Capital at risk. All investments carry a varying degree of risk and it’s important you understand the nature of these. The value of your investments can go down as well as up and you may get back less than you put in. Where we promote an affiliate partner that provides investment products, our promotion is limited to that of their listed stocks & shares investment platform. We do not promote or encourage any other products such as contract for difference, spread betting or forex. Investments in a currency other than sterling are exposed to currency exchange risk. Currency exchange rates are constantly changing which may affect the value of the investment in sterling terms. You could lose money in sterling even if the stock price rises in the currency of origin. Stocks listed on overseas exchanges may be subject to additional dealing and exchange rate charges, and may have other tax implications, and may not provide the same, or any, regulatory protection as in the UK. Accurate at the point of publication.

Investing in precious metals, such as gold, silver, platinum and palladium, can provide access to an alternative asset class distinguished by inherent scarcity and high economic worth.

Precious metals can also add stability and diversification to an investment portfolio, particularly in times of economic and geopolitical uncertainty. This fuelled the price of gold to a record high earlier this year as investors sought ‘safe haven’ assets.

That said, precious metals are a volatile asset class, with fluctuating demand from investors and industry alike. While gold has typically performed strongly during economic downturns, the cyclical nature of industrial demand for other precious metals can also restrict their effectiveness as a hedge.

To help investors navigate the options on offer, we take a closer look at investing in precious metals and the outlook for the sector.

What are precious metals?

Precious metals are highly valued both for their aesthetic appeal and their practical application in certain industries.

The best-known precious metals are:

- Gold: one of the most highly-prized precious metals with a long history of use as a currency, in jewellery and more recently in consumer devices such as smartphones.

- Silver: used in jewellery as well as industrial applications due to its highly conductive, malleable and anti-bacterial qualities.

- Platinum: in high demand for automotive catalytic converters thanks to its density and resistance to corrosion, in addition to jewellery and medical products such as chemotherapy drugs.

- Palladium: also used in catalytic converters, as well as electronics and jewellery.

However, the following metals are sometimes included in the precious metal category:

- Rhodium: one of the rarest and most expensive precious metals, used for catalytic converters and plating jewellery.

- Iridium: one of the densest and most corrosion-resistant metals, used in spark plugs, electrical contacts and other industrial processes.

We’ve also produced separate guides on how to invest in gold, silver and platinum.

How have precious metals performed?

