Bruce Bennett

Honda (NYSE:HMC) is a pretty low multiple stock, but it’s not exactly in the best possible situation when considering all the likely forces we’ll see on earnings. Pent-up demand may last, but probably not given the credit cycle. The financial business is seeing a return to normal in default rates that won’t reverse, so that decline will be permanent. Moreover, Honda isn’t really future proof either. While a China recovery might be a decent mitigant, sustained earnings growth seems less likely, and there are strictly better deals out there in automotive that outdo Honda. A pass.

Q3 Results

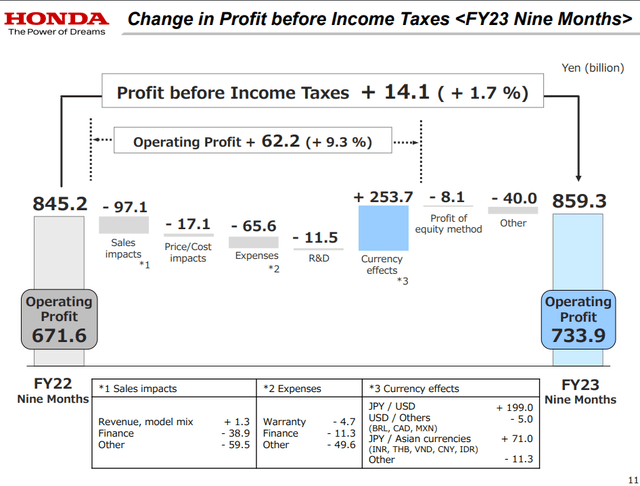

Let’s start with the profit waterfall, since that’s where all the key info is.

Profit Waterfall (Q3 2022 Pres)

We note that one of the biggest impacts on sales is coming from the financing business. While not explained in the releases, management commented on the business saying that particularly in the US, which has been levitated by ‘subsidies’, which we think they mean as the stimulus checks, lending has been high and default rates low, abnormally so, throughout COVID-19. They are now making a permanent return to normal. In fact, this income doesn’t come back when you look at the profit forecasts for the company. The default issue affects the expenses in the waterfall through its impact on default reserves in the financing business.

Price/cost impacts were small, thanks to price realisation mostly offsetting inflation.

The big delta in the profit waterfall was from currency effects, where being a Yen-denominated company has helped them, at least on paper, as the denominated currency depreciates against the currencies of its portfolio of markets. While the Ueda decision yesterday seems to indicate further easing, which means the Yen won’t rocket yet, the Yen is historically at very weak levels and some convergence, either by foreign currencies seeing lower rates on the Yen seeing higher rates, will eventually close this gap and impact the benefit from currency effects that we see on the profits.

Note that unit sales declined in every geography in cars due to the continued semiconductor issues, and management reported that deal inventories remains extraordinarily low. Pent-up demand is still a reasonable case for the time being, although we think that retail trends are going to necessarily deteriorate given the credit cycle situation. Motorcycles actually performed well, even in volumes, especially in Asia excl. Japan, where the motorcycle business has been again profitable after years of being a negative profit contributor.

Conclusions

China has been bad in the so-far reported quarters due to COVID-zero policies. However, now China is seeing a pretty strong economic reversal, likely things picking up heavily in the service industry. Declines were more than 10% in China for HMC in the Q3 on a 9m basis, and we think this could see some reversal. That’s about the only major positive we see on the sales side for the next cycle. Pent-up demand may see HMC coasting for another two quarters, but if the credit conditions really hit the EU and US markets, earnings growth will be more iffy.

There’s another issue, which is that Biden is saying that he will toughen up on polluting vehicles. Japan is not in the game when it comes to EV, likely lulled for years by an idiosyncratic success of hybrid.

HMC stock trades at around 8-9x PE, which is low, but Mazda (OTCPK:MZDAY) is half that, and Volkswagen (OTCPK:VWAGY) is also half that but with much more presence in EV and a great IPO under their belt with Porsche. HMC doesn’t stack up against these alternatives. Pass.