-

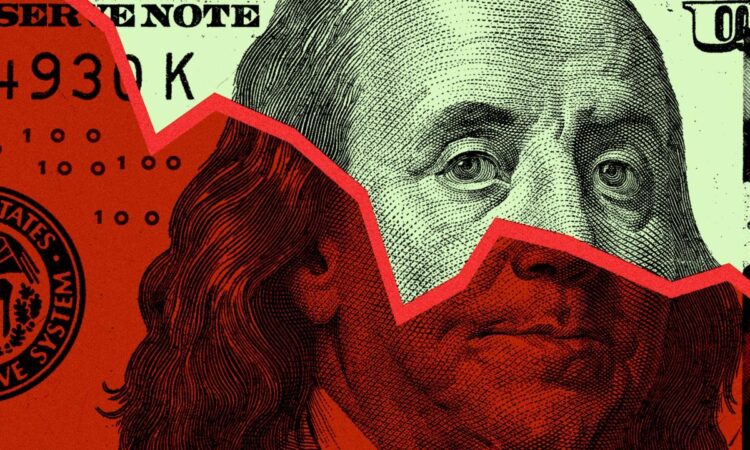

Saudi Arabia is moving away from the US dollar in the oil trade as it looks at alternative markets.

-

The end of a long-standing “petrodollar” agreement would dent dollar dominance, the Atlantic Council wrote.

-

The move would be a sign that Saudi Arabia is instead seeking to diversify its trade.

The potential end of a watershed trading agreement between the US and Saudi Arabia would be a hit to the dollar’s oil-market supremacy, and offer a symbolic win for de-dollarization, the Atlantic Council said.

In a new blog post, the think tank mulled the prospect that a 1974 accord that mandates Saudi Arabia exclusively use greenbacks when selling its crude oil could come to an end. For 50 years, the “petrodollar” deal has ensured the US dollar’s role as the world’s chief financing and trading currency, the think tank said.

As uncertainty rocked the US economy in the 1970s, the petrodollar became a way to keep the dollar stable. In exchange for security guarantees and military supplies, part of the agreement with Saudi Arabia saw that traded greenbacks were recycled into US bonds, deepening the dollar’s role as a reserve currency.

But since the deal’s origins fifty years ago, much has changed, the Atlantic Council said.

American economic dominance is no longer as stark, with its share of world GDP falling from 40% to 25% since 1960. Moreover, US dependence on Saudi oil has slid considerably, given a historic explosion in US domestic production.

Instead, alternative markets have sprung up, incentivizing crude economies to rethink their trading practices.

“China has become Saudi Arabia’s largest oil customer, accounting for more than 20% of the kingdom’s oil exports. Beijing has established close, trade-driven relationships throughout the Middle East, where US influence has waned,” nonresident fellow Hung Tran wrote.

For this reason, Riyadh has gradually aligned itself with the de-dollarization movement, which seeks to lower the greenback’s dominance of world finance.

For instance, Saudi Arabia is among potential BRICS candidates, an economic bloc that has become one of the leading voices against the dollar. It’s also linked with China to help establish mBridge, a cross-border payments system that uses central bank digital currencies.

If such payment ecosystems make ground, it’s a real threat to US Treasury liquidity, risking a key pillar of the greenback’s international position, Tran said.

“In such a world, the dollar would remain prominent but without its outsized clout, complemented by currencies such as the Chinese renminbi, the euro, and the Japanese yen in a way that’s commensurate with the international footprint of their economies,” he said.

Tran concluded: “In this context, how Saudi Arabia approaches the petrodollar remains an important harbinger of the financial future to come as its creation was fifty years prior.”

Editor’s note: This article has been revised to reflect the fact that Saudi Arabia made no announcement on June 13 related to oil traded in US dollars. There is no official agreement between the United States and Saudi Arabia to sell oil in US dollars.

Read the original article on Business Insider