The British pound sterling (GBP) has strengthened against the Canadian dollar (CAD) in the past month, as the CAD has followed the US dollar (USD) lower and crude oil prices have dropped to their lowest levels since the start of the year.

The GBP/CAD foreign exchange (forex) rate has gained more than 8% since early November, although it remains down by 2.9% since the start of the year.

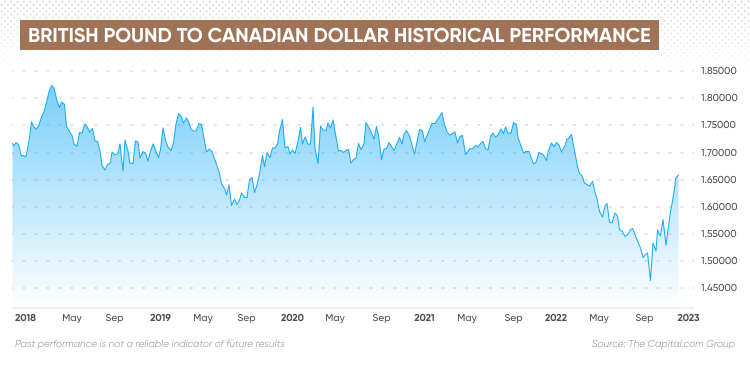

GBP/CAD live chart

What drives the GBP/CAD exchange rate and will the pound continue to strengthen or will upside be limited by a bearish UK economic outlook?

What drives GBP/CAD?

Currencies are traded in pairs in the forex markets, which represent their relative value. The GBP/CAD pair refers to how many Canadian dollars – the quote currency – are needed to buy one British pound – the base currency.

The British pound is the former global reserve currency and has remained one of the strongest in the world. Sentiment has been a major driver for the currency since 2016 given the uncertainty surrounding negotiations between the UK and the EU over the UK’s exit from the bloc.

More recently, political instability and the impact of the Russia-Ukraine war on inflation in the UK have weighed on the pound’s value.

Macroeconomic indicators, including gross domestic product (GDP), inflation, interest rates, services and manufacturing activity, and unemployment generally drive the currency markets. They affect a country’s attractiveness to investors and in turn demand for its currency.

The Canadian dollar is strongly influenced by the direction of the US dollar as well as commodity prices such as Brent crude oil. As a major producer of oil from tar sands and industrial metals, the CAD is considered to be a commodity currency along with the Australian (AUD) and New Zealand dollars (NZD). Higher commodity prices increase revenues from exports, supporting commodity currencies, while lower prices weigh on them.

According to analysis by Japan-based MUFG Research:

“The Canadian dollar is essentially like a low-beta US dollar – it was the best performing G10 currency amongst the other G10 currencies when the dollar advanced sharply through to toward the end of September and since that peak for the US dollar through to the end of November as the US dollar turned weaker, CAD is now the worst performing G10 currency.”

Analysts at Monex Europe attributed the Canadian dollar’s weakness to the USD pullback, noting:

What is your sentiment on GBP/CAD?

Vote to see Traders sentiment!

“Other factors leading to the Canadian dollar’s underperformance include falling commodity prices… The commodity price pullback is primarily linked to China’s lockdown measures and the impact a slowing Chinese economy is having on global commodity demand at a time when supply levels are starting to normalise, specifically in oil markets.”

GBP/CAD rebounds on stabilising UK, CAD weakness

GBP/CAD has been relatively stable in recent years around the 1.75 level, with the exception of a brief dip to 1.67 in March 2020 at the start of Covid-19 lockdowns. But the pair has not been immune to the heightened volatility in forex markets in 2022.

GBP/CAD has been relatively stable in recent years around the 1.75 level, with the exception of a brief dip to 1.67 in March 2020 at the start of Covid-19 lockdowns. But the pair has not been immune to the heightened volatility in forex markets in 2022.

The pair initially rose from 1.17178 to 1.7327 early this year, but entered a seven-month decline to 1.4761 on 23 September when the pound collapsed in response to former UK Prime Minister Liz Truss announcing a programme of tax cuts.

The pound subsequently rebounded as the government reversed the proposals and the Bank of England (BoE) intervened in the financial markets. A change in leadership, with Rishi Sunak replacing Liz Truss in October, contributed to continued volatility.

GBP/CAD moved up to 1.55 in early October, slipped to 1.5132 on 11 October and rebounded to 1.56 by the end of the month.

GBP made further gains in November, trading up to 1.6176 by the end of the month and reaching 1.66 on 7 December.

The Bank of Canada raised its policy interest rate by 50 basis points (bps) on 7 December to 4.25%, its sixth straight hike. Economists had expected a hike of 25 or 50 basis points.

Consumer price inflation in Canada came in at 6.9% in October, while UK inflation jumped to a 41-year high of 11.1% in October.

The BoE last raised its key bank rate by 75 bps to 3% on 3 November. Its next meeting is on 15 December, when economists expect a 50-bp hike.

