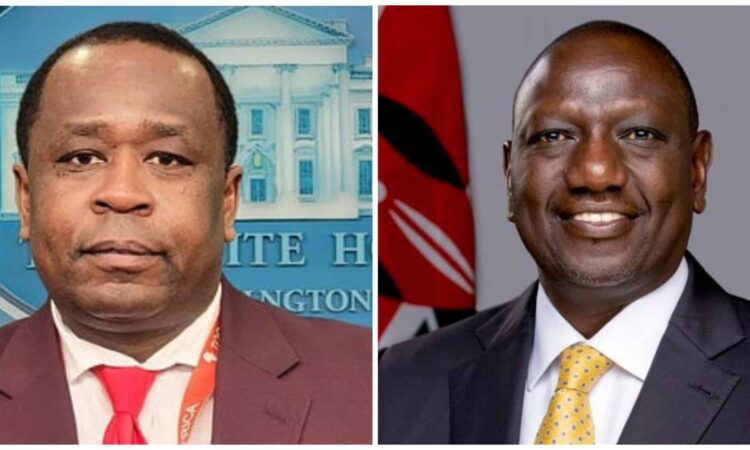

Kenyan President William Samoei Ruto Urges African Nations to Shift Away from US Dollar in Intracontinental Trade, Journalist Simon Ateba Cautions Challenges

Kenyan President William Samoei Ruto has called upon African nations to shift away from using the US dollar for intracontinental trade. During his recent address at the Djibouti parliament, President Ruto highlighted the need to abandon reliance on the US dollar for trade transactions between Djibouti and Kenya.

Currently, traders in Djibouti and Kenya have to acquire US dollars when engaging in trade between the two countries. President Ruto questioned the necessity of involving the US currency in the trade activities between the two nations.

President Ruto emphasized that the African Export–Import Bank (Afreximbank) has provided a mechanism that enables traders within the continent to engage in trade using their respective local currencies. Afreximbank facilitates the settlement of payments in local currency, making it possible for traders to conduct transactions in a more seamless manner. The President expressed Kenya’s support for the Pan-African payment and settlement system, which is administered by Afreximbank.

President Ruto raised the question of why it is necessary to purchase goods from Djibouti and pay for them in US dollars. He stressed that there is no valid reason for this practice. The President clarified that the intention is not to oppose the US dollar, but rather to promote more unrestricted trade. He suggested that purchases made from the United States can still be settled in US dollars, while transactions with Djibouti can be conducted using local currencies.

It is worth noting that Afreximbank, established in 1993 under the auspices of the African Development Bank, is a pan-African supranational multilateral financial institution. Its primary objective is to promote and finance intra- and extra-African trade activities.

President Ruto’s remarks reflect Kenya’s commitment to fostering greater economic integration within Africa and reducing reliance on external currencies for regional trade. The proposal to shift away from the US dollar in intracontinental trade could potentially streamline transactions and promote economic growth among African nations.

However, journalist Simon Ateba has cautioned that implementing President Ruto’s call for a shift away from the US dollar may face challenges. In his analysis, Ateba acknowledged that while alternative currencies and regional trading blocs facilitate trade within their respective regions, such as the euro in the European Union or the Chinese yuan in East Asia, there are various reasons why many nations continue to use the US dollar for trading.

Ateba emphasized the importance of understanding these reasons, as they shed light on the current state of global trade dynamics. He highlighted the fact that countries with more stable and widely available currencies, backed by a robust economy, tend to attract more trading partners. Ateba gave an example of a small country with limited trade and influence, where its currency is rarely used outside its borders due to various factors such as a lack of trading partners or limited manufacturing capabilities. In contrast, a powerful nation with a stable currency that is widely accepted and used in numerous countries gains more prominence in international trade.

The journalist listed several reasons why the US dollar remains the preferred currency for trading on a global scale. First, the US dollar has held the status of the dominant global reserve currency since the conclusion of World War II. Central banks worldwide hold US dollars as a significant component of their foreign exchange reserves, ensuring stability and liquidity within their economies. Second, the strength and stability of the US economy, coupled with trust in the US government, instill confidence among international traders and investors.

Furthermore, the US’s position as one of the largest trading nations, with a significant portion of global trade conducted in US dollars, simplifies international transactions and reduces exchange rate risks. The depth and liquidity of the US financial markets, including the New York Stock Exchange and the US Treasury market, provide access to a wide range of financial instruments denominated in US dollars.

Ateba said, “It is true that while the US dollar is widely used, alternative currencies and regional trading blocs facilitate trade in their respective regions, such as the euro in the European Union or the Chinese yuan in East Asia.

“However, the question remains: Why do many nations use the US dollar for trading? There are numerous reasons, and it is important to understand them. While these reasons may change over time, eventually leading to the emergence of a new global currency that is stable and widely available, comprehending the existing reasons helps maintain a sense of excitement.

“Consider a small country that engages in minimal trading. Once you leave that country, their currency is hardly used by anyone. There are various reasons for this, such as limited trading relationships, lack of capital to extend beyond their borders, or a scarcity of attractive investments.

“Now, envision a more powerful nation with a stable currency that is widely available in numerous countries. This country manufactures goods and services that are in demand worldwide, and it maintains stability, fostering trust from the rest of the world that it will not default on its obligations. In such a scenario, more people will opt to trade using the currency of the more influential nation, compared to the smaller nation that has little impact. The lesson here is that when conditions change, and a country experiences civil unrest or economic turmoil, its currency may collapse, leading to the emergence of a more stable and widely accepted currency.”

While using local currencies in Africa for trading among African nations may sound great, it is clear that it would depend on many factors, including the stability of the African continent, the growth of trading volume in Africa, the volume of trade between Africa and the rest of the world, and many other reasons.