European and Asian equities tumbled in morning trade on Friday as fears over the health of banks’ bond portfolios added to investors’ tensions ahead of the release of closely watched US economic data.

The region-wide Stoxx 600 fell 1.4 per cent, hit by declines in bank stocks such as Deutsche Bank and Société Générale, which fell 7.7 per cent and 4.6 per cent respectively. The Stoxx bank index lost 4 per cent, its worst one-day performance since last June.

The declines came ahead of the publication of the closely watched non-farm payrolls data, due out later on Friday. Stocks and bonds have already been jolted this week by comments from the Federal Reserve that it would be prepared to reaccelerate the pace of interest rate increases if the US economy and inflation do not cool.

Non-farm payrolls data is expected to show that 210,000 jobs were added to the US economy in February, and that unemployment will stay flat at 3.4 per cent.

Futures tracking the blue-chip S&P 500 were trading flat while contracts tracking the tech-heavy Nasdaq rose 0.2 per cent.

The sharp falls in Europe on Friday were sparked by a widespread sell-off overnight in US bank stocks, which analysts linked to financial problems at Silicon Valley Bank, a small US lender. The S&P 500’s financial sub-index lost 3.9 per cent on Thursday.

SVB’s losses shifted investor attention to the potential risks in the large portfolios of bonds held by banks, which invested deposits into long-dated securities such as Treasuries at the height of the pandemic. The prices of those assets tumbled in last year’s global bond market rout, meaning banks would realise large losses on their holdings if they are forced to sell.

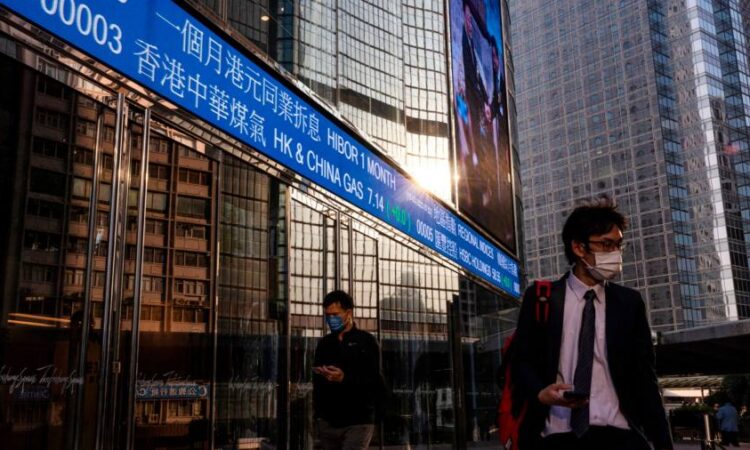

London’s bank-heavy FTSE 100 was down 2 per cent. In Asia, Hong Kong’s Hang Seng index was down 3 per cent, China’s CSI 300 shed 1.3 per cent, South Korea’s Kospi declined 1 per cent and Japan’s Topix lost 1.9 per cent.

“An earthquake in Silicon Valley led to aftershock on Wall Street and the tremors could still be felt in London on Friday morning,” said Russ Mould, investment director at AJ Bell, a UK investment platform.

“Lots of banks hold large portfolios of bonds and rising interest rates make these less valuable — the SVB situation is a reminder that many institutions are sitting on large unrealised losses on their fixed-income holdings.”

US Treasuries gained as traders piled into government debt. The yield on the 10-year note declined 0.08 percentage points to 3.83 per cent. The yield on the two-year benchmark, which is more sensitive to interest rates, fell 0.1 percentage points to 4.79 per cent. Yields fall when the price of debt rises.

Yields on European sovereign debt also fell, with 10-year German Bunds falling 0.11 percentage points to 2.5 per cent.

“[Silicon Valley Bank] is not the issue in and of itself, because it can be resolved with deposit insurance or a bailout, so it’s not insurmountable,” said John Roe, head of multi-asset funds at Legal & General Investment Management. “But it’s a reminder that if you change conditions very quickly you can create issues, and perhaps for the Federal Reserve to, if in doubt, be a bit slower [with rate rises].”

The yield on British gilts fell 0.07 percentage points after UK gross domestic product came in stronger than expected, with year-over-year growth flat, compared with expectations of a 0.2 per cent fall.

The dollar index, which measures the greenback against a basket of six peer currencies, fell 0.1 per cent. The euro rose 0.1 per cent and sterling climbed 0.2 per cent, both against the dollar.

Brent crude fell 0.9 per cent to $80.89 per barrel, while WTI, the US equivalent, fell 1.1 per cent to $74.91.

Additional reporting by Kana Inagaki in Tokyo, Kaye Wiggins in Hong Kong and Philip Stafford in London