“MPC’s [monetary policy committee] updated projections for activity and inflation describe a very challenging outlook for the UK economy,” the bank stated following the November meeting.

“GDP is projected to continue to fall throughout 2023 and 2024 H1, as high energy prices and materially tighter financial conditions weigh on spending. Four-quarter GDP growth picks up to around ¾% by the end of the projection… should the economy evolve broadly in line with the latest Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target, albeit to a peak lower than priced into financial markets.”

What do the pressures on the Canadian and UK economies mean for the GBP/CAD exchange rate as 2023 approaches? What is a realistic British pound to Canadian dollar forecast based on analysts’ predictions?

GBP/CAD forecast: Will sterling extend gains or fall to US-influenced CAD?

A GBP/CAD technical analysis by Canada’s Scotiabank on 7 December showed buy signals on the moving average convergence divergence (MACD), the nine and 21-day moving averages and the relative strength index (RSI). There was support at 1.65 and resistance at 1.6701.

Analysts at US-based State Street Global Advisors were cautious in their outlook for both the pound sterling and Canadian dollar, noting.

“Our models continue to point to GBP strength largely due to a short-term oversold condition, even after the October rally. However, it is difficult for the models to fully appreciate the rapidly changing policy outlook. The abrupt shift to austerity should prevent the panic selling in the GBP that we saw in late September. That said, it does point to a deeper, longer recession which, while it may be good to reign in the current account deficit, will be painful and raises the risk that the BoE will adopt a more cautious approach to monetary policy. These conditions are not positive for the GBP. Therefore, we are significantly more cautious on the currency compared to our model signal.”

On the CAD, the analysts added:

“Going forward, we see further downside for the CAD in response to soft, range-bound commodity prices and steadily deteriorating employment, home prices, and manufacturing PMI. The recent divergence between the expected monetary tightening path of the BOC and the Fed is also likely to be a drag on the currency. Extremely high home prices and elevated levels of consumer debt in Canada should make the economy and inflation sensitive to policy rate hikes compared to the US.”

MUFG’s analysts “expect CAD underperformance against other G10 FX to continue as the US dollar weakens later in 2023”.

The GBP/CAD forecast from data provider Trading Economics estimated that the pair could stabilise in December to end the year at 1.64508 and then slip lower to 1.61480 in one year, based on global macro model projections and analysts’ expectations.

But the GBP/CAD forecast for 2023 from Denmark’s Danske Bank suggests that the pound could weaken further against the Canadian dollar, to 1.55 in one month, 1.54 in three months, 1.52 in six months and 1.50 in a year.

The GBP/CAD forecast from Canada’s TD Bank also projected that the Canadian dollar will strengthen against the pound, with the pair trading down to 1.55 at the end of 2022 to 1.53 in the first quarter of 2023, 1.50 in the second and third quarters and 1.51 in the fourth quarter.

According to GBP analysis by Allied Irish Banks (AIB): “Further rate hikes should provide some support for sterling, but the BoE has given guidance that it is unlikely to raise rates to the extent expected by the markets. Meanwhile, a close eye should be kept on the current negotiations with the EU over the Northern Ireland Protocol as it may damage sterling if the talks break down. Overall, against the very weak UK macro backdrop, sterling seems likely to continue to be prone to bouts of volatility over the coming quarters.”

For the longer term, the GBP/CAD forecast for 2025 from algorithm-based forecaster Wallet Investor was bearish on the outlook for sterling at the time of writing (8 December), projecting that it could drop back to 1.525 by the end of the year after falling from 1.635 at the start of 2023 to 1.599 at the end of next year. The GBP/CAD prediction showed that the pair could drop to 1.469 by late 2027.

Given the volatility of forex markets, analysts and forecasters have yet to come up with a GBP/CAD forecast for 2030.

If you are looking for a GBP/CAD forecast for forex trading, it’s important to remember that currency markets are highly volatile, making it difficult for analysts and algorithm-based forecasters to come up with accurate long-term predictions.

We recommend that you always do your own research. Look at the latest market trends, news, technical and fundamental analysis, and expert opinion before making any investment decision. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

FAQs

Why has GBP/CAD been rising?

The GBP/CAD exchange rate has risen over the past month as the Canadian dollar has followed the US dollar and commodity prices lower. Meanwhile, the British pound sterling has moved up from its recent lows in response to political stabilisation.

Will GBP/CAD go up or down?

No-one can say for sure. The direction of the GBP/CAD pair could depend on monetary policy on interest rates and inflation in Canada and the UK, as well as whether either or both economies enter recession.

When is the best time to trade GBP/CAD?

The best time to trade on forex markets is around the release of major economic announcements, such as trade data, inflation and interest rates.

Is GBP/CAD a buy, sell or hold?

How you trade the GBP/CAD pair is a personal decision depending on your risk tolerance and investing strategy. You should do your own research to take an informed view of the market. Keep in mind that past performance is no guarantee of future returns. And never invest money you cannot afford to lose.

Rate this article

Comments

There are currently no responses for this story.

Be the first to respond.