The British pound and the euro showed significant movements compared to the USD throughout this year, but a run of good luck took a turn as the summer came to an end. Then, a moment of decline set in, and European currencies squandered their lead. There are well-known events, but what’s the story with the EURGBP pair during this time? Let’s try to find the answer and also explore potential trading opportunities.

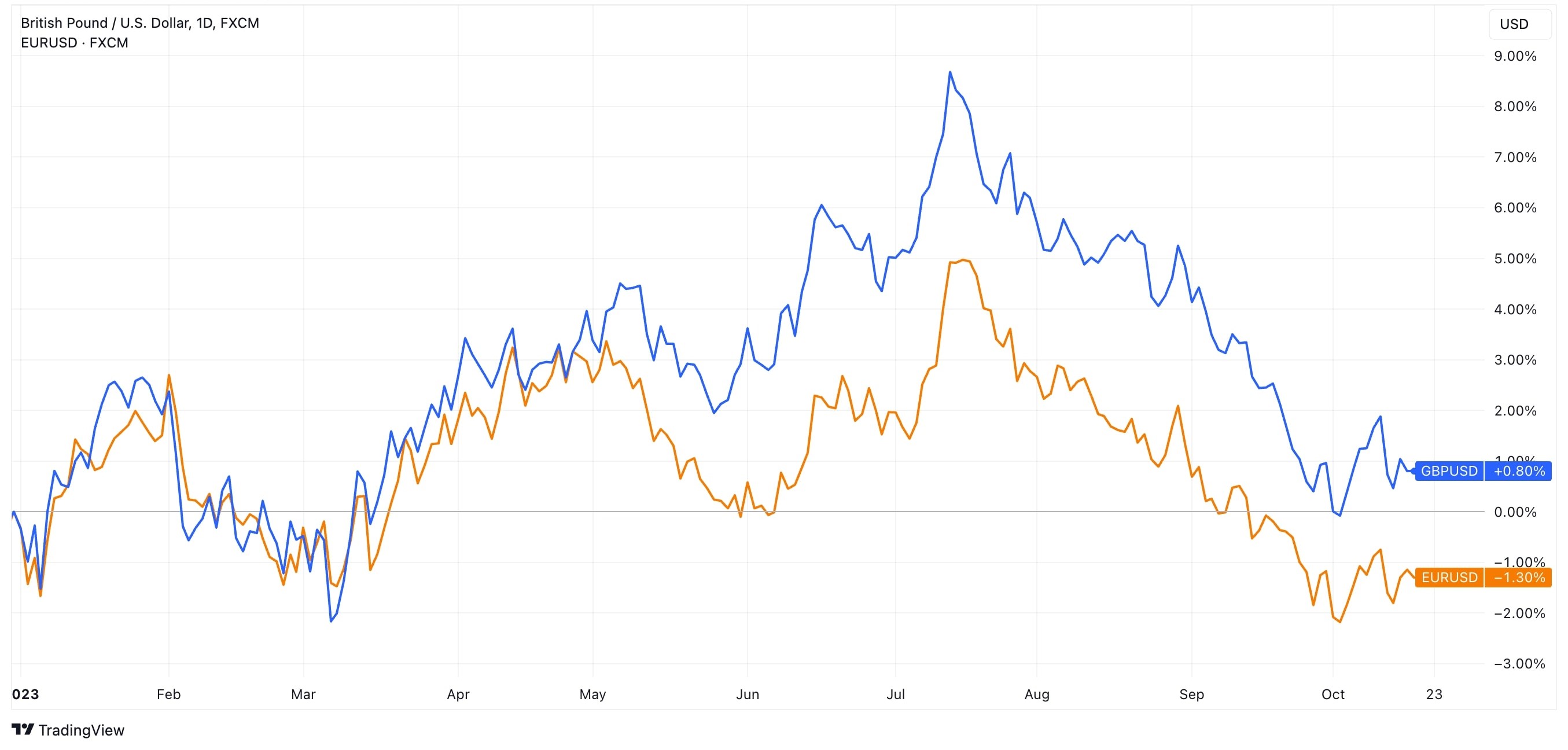

To begin with, let’s take a look at the GBPUSD and EURUSD pairs and their performance since the beginning of 2023. This chart illustrates the above mentioned shifts in the euro and pound value. Plus, it reveals how synchronously they have moved.

The lines above also shed light on the factors behind the disparities in the EUR and GBP exchange rates.

As you can see, the pound substantially outperformed the euro several months ago. And by the end of the summer, many experts expected that this trend would persist. But then, investors noticed signals from the Bank of England, indicating that significant interest rate hikes were unlikely, and the current cycle was approaching its end. As a result, the euro won back 1.5%.

