Dollar ended as the weakest performer last week, with it poor performance aligning with broader rally in both stock and commodity markets, underpinned by growing investor sentiment favoring US economic soft-landing. Furthermore, minutes from FOMC meeting suggested a potential softening of Fed’s hawkish stance. As risk-on sentiment seems poised to continue in the near term, potentially until the next FOMC rate decision, Dollar may continue to face downward pressure.

Japanese Yen, ranking as the second weakest currency last week, saw a reversal of some of its recent gains. The lack of fresh stimuli in the market meant there wasn’t enough impetus for Yen buyers to drive further appreciation of the currency. Euro ended up as the third weakest, struggling in its crosses despite improvements in economic data.

Sterling emerged as one of the top performers of the week, ranking third. Its strength was driven by improved economic outlook and comments from officials at BoE. Australian Dollar stood out as the second strongest, supported by hawkish RBA minutes, as well as rallies in key commodities, particularly Iron Ore and Copper. New Zealand Dollar claimed the top spot as the strongest performer. Market participants are now eagerly awaiting RBNZ rate decision, scheduled for the coming Wednesday.

Dollar decline deepens as DOW notches four-week winning

Dollar notably ended as the weakest performer last week, continuing its near-term selloffs. This decline coincided with an extended rally in risk markets. DOW achieved a four-week winning streak, reflecting growing sentiment among investors betting on soft-landing scenario for the US economy, contrary to earlier fears of harsh economic downturn.

Meanwhile, minutes of November FOMC meeting was rather balanced, and possibly indicate a softening hawkish stance. A notable change is that the previous stance, which suggested that “one more increase in the target federal funds rate at a future meeting would likely be appropriate,” was conspicuously absent in the latest minutes.

The current bullish momentum in major stock indexes suggests that this positive trend has the potential to carry forward into early December. While this period features several important economic indicators including PCE inflation data and non-farm payroll figures, they’re not too likely to deter current risk-on sentiment.

The performance of these indexes through the end of the year, including whether they reach new all-time highs, will likely hinge on the Federal Reserve’s rate decision and new economic projections set for December 13. These announcements are pivotal, as they will provide crucial information about the timing and speed of policy loosening next year.

Technically, near term outlook in DOW will stay bullish as long as 34818.03 support holds. Current rise should extend through 35679.13 resistance. The real hurdle lies in resistance zone between top channel line (now at around 36077), and 36952.65 (2021 high).

Rejection by 36952.65 would suggest that the long term consolidation pattern from there is still in progress, and would extend with another medium term falling leg. However, sustained break of 36952.65 will confirm up trend resumption.

Dollar Index’s fall from 107.34 continued last but recovered after hitting 103.17. Further decline is expected as long as 104.55 resistance holds. Next target is 61.8% retracement of 99.57 to 107.34 at 102.53.

As noted before, it’s uncertain for now whether fall from 107.34 is a correction to rise from 99.57, the second leg of a range pattern above 99.57, or resuming the whole down trend from 114.77 (2022 high). Firm break of above mentioned 102.53 fibonacci level could tile the favor to the latter two bearish scenarios. On the other hand, strong bounce from 102.53 will favor the former case, which is still medium term bullish.

Sterling’s robust performance driven by economic optimism

Sterling stood out as one of the top performers, driven by improved economic outlook and significant comments from top officials at BoE. Sterling’s performance was particularly noteworthy against Dollar, where it reached a two-month high, and against Japanese Yen, where it resumed its long-term uptrend.

The release of the UK’s preliminary PMI figures for November played a significant role in bolstering Sterling. The data revealed an unexpected expansion in the vital services sector, a key driver of the UK economy. Although the manufacturing sector’s PMI remained below the 50 threshold, signaling contraction, the extent of contraction was smaller than expected, lending further support to the Pound.

The set of PMI data suggests that the overall pace of UK’s economic slowdown might be more moderate than initially feared. S&P Global emphasized this positive development, stating, “The UK economy found its feet again.” Nonetheless, the PMI data also pointed to resurgence in input cost pressures, which could signal ongoing inflation challenges.

