(Bloomberg) — By late-1923, hyperinflation had rendered Germany’s currency so worthless that one woman used several billion marks of banknotes to fashion a dress for carnival.

The gown is part of an exhibition at the Frankfurt History Museum that’s striking an uncomfortable chord with Germans today who’ve been rocked by the steepest price rises since the country’s reunification, thanks to Russia’s attack on Ukraine.

This advertisement has not loaded yet, but your article continues below.

“We couldn’t have imagined it would be so relevant,” said Nathalie Angersbach, a co-curator of ‘Inflation 1923. War, Money, Trauma.’ “We see this with one eye laughing and the other weeping — of course we don’t want inflation, but the attention we have now makes us happy.”

A hit with young and old, the exhibit has won praise from Philip Lane, chief economist at the European Central Bank, which is based in the city and has been battling to drag price gains across the 20-nation euro zone back down to 2%.

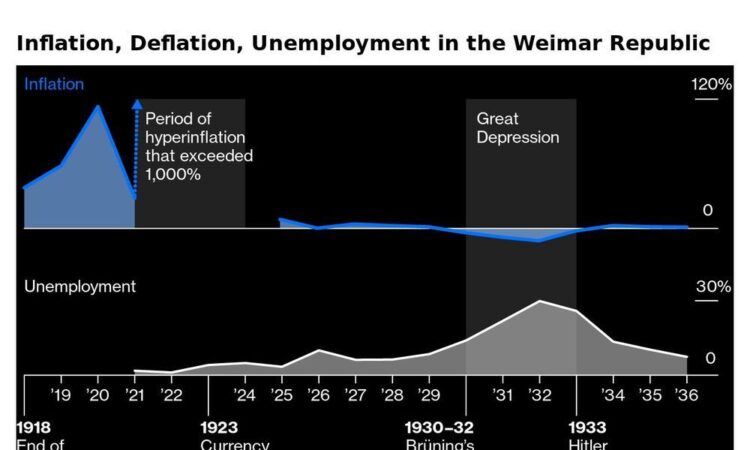

For Germany, despite the recent bout of inflation being nowhere near the 29,000% or more that quickly vaporized households’ savings a century ago, the challenges it’s unearthed shouldn’t be underestimated.

Soaring energy costs helped trigger a recession that’s exposed economic frailties. Heightened inequality, meanwhile, is fueling a resurgence of far-right political forces.

Having peaked at 11.6% last October, inflation in Europe’s largest economy may abate to 6.4% this month, according to a Bloomberg survey of analysts. But the ramp-up in the cost of everything from gasoline to butter, alongside the unprecedented barrage of interest-rate increases the ECB has unleashed in response, are stinging. And while nearing their end, the hikes may yet persist.

This advertisement has not loaded yet, but your article continues below.

Germans’ traditional aversion to inflation, rooted in the ordeal of the 1920s, was revived in 2022 after moderating a little in the preceding period, polls have showed.

Like a century ago, the ensuing economic hardship is proving to be fertile ground for populism. Support for Germany’s AfD has surged to record highs in recent months, propelling the far-right party past Chancellor Olaf Scholz’s center-left Social Democrats.

AfD sympathizers are significantly more dissatisfied with their own lives and the economy than average voters, according to Marcel Fratzscher, who heads the DIW research institute. With German output stagnating, things may yet get worse.

For the poor, the spike in inflation has been particularly pronounced, with food costs — which make up a bigger chunk of their spending than they do the wealthier households — jumping at twice the pace of overall prices.

In Frankfurt, beyond the skyscrapers that are home to some of Europe’s biggest banks, the Frankfurter Tafel food bank has witnessed the fallout first-hand.

Requests for assistance have soared by such an extent that the charity was forced to impose a freeze on new intake. While it has plenty of storage space, donations haven’t kept up with demand.

This advertisement has not loaded yet, but your article continues below.

“Once, there was only one onion and three carrots left, and there were still four families waiting, who then started fighting over it all,” spokeswoman Nilab Alokuzay-Kiesinger said, surveying empty warehouse shelves.

At one distribution point, located in a Latin American nightclub, people line up every Friday morning amid colorful party decorations, waiting for their bags filled with everything from vegetables to sausage and yogurt. One retiree said her pension doesn’t cover both food and rent, since prices shot up.

Inflation is poised to slow further, though prices aren’t likely to offer relief by falling.

“There is that understanding that the overall inflation is coming down,” Bundesbank President Joachim Nagel told Bloomberg TV last week. “It’s often like that, that it takes more time for the core inflation to come down. That could be a possible scenario. But we should wait for the September numbers.”

But the government is also paring back support measures that helped keep heating bills down after the war in Ukraine sent energy prices rocketing.

Scholz is optimistic that inflation can be overcome, calling Germany “perfectly capable of mastering the problems of our time.” Initiatives include rapidly installing liquefied natural gas terminals to lower energy costs, and investing in the green transition to keep electricity cheap for an industrial sector that had grown addicted to low-cost fuel from Russia.

This advertisement has not loaded yet, but your article continues below.

The chancellor is also defiant on the rise of AfD. “We won’t be able to avoid taking a stand and saying that we’re defending democracy and the freedom we’ve achieved,” he said this month.

Back in the Frankfurt museum, visitors learning about the perils of money-printing include Klaus Moor, a pensioner who keeps a box with millions of devalued marks from his grandfather at home.

“I hope it’s not going to get as bad as back then,” he said. “I have a good pension but I can imagine that many families, especially the ones with children, are having a hard time coping with today’s price increases.”

Read More About Germany:

German Budget Hawk Steers Faltering Coalition as Far Right Rises

Germany’s Economic Malaise Evokes ‘Sick Man of Europe’ Era

Germany’s Economy Seen Stalling for Remainder of the Year

Scholz Vows to Fight ‘Enemies of Democracy’ as Far-Right Surges

Bloomberg Opinion: What Germans Think They Know About Inflation Is Wrong

—With assistance from Alexander Weber and Michael McKee.