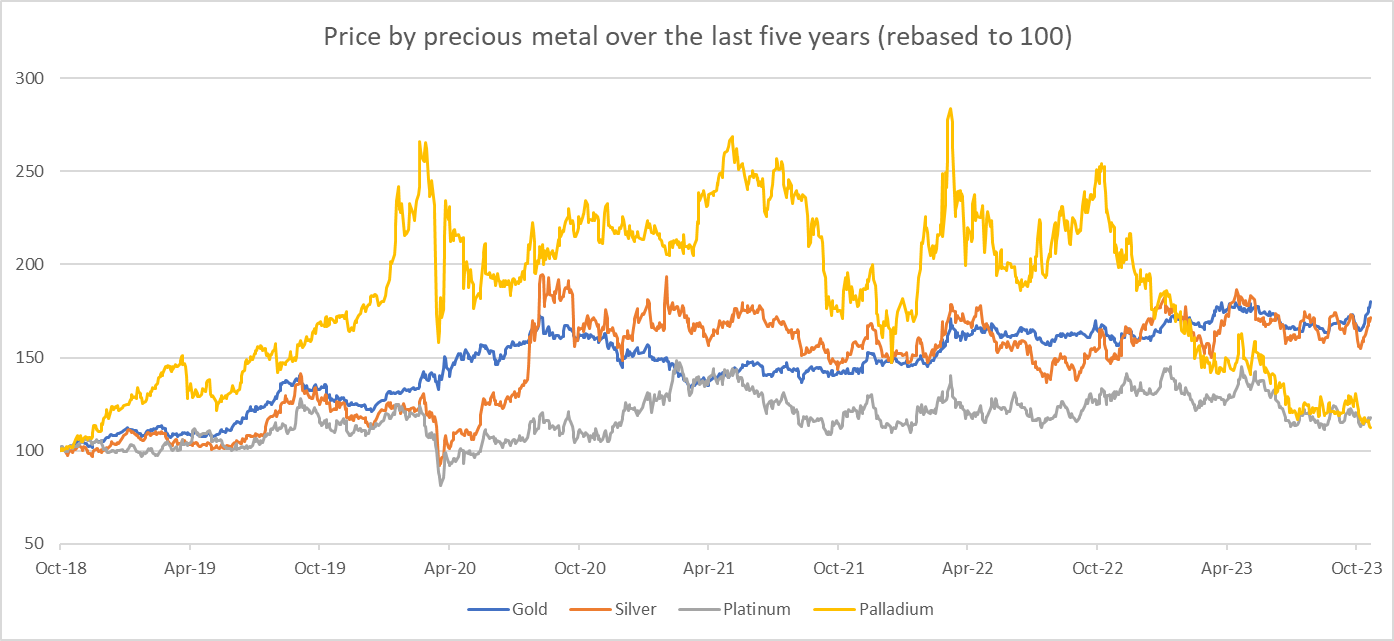

The four most-traded precious metals have all delivered positive overall returns over the last five years, as shown in the chart below:

Source: BullionVault

Gold and silver have been the best-performing precious metals, achieving a total five-year return of 80% and 72% respectively. In contrast, palladium delivered a considerably lower return of 13%, followed by 18% for platinum.

Investors are often attracted to gold due to its comparatively lower volatility than other precious metals, as illustrated in the chart above. In contrast, investing in silver and palladium can be a bumpier ride, with sharp peaks and troughs.

Gold is also generally less cyclical as industrial demand accounts for less than 10% of overall demand, compared to over 50% for the three ‘white metals’, according to BullionVault.

Looking more recently, all four precious metals delivered positive returns in 2022, ranging from 5% (palladium) to 19% (platinum). However, precious metals have faced a more challenging 2023, with only gold managing to deliver a positive year-to-date return, and palladium prices falling by more than a third.

Adrian Ash, director of research at online precious metals marketplace BullionVault, comments: “Physical investment flows have seen investors taking profit on gold’s sudden jump. These high prices, plus the highest interest rates on cash in the bank for well over a decade, make selling gold and banking the cash an attractive trade.

“Together with the cost-of-living squeeze, that same combination is also denting new demand, now running well below the historically high levels of 2020 to 2022.”

Andrew Dickey, director of precious metals at The Royal Mint, adds: “In September, the precious metals saw a modest 4% decline, driven by rising bond yields and a stronger dollar.

“However, in recent weeks, gold has jumped in value to trade between $1,900 to $1,950 per troy ounce and is nearing an all-time high in sterling. Conflict in the Middle East, rising oil prices and sticky inflation are all factors which are driving gold prices right now.”

Why invest in precious metals?

There are several reasons why investors may choose to invest in precious metals:

1. Diversification into other assets

One of the main attractions of precious metals is the opportunity to diversify portfolios into an alternative asset class to bonds and equities. This can help to safeguard overall returns when one asset class underperforms.

Matt Weller, head of market research at trading platform FOREX.com, comments: “Precious metals, notably gold, have long been viewed as a store of value and a hedge against economic uncertainty, playing a significant role in diversification.”

Added to this, gold has often demonstrated an ‘inverse correlation’ with equities, in other words, gold prices have typically increased as stock markets have fallen.

Mr Ash comments: “Gold tends to do well when other assets do poorly. Sometimes all asset prices fall together nor does gold zig on a minute-by-minute basis when the stock market zags.