BoE Governor Andrew Bailey, speaking at a Treasury Committee hearing, warned cautioned that the markets might be “underestimating” the persistent nature of inflation and stressed that it was “far too early to be thinking about rate cuts.” This perspective indicates a continued commitment to a tighter monetary policy.

Bailey’s sentiment was echoed by some economists, with Citigroup revising its expectations for the BoE’s first rate cut to August next year, later than its earlier prediction of May. This delay in anticipated rate cuts reflects an expectation of prolonged inflationary pressures and a sustained tight monetary policy in the UK.

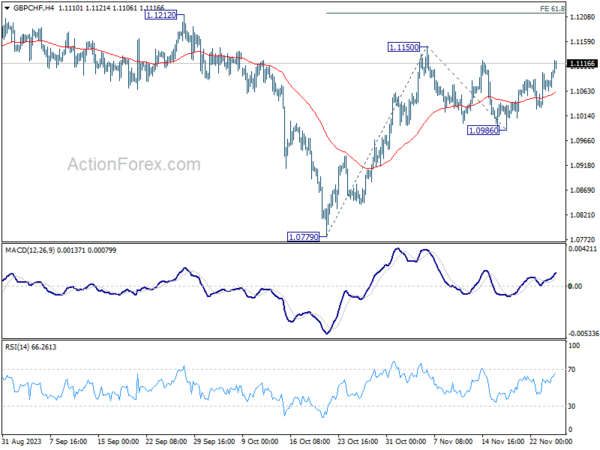

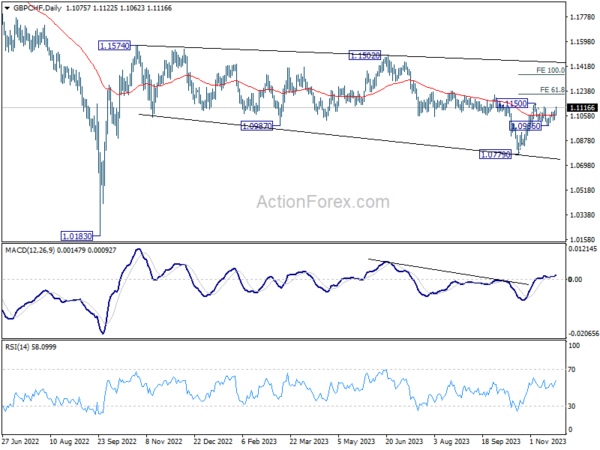

GBP/CHF is a pair to watch in the coming days to verify underlying momentum of the Pound. Near term pullback from 1.1150 is possibly completed at 1.0986 already. Break of 1.1150 will resume the rise from 1.0779 to 61.8% projection of 1.0779 to 1.1150 from 1.0986 at 1.1215.

Decisive break of 1.1215 will also bolster the case that whole medium term consolidation from 1.1574 (2022 high) has completed with three waves down to 1.0779. Next near term target will be 100% projection at 1.1357.

Australian Dollar’s surge fueled by hawkish RBA and rising commodity prices

Australian Dollar was also among the top performers of the week, buoyed by a combination of hawkish monetary policy signals from RBA and the surge in commodity prices, particularly in base metals.

RBA’s November 7 meeting minutes revealed a clear commitment to tackling inflation, reiterating the low tolerance for unexpected inflationary pressures. This firm stance was further emphasized by RBA Governor Michele Bullock, who indicated in a separate speech that the nature of inflation in Australia is increasingly becoming “homegrown and demand driven”, necessitating a stronger policy response.

Additionally, Aussie found support from the rally in base metal prices. Notably, the benchmark Iron Ore price on Singapore Exchange recorded its fifth consecutive week of gains. This rally was primarily driven by China’s recent measures to revitalize its debt-ridden property sector, a significant consumer of steel. There are reports that China may allow banks to offer unsecured short-term loans to qualified property developers for the first time, signaling a potential shift in policy to support the ailing sector.