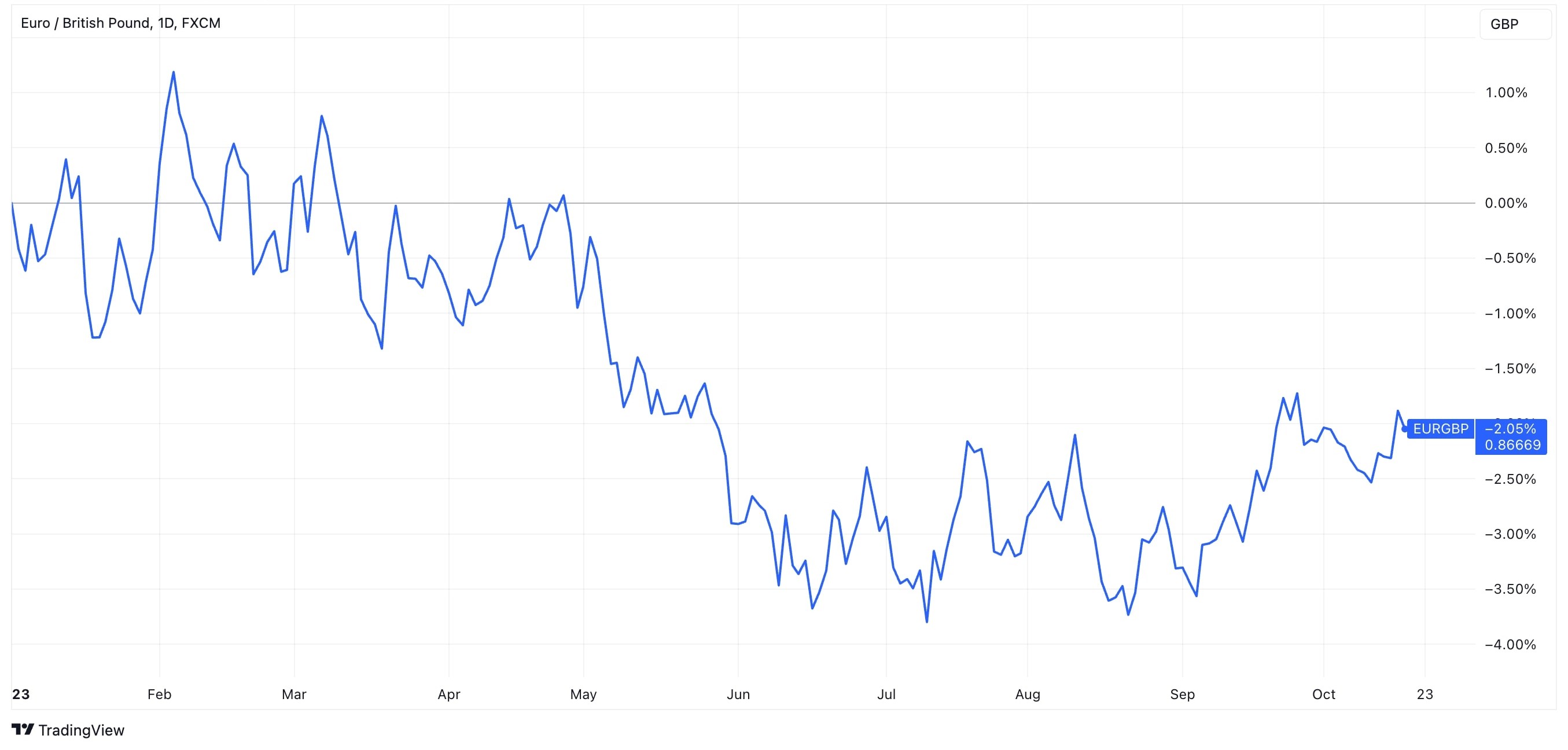

The unique aspect of the EURGBP pair is that both currencies and economies are grappling with similar challenges at the moment. Both central banks are hesitant to make significant changes to their key interest rates, both economies are in trouble, both regions might feel the influence of energy prices. In other words, experts believe that there is a limited possibility of significant movements within this pair in the coming year.

Perhaps we should turn our attention to USD-related pairs in this case – GBPUSD and EURUSD. The US dollar looks solid at the end of 2023. However, many specialists believe this trend will change in the upcoming year, when the Federal Reserve and the US economy face tougher conditions. The Fed is likely to adjust its policy before other central banks, and the economy could bear the brunt of an aggressive cycle of interest rate hikes.

It seems that 2024 may, in the end, favor European currencies over the US dollar. But, let’s not forget that we held similar expectations for 2023. Therefore, it’s essential to carefully monitor the markets, stay updated on the latest news and statistics, and conduct your own analysis before making any trading decisions.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.