(Bloomberg) — Emerging-market currencies dropped, reversing earlier gains, after US jobs data came out hotter than expected, showcasing a resilient labor market and triggering bets that the Federal Reserve may keep rates stable even beyond May.

Most Read from Bloomberg

The MSCI Emerging Markets currency index tumbled and the dollar touched a session high after nonfarm payrolls increased 353,000 last month, almost double the 185,000 estimate. Previous months were also revised higher. Latin American currencies all declined on the news, with the Chilean peso leading the way.

“Today’s jobs data provides a significant blow to the building confidence over US disinflation and a rapid easing cycle from the Fed,” said Simon Harvey, head of FX analysis at Monex Europe Ltd. “With the prospect of Fed easing in May no longer a sure thing, EM assets are likely to come under a wave of pressure.”

Mexico’s peso, which remains as the best performing Latin American currency, dropped 0.3%. The country’s tight link with US helps it benefit from strong growth in the world’s biggest economy. The Brazilian real fell 0.9% while the Chilean peso tumbled 1.3%.

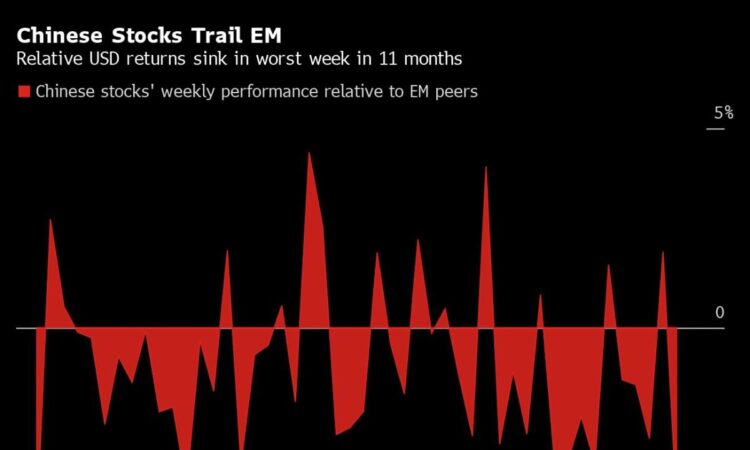

Equities across the developing world also pared gains, but remained higher in the session. Emerging markets left Chinese stocks behind this week, outperforming by the most in 11 months, as investors remain unconvinced that a $728 billion stimulus can solve the problems dogging the world’s second-biggest economy.

The benchmark index of developing nations excluding China is heading for a second weekly rally, driven by Korea’s so-called chaebols and Indian technology firms. Meanwhile, a key gauge of China’s mainland stocks, the CSI 300, posted the biggest weekly drop since October 2022, while the Shanghai Composite fell the most since 2018.

Read more: China Stocks Swing Wildly in Chaotic End to Worst Week in Years

Chinese stocks have extended their losses this year to more than $1.3 trillion as money managers pull funds from the country that’s seeing a growth slowdown, property crisis and geopolitical tensions with the West. That contrasts with other developing nations, where falling borrowing costs are sparking new growth and earnings cycles. Analysts have reduced their forecasts for profit at Chinese companies to the lowest since 2020, while lifting estimates for the rest of emerging markets by about 8% since July last year.

The country’s economic woes worsened this week with property giant China Evergrande Group beginning insolvency proceedings, while data showed a contraction in manufacturing and slippage in industrial profits. That offset brief optimism seen late last week about a series of measures the government and the People’s Bank of China took to support markets.

Indian stocks posted their biggest weekly advance since December after the government of Prime Minister Narendra Modi presented a budget focusing on infrastructure development and fiscal prudence. In Korea, foreign investors poured in $2.5 billion this week amid a government push to boost corporate governance. Money managers see both markets as more attractive than China, where regulatory risks remain high.

India Budget

“The India-over-China trade had another good week, with investors cheering a capex-heavy budget in India and bemoaning the lack of sufficient stimulus for real estate and consumers in China,” said Hasnain Malik, a Dubai-based strategist at Tellimer. “Tech is steaming ahead, driven by artificial intelligence and cloud computing, and the biggest Korean and Taiwan stocks are clear beneficiaries.

Meanwhile, Egypt’s sovereign dollar bonds posted some of the biggest gains among EM peers after International Monetary Fund Managing Director Kristalina Georgieva said the lender is close to agreeing on a new financial package for the North African country.

Nigeria’s naira was attracting greater investor interest after authorities let the currency slide enough to catch up with parallel-market rates. The measure, along with some rule easing, has created fresh hopes that the administration of President Bola Tinubu is reviving its reform agenda.

–With assistance from Giovanna Bellotti Azevedo.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.