“But on a longer horizon, a small allocation to gold has in the past repeatedly helped offset losses on other, more usually profitable investments when they struggled for an extended period of time.”

Mr Ash also highlights that, when the S&P 500 index has fallen in value over a five-year period, the US dollar gold price has risen over the same period, based on the last 50 years. He adds that the same trend is apparent for the sterling gold price versus the FTSE All Share index and the euro gold price against the German all-share CDAX index.

2. ‘Safe haven’ asset

Investors may perceive precious metals as ‘safer’ assets during periods of economic or geopolitical instability, due to their ability to hold their value.

Mr Dickey comments: “In times of economic uncertainty and global instability, we often see investors move into gold as many view the asset as a ‘safe haven’ investment choice.”

Consequently, the price of gold and silver increased by more than 10% after Russia’s invasion of Ukraine and the recent conflict in Israel and Gaza. And palladium prices soared by nearly 50% in the two weeks following the Ukraine conflict due to Russia’s position as the world’s largest exporter of the metal.

Some precious metals are also seen as safe haven assets in times of high inflation, which erodes the ‘real’ value of money. Precious metals are real physical assets with an inherent economic value, whereas inflation reduces the value of ‘fiat’ currencies such as the British pound or US dollar.

According to the World Gold Council, gold has achieved average annual returns of 15% per annum when inflation is higher than 3%, compared to just over 6% per annum when inflation is lower than 3% over the 50 years to 2019.

3. Growth drivers

As well as being a store of value for investment purposes, precious metals are also in high demand for industrial processes. As mentioned earlier, palladium and platinum are key components in automotive catalytic converters, while silver is used for solar panels and batteries.

As a result, the clean energy transition required to meet net-zero emissions is forecast to fuel a considerable growth in demand for these precious metals. As supply is limited, this could have a significant impact on prices.

Mr Ash comments: “Both silver and platinum are proving to be essential metals in the energy transition. Demand for silver from the relentless growth in solar panel installations worldwide contrasts with limited, if not falling, silver mining output.

“Similarly, platinum is already seeing deep deficits between new mine supply and global demand, and it also shows great promise for helping the world move to net-zero, thanks to its use in hydrogen fuel-cell catalysts.

“For now however, the market hasn’t yet caught on to these stories and, in the case of silver, it’s tracking the price of gold rather than forging its own path as a truly critical mineral in the energy transition.”

What are the risks of investing in precious metals?

Investing in precious metals also carries a number of risks which investors should be aware of:

- Volatility: the price of precious metals can be volatile, particularly for silver and palladium, with the potential risk of suffering significant losses.

- Lack of income: precious metals do not provide an income or ‘yield’ for investors, unlike savings accounts, bonds and dividend-paying shares.

- Holding in physical form: buying metals in their physical form can be difficult and costly, due to the need for authentication and safe storage. Investors with limited amounts to invest may also find it difficult to buy metals in smaller quantities.

- Limitations as a hedge: while gold has typically been a natural hedge in stock market downturns, this has not always been the case. In addition, the higher level of industrial demand for silver, palladium and platinum limits their usefulness as a hedge in a recession, with the associated drop in manufacturing output.

- Geopolitical and economic factors: the price of precious metals can be strongly correlated to geopolitical events, which are often unpredictable. Furthermore, economic factors such as inflation and interest rates can have a considerable impact on price.

What are the options for investing in precious metals?

It’s possible to invest in precious metals by buying it in physical form, or indirectly through a related investment product.

1. Buy in physical form

Investors can buy physical precious metals in the form of bullion bars, coins and other products from The Royal Mint and precious metal dealers:

- Bullion bars: these typically vary in size from one gram to a kilogram. The Royal Mint currently charges just under £30 for a one ounce silver bar up to £53,000 for a one kilogram gold bar.

