For a freelance content writing gig that Bengaluru-based Udita Pal had done some years back, she received $88 of the total $100 payment due. No, she wasn’t scammed. She lost 12% in forex conversion and cross-border payment costs charged by the online money transfer company that she used.

Keyur Kumbhare, 22, has a similar story to share. He was losing nearly 8% in each payment received through the platform that is widely used by businesses for international payments. “I started convincing my clients to sign up with the cross currency money transfer service that I found to be the cheapest,” said Ahmedabad-based Kumbhare, who now runs a marketing agency.

Kumbhare is referring to Wise (erstwhile TransferWise). Wise became a preferred choice for Kumbhare after he tried several options. “PayPal was the first platform I used as it was the most popular one but it was expensive. Though direct bank-to-bank transfer was cost-efficient, it took 10-12 days for the payment to be released,” he said.

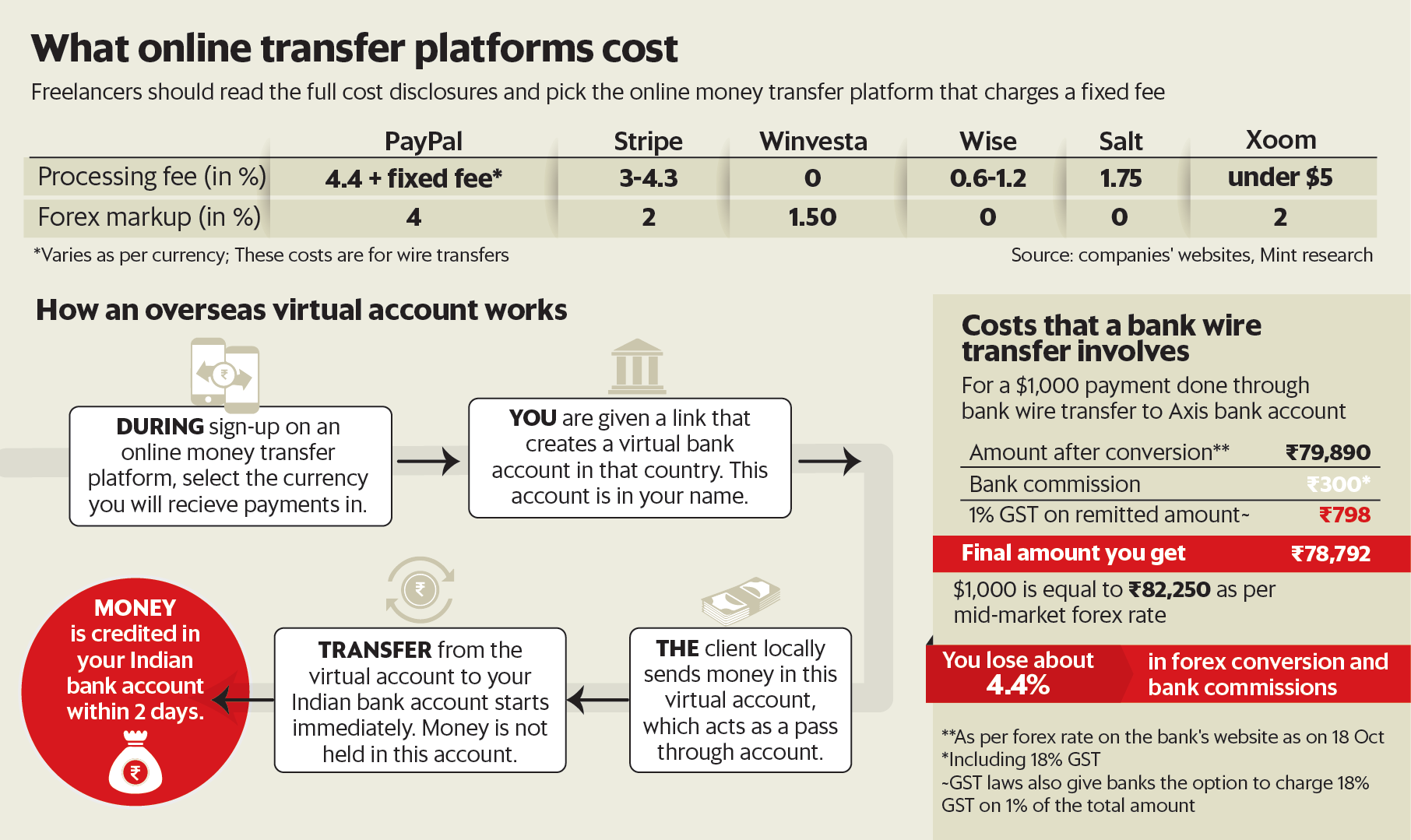

Money transfer tech companies, including the likes of Wise, Payoneer, PayPal, Winvesta and Salt (an Indian startup) have ensured faster receipt of money from abroad for freelancers compared to traditional banks. In some cases, bank transfers can work out better in terms of costs and safety as they do not involve intermediaries (see table).

Bank transfers: SWIFT (Society of Worldwide Interbank Financial Telecommunicationwire) transfer mechanism followed by banks is the fastest bank-to-bank payment transfer option that one can choose. This typically carries three costs—sender bank’s commission, receiving bank’s commission and forex mark-up fee.

Sender bank’s commission is typically footed by the client making the payment, but the client can choose to pass on the full cost or share it with the freelancer. Ensure that this doesn’t happen because in countries like the US, banks charge a high fee of $40-50.

As for the receiver bank’s commission, most of the big Indian banks, such as HDFC, ICICI and SBI, have over the years removed it and only charge forex mark-up fee. Some banks like Axis and Induslnd charge a fee of ₹100-500 per transaction for wire transfers. GST is levied by banks on all inward remittances.

Digital marketing freelancer Shivay Madan, 21, prefers bank transfers because of their low-cost structure. “In most bank transfers from countries like Singapore and Malaysia, I receive the exact amount generated in my invoice. However, this is not the case with bank transfers from the US or UK,” he said. Businesses in the US and UK prefer PayPal or Stripe over bank transfers due to high commissions.

View Full Image

Apart from transaction fee, Indian banks charge a fee of ₹100-300 for issuing a Foreign Inward Remittance Certificate (FIRC) per certificate. An FIRC is to be mandatorily procured by the freelancer for each inward remittance.

Online transfers: PayPal or Stripe are the most popular online options, but carry the steepest fee (see table). Other new-age money transfer platforms such as Winvesta, Payoneer, Xoom, Wise and Salt, among others, charge a fixed fee of 0.8-2% on the total amount and offer forex conversion at mid-market rates.

Regulations in India do not allow holding a foreign currency in an online wallet or an online money transfer platform’s account. The remitted amount has to be directly credited in the receiver’s bank.

Most money transfer platforms enable transactions through a multi-currency virtual bank account (see table).

“We create a virtual bank account in the country where the freelancer’s client is based. The client transfers the money locally in your virtual account, which is then remitted to the Indian bank account,” said Pal, co-founder of online money transfer platform Salt.

Swastik Nigam, founder and CEO, Winvesta, said these accounts are just used as a pass-through account to bring money in India. “Money is not held overnight in these accounts and there’s only one beneficiary to the account, which is your Indian bank account” On being asked whether these accounts qualify as foreign assets, Nigam said, they don’t as no funds are held in them. “Though not required, the customer can choose to declare the virtual account in the foreign asset schedule in ITR and mention the balance as zero,” he said.

Download The Mint News App to get Daily Market Updates.