Euro Analysis (EUR/USD, EUR/GBP)

EUR/USD Reverses Course but Immediate Support Provides the Next Test

The Euro has come under pressure and has depreciated against a number of major FX currencies. The European outlook is fraught with difficulties as the global growth slowdown has had a major impact across the bloc, including Germany, Europe’s largest economy.

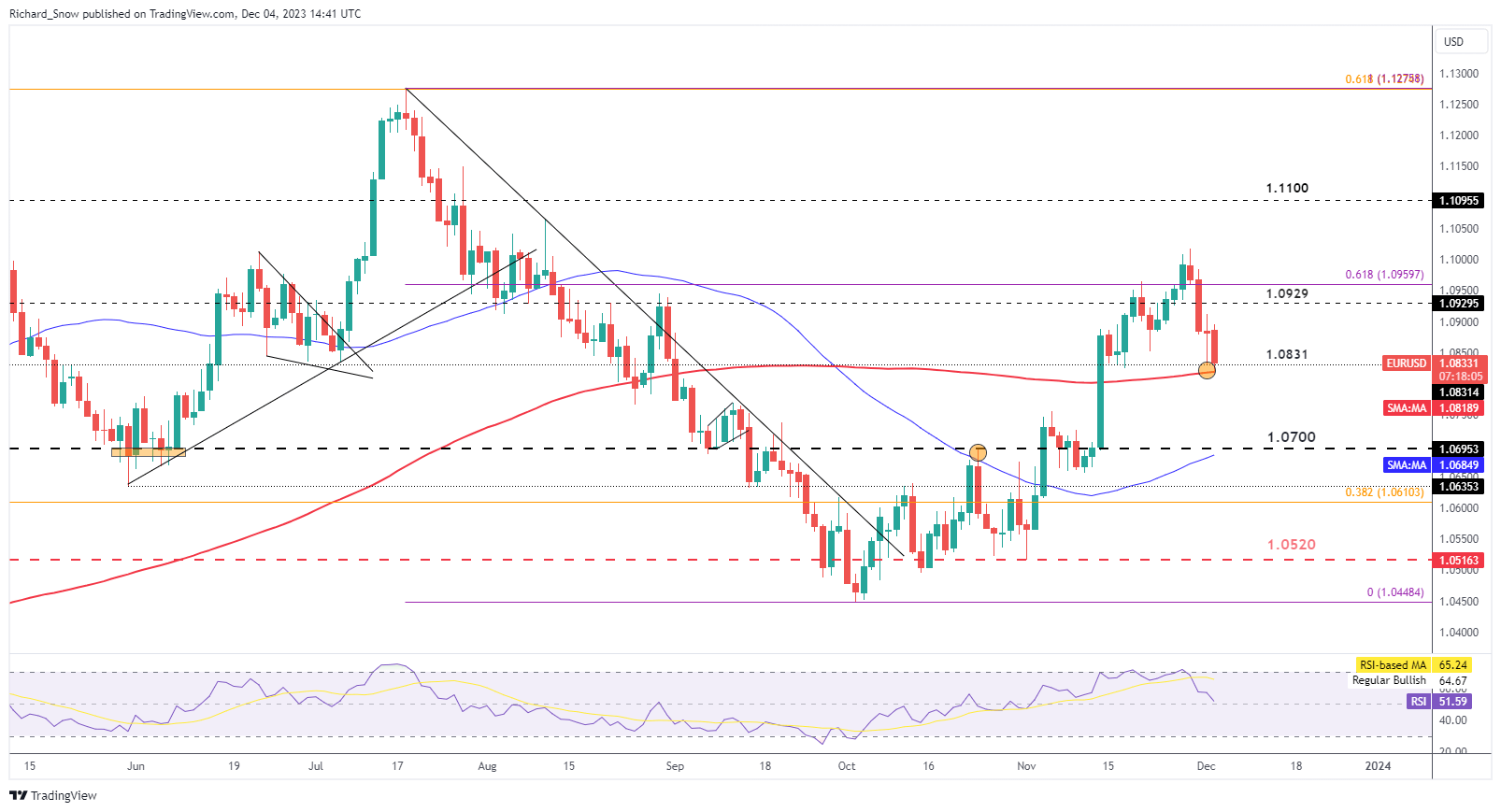

EUR/USD has traded lower since the swing high last week Wednesday and has approached a zone of support. The zone comprises of the 200-day simple moving average (SMA) and the 1.0831 level of support.

The pair may trade in a choppier fashion this week as US jobs data trickles in ahead of the major NFP print on Friday. The RSI suggests that further bearish momentum may have further to run as the current downward move is far from oversold territory. However, a close below the 200 SMA with considerable momentum is favourable from a bearish perspective given the potential for the 200 SMA to halt price declines.

