Social media posts including a widely shared tweet from Robert F. Kennedy Jr. claim the US Federal Reserve is launching a central bank digital currency allowing it to monitor and restrict people’s financial transactions. This is false; an instant payment service called “FedNow” is unrelated to a separate digital dollar plan, which is being studied, the Fed and independent experts said.

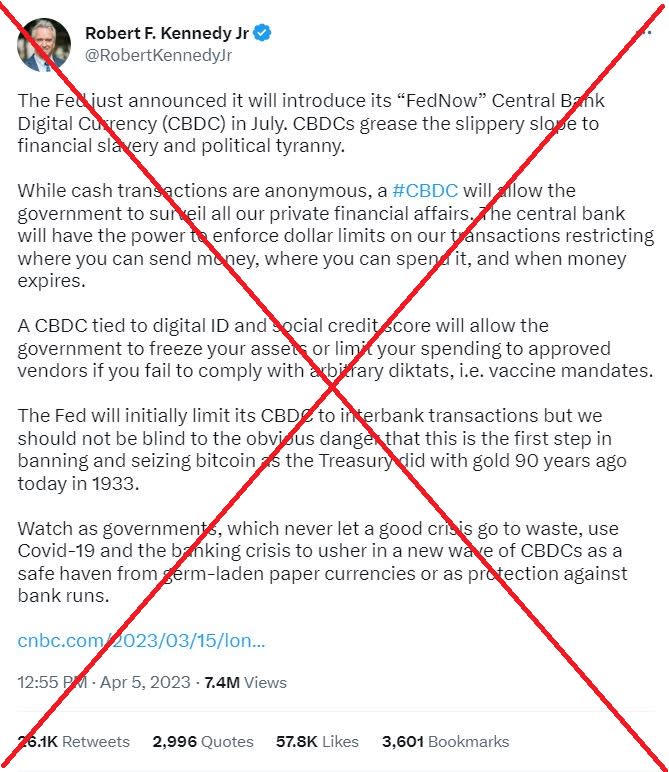

“The Fed just announced it will introduce its ‘FedNow’ Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny,” said an April 5, 2023 tweet from Kennedy, who is running for president in 2024, shared some 30,000 times.

This system “will allow the government to surveil all our private financial affairs. The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires,” added Kennedy, who also heads an anti-vaccine organization which has been fact-checked by AFP for misinformation.

The post was shared by others on Instagram and Facebook, and some users said this would lead to government control of personal spending.

“Better get your money out of banks. CBDC (central bank digital currency) has started. This will be in full effect in July. Meaning you will wake up one morning and all your US paper dollars will be converted into US digital dollars,” one Instagram user wrote.

The posts misrepresent the March 15 announcement of FedNow, which aims to speed bank-to-bank payments, but is unrelated to studies about implementing a digital currency.

“FedNow is not related to a digital currency,” the central bank said in a statement posted on its website April 7.

“FedNow is a payments service the Federal Reserve is making available for banks and credit unions to transfer funds. It is like other Federal Reserve payments services, such as Fedwire and FedACH. The FedNow Service is neither a form of currency nor a step toward eliminating any form of payment, including cash.”

Experts said FedNow is an upgrade to interbank payments technology, allowing the United States to catch up to the real-time payments used in many other countries.

At present, “it can take anywhere from two to six days for a check to clear in America using the backward Fed system which is built on technology from the 1960s,” said Aaron Klein, a senior fellow at the Brookings Institution, focused on financial technology and who previously was a US Treasury official and chief economist at the Senate Banking Committee.

Klein said the FedNow system will enable real-time payments but is unrelated to the CBDC being studied.

“One has nothing to do with the other,” Klein told AFP.

CDBC and surveillance

Claims that a Fed-sponsored CBDC — a system that would allow consumers to hold digital cash without using a bank — would lead to increased surveillance lack context, notably because no system has been authorized in the United States.

Critics of this system point to a Chinese plan and raise concerns a CBDC could be abused and lead to financial monitoring. The Federal Reserve says in a FAQ webpage that any digital currency would “strike an appropriate balance between safeguarding the privacy rights of consumers and affording the transparency necessary to deter criminal activity.”

The Fed webpage says the central bank “does not intend to proceed with issuance of a CBDC without clear support from the executive branch and from Congress, ideally in the form of a specific authorizing law.”

The key difference between a digital currency and other assets is that it would be a liability of the central bank and not a commercial entity, according to the Fed.

Josh Lipsky, senior director of the Atlantic Council’s GeoEconomics Center, which follows the progress of CBDC efforts, said the same financial privacy laws that currently apply to banks and credit card transactions — generally requiring a court order for release — would apply to a digital currency system.

“Protection from privacy would not be different under a CBDC,” Lipsky said.

“There is no difference in privacy or surveillance whether you are using your Visa card or a CBDC,” Klein said.

End of cash?

Claims that these new tools would lead to the end of cash are also misleading, according to experts and the central bank.

“The Federal Reserve is committed to ensuring the continued safety and availability of cash and is considering a CBDC as a means to expand safe payment options, not to reduce or replace them,” the central bank said on its webpage.

While research has shown declining use of cash in the United States, a CBDC does not necessarily eliminate hard currency.

“CBDC and elimination of cash are two separate questions,” Klein said. “You could eliminate cash if you wanted without a CDBC, and a CBDC is not necessary to eliminate cash.”

AFP has debunked other claims about digital currency plans here.