace to last month. Canadian CPI is on Tuesday.

- Consensus sees Friday’s Eurozone core inflation ticking higher to 5.5% from 5.3% y/y with base effects from cheap German transport in June to August last year one unhelpful factor. Before Friday’s Eurozone number, watch out for Italian data on Wednesday and German, Spanish and Belgian data on Thursday. The Riksbank meets on Thursday

- Adding to the slew of inflation updates, Japan gets Tokyo CPI for June on Friday. Elsewhere, Chinese PMI’s on Friday are likely to continue to suggest a slowing recovery.

Market Prices

For further FX, Interest rate and Commodities information visit nab.com.au/nabfinancialmarkets. Read our NAB Markets Research disclaimer.