A Political Crisis, An Energy Crisis and A Cost of living Crisis Defines Poor Year for the Pound

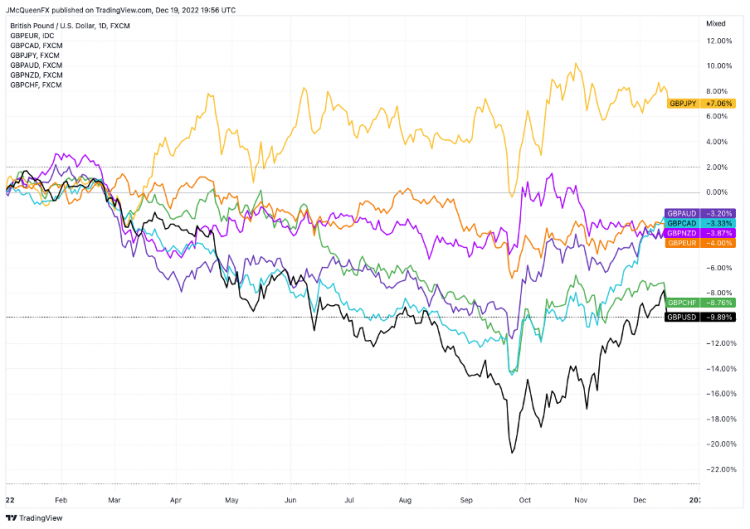

In a year that has seen three UK Prime Ministers, and four Chancellors, it is fair to say that 2022 has been a year to forget for the Pound. The currency has been among the worst-performing currencies in the G10 amid a war in Europe, an energy crisis, double-digit inflation and political instability. What’s more, the pound fell to a record low against the USD hitting 1.0350 after the fallout of Liz Truss’s mini-budget. However, as markets priced out the undoing of fiscal policies announced by Liz Truss, coupled with the sell-off in the greenback. The Pound has seen a late surge in Q4 and looks set to close the year down circa 10%.

What is your sentiment on GBP/USD?

Vote to see Traders sentiment!

British Pound’s Performance in Review

British Pound Yearly Performance – Photo: Capital.com. Source: Tradingview

British Pound Yearly Performance – Photo: Capital.com. Source: TradingviewGBP Vulnerable to Dovish Repricing as Bar is Set High for the BoE to Deliver

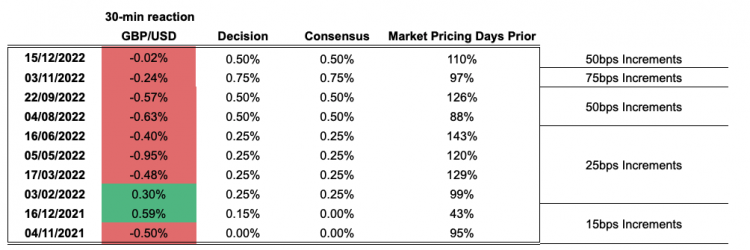

Since the Bank of England has embarked on their tightening cycle, Governor Bailey and Co. have been somewhat reluctant hikers. As such, relative to market pricing, the Old Lady has often underwhelmed expectations, which in turn has weighed on the Pound. Looking ahead to 2023, money markets remain far too aggressive, pricing in another 120bps of tightening to take the terminal rate above 4.5%. Consequently, risks remain tilted to the downside for the Pound with the bar set high for the BoE to surprise on the hawkish side and thus a dovish repricing could see expectations of the terminal rate being brought down to 4%. Keep in mind that at the December meeting, two officials voted to leave the bank rate unchanged. Therefore, this raises the probability that the BoE could be a first-in, first-out in this global hiking cycle, which given that markets are pricing in peak rates in the middle of 2023, provides another risk of hawkish disappointment.

GBP/USD Initial Reaction to BoE Rate Decisions

GBP Reaction to BoE Decisions – Photo: Capital.com. Source: Tradingview

GBP Reaction to BoE Decisions – Photo: Capital.com. Source: TradingviewIs the Negative News Priced In?

Among the G10 countries, the consensus among economists is that UK economic growth will likely underperform relative to its counterparts. The OBR has stated that the UK is in a recession, meanwhile, the BoE expects the UK to face its longest recession since the 1930s, albeit they were less pessimistic in their December meeting. Consequently, this raises the question of how much negative news has been priced into the Pound. This, of course, is difficult to answer, however, should economic data signal recession risks facing the UK economy are less severe this could underpin the currency with a return back to 1.25 for Cable.

Winter Season to Remain a Challenge

Much like the Euro, the Pound is also vulnerable to a cold snap during the winter months, which in turn would kickstart concerns surrounding gas storage levels in the region and thus add to the vulnerabilities of the UK housing market. Unlike the Euro Area, the UK housing market is much more fragile and will feel pressure from rising interest rates as well as the drop in real incomes. At the same time, the UK consumer is also at risk of a mortgage reset, which will likely be a narrative towards the backend of the year.

GBP Technical Analysis

GBP/USD: After staging a sizeable Q4 rally, the pair has failed at the first test of its 55DMA situated at 1.2430-40, protecting the psychological 1.25 handle. In turn, with topside momentum stalling, it will be key for bulls to hold onto its 200DMA (1.2088). Failure to hold leaves the pair at risk of a sub-1.20 print as well as opening the door towards 1.1760-70. Outside of UK-specific events, risk sentiment will also guide the currency and market participants raising concerns over earnings growth in the US heading into earnings season, there is a risk that the Pound will be off to a sluggish start against the safe-haven USD at the beginning of the year. On the flip side, bulls will be reinvigorated with a close above the 55WMA, which in turn places the late May/early June highs in focus at circa 1.2690.

GBP/USD Chart: Daily Time Frame

GBPUSD Chart – Photo: Capital.com. Source: Tradingview

GBPUSD Chart – Photo: Capital.com. Source: TradingviewEUR/GBP: While the BoE and ECB both hiked by the same increments at the final rate decision of the year. There was a stark contrast in messaging with the ECB turning up its hawkish rhetoric by a notch, while the BoE continued to offer a cautious update. As such, with rate differentials moving in favour of the Euro, this will likely keep EUR/GBP underpinned. At the same time, with the reopening of China’s economy favouring Euro-Area growth over the UK, risks are geared to the topside for EUR/GBP. From a technical point, the 200DMA remains critical support for bulls and thus the bias will be to fade dips as long as the 200DMA holds.

EUR/GBP Chart: Daily Time Frame

EURGBP Chart – Photo: Capital.com. Source: Tradingview

EURGBP Chart – Photo: Capital.com. Source: TradingviewRate this article

Comments

There are currently no responses for this story.

Be the first to respond.