The new week has begun with a small reversal in the some of the risk positive moves recorded last week, particularly in FX markets and US Treasuries while equity market are showing resilience.

Today’s podcast

Overview: You need to calm down

- Start of new week sees small reversal from last week’s risk positive moves

- USD is a tad stronger, UST rates higher while equities show resilience

- Fed speakers setting the tone, reminding markets there still work to be done on inflation

- CNY extends last week’s gains as the market assess ease in Covid restrictions and property market support

- Biden-Xi meeting “No Kumbaya”, but a positive de-escalation step

- Coming up: RBA Minutes, JN GDP, CH Activity readings, UK Labour Mkt, EU GDP, US Empire, Fed and ECB speakers

Events Round-Up

NZ: Performance of services index, Oct: 57.4 vs. 55.9 prev.

EC: Industrial production (m/m%), Sep: 0.9 vs. 0.5 exp.

The new week has begun with a small reversal in the some of the risk positive moves recorded last week, particularly in FX markets and US Treasuries while equity market are showing resilience. Fed speaker have set the tone, reminding markets that there is still a lot of work to be done to bring inflation to heel. The USD is broadly stronger with last week’s outperformers (GBP and JPY) leading the declines. CNY is a notable exception, extending last week’s gains as investors continue to positively assess the ease in covid restrictions and new initiatives to support the property sector. The latter probably helping antipodean currencies with the AUD and NZD little changed. President Biden and XI shook hands and although this was “no kumbaya”, is still a positive de-escalation step.

Speaking in Sydney yesterday, Fed Governor Waller set the tone for markets noting financial markets seem to have overreacted to the softer-than-expected October consumer price inflation data last week. “It was just one data point,” Waller said, adding that “The market seems to have gotten way out in front over this one CPI report. Everybody should just take a deep breath, calm down. We’ve got a ways to go ” Waller said.

Singing from the same song sheet, overnight Fed Vice Chair Brainard said “It will probably be appropriate soon to move to a slower pace of increases,”, but then caution that “I think what’s really important to emphasize, we’ve done a lot, but we have additional work to do.”

Governor Waller’s comments set the tone at the start of the new week during our APAC time zone with a decent move up in UST yields at the Tokyo opening. The UST curve is showing a mild bear flattening bias with the 2y rate up 7.5bps to 4.409% while the 10y gained 6bps to 3.87%. Reversing some of the move lower in yields recorded last week.

Meanwhile core yields in Europe have had a more subdued start to the new week with 10y Bunds yields steady at 2.16% while Italian 10y BTPS declined -2bps to 4.19%. ECB Panetta may have played a part, dovishly noting that aggressive policy tightening is not advisable. Panetta said that before lifting the policy rate to a restrictive level “in the absence of clear second-round effects, we would need convincing evidence that the current shocks are likely to keep having a more adverse effect on supply than on demand.”.

US equity markets opened lower, reflecting cautiousness after Governor’s Waller induced jump in UST yields during our APAC trading time. Then after recovering from the initial decline, the S&P 500 has more recently paired earlier gains and now flat on the day. Meanwhile the NASDAQ is currently down 0.32% showing a similar down and up and down again trading pattern. After initially taking a more dovish interpretation to Brainard’s comments, equity investors have seemingly come around to the idea that there is still an uncertain policy path ahead while the Fed message is that more data is needed to confirm if the cumulative impact from the policy tightening so far is having the desired effect. If not, more tightening will be needed.

Moving onto currencies, the USD is broadly stronger with last week’s notable outperformers (JPY and GBP) leading the declines. The move up in 10y UST yields weighed on the yen with USD/JPY edging up 1.10% to just below the ¥140 mark while the pound is down 0.65% to 1.1784.

Against a stronger USD backdrop with European currencies down between 1% and 0.2% while antipodean currencies are showing some resilience. NZD tracking sideways and trading just above the 61c mark and in a similar fashion the AUD is steady above 67c (now at 0.6720).

One factor likely helping the pro-growth AUD and NZD pairs (vs a solid USD backdrop) can be attribute to CNY’s performance. The yuan has extended its from last week as the market continues to positively assess the ease of covid restriction and new initiatives to support the property sector. USD/CNY closed down 0.4% to just below 7.07.

In other news, President Biden and Xi met in Bali, shook hands, and spoke for three and half hours. As President Biden said this was “No Kumbaya”, but it was certainly a positive de-escalation step which should be welcomed given the cumulative increase in tensions in recent time including from Taiwan, Russia-Ukraine war and the increase in US tech trading restrictions. China and the US still have a lot of disagreement and unresolved tensions but on the positive side both presidents agreed that the US and China have a responsibility to “prevent competition from becoming anything ever near a conflict,” and Xi said the two sides “need to find the right direction” and “elevate the relationship.”. Both countries have also agreed to resume cooperation on issues including climate change and food security and importantly too they jointly rebuked the Kremlin for loose talk of nuclear war over Ukraine.

Hopefully the handshake paves the way for more cooperation rather than more tensions between the two countries. Biden’s reiteration the US remains committed to its One China policy in which Taiwan is not recognised as an independent country doubtless helped, though he did raise objections to the PRC’s coercive and increasingly aggressive actions toward Taiwan. Furthermore, the new ease in tensions could be tested soon as Congress considers the Taiwan Policy Act, which would formally designate the island a “major non-NATO ally.”

Coming Up

- This morning Australia gets RBA Minutes (November) and our economists reckon they may garner slightly more attention than usual to see whether they align with the RBA Deputy Governor Bullock’s Senate Estimates remarks of getting to the point where “maybe, there might be an opportunity to sit and wait and look a little bit”. On careful listen, the remark was in response to a Senator suggesting interest rate hikes were counterproductive, clarified with “we think interest rates probably have to go up a little bit further” and in that context are still consistent with a near-term string of 25bp increases. Another point of interest will be any commentary on whether the decision to hike by 25bps (rather than 50bps) was closely balanced.

- Japan releases its preliminary Q3 GDP reading with the market expecting a slowdown in growth towards 1.2% (SA QoQ) vs 3.5% previously. Net trade was probably a growth drag while private consumption and business investments were likely growth supportive.

- China monthly activity indicators are also out during our time zone today with consensus looking for a soft retail sales print (0.7% vs 2.5% yoy) given local governments strictly enforced pandemic controls around the Congress period. Soft export and domestic demand readings in October suggest Industrial Production likely slowed to 5.3% yoy vs 6.3% prev. As for Fixed asset investment, the market is looking for an unchanged YTD yoy reading of 5.9%.

- Germany releases its November ZEW survey (expectations -54 vs -59.2 prev.) and the Eurozone gets Q3 GDP preliminary reading (0.2% SA qoq, same as Q1) as well as Q3 employment figures.

- The UK releases labour Market data for September (ILO unemployment unchanged at 3.5%) and later tonight the US publishes the November Empire Survey (-5 vs -9.1prev.)

- There are a few Fed (Williams, Harker and Cook) and ECB (Villeroy and Elderson) speakers on the roaster today.

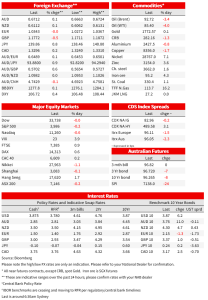

Market Prices