Written by Convera’s Market Insights team

Biden out, Kamala in?

Boris Kovacevic – Global Macro Strategist

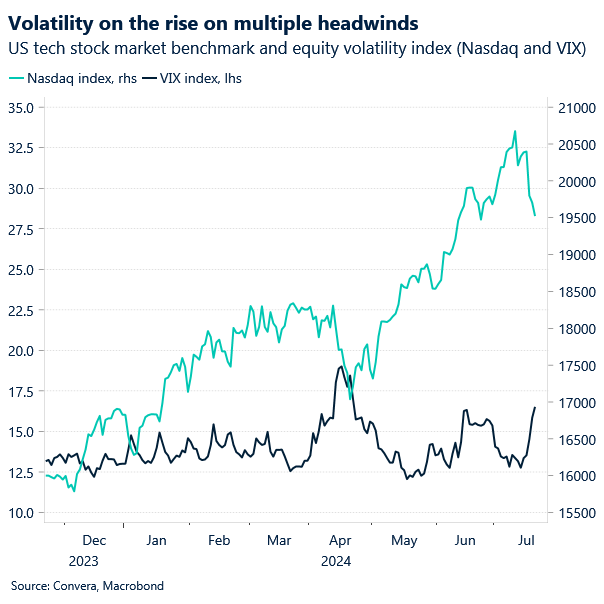

The weekends have been particularly market moving so far in July. The two rounds of voting in the French parliamentary election, a failed assassination attempt on former US president Donald Trump and yesterday’s announcement of current president Joe Biden dropping out of the presidential race have all taken place on Saturday or Sunday. This has made for a volatile market open on all four Mondays this month. Traders also took on a more cautious approach last week as the global IT outage caused by an update from CrowdStrike (Microsoft Windows) disrupted several industries. To complicate matters further, investors digested the prospect of additional trade restrictions on China proposed by the Biden Administration.

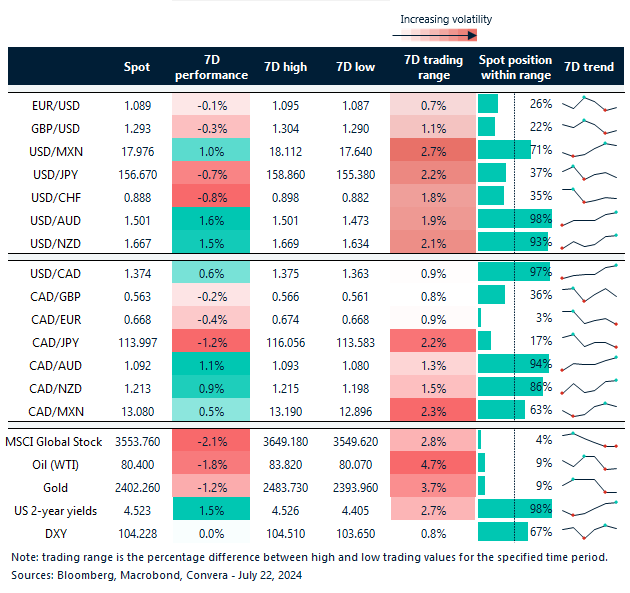

The US tech benchmark Nasdaq recorded its second worst week of the year, falling by more than 4%. The European Stoxx 600 fell on all trading days last week and shed 2.5% of its value, the most in 2024. The US dollar naturally outperformed in such an uncertain environment and pushed marginally higher after two consecutive weeks of losses. The dollar’s rebound is still a bit surprising given recent data, particularly signs of a softening labour market, has boosted the odds of Fed easing. US yields were largely flat on the week though, hovering near 4-month lows still. But equities are down and safe haven currencies, like USD, were up, in a sign of investor angst about geopolitical and trade tensions. This is a growing concern, as FX traders are bracing for what could be a volatile period even after the US election – with the gap between 9- and 6-month implied volatility for EUR/USD moving above average levels across much of the past 5 years.

