US Job Cuts Announced, monthly

There were two major economic announcements last week. The Q4/22 GDP, released by the BEA (Bureau of Economic Analysis) on Thursday (January 26th) was fawned over by the media. As we analyze below, some pundits falsely conclude that the +2.9% annualized growth rate was a sign that the economy would have a “soft-landing.” The more important announcement by OPEC+, likely to have long-term negative impacts on the U.S. economy, was all but ignored by the media. The oil cartel announced their intention to accept payment in currencies other than dollars, a first step in challenging the dollar’s reserve currency status.

GDP: +2.9% – Don’t Be Fooled

To a great sigh of relief on Wall Street, and among the political class, GDP grew +2.9% in Q4. That brought back the hope of a “soft landing” for the economy, i.e., the avoidance of Recession. Unfortunately, like last month’s employment report, the headline number was about the only saving grace for the GDP report.

- Real final sales grew +1.4% in Q4, that down from +4.5% in Q3. We entered the new year with significant deceleration in the most important economic sector, consumption. If government spending is excluded, there was essentially no growth in the private sector.

- Given the upcoming political fight over the debt ceiling, it is likely that government spending, now accounting for 40% of final sales, will not be such a net positive for GDP in 2023. The deceleration on the consumer side is shown in the chart below (Redbook’s same store sales data).

Redbook Same Store Sales

- Q4’s New Housing Index fell at a -27% annual rate and has now fallen seven quarters in a row. This happened despite the misleading +2.3% rise in New Home Sales in December to 616K units (annual rate) from 602K in November. We say “misleading” due to the positive “growth” only occurred because, at the time of the report, it was revealed that November’s data had been revised down from 640K to 602K. The December 616K was really a fall of -3.8% from that 640K pre-revision number (lies, damn lies, statistics)! Even so, December’s 616K unit annual rate is down -27% Y/Y and is down -59% from the August 2020 peak of 1,036K units. You can see from the chart below the sharp declines from the 2020 and 2022 peaks. The recent slight uptick is undoubtedly due to the fall in interest rates, engineered by the bond-vigilantes, that we discussed in our last blog.

- In addition, speculative buying of new homes seems to be the only area of strength; it rose +47% in December after rising +18% in November and +31% in October. Thus, a goodly portion of these sales are either going to be immediately resold upon completion (putting yet more supply on the market) or will join the record number of multi-family units entering the rental market (and continuing to put downward pressure on rents as 2023 progresses).

US New Single Family Houses Sold

- All of this has led to a falloff in new home prices (median value); -3.7% M/M in December after a fall of -6.6% in November. We expect that such prices will continue to fall over the next several months, as they will, undoubtedly, also be falling in the Existing Home space.

- Speaking of Existing Homes, their sales were down -1.5% M/M in December, down now 11 months in a row and off -34% on a yearly basis. A comparison to the Great Recession shows that the worst Y/Y comp was -31% and the monthly losing streak ended in eight months. (We also note here that Wells Fargo

WFC

- Back to the GDP file, in Q4, both imports and exports fell indicating weakness both at home and abroad. Because imports fell faster than exports, this was an addition (+) to GDP despite the fact that they both bode ill going forward.

- Inventories also grew in Q4, again adding to GDP growth. Because that inventory growth was unwanted, new orders to start 2023 will be soft. We see that in all the Regional Fed Surveys. In the latest such survey from the Kansas City Fed, new orders came in at -8 in December (below zero is negative growth) vs. -15 for November. New orders have now been zero or negative for eight months in a row. We see similar behavior for backlogs and new export orders. On the positive side, expectations for prices paid and prices received are now at levels (i.e., lows) not seen for more than two years.

- One last comment on the GDP file, business investment was flat in Q4 indicating diminished business confidence as we entered the new year.

Our conclusion for the GDP report is the headline was nice, but the details imply that the handoff from Q4/22 to Q1/23 was soft. Real final sales were weak and are getting weaker; there was unwanted inventory buildup (big discounts ahead!), new business investment was nearly non-existent, and new housing activity was in the dumpster. Unfortunately, not very positive for 2023.

The Labor Market

Over the past few blogs, we have been tracking layoffs – Microsoft

MSFT

AMZN

It now appears that the layoff binge has morphed to other economic sectors. The table shows the latest announcements, and it feels like we are now getting major layoff announcements on a daily basis.

Company Layoffs

Even government data is showing a weaker jobs market despite the fact that weakness is not yet evident in the unemployment rate. The Department of Labor’s weekly data shows that in December +826K unemployment claimants had been out of work for three and a half to six months. That number was +526K last April. (Subtle, but Significant!)

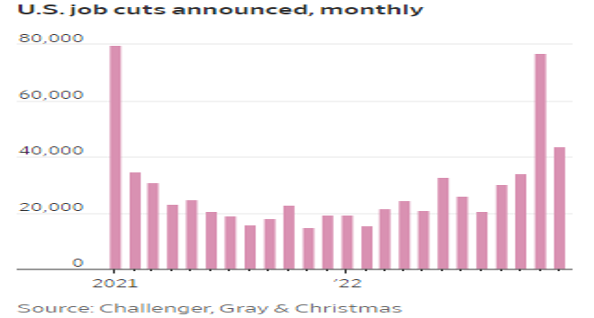

The chart at the top of this blog and on the left below shows a marked acceleration in layoffs since the summer. We expect this to continue as 2023 unfolds. The right-hand side of the chart below shows tech layoffs by industry. For those with an interest, visit the Layoffs.fyi website.