Speculation surrounding Chinese government’s plans to stimulate economic growth and bolster the property market suggests a larger and more immediate intervention than previously expected. Such measures are likely to increase demand for Australian exports, particularly metals and minerals like iron ore and copper. This expected rise in demand typically leads to higher commodity prices, which in turn supports Australian Dollar, given the country’s status as a major commodity exporter.

As with Iron Ore, the strong break of 132.53 resistance should confirm resumption of whole up trend from 77.78 (2022 low). Next medium term target is 100% projection of 77.78 to 132.53 from 99.69 at 154.44.

Copper is now pressing 55 W EMA (now at 3.7966) after last week’s rise. Sustained break there will strengthen the case that correction from 4.3556 has completed at 3.5021. Further rally would then be seen to 4.0145 resistance first. Firm break there will argue that whole rise from 3.1314 (2022 low), is ready to resume through 4.3556 in the medium term.

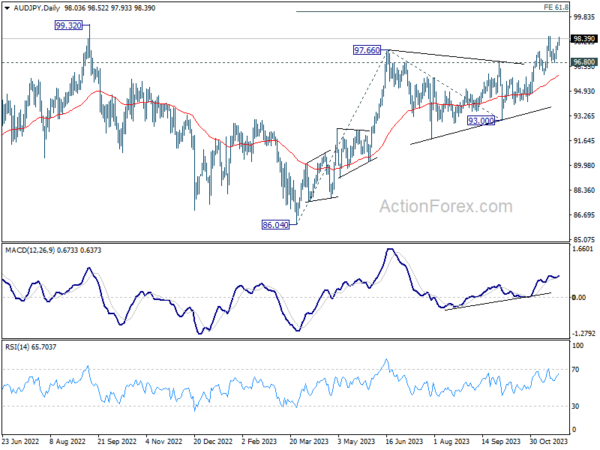

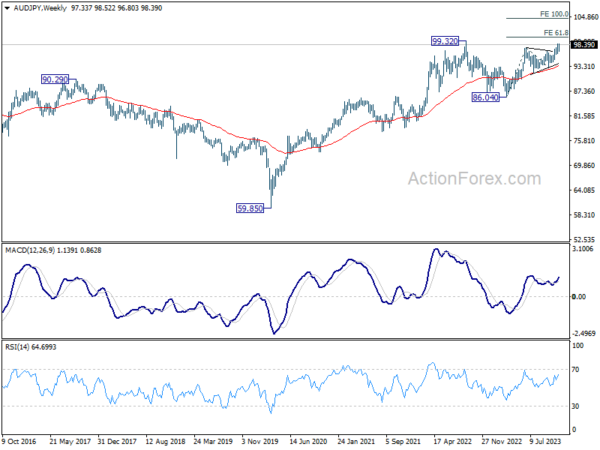

Late rally in AUD/JPY suggests that rise from 86.04 is ready to resume and extend. Near term outlook will now stay bullish as long as 96.80 support holds. Next target is 61.8% projection of 86.04 to 97.66 from 93.00 at 100.18. If realized, that would also have 99.32 resistance taken out too, indicating resumption of whole up trend from 59.85 (2020 low).

GBP/USD Weekly Outlook

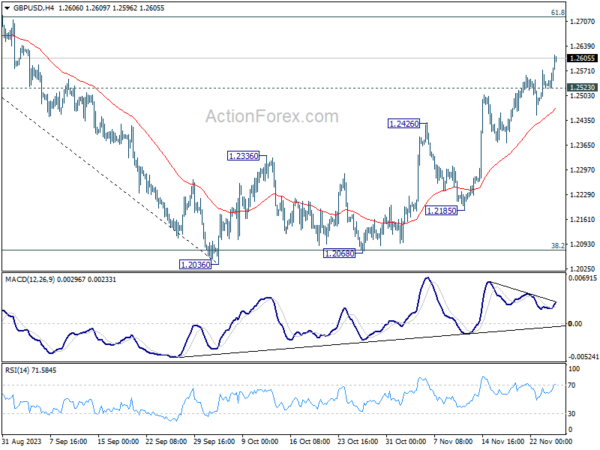

GBP/USD’s rise from 1.2036 continued last week and hit as high as 1.2613. Initial bias stays on the upside this week for 61.8% retracement of 1.3141 to 1.2036 at 1.2716 next. On the downside, below 1.2523 minor support will turn intraday bias neutral and bring consolidations first, before staging another rally.

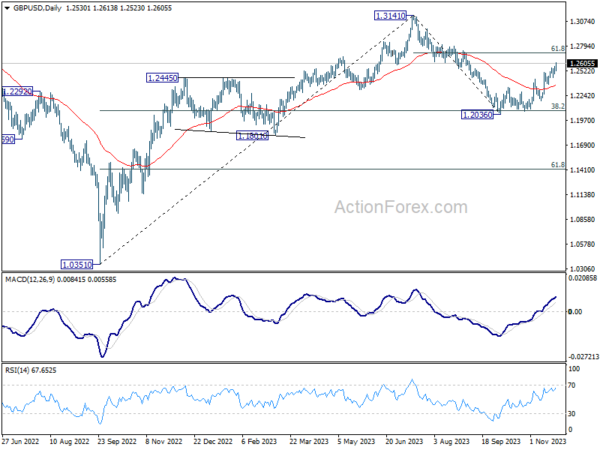

In the bigger picture, price actions from 1.3141 are seen as a corrective pattern to rise from 1.0351 (2022 low). Strong rebound from 38.2% retracement of 1.0351 (2022 low) to 1.3141 at 1.2075 suggests that current rise from 1.2036 is already the second leg. However, while further rally could be seen, upside should be limited by 1.3141 to bring the third leg of the pattern.

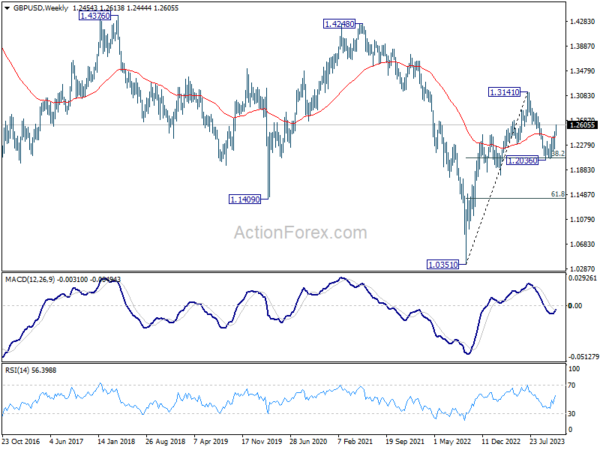

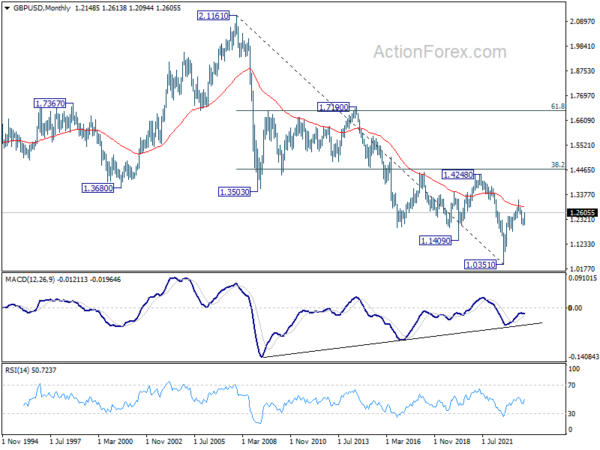

In the long term picture, a long term bottom should be in place at 1.0351 on bullish convergence condition in M MACD. But momentum of the rebound from 1.3051 argues GBP/USD is merely in consolidation, rather than trend reversal. Range trading is likely between 1.0351/4248 for some more time.