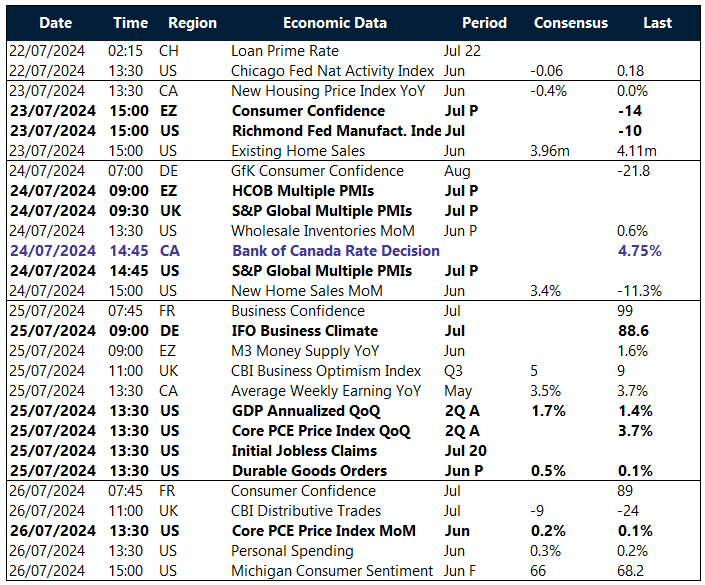

Looking into the upcoming week, political events around the US presidential race will continue to matter. President Biden has already endorsed Vice President Kamala Harris as the new candidate. On the macro front, another inflation report will keep investors guessing where monetary policy will be headed in the second half of the year. A benign PCE print could support the recent shift in Fed pricing suggesting three rate cuts are still in play for 2024. Inflation is expected to come in between 0.1% and 0.2% on a monthly basis in June. However, the consensus expects a GDP pick up from 1.4% in Q1 to 1.7% in Q2. Leading indicators point to the possibility of a slight upside surprise to that view.

$1.30 comes and goes

George Vessey – Lead FX Strategist

Back in April, we stated there was more scope for GBP/USD to hit $1.30 than $1.20 by the summer. The pair fell as low as $1.23 by late April but climbed around 6% to breach $1.30 recently for the first time in a year last week. Sterling has already lost its grip on this psychologically important level though in a sign of exhaustion to the upside and waning risk appetite amid geopolitical and global trade risks.

The optimism around the new Labour government providing some welcome political stability, coupled with the better-than-expected UK economic recovery so far this year has seen GBP appreciate against over 70% of 50 global currency peers we’re tracking, and making it the star performer of the G10 space. The stickiness of core and services inflation in the UK has resulted in an adjustment to less-dovish BoE pricing which has supported sterling’s yield advantage too. But cooling wage growth and softer retail sales data of late keeps the door open for an August BoE cut. We note that when GBP/USD reclaimed $1.30 last year – it only lasted a week before a big correction in BoE pricing to the dovish side saw cable tumble ten cents in just a couple of months.

We are not suggesting history repeats and, overall, we think the outlook does look brighter for sterling. However, a more dovish BoE than markets expect does leave the pound vulnerable to a bigger correction in the short-term. Global flash industry PMIs will be in the spotlight this week to determine any divergences in economic activity amongst the major economies.

Euro in a holding phase

Ruta Prieskienyte – Lead FX Strategist

Having recently touched a fresh four-month high against the US dollar amid brewing expectations of a Fed rate cut in September, the euro was unable to hold onto these gains as renewed dollar buying towards the end of the week and a correction from an overbought condition took their toll. Despite the retreat, the euro remains the third-best performing G10 currency this month, rising nearly 1.6%, its best July performance since 2020.

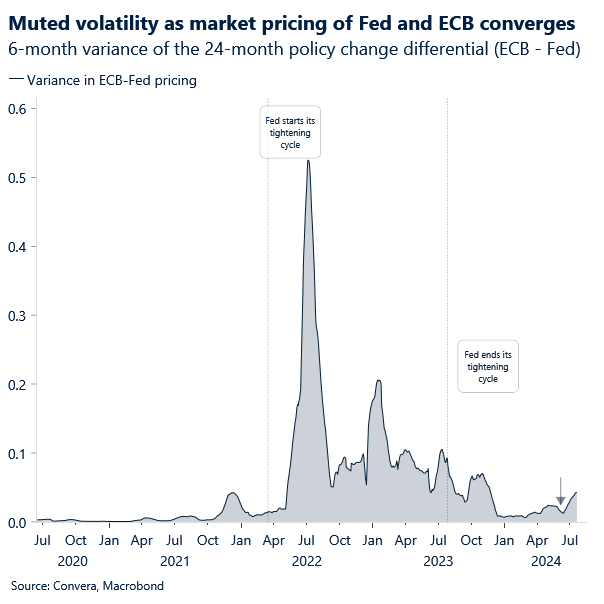

Last week, the ECB failed to excite the markets with no rate change and no forward guidance culmination. President Lagarde refrained from pre-committing to a specific rate cut trajectory, noting that September’s decision is wide open. With the need for more evidence of easing inflation pressures growing, especially on the services and wage growth front, we view rate cuts as more likely at meetings accompanied by updated staff forecasts, namely in September and December. With a growing number of GC members endorsing the current ECB money market pricing (45bps by year end), these expectations are likely to remain stable throughout the coming weeks, shifting the attention to the Fed.

Looking ahead, consumer confidence, German business confidence, and the purchasing manager index will be watched for signs of a slowing recovery in sentiment indicators. This should only marginally impact the euro negatively as the US story remains front and centre. Hedge funds turned bearish on the euro through options on a tactical basis, but the one-week risk reversals remain in favour of the euro by five basis points. We anticipate EUR/USD is likely to remain supported in the upper $1.08 area, with $1.10 appearing out of reach for now.

Risk off flows dominate

Table: 7-day currency trends and trading ranges

Key global risk events

Calendar: July 22-26

All times are in BST

Have a question? [email protected]

*The FX rates published are provided by Convera’s Market Insights team for research purposes only. The rates have a unique source and may not align to any live exchange rates quoted on other sites. They are not an indication of actual buy/sell rates, or a financial offer.