- Bullion coins: the two most common types of gold coin produced by the Royal Mint are the Britannia and Sovereign. The one ounce platinum Britannia coin is its most popular platinum product and currently costs around £800. These coins are classed as legal tender, meaning that any gains are exempt from capital gains tax in the UK.

- Digital metals: this allows investors to own fractions of larger gold, silver or platinum bars stored in the providers’ vaults.

- Jewellery: this carries additional risks to buying bullion due to the mark-up for design, manufacturing and retail costs.

It’s important to use a reputable dealer when buying precious metals, such as The Royal Mint or a Member of the British Numismatic Trade Association.

2. Buying shares in mining companies

One way to invest indirectly is to buy shares in companies that mine, refine and trade precious metals. However, while the prices of mining company shares correlate to precious metal prices, their share prices are also impacted by other fundamentals such as profitability, geopolitical risks and environmental issues.

Investing in a mining company provides the opportunity for capital growth if the share price rises, along with income in the form of dividends.

Some of the largest global precious metal mining companies include:

- Barrick Gold Corporation: headquartered in Toronto, Barrick is a major gold and copper producer, operating mines in 13 countries.

- Newmont Corporation: Newmont mines gold in addition to copper, silver, zinc and lead. It’s headquartered in the US, with mines in Africa, Australia and North and South America.

- AngloGold Ashanti: a South African company producing gold, silver and copper through mines in nine countries.

In addition, FTSE 100 companies BHP Group, Rio Tinto and Glencore have precious metal mining activities.

3. Buying funds

Funds aggregate sums of money from investors to be managed on their behalf. Funds may be actively-managed (where the manager aims to beat the benchmark by stock-picking) or passively-managed (where the fund tracks an index).

Passive funds usually charge annual management fees of around 0.1-0.2% compared to 0.5%-1.0% for actively-managed funds.

In terms of precious metals, options include:

- Precious metal exchange-traded funds (ETFs) and exchange-traded commodities (ETCs) which hold the metals in physical form (or via futures contracts), or aim to replicate a broader index such as the Dow Jones Precious Metals index. Investors can choose from exchange-traded products tracking the price of gold, silver, platinum and palladium individually, or a broader basket of precious metals.

- Actively-managed funds which generally invest in mining companies, rather than the underlying metal itself. If the price of the metal rises, this has a positive impact on the value of the revenue of mining companies.

What’s the outlook for precious metals?

Looking ahead, inflation, interest rates and geopolitical factors are likely to remain the key price drivers of precious metals over the shorter term. Demand has also been buoyed by heavy stockpiling of precious metals by central banks as an easy-to-liquidate asset.

Mr Ash explains: “Looking ahead, most bullion-market analysts would advise keeping an eye on interest rates. Because gold pays no yield or interest to its owners, it has tended to fall in value when bonds or cash savings have offered a rising rate of return.

“However, this relationship has broken down since inflation took off in 2021, with the fastest jump in interest rates since the start of the 1980s offset by economic, geopolitical and financial worries.”

He adds: “Witness the ongoing leap in US Treasury bond yields. It is remarkable that gold prices have also jumped right alongside, something not seen in 20 years.”

That said, there are downside risks for precious metals in a rising interest rate environment, together with a stumbling manufacturing sector in China and the US economy continuing to swerve a ‘hard’ landing.

However, a deterioration in the US economy over the next year could yet provide a tailwind for precious metals as a safe haven asset.

Mr Dickey comments: “The Fed’s noise around ‘higher for longer’ interest rates has created concern around low global economic growth and the performance of equities in the years ahead. Only last week the IMF downgraded global economic growth for 2024.

“In times of economic uncertainty and global instability, investors are increasingly looking to protect and future-proof their portfolio as well as find long-term investment opportunities that outperform inflation and stock markets.”

It’s worth noting that any investment in precious metals should form only one part of a balanced and diversified portfolio. As a rule-of-thumb, commodities such as precious metals should not represent more than 5% of an overall portfolio.