When the Nigeria-China currency swap deal was sealed in 2018, it promised to boost economic and trade activities between the two countries. That is by way of removing the hurdles business people encounter navigating from Naira to Dollar, then to Yuan and vice versa, before they could trade among themselves. PAUL OGBUOKIRI reports that five years down the line, the objective of the currency swap agreement has not been achieved, even as the Central Bank of Nigeria insists that the agreement is still active

The currency swap agreement

A currency swap is an agreement between two parties to exchange cash flows in different currencies at some predetermined rates for a specified period. To promote the international use of the Chinese Yuan (CNY), the PBoC signed bilateral currency swap deals with other central banks that share the same interest. Under the bilateral currency swap agreement, the Peoples Bank of China (PBoC) will receive about 16 billion Chinese Renminbi (RMB), while the Central Bank of Nigeria (CBN) will give about $2.5 billion.

Then CBN governor, Godwin Emefiele, said the funds would provide adequate local currency liquidity to Nigerian and Chinese industrialists to carry on their businesses. Also, the currency swap was expected to assist other local businesses by reducing the difficulties they encounter in the search for currencies in their business transactions.

Standard Chartered Bank is the settlement bank, Stanbic IBTC Bank, which has affiliation with Investment & Commercial Bank of China (ICBC), serves as the correspondent bank at the China end for the swap deal. According to the CBN governor, the deal would make Naira available to Chinese businesses. In return, supply of Chinese currency (RMB) would be guaranteed for their Nigerian counterparts, to boost speed, convenience and volume of transactions between the two countries.

Then CBN spokesperson, Isaac Okoroafor, said the swap arrangement would make it easier for most Nigerian manufacturers, especially small and medium enterprises (SMEs) and cottage industries in manufacturing and export businesses, to thrive. Okoroafor said the area the new arrangement would be most useful would be for importation of raw materials, spare parts and simple machinery for businesses.

“Those categories of businesses will take advantage of available RMB liquidity from Nigerian banks under the swap deal to pursue their businesses without being exposed to the hassles of seeking other scarce foreign currencies, which attract higher interest rate charges “Indeed, the deal will protect Nigerian business people from the harsh effects of third currency fluctuations,” he added. Okoroafor said the deal, which is purely an exchange of currencies, would also make it easier for Chinese manufacturers seeking raw materials from Nigeria to obtain Naira from banks in China to pay for imports from Nigeria.

Other African countries with bilateral currency swap deals with China include South Africa, with a $4.75 billion swap agreement signed in 2015, and Egypt, with a $2.62 billion swap agreement.

Currency swap will benefit Chinese contractors, traders in Nigeria

In recent times, scores of Chinese contracting firms and businesses have come to Nigeria to do business. They exist in different sectors of the economy. Some came to trade, engage in agriculture and other businesses. With the significant presence of Chinese firms in the Nigerian economy in recent times, most of the companies executing various multi-billion dollar infrastructure projects for Nigeria have had to struggle with serious funding constraints to complete them.

Deputy Chinese Ambassador to Nigeria, Lin Jing, said Nigeria is China’s biggest investment destination in Africa as well as the second largest export market and the third largest trading partner to China in Africa. Most of these contracts, including railways systems, roads, power, water, hospitals, petro-chemical plants, airport terminals as well as projects in the oil and gas sector are financed through various counterpart funding arrangements between the Nigerian and Chinese governments. Some of these contracts have been stalled or frustrated into abandonment by lack of funding.

Relying on local banks for loan support has proved largely unsustainable. Contractors are made to pay as high as 26 to 30 per cent in interest on loans. The high cost of government contracts is directly attributable to high cost of funding of such contracts. The swap deal is one of the strategies adopted by the Federal Government to overcome the stress and frustrations encountered by businesses in getting financing for contracts and trade deals through local commercial banks.

Under the swap arrangement, contractors or businesses with genuine contract award documents can approach any of the accredited banks to request for credit facilities to execute the contract under terms and conditions to be spelt out in the approved guidelines. Although details of the interest rate and other conditions required by prospective businesses to qualify for the credit facility are yet to be unveiled by the CBN, those familiar with the deal say at the expiration of the contract, the CBN would refund the RMB, while the PBC would refund the Naira at pre-determined exchange rates.

An analysis by a credit rating, finance and economics agency, Bode Agusto & Co., said the N900 billion to be received by PCB under the swap deal would increase its Naira assets base, while cutting its RMB savings by the equivalent amount. The Chinese government would then utilise the funds to give out loans to interested Chinese businesses in Nigeria at concessional interest rates (usually single digits) to enable them carry out their contractual and trade obligations.

This arrangement would not only boost the competitiveness of Chinese businesses in Nigeria, it would equally deepen their operations in the country. The arrangement would not only eliminate threats of abandoned projects due to funding challenges, it would boost the capacity to provide critical infrastructure that increase growth in key sectors of the economy, enhance productivity and accelerate job creation efforts. According to the analysis, on the settlement maturity date, the PBC would either repay the CBN from the profits generated by Chinese businesses in Nigeria to whom the funds were loaned, or trade RMB or dollars for Naira.

