Global financial markets are experiencing subdued activity in Asian session today, with market participants scaling back their activity in light of Thanksgiving holiday. Major US stock indexes managed to close higher overnight, yet there’s a palpable reluctance among investors to propel these indexes to new highs for the year. In contrast, Asian markets are demonstrating mixed reactions, oscillating within tight ranges without clear directional trends.

The commodities market is seeing some interesting movements. Gold has retreated below 2000 psychological level, after failing to break through its October high. This pullback might reflect a combination of profit-taking and market reassessment of Gold’s near-term path. Oil prices are also experiencing limited movement, remaining in a narrow range. This stagnation follows news that OPEC+ is postponing its meeting, which has introduced uncertainty regarding future output cuts and consequently influenced oil prices.

In the currency markets, Dollar is showing slight signs of softening after yesterday’s recovery attempt. It’s now in a consolidation phase with downside potentially expected in the near term. Canadian Dollar and Sterling are also showing softness. Contrastingly, Australian and New Zealand Dollars, along with Yen, are emerging as stronger currencies for the day. Australian Dollar, in particular, is drawing strength from hawkish comments by RBA, despite disappointing PMI data indicating economic slowdown.

Euro is exhibiting mixed performance for the day and currently stands as the weakest for the week. As investors shift their focus to the upcoming PMI data from the Eurozone and the UK, there’s potential for market movement. Eurozone’s manufacturing sector has shown signs of stabilization in recent months, despite remaining in contraction territory. Services sector also seems to be avoiding further deterioration. Today’s PMI data could potentially bring positive surprises, providing Euro with a much-needed boost.

From technical analysis standpoint, EUR/GBP is holding above 0.8687 support despite this week’s deep retreat. Further rally is still in favor and break of 0.8764 resistance will resume whole rise from August low at 0.8491. However, break of 0.8687 and sustained trading below 55 D EMA (now at 0.8681) will argue that the rebound from 0.8491 has completed as a corrective move. That would turn near term outlook bearish for deeper fall.

In Asia, Japan is on holiday. Hong Kong HSI is down -0.24. China Shanghai SSE is up 0.32%. Singapore Strait Times is down -0.26%. Overnight, DOW rose 0.53%. S&P 500 rose 0.41%. NASDAQ rose 0.46%. 10-year yield fell -0.002 to 4.416.

ECB’s Nagel: Close to terminal rate, but nobody knows

Bundesbank President Joachim Nagel, in his remarks at a conference overnight, suggested an element of uncertainty regarding further ECB rate hikes, adding that will be “data driven.”

However, he expressed a belief that ECB is “close to that level we see as the terminal rate,” and added, “rates will stay where they are for a while.”

On a positive note, Nagel observed that inflation is on the decline, describing it as “a greedy beast” that ECB is actively working to tame. He expressed confidence in ECB’s strategy, projecting that it is on track to bring inflation closer to its 2% target over the next 12-15 months.

Despite this optimistic view on inflation, Nagel cautioned that there are still risk factors that could spur another round of inflation. He acknowledged the uncertainty in predicting future economic developments, concluding with “So nobody knows” what’s next.

BoC’s Macklem: Interest rates may now be restrictive enough

BoC Governor Tiff Macklem, at an event overnight, acknowledged monetary tightening is “working”. He suggested that the existing level of interest rates might be “restrictive enough” to achieve price stability.

Addressing the economic outlook, Macklem anticipates a period of softness in the near future. He noted, and highlighted the dissipation of excess demand that previously facilitated easier price increases in the economy.

Despite this outlook, Macklem reiterated BoC’s willingness to increase rates again if the situation warrants.

Macklem’s comments also came in the wake of the government’s Fall Economic Statement, which he believes aligns with the central bank’s objectives.

He remarked positively on the statement’s implications that the government is “not adding new or additional inflationary pressures,” Macklem said. Furthermore, he appreciated the introduction of new “fiscal guardrails”, considering them beneficial from a monetary policy perspective.

