November 09, 2023

Kelly Services Inc. (NASDAQ: KELYA, KELYB) reported customers took a more guarded approach to hiring and starting new projects in the third quarter. The hesitancy came amid concerns about the economy.

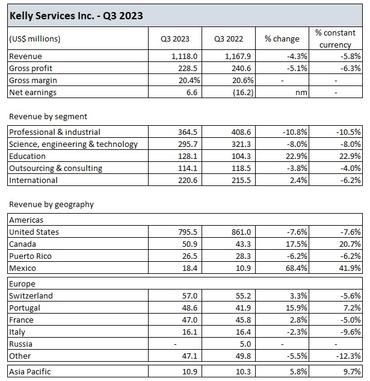

Revenue fell 5.8% in constant currency to $1.12 billion at the staffing giant. However, Kelly posted growth in its education segment, where revenue rose 22.9%.

“In the third quarter, persistent macroeconomic uncertainty continued to temper demand for temporary and permanent staffing services,” Peter Quigley, president and CEO, said in a press release. “We continued to focus on what we can control in this challenging operating environment, driving significant progress in the execution of our transformation initiatives — the benefits of which are evident in our operating results.”

Kelly is also in the process of selling its European staffing operations to Italy’s Gi Group. Kelly will continue to provide MSP, RPO and functional services provider services in Europe even after the sale.

US revenue

In the third quarter, US revenue fell 7.6%. However, revenue rose 20.7% in Canada and 41.9% in Mexico — both in constant currency.

Asia Pacific revenue also rose 9.7%, and revenue in the Europe region fell 7.0%, both in constant currency.

Revenue by segment

Revenue from Kelly’s outsourcing and consulting operations fell by 4.0% in constant currency. This includes MSP, RPO, payroll process outsourcing and consulting.

Professional and industrial revenue fell 10.5% in constant currency. This segment includes industrial, contact center and office/clerical staffing.

Science, engineering and technology revenue fell 8.0% in constant currency. This includes engineering, science and clinical, technology and telecom.

International revenue fell 6.2% in constant currency, while education saw revenue jump 22.9%.

Kelly noted perm placement revenue was affected by the economy and fell 28.5% in constant currency to $14.6 million.

The company also executed on workforce reductions and other initiatives, which included $10.4 million in severance expenses and lease terminations costs.

SG&A expenses fell to $228 million in the third quarter from $231 million in the third quarter of last year.

Click to enlarge.

Share price

KELYA shares were up 5.53% to $19.64 as of 1:35 p.m. Eastern time today; they set a new 52-week high today when they reached $19.76, according to FT.com.