Tech Layoffs since covid-19

World Business

The world’s economies are also faltering.

- South Korea reported its first GDP contraction in Q4 (-0.4%) since the COVID lockdowns (Q2/2020). They had a -6% Y/Y plunge in exports while domestic consumption only grew +0.4%. In the first 20 days of January, the negative export trend continued (-2.7%).

- China’s real GDP also slowed to +3.0% in 2022, a recession like growth rate for that economy. We expect that the withdrawal of the COVID restrictions will spur growth there, at least in the short-term. But, because their population is now declining (the result of their one-child policy from the 1980s until 2015), we won’t see the same kind of growth in the future that they’ve had over the past 30 years.

- Japan’s core CPI (ex-food) rose +4.3% in January, faster than expectations (+4.2%) and higher than December’s +4.0%. This is the highest rate of inflation they’ve experienced in more than 40 years. Unlike central banks in the developed world, the central bank chief, Kuroda, has kept Japan’s interest rates at near zero levels. And Japan has paid for this with a large erosion in the value of their yen. Kuroda’s term ends in April, and it is likely that a new chief will have a different approach (higher rates) given both the record high inflation and the currency’s weakness.

The Reserve Currency Issue

Several blogs ago, we touched on the risk the Fed was taking with the dollar’s reserve currency status by raising rates so much faster than other major central banks. We stated then that a rogue Fed was a threat to the dollar’s reserve currency status. When the central bank that is the keeper of the reserve currency raises rates too far and too fast, the currencies of other countries suffer, i.e., they depreciate against the value of the reserve currency (in this case, the dollar). Therefore, when foreigners need to transact to buy a commodity, such as oil, that is traded in terms of the reserve currency, they must first translate their currency into dollars. It costs them a lot more when their currencies have depreciated against the dollar.

We are now seeing the first steps in that process (the threat to the dollar’s reserve status) come to fruition with the agreement between OPEC+ (mainly Saudi Arabia) and China to accept payment in RMB (renminbi – Chinese currency) or other currencies.

When someone buys oil, say a Japanese company buys from OPEC+, and is paying in dollars, they go to their bank, and exchange their yen for dollars. (They usually don’t have idle dollars floating around waiting to be used.) The bank, via its world connections, converts the yen to dollars. The demand curve for dollars has moved. If OPEC+ now accepts yen, there is no need for the dollars, and the dollar demand curve doesn’t move.

The dollar as the world’s reserve currency, adds value to U.S. businesses. Once someone pays Saudi Arabia in dollars, the Saudis must do something with those dollars. They can buy “stuff” from the U.S. or use the dollars to buy American stocks/bonds. If they have Chinese RMB in payment, they will use that money to buy Chinese “stuff” or Chinese investments. This is a big deal, as the result is less foreign demand for our goods or financial assets. (We note that foreign holdings of U.S. financial assets are quite substantial.) This isn’t going to be an overnight rapid change, but it sure does look like the first step toward a different international currency order.

Too bad the 400 economists on the Fed’s staff didn’t explain to the FOMC that there was this potential development. Not sure it would have made any difference as it does appear that the Fed has been politicized (i.e., must look like they are “fighting inflation” for political reasons when, in fact, they caused most of the inflation to begin with by monetizing the crazy money giveaways).

Final Thoughts

The Fed meets this coming week (Tuesday January 31st and Wednesday February 1st). Because of their hawkish rhetoric, they will certainly raise interest rates. Last week, their “Fed Whisperer” at the Wall Street Journal, Nick Timiraos, indicated that the Fed will be further “stepping down” rates, so we expect a 25-basis point (bps) rise on Wednesday to a range of 4.50%-4.75% for the Federal Funds Rate (the rate banks pay for reserves). Depending on incoming data, at their March meeting (March 21-22), they will either raise another 25 bps, or “pause.” While we think the economy’s deterioration will get worse and that inflation will continue to melt, this Fed seems to dream up excuses to raise.

This behavior makes us think that there might be a hidden agenda. Some commentators think the Fed is out to eliminate the market’s reliance on the “Fed Put,” i.e., the idea that the Fed will “pivot” if there is too much stress/pain in the financial markets, especially in the equity pits.

Our view is that the Fed has been politicized and is currently responding to the political issue of needing to fight inflation. Only when all the pundits and commentators see Recession, especially when weakness is observed in the unemployment rate, will the Fed respond by “pivoting” to lower interest rates. We expect this will occur sometime in this year’s second half.

As the Recession unfolds, corporate revenues and earnings will tumble. We just saw an unexpected example of that last week (week of January 23) when Intel

INTC

M2 % Change From a Year Ago

In closing, we note that the growth of the monetary aggregates are now in negative territory, with M2 (cash +demand deposits +time deposits +money market funds) at -1.9% Y/Y (see chart above). This is an historic record low for M2 growth. Monetarist economists know that this means Recession!

(Joshua Barone contributed to this blog)