PBC could borrow Naira from the Nigerian financial market. This will continue to service a pool of funds available for other Chinese businesses in Nigeria to borrow from. The CBN governor said the swap deal was executed after almost two and a half years of rigorous negotiations with the PBC primarily to boost trade relations between Nigeria and China.

“There are some importers from, say, England, that would be given invoices in Pound Sterling if they want to import goods from England, or invoices in Euro against the Dollar if they want to import from Europe. “Under the China-Nigeria swap deal, Nigerians will begin to see Chinese suppliers, based on negotiations with Nigerian importers, issuing invoices in Renminbi (RMB) (Chinese currency) and executing contracts in the same currency.” With China controlling almost about 35 per cent market share, the CBN governor said the country is Nigeria’s largest trading partner at the moment.

By the time the operational framework for the current swap is published by the CBN, he said Nigerians would begin to see invoices in Chinese currency, rather than the traditional dollar. The direct impact would be that all those businesses involving the Chinese that Nigerians could not do because of lack of access to Chinese currency would become possible with the swap deal. One can then imagine the exponential impact on the economy.

“Overall, it is going to be positive for Nigerian imports and for Nigerian businesses. By the time the swap deal becomes operational, Nigeria will become the trading hub in the West African sub- region. It can never, never be negative to Nigeria,” the CBN governor said.

The $2.4bn swapped, inadequate

Taiwo Oyedele, head of tax and corporate advisory services at PwC Nigeria, said the bilateral currency swap policy was meant to bypass the use of a third currency, particularly the USD. “The implementation has so far been a challenge due essentially to the trade imbalance between Nigeria and China. While we import so much from China, we do not export nearly as much, which in fact, has been on the decline in addition to the relative instability in the value of the naira,” he said.

Muda Yusuf, chief executive officer of the Centre for the Promotion of Private Enterprise, pointed out that the agreed currency swap is only a portion (12 per cent) of the total trade volume between Nigeria and China. “The whole concept of currency swap agreement was that if you want to buy something from China, you can pay in local currency. First of all, the total amount is small when you compare it with the volume of trade between us (Nigeria) and China. “The total amount involved is equivalent to about $2.4 billion over three years. If you look at the volume of trade between Nigeria and China annually, I don’t think it is less than $20 billion.”

China dominates Nigeria’s imports despite flops in Naira-Yuan swap deal

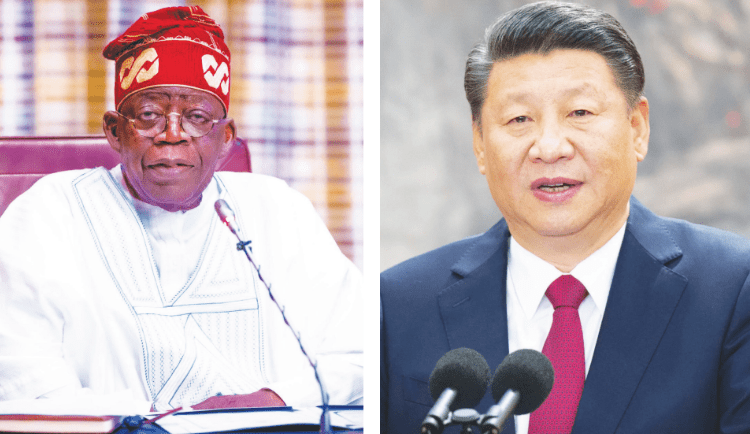

Despite the clog in the wheel of the Naira-Yuan swap deal, China continues to dominate Nigeria’s import trade transactions. The far East Asia country is one of the trading partners with Nigeria on import transactions. However, many stakeholders are concerned about promoting Nigeria-China currency for transactions. Professor Uwuigbe Uwalom- wa of the Economics Department, Covenant University, said President Bola Tinubu should take a second look at the agreement to find out why it is not living to expectation.

He, however, agreed with Dr. Muda Yusuf that the amount being swapped is a drop of water in the ocean of the economic transactions between Nigeria and China in a year. “Meanwhile, I understand that agreement is like a private sector thing, between the People’s Bank of China and the Central Bank of Nigeria. I think the governments of both countries should be involved because I think the agreement should be reviewed to accommodate all economic transactions between both countries,” Uwalomwa said.

Another economist, from the Babcock University, Onakoya Adegbemi Babatunde, said that the agreement needs to be reviewed urgently by the new administration of President Tinubu with the view to removing all hurdles on the way of the success of the scheme, saying the advantage of a successful currency swap between Nigeria and China will bring about a reduction in the pressure on the Naira be- cause China remains Nigeria’s number one trading partner.

“That means that most of our forex goes into funding trade with China. So, trading with China in our local currency and vice versa makes a lot of sense,” Babatunde said. He also said that the scheme cannot be successful if it remains at the current paltry sum of $2.5 billion as what is being swapped “when reports indicate that our trade transaction with China in a year is in excess of $20 billion.”