EUR/USD Daily Chart

Source: TradingView, prepared by Richard Snow

Recommended by Richard Snow

How to Trade EUR/USD

EUR/GBP attempts to halt the sell-off after Friday’s massive drop

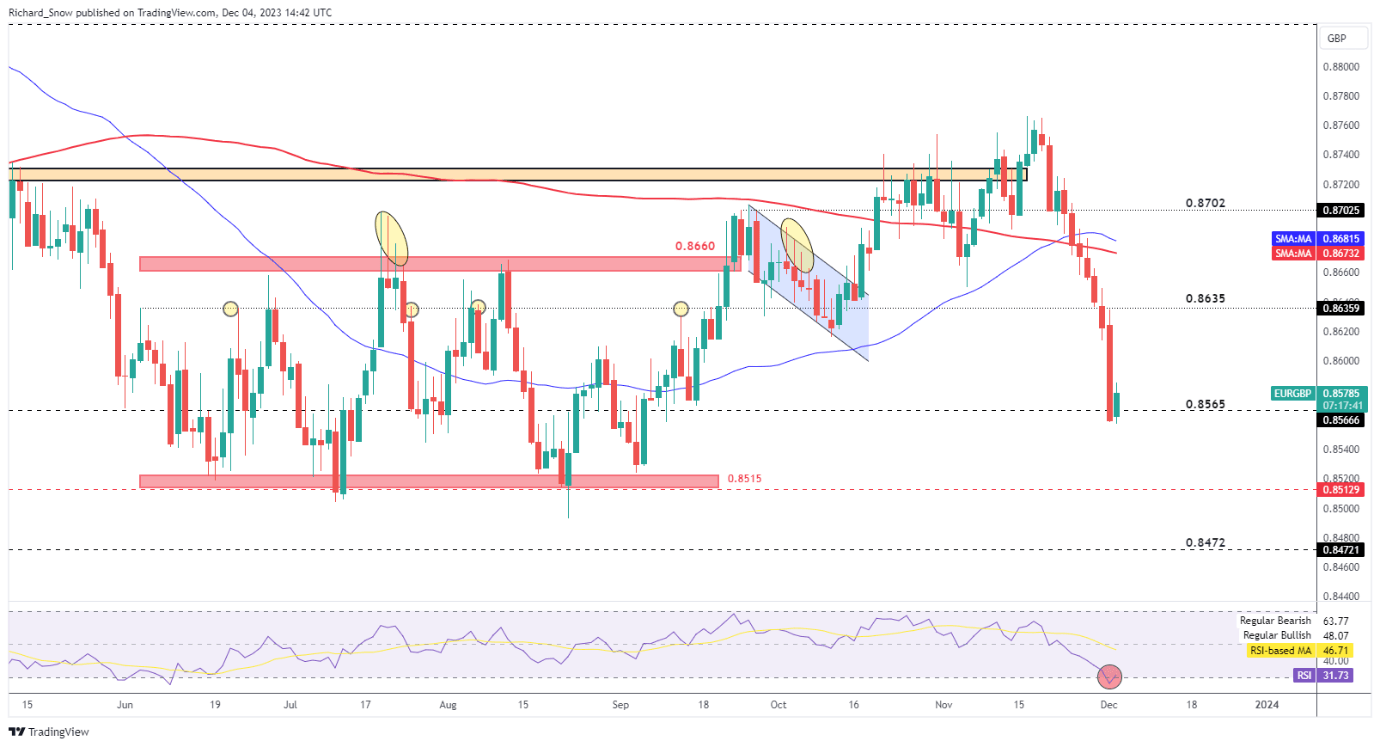

Friday saw a massive bearish continuation in EUR/GBP, marking a seventh straight day of declines but today’s price action attempts to break the streak. A pullback does appear to be due as the RSI attempts to recover from oversold territory. Support appears to be hanging on at 0.8565 but there is a lot of ground to recover from here.

Sterling has few, if any, bullish drivers but despite this, the pair remains vulnerable to the downside. Markets anticipate fewer rate cuts in the UK than they do for the ECB and the Fed, providing a slight edge for the pound. A bearish continuation could open up 0.8515 as the next major level of support. A pullback from here would do well to reach 0.8635 – the next level of resistance.

EUR/GBP Daily Chart

Source: TradingView, prepared by Richard Snow

Risk Events in the Week Ahead

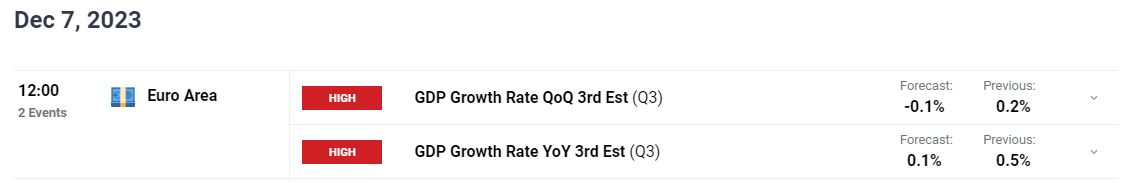

The extent of Europe’s economic challenges is likely to take another turn, potentially for the worse, when the third estimate of Q3 GDP comes due on Thursday. Growth has been anaemic throughout Europe and Germany (Europe’s largest economy) has felt the pressure too, registering stagnant growth and narrowly avoiding a technical recession.

GDP growth for Q3 is expected to register a 0.1% contraction compared to Q2 while the year-on-year data is expected to reveal a meagre 0.1% improvement when compared to Q3 of 2022.

In addition, US services PMI and incoming jobs data (JOLTs, ADP employment and initial jobless claims) are likely to provide markets with points to consider in a week devoid of Fed speak. The Fed has entered the mandatory blackout period ahead of the final FOMC meeting.

The main even for the week is undoubtedly the NFP report. October’s jobs data showed a notable drop in the number of positions added to the US economy but more significantly there was movement in the unemployment rate which eased from 3.8% to 3.9%. Easing in the job market is likely to extend the dollar sell-off as markets price in more interest rate cuts into 2024 in response to improved inflation data.

Customize and filter live economic data via our DailyFX economic calendar

Recommended by Richard Snow

Traits of Successful Traders

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX