Written by Convera’s Market Insights team

Sterling steady after Labour landslide

George Vessey – Lead FX Strategist

As expected, the UK election has ended up a non-event for markets. The UK’s Labour party won the general election and is on course for a huge parliamentary majority, but UK bonds and the British pound are unfazed given that opinion polls have barely budged since the election was called six weeks ago. What next? Investors will switch focus back to the interest rate story, which will ultimately determine the direction of the pound in the coming weeks and months.

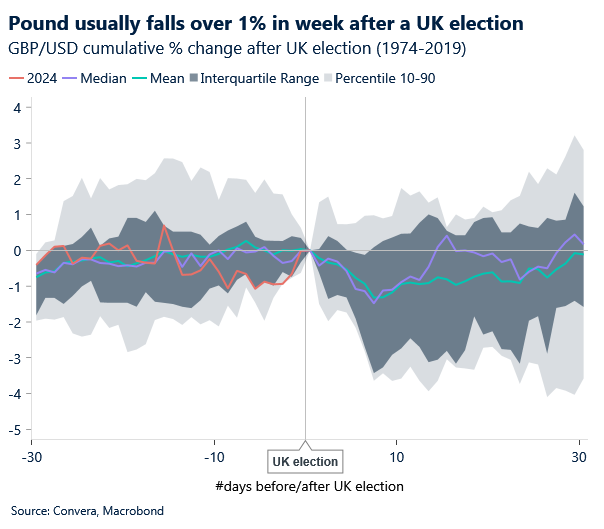

For the next five years, Labour will govern with its biggest majority (170) since 1997 according to the 10pm exit poll. Votes are still being counted, but Keir Starmer’s party passed the magic number of 326 seats for a House of Commons majority just before 5am this morning and are predicted to win 410 seats versus the Conservatives’ 131. The Liberal Democrats are expected to take 61 seats and Reform UK 13, suggesting the party squeezed the Conservative vote across the country. This might pose a challenge for Labour, which will have to devise a strategy to fight the rise of the hard right, a trend mirrored across Europe. But Labour has voiced its intention to strengthen trade relations between the UK and EU and this should lead to a (partial) unwinding of the pound’s Brexit premium. However, any enthusiasm for the currency will be measured given the new ruling party has dismissed re-joining the single market or customs union. Indeed, we wouldn’t be surprised to see sterling slide modestly over the next week given GBP/USD has fallen, on average, around 1% after a general election, although today’s US jobs report might upend this historical trend if it comes in soft.

Some investors are betting UK assets, including GBP, will provide a refuge in the coming months from political chaos elsewhere, like in France and the US. But the focus also remains on the macroeconomic data and the monetary policy outlook, and we lean towards more BoE easing compared to market expectations (45bps) this year, starting with a cut in August. This could keep GBP/USD pinned below $1.30 for some time still, whilst GBP/EUR should remain relatively steady, barring any French election turbulence this weekend.

Dichotomies in markets

Boris Kovacevic – Global Macro Strategist

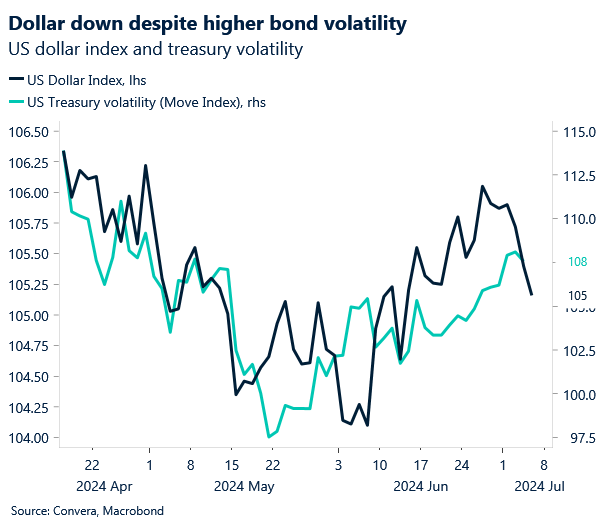

Two opposing forces (fiscal- and monetary policy) are affecting fixed income and FX markets currently, and are contributing to some volatile directional trading as of late. 1. All US presidential candidates seem to be fiscally positive, and the budget deficit is not expected to significantly shrink any time soon. Government bond yields on the long end are therefore stuck between fiscal expansion (higher yields) and monetary contraction (lower yields) over the next quarters. 2. A similar dichotomy is dominating the outlook for the US dollar. Politics continues to put upward pressure on the currency while the expected easing cycle by the Federal Reserve (Fed) might do the opposite.

The macro outlook has affected the US dollar negatively this week as well. Business conditions are worsening, the labour market is coming back into balance and disinflation is back on track. The most important data point this week so far was the ISM PMI, which showed the services sector contracting in the month of June with the index falling to a four-year low of 48.8. Seven out of the eight components declined in addition to the production sub-index recording its third largest fall on record, falling by 11 points to 49.6. This is the first negative reading since the pandemic and is usually not seen outside recessions.

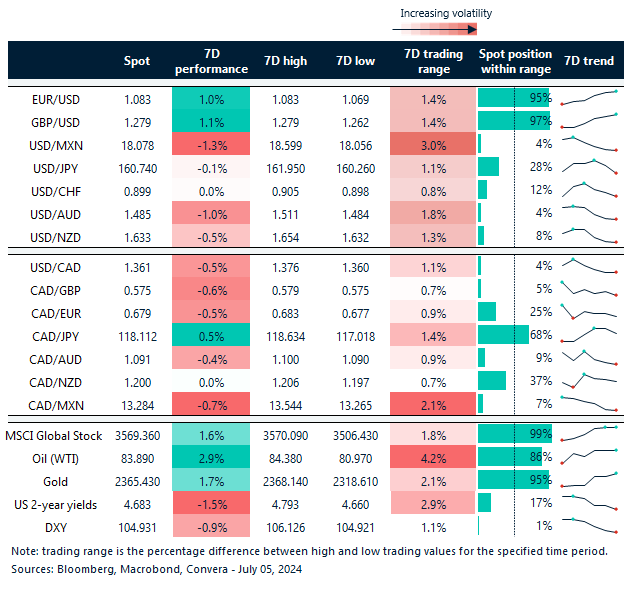

All of this has contributed to the US currency falling for a sixth consecutive session and against most currencies this week. Market attention is now turning to the US jobs report, which should show some easing of hiring. Most of the recent easing of the tight labour market has come via falling job openings. Any further improvement would need to come from weaker hiring, which is already starting to play out looking at leading survey data like the PMIs.

Euro drifts higher before US jobs report

Ruta Prieskienyte – Lead FX Strategist

The euro continued to benefit from the risk-on market sentiment and thin trading due to the US Independence Day holiday. EUR/USD drifted higher towards the recent 3-week high of $1.0815 observed the day prior but was unable to breach above this level given a lack of impetus.

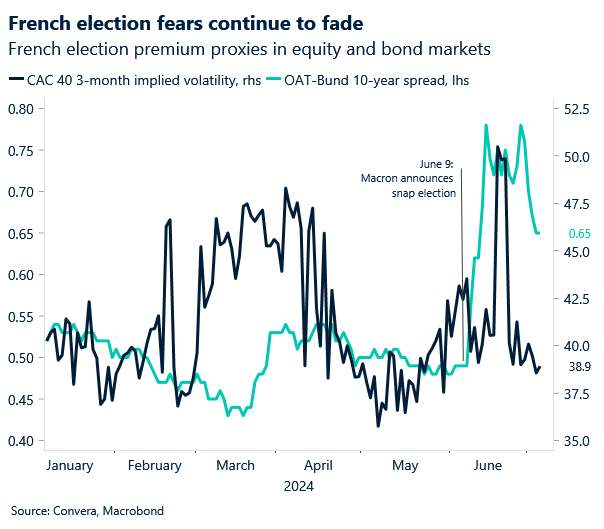

The key focus going into the final stretch of the week remains on the culmination of the French parliamentary elections, with the second round of voting scheduled for this Sunday. The latest polls project that Marine Le Pen’s National Rally is set to fall well short of an absolute majority. In fact, earlier this week Macron’s centrist alliance and the New Popular Front strategically pulled more than 200 candidates from runoff ballots to avoid splitting opposition to the far right in an attempt at building a so-called Republican front. With the tactic seemingly working, the chances of a hung parliament are rising, which appears a more desirable outcome for markets as it limits the chances of aggressive spending manoeuvres. The French Treasury also held its last bond auction ahead of the weekend, which saw modest demand indicating that investor angst continues to soothe. The OAT-Bund 10-year yield spread remained steady at 68bps.

In FX, one-month EUR/USD risk reversals traded at 0.51 in favour of the euro puts, versus 1.52 observed on June 17. The sharp pullback of euro bearish sentiment has largely been a function of an increase in the dovish money market wagers on the Fed as well as subsiding concerns over French politics. Meanwhile, EUR/CHF briefly rallied above 0.975, a one-month high, on reports that the Swiss June inflation fell by more than expected (1.3% y/y vs market consensus of 1.4%). On the back of the report, money markets increased their bets of a back-to-back cut in September by the SNB to 64%, up from 59% the day prior. Despite that, the euro was unable to maintain the initial gains as the uncertainty of the outcome of the second round of the French elections remains evident across other euro crosses.

DXY dips below 105

Table: 7-day currency trends and trading ranges

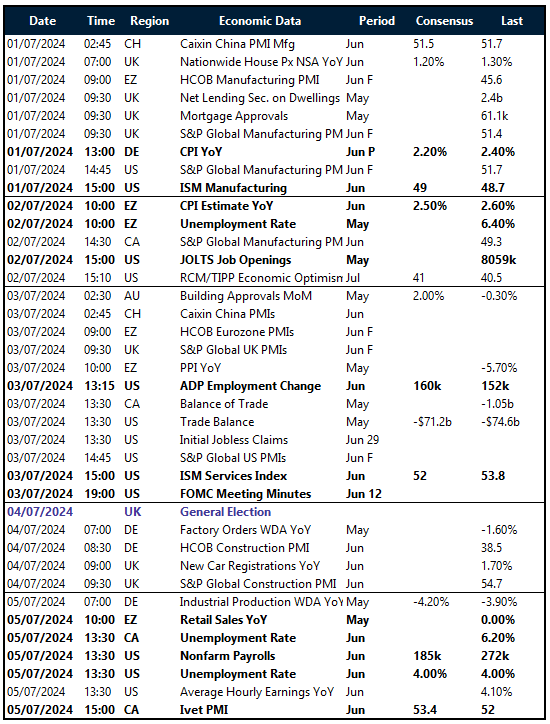

Key global risk events

Calendar: July 01-05

All times are in BST

Have a question? AskMarketInsights@Convera.com

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.