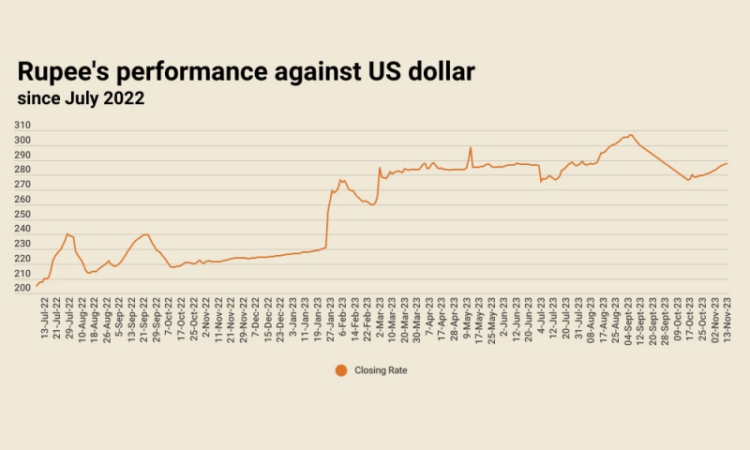

The Pakistani rupee continued to endure losses for the 15th consecutive session against the US dollar, as it depreciated 0.18% in the inter-bank market on Friday.

As per the State Bank of Pakistan (SBP), the rupee settled at 287.55, a decrease of Re0.52.

During the previous week, the rupee extended its downtrend against the US dollar as it depreciated 0.95% or Rs2.72 to settle at 287.03 in the inter-bank market.

It was the fourth consecutive week that the local currency witnessed a fall, cumulatively down by 3.3% or Rs9.41 since October 13.

Earlier, the local currency maintained a positive close for 28 successive sessions – one of the longest appreciation runs as it cumulatively gained 10.93% since hitting a record low of 307.1 in the inter-bank market on September 5.

Meanwhile, Pakistan and the International Monetary Fund (IMF) are likely to initiate policy-level talks from November 13 (today) onwards.

Internationally, the US dollar was steady on Monday as traders awaited another batch of inflation data from the United States that is expected to offer further clues this week on whether the Federal Reserve has more work to do to tame price pressures.

The focus for most traders will be firmly on US consumer price index (CPI) numbers due on Tuesday after the Fed’s policy meeting this month tempered its hawkish stance although Fed Chair Jerome Powell last week hinted that the battle against inflation may not be over yet.

The dollar index, which measures the dollar against a basket of currencies, was last mostly flat at 105.80.

Oil prices, a key indicator of currency parity, wavered on Monday, as renewed concerns over waning demand in the United States and China, coupled with mixed signals from the US Federal Reserve, kept markets uncertain.

Brent crude futures for January were down 8 cents at $81.35 a barrel at 0916 GMT, after losing $1 in earlier trading, while the US West Texas Intermediate (WTI) crude futures for December were at $77.11, down 6 cents.