Australia PMI composite fell to 27-mth low at 46.4, but no real signs of hard landing

Australia’s manufacturing and services sectors showed continued contraction in November, reaching multi-month lows. PMI Manufacturing index fell from 48.2 to a 42-month low of 47.7, while PMI Services index dropped from 47.9 to a 26-month low of 46.3. PMI Composite also decreased from 47.6 to a 27-month low of 46.4.

Warren Hogan, Chief Economic Advisor at Judo Bank, interpreted these figures as evidence of a further slowdown in Australian economic activity. He commented that the data “all but confirms that the economy is experiencing a soft landing,” aligning with RBA’s expectations. However, Hogan also noted that there are “no real signs of a hard landing” in the survey, indicating a more controlled economic deceleration.

Despite the overall softness in manufacturing, Hogan observed that the sector “does not appear to be slipping into recession” at this stage. Additionally, an improvement in the employment index in the services sector was seen as indicative of “continued strong demand for labour.” This sustained high demand for labour, despite lower activity indexes, points to a persistent imbalance between labour demand and supply.

For RBA, the slowdown in business activity is a welcome development. Still, the strong employment index and an increase in price indexes signal ongoing inflation risks into 2024.

Hogan cautions that it is “still too early to think about rate cuts” in Australia.

Looking ahead

Eurozone and UK PMIs will be the main focuses in European session while ECB will also publish meeting accounts.

GBP/JPY Daily Outlook

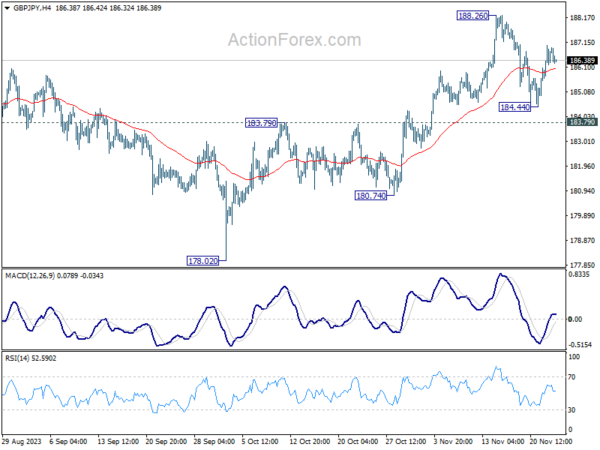

Daily Pivots: (S1) 185.98; (P) 186.51; (R1) 187.37; More…

Intraday bias in GBP/JPY remains mildly on the upside at this point. Rebound from 184.44 would extend to retest 188.26 high first. Decisive break there will resume larger up trend. On the downside though, below 184.44 support will resume the fall from 188.26 to 183.79 resistance turned support.

In the bigger picture, as long as 180.74 support holds, larger up trend from 123.94 (202 low) should still be in progress, next target is 195.86 (2015 high). However, firm break of 180.74 will now argue that a medium term top is formed, possibly in bearish divergence condition in D MACD, and bring deeper fall back to 178.02 support.

Economic Indicators Update

| GMT | Ccy | Events | Actual | Forecast | Previous | Revised |

|---|---|---|---|---|---|---|

| 22:00 | AUD | Manufacturing PMI Nov P | 47.7 | 48.2 | ||

| 22:00 | AUD | Services PMI Nov P | 46.3 | 47.9 | ||

| 08:15 | EUR | France Manufacturing PMI Nov P | 43.2 | 42.8 | ||

| 08:15 | EUR | France Services PMI Nov P | 45.7 | 45.2 | ||

| 08:30 | EUR | Germany Manufacturing PMI Nov P | 41.3 | 40.8 | ||

| 08:30 | EUR | Germany Services PMI Nov P | 48.5 | 48.2 | ||

| 09:00 | EUR | Eurozone Manufacturing PMI Nov P | 43.4 | 43.1 | ||

| 09:00 | EUR | Eurozone Services PMI Nov P | 48 | 47.8 | ||

| 09:30 | GBP | Manufacturing PMI Nov P | 45 | 44.8 | ||

| 09:30 | GBP | Services PMI Nov P | 49.5 | 49.5 | ||

| 12:30 | EUR | ECB